Mongkol Onnuan

Vertex (NASDAQ:VERX) is a relatively undervalued tax software player. While the company’s revenue has grown in the teens, its low FCF margin has possibly led to a depressed valuation (on an EV/S basis). However, we think a potential re-rating is on the cards with the growth on the back of Vertex’s integration with its ecosystem, which is possibly not well understood.

Business

Vertex provides tax-related SaaS offerings and services for enterprises using a continually evolving database of over 500 million data-based tax rules that help the company operate in over 19,000 jurisdictions worldwide. Vertex is headquartered in Pennsylvania and employs over 1,300 professionals globally.

Business segments

The company provides industry-specific solutions for tax determination, compliance and reporting, tax data management and associated services.

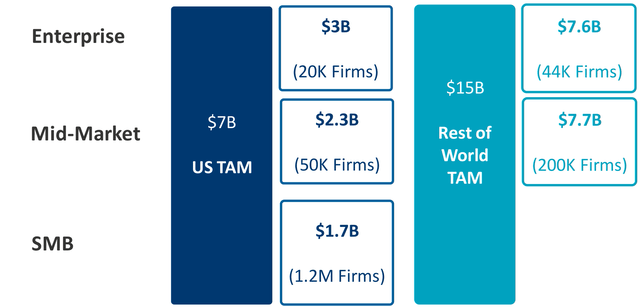

Vertex estimates the total addressable market to be c. $22 billion with less than 10% software adoption.

Company filings

While sales, marketing, finance, accounting and human resources departments of organizations have been quick to embrace technology, the taxation part of the business has remained insulated from technology due to inherent challenges to adoption, such as complexity of calculation, jurisdictional aspects, etc.

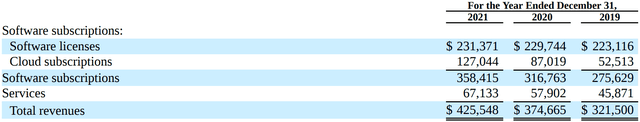

Vertex’s 40 years of operational experience has helped it productize its services, and the company reports its revenue as software and services.

Company filings

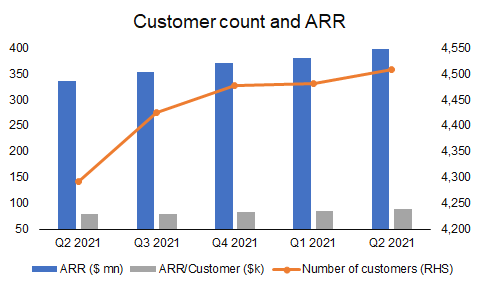

The steady growth in software revenue is notable and is accompanied by an increase in ARR.

Company filings

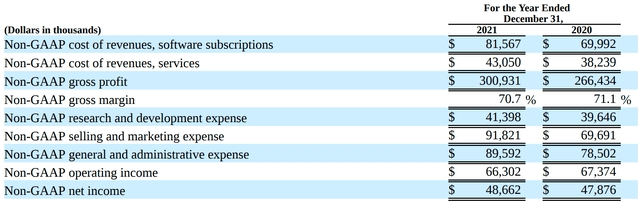

The revenue growth must be seen in conjunction with the gross margins, which are 70%+

Company filings

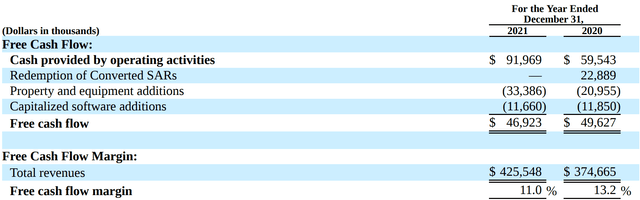

The software component of Vertex’s business is meaningful and translates into FCF.

Company filings

What looks a bit concerning is the weakness in the FCF margin, which is due to the continued investment. However, we find the revenue growth and stability in gross margin (at 70%+ levels) comforting.

Market

Tax is one of the primary revenue sources for governments across. Vertex fits in well in the overall scheme of things as a provider of solutions to estimate taxes and manage the associated documentation. The changing regulatory environment in response to evolving business and technology landscapes has increased taxation complexity. The increased exposure due to the growing geographical presence is further amplified by companies offering newer products and services.

Historically, over the past 60 years, it has been shown that indirect taxes provide a more consistent method of government funding during adverse economic cycles relative to income and property tax, which are the other primary sources of funding. As a result, indirect tax revenues play a key part in the global economy and serve as a primary source of revenue for governments around the world.

In fact, government revenue from indirect taxes is more than double that of income tax. And this will only continue to increase with expanding requirements for digital commerce and real-time reporting in a growing number of countries. All of this puts added pressure on companies of all sizes and market segments to automate indirect tax compliance to keep pace with changing requirements.

Source: Q2 2022 Earnings call from Seeking Alpha

Vertex’s position as a veteran player in the industry lends the company credibility, along with system-level intelligence, that has allowed Vertex to see sustained growth.

While Vertex competes directly with Thompson Reuters in the enterprise market, the company competes with Vista, Avalara and ADP in the mid-market.

Financials

The company reinforced its guidance during its Q2 2022 earnings release:

- Revenue: $479-483 mn

- Adj EBITDA: $72-75 mn

Vertex’s revenue growth has three triggers:

- Business model transitions: When companies offer newer products and services, the taxation of new revenue requires additional inputs from the tax teams, leading to business for Vertex.

- Change in regulatory requirements: The growing regulations and consequent granularity in audit processes is another trigger for the company’s products’ adoption.

- Systems change: A new e-commerce system or a new ERP system is often accompanied by a revamp in taxation.

Referenceability (or the ability to find adoption) is another factor driving growth in Europe. It is always advisable to go for a tax accountant who has worked on a similar assignment. The same holds for Vertex’s software. Especially in Europe, referenceability for Vertex has been such a vital element that while other software companies have called out weaknesses in Europe, Vertex has been winning customers.

EBITDA weakness was attributed to the sustained investment in research and sales towards growing the business. The Vertex management expects 2022 to be the heaviest year of investment where margins bottom out.

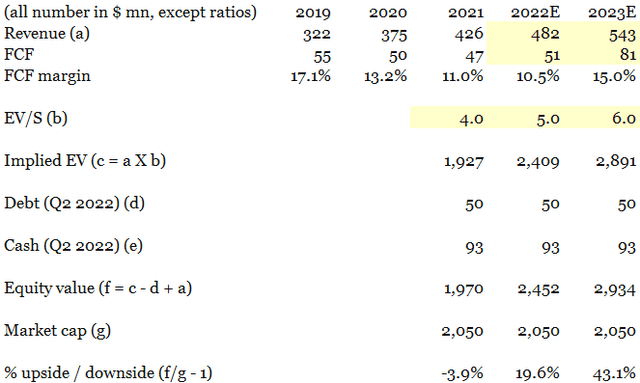

Consensus estimates suggest 2022 and 2023 revenues could be $481.8 and $543.3 million, respectively, implying a compounded annualized growth rate of c.13%.

Growing OCI adoption: Growth catalyst

Vertex has been quite dependent on the indirect channel. While it is arguably more dependent on external parties, the nature of Vertex’s business is such that from a GTM standpoint, it is easier to piggyback. This is the second dimension of Vertex referenceability, where Vertex comes on board using the goodwill of its partners.

Vertex offers pre-built integrations with several partners such as Adobe/Magento (ADBE), Coupa (COUP), Microsoft (MSFT) Dynamics, NetSuite, Oracle (ORCL), Salesforce (CRM), SAP (SAP), SAP Ariba, Workday (WDAY), and Zuora (ZUO), etc.

Additionally, the company offers technology-specific solutions for SAP and Oracle, where Vertex’s solutions are deeply integrated within SAP and Oracle’s technology stacks. While the dependence on SAP is evident due to Chain Flow Accelerator and LCR (SAP-oriented offerings from Vertex), the dark horse is likely to be Vertex’s integration with Oracle Cloud Infrastructure or OCI.

Oracle has slowly emerged as potentially the fourth major cloud player behind AWS (AMZN), Microsoft, and Google (GOOG) (GOOGL). While the Larry Ellison company has had its share of issues, its market share in databases has helped it conjure up a $2.8 billion OCI and Cloud@Customer business which is growing at 50%.

A large part of the growth in OCI is likely to continue from migrations of legacy on-prem systems to the cloud. Vertex’s stack-level integration with Oracle is expected to help Vertex piggy-ride on Oracle’s growth. Of course, the risk here is that OCI and autonomous database growth have long been coming and in case of any hiccups, Vertex may not be able to achieve the expected alpha in growth.

Valuation

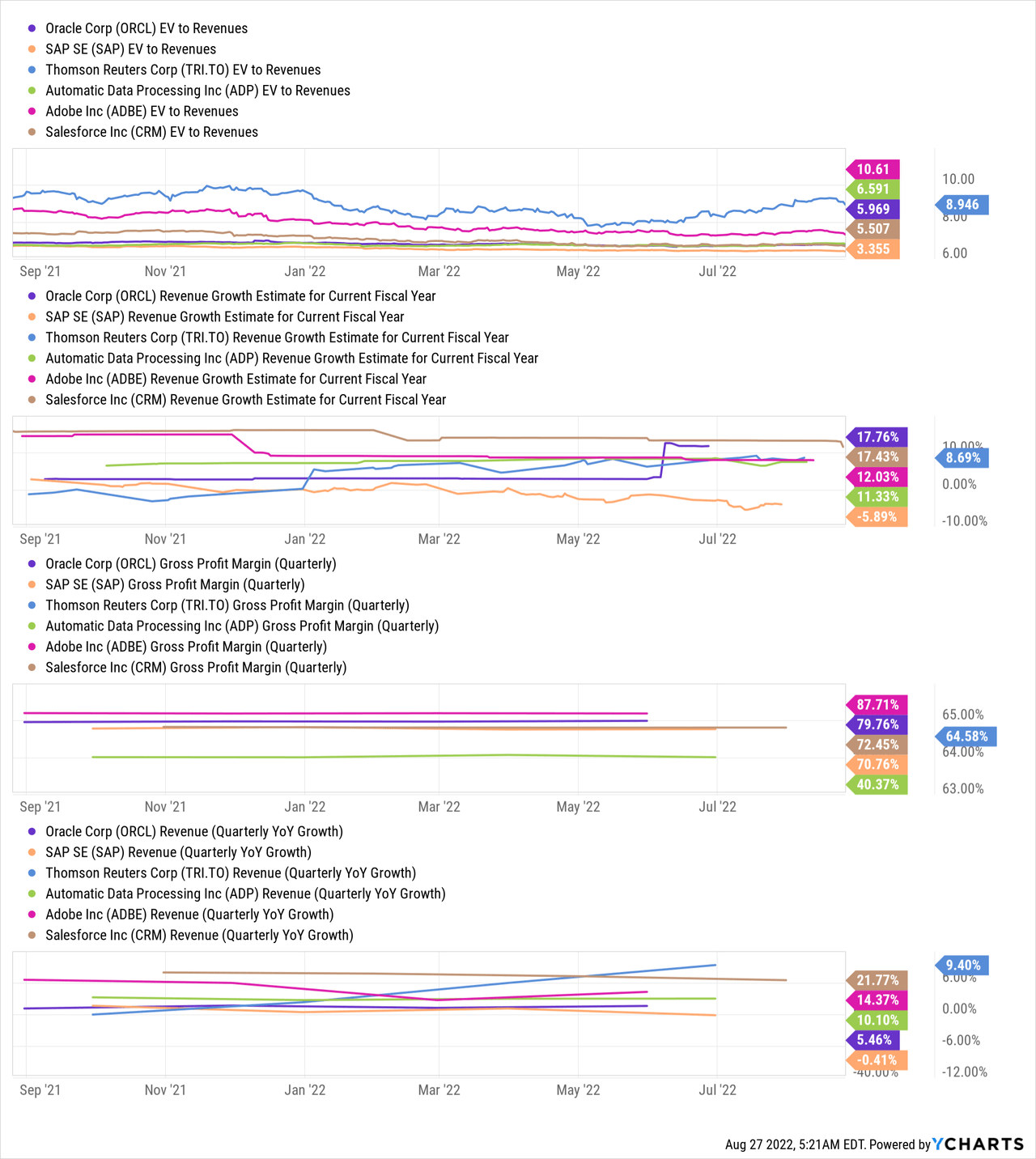

Due to the sustained opex and capex investments, while the company trades at a premium on a P/FCF basis, the company is relatively underpriced for a SaaS business on an EV/S multiple.

We think the teen revenue growth rate, coupled with a 70% gross margin, makes a compelling case for the company to be valued at an EV/S multiple.

We use the Bessemer Venture Partners Nasdaq Emerging Cloud Index and look at the gross margin, FCF margin and revenue growth versus the EV/Sales.

On regressing the revenue growth, gross margin and FCF margin with the EV/S multiple, we find the company’s EV/S multiple should be around 5x.

Regression equation: EV/S = -1.2 + 12.7 X Revenue Growth + 4.7 X Gross Margin + 13.2 X FCF margin

Company filings, Seeking Alpha, Author’s Analysis

In the base case of EV/S at 5x, the stock could potentially witness an upside of 20%. In the more bullish scenario (EV/S of 6x), the stock could see an upside of 40%; in a more challenging environment (EV/S of 4x), we see a limited downside of 4-5%.

Risks

- Sales investments take time to kick, and Vertex’s investments seem to reap dividends as ARR grows. However, a delay in operating leverage kicking in will defer the expected growth in FCF, making the stock continue to look expensive.

- The growth in direct clients has somewhat been muted. While Vertex has benefitted from referenceability and sales focus, change in the global macro could erode some of this benefit.

Conclusion

Vertex’s business model resilience stems from the focus on the tax market. The company’s stable growth should allow operating leverage to kick in, helping it achieve GAAP profitability. We think the company is trading at a relatively inexpensive 4-5x times revenue and can see a sharp up move as the business model-led re-rating in multiples happens.