David Ramos

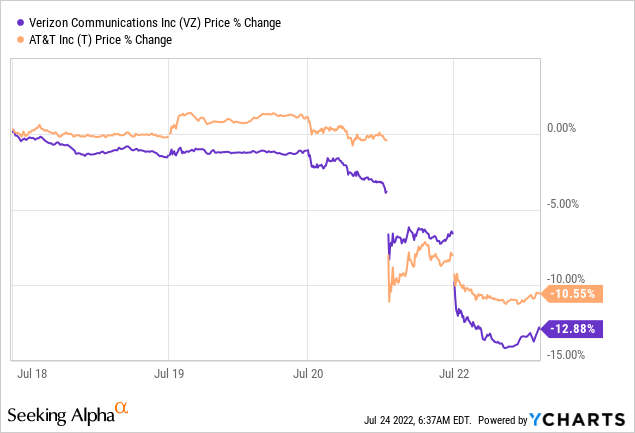

Shares of Verizon (NYSE:VZ) had been brutalized after final week’s earnings which I consider creates a shopping for alternative for the telecom agency. Verizon skidded 7% on Friday after the corporate lowered its revenue outlook for FY 2022 and indicated that it anticipated slower development as a consequence of pricing pressures and inflation. Regardless of weaker free money circulate expectations, I consider the danger profile for Verizon is extraordinarily favorable proper now. Because the agency covers its dividend with FCF, I don’t count on Verizon to decrease its dividend funds!

Parallels to AT&T, decrease free money circulate expectations

AT&T’s (T) shares additionally skidded final week after the telecom agency lowered its free money circulate outlook for the present yr from $16B to $14B as a consequence of prospects taking longer to pay their payments. Regardless of the $2B lower in free money circulate steerage relative to the prior outlook, AT&T’s hovering yield and low FCF valuation issue made AT&T a purchase. I defined final week’s occasions in AT&T: Be Grasping When Others Are Fearful.

Verizon’s earnings card for Q2’22 led to an analogous outcome than AT&T’s: The inventory’s backside fell out.

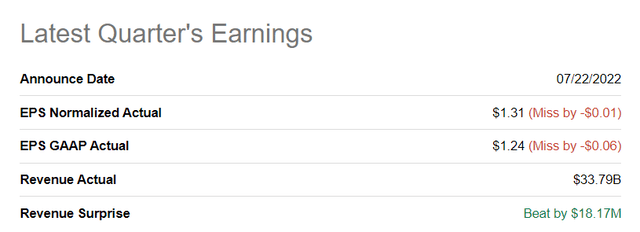

Verizon’s earnings confirmed a small EPS miss, however the lowered revenue outlook for FY 2022 is what set off a serious decline in pricing.

Searching for Alpha – Verizon Q2’22 Earnings

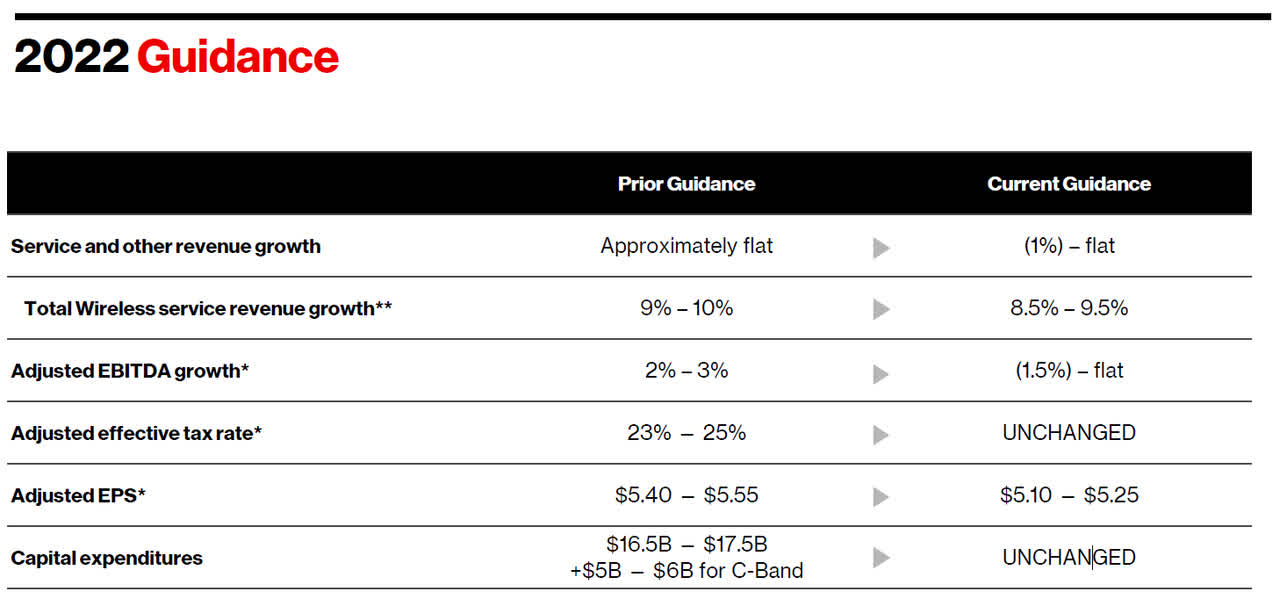

Whereas the US wi-fi service lowered its income and adjusted EPS projections for FY 2022, the agency didn’t give particular free money circulate steerage. What Verizon did give, nevertheless, was steerage for its high line development. Verizon’s earlier steerage referred to as for wi-fi service income development of 9-10% which was down-graded to eight.5-9.5%. Service and different income development is now anticipated to be barely unfavourable, (1)% – flat yr over yr, in comparison with a flat forecast earlier. Verizon’s adjusted EPS steerage was down-graded by 5.5% to a brand new vary of $5.10-5.25 as a consequence of pricing challenges and inflation that’s impacting enterprise in a unfavourable method.

Verizon

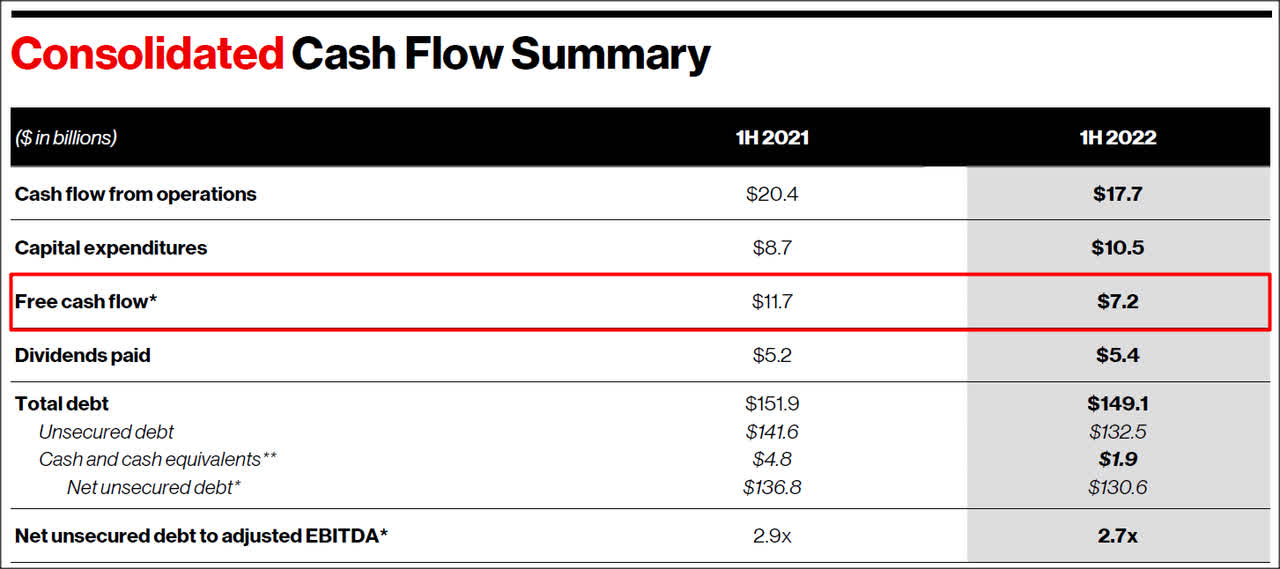

Whereas Verizon didn’t give an estimate of free money circulate for FY 2022, we will calculate an estimate primarily based on the down-grade in AT&T’s FCF outlook for FY 2022. AT&T lowered its free money circulate by $2B or 12.5% in comparison with its earlier outlook.

I just lately estimated that Verizon has a base degree of free money circulate of round $22B with FCF upside coming from Verizon’s 5G roll-out. If we had been to use a (safer) 15-20% low cost to this free money circulate estimate — to account for Verizon’s rising high line and FCF dangers — than the US wi-fi service may see between $17.6B and 18.7B in free money circulate in FY 2022.

Verizon achieved $7.2B in free money circulate within the first six months of the yr, so the wild card goes to be how a lot free money circulate the telecom agency can safe within the second half of the yr.

Verizon

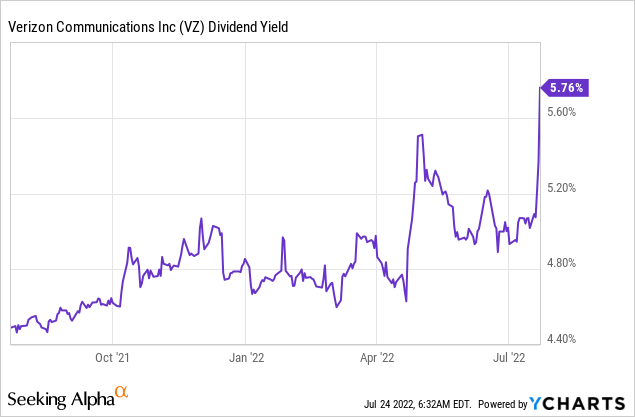

If we had been tremendous cautious and assumed that Verizon may solely about double its H1’22 free money circulate to $15B… even then Verizon would supply a great deal: Based mostly off of low-case estimate of $15B in FCF, Verizon would have a FY 2022 P-FCF ratio of 12.4 X. Due to final week’s decline in pricing, shares of Verizon now have a yield of 5.76%.

Is the dividend in danger?

If free money circulate dangers enhance then dividend dangers additionally enhance, in principle. As a result of Verizon’s enterprise nonetheless generates an infinite quantity of free money circulate yearly, I don’t see the agency chopping its payout, and a fast calculation helps this: Verizon has 4.2B shares excellent and pays an annual dividend of $2.56, which means dividend funds price Verizon roughly $10.8B yearly… which is about 72% of the estimated low-case FCF estimate I derived for FY 2022.

Dangers with Verizon

Verizon’s free money circulate dangers have barely elevated, however to not an extent that buyers have to fret concerning the dividend. Even with decrease anticipated free money circulate this yr, Verizon ought to be capable of cowl its dividend funds with none main issues. What I see as greater business dangers for Verizon are slowing high line development and decrease margins within the quickly rising 5G market in the long term.

Closing ideas

The market misplaced its thoughts final week and I consider it completely overreacted to the earnings releases and projections of AT&T in addition to Verizon. Each telecom companies had been trampled upon with valuations skidding greater than 10% final week. The down-graded steerage is an issue for Verizon solely within the quick time period, I consider, and the drop creates a shopping for alternative: with a yield of 5.8% and a sturdy quantity of free money circulate set to be generated this yr, regardless of financial headwinds, I consider the inventory has develop into extra attention-grabbing on the drop, not much less!