Bruce Bennett

Verizon Communications Inc. (NYSE:VZ) is a telecommunication conglomerate, one of the largest in the world, with its market capitalization of more than $150 billion. The company’s unique and strong asset portfolio and continued cash flow, will, as we’ll see throughout this article, continue to support its dividend of almost 7% and strong overall shareholder returns.

Verizon Financial Performance

Verizon has continued to achieve strong financial performance, showing the strength of its business.

Verizon Investor Presentation

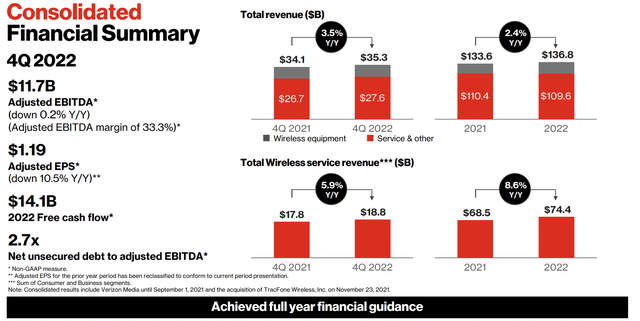

The company achieved 3.5% YoY revenue growth to $35.3 billion for the Q4 quarter (2.4% annualized revenue growth). The company’s wireless service revenue grew faster at 5.9% for the quarter or 8.6% for the year. The company’s adjusted EBITDA of $11.7 billion represents a strong 33.3% adjusted EBITDA margin with $1.19 in adjusted EPS down 10.5% YoY.

The company’s net unsecured debt to adjusted EBITDA points to a $123 billion net debt load. That’s a substantial debt load that was more manageable in a low interest rate environment but could quickly become tougher to handle. However, the company still had $14.1 billion in free cash flow (“FCF”) for the year after interest expenditures, a 9% FCF yield that covered its 6.9% dividend.

Growth Acceleration

The company is working to accelerate its growth, which we’d like to see the company achieve and take advantage of.

Verizon Investor Presentation

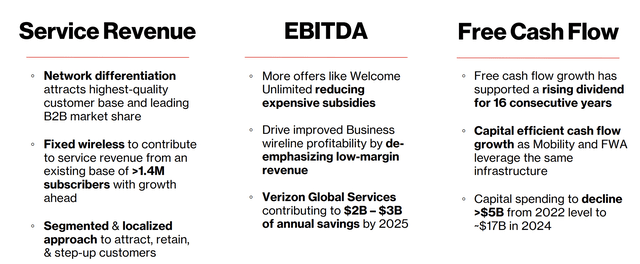

The company is focused on network differentiation, with an impressive portfolio of assets, and peak download speeds of 2.4 Gbps expected by year-end. The company achieved positive consumer postpaid net adds and had the highest quarterly broadband net adds in over a decade. The company is ahead of its goals for C-band and quarterly which is impressive to see.

The company’s capital spending decline ($5 billion by 2024) along with an expanding customer base and continued growth should substantially help overall returns. We expect that the company should be able to push $20 billion in FCF by 2025 which gives it the room to continue increasing its debt and drive increased shareholder returns.

Guidance

Verizon’s guidance should support increased shareholder returns in 2023.

Verizon Investor Presentation

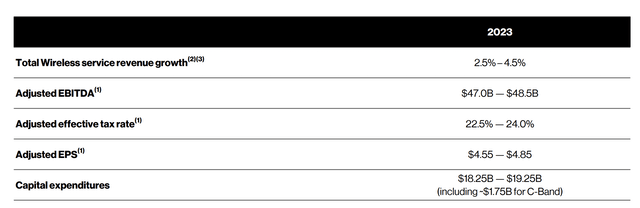

The company expects a midpoint of 3.5% in wireless service revenue growth and $47.5-48 billion in adjusted EBITDA. With an effective tax rate of roughly 23%, the company expects $4.7 in EPS which means a high single-digit P/E ratio for the company. The company expects capital expenditures to be just under $19 billion a manageable level.

We expect the company to expand its FCF past the $14.1 billion it achieved and enact a modest dividend yield and continued growth.

Our View

Verizon is one of the largest telecommunication companies in the world, operating in an oligopoly with AT&T and T-Mobile. The scale of the business is evidenced through the company’s $45 billion in capital spending at a single auction in 2021. We expect the company’s capital spending to decrease substantially in the coming years.

Those who invest now receive a dividend yield of almost 7%, enough to comfortably justify the valuation. Additionally, the company can reduce its debt and utilize share repurchases with growing FCF, to drive other forms of shareholder returns. Regardless of how the company spends its cash, we expect near-double digit returns, making the company a valuable investment.

Thesis Risk

The largest risk to our thesis is the company’s size and ability to continue growing. The company is achieving just a few % annualized revenue growth and higher inflation doesn’t mean that the company can just adjust its prices upwards accordingly. That could hurt its ability to continue driving shareholder returns.

Conclusion

Verizon Communications Inc. is a $160 billion giant in the cellular industry. The company is focused on its differentiating factor of quality, as it competes in an oligopoly with AT&T and T-Mobile and spends $10s of billions of cellular spectrum. Despite a hefty debt load, the company continues to generate substantial FCF, with a dividend yield of almost 7%.

Verizon Communications Inc.’s debt load is still concerning. However, with growing FCF, the company can afford to pay down its debt. We expect the company to be able to continue generating growing returns, and would like to see some opportunistic share buybacks given its dividend yield. Still, raising interest rates is a risk for Verizon Communications Inc.