David Ramos

Thesis

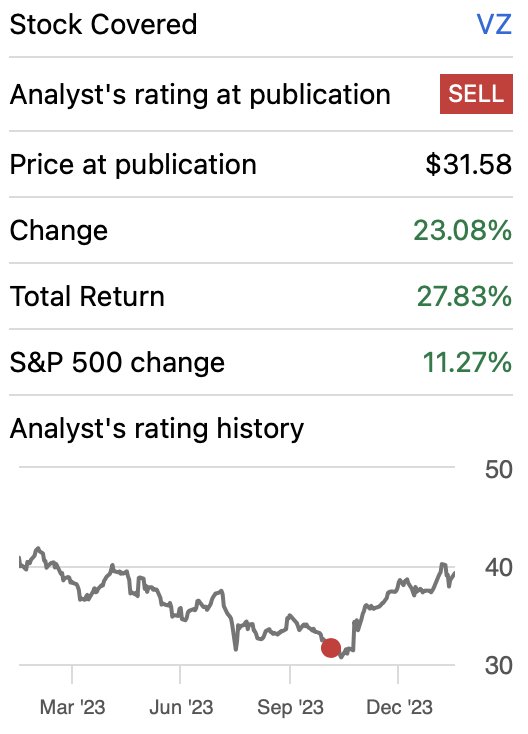

In my previous analysis of Verizon Communications, Inc. (NYSE:VZ), I assigned a “sell” rating despite my models indicating a fair price of $40.4. This rating was primarily influenced by concerns related to the company’s substantial debt. In this follow-up article, I will increase the rating to “hold”, highlighting the persistent challenges tied to Verizon’s financial obligations, nevertheless, investors’ willing to go into it and therefore pushing momentum.

Upon reevaluating the company’s financial performance using the latest results, I arrived at a current fair price of $68.8 and a projected future price of $88.1. However, despite these revised figures, my stance on the stock remains unchanged due to the ongoing issue of Verizon grappling with considerable debt, exacerbated by substantial dividend spending, which means that the slightest breeze could make the stock go down.

This “hold” rating is grounded in the anticipation that, at some point, the company may be forced to cut dividends to alleviate the strain on its financials, especially in the absence of a safety net against declining sales.

Seeking Alpha

Overview

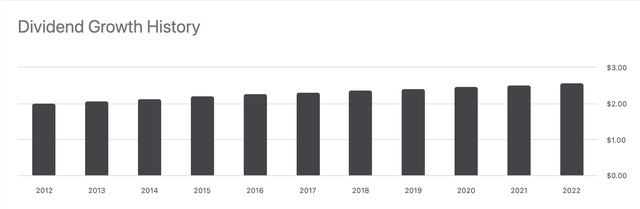

Verizon, a leading U.S. telecommunications company, distinguishes itself with top-notch connectivity and has received numerous awards for its exceptional network quality. Offering a range of services like pay-TV, internet, mobile data, and calling, Verizon’s reputation for superior service quality allows it to command higher prices. Notably, the company recently raised its dividend, achieving an impressive 8.3% dividend yield. The stock has also seen a 23.08% increase, contributing to a 6.77% dividend yield, reflecting Verizon’s consistent commitment to annual dividend growth for the past 17 years.

Seeking Alpha

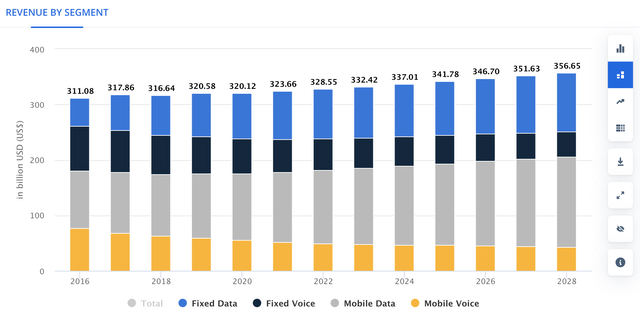

While the overall communications sector in the US is projected to experience a modest compound annual growth rate [CAGR] of 1.42% from 2023 to 2028, Verizon’s consensus revenue growth rate lags behind, standing at 0.44%.

Statista

Financials

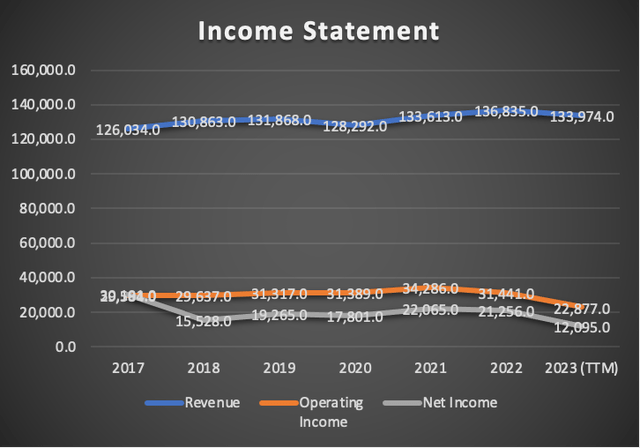

Verizon’s revenue has maintained a modest annual growth rate of 1% since 2017. Since the publication of my previous article in Q2 2023, revenue, on a trailing twelve-month [TTM] basis, has experienced a slight decrease of -0.81%. Operating income, following a -3.8% annual growth trend since 2017, has seen a marginal change of -25% since Q2 2023. Meanwhile, net income has exhibited a negative growth of -10% since 2017, with a -42% variance since Q2.

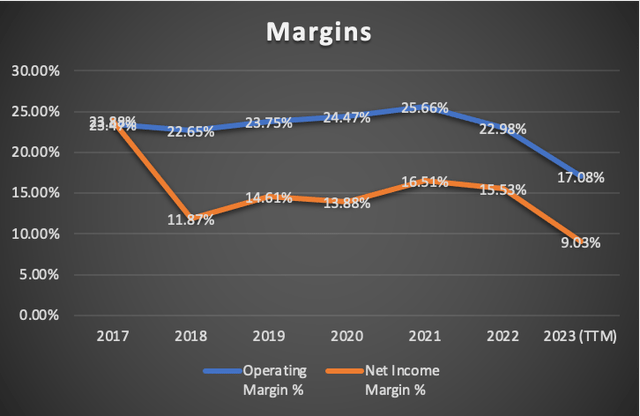

In terms of margins, the operating margin has inched down from 22.73% in Q2 to 17.08%. However, the net income margin is significantly below its 2017 peak of 23.88%, currently sitting at 9.03%, it also showcases a significant reduction from that one of Q2 2023 TTM of around 15.58%.

Author’s Calculations Author’s Calculations

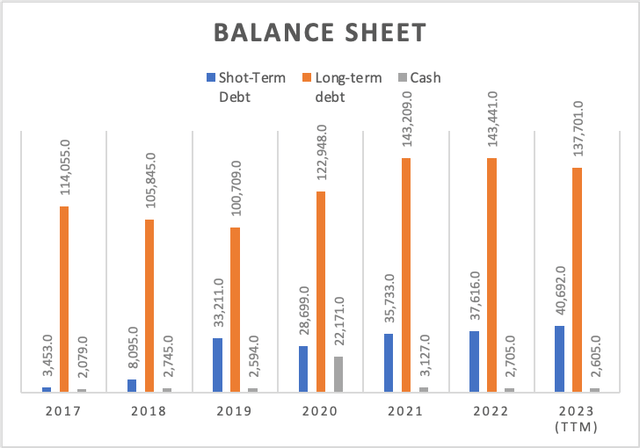

Turning attention to Verizon’s balance sheet, it raises concerns. The substantial $178 billion total debt, coupled with a modest $2.6 billion cash reserve, places the company in a precarious position. The net debt, hovering around $151 billion, remains high. While total debt has increased at an 8.6% annual pace since 2017, cash has grown at a slower rate of 4.2%, and has hardly surprised the $4 billion mark since 2017, with the exception of 2020.

Author’s Calculations

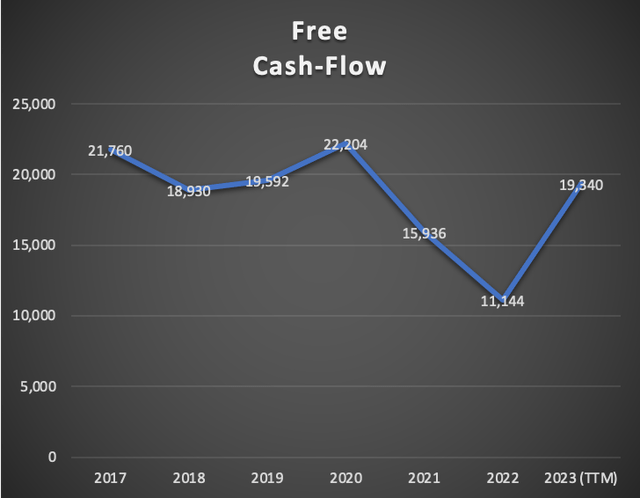

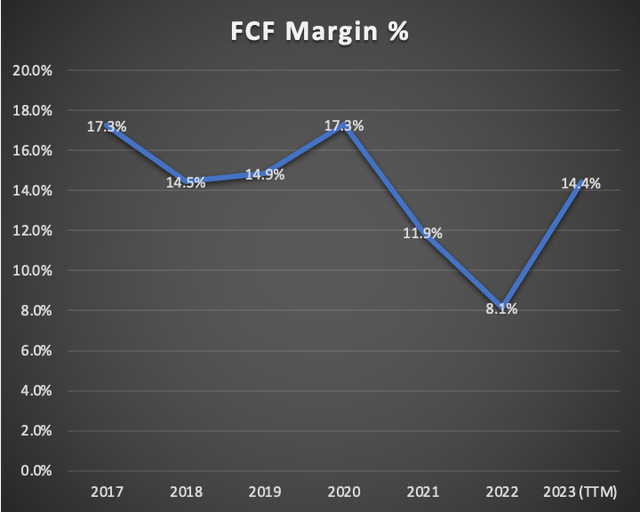

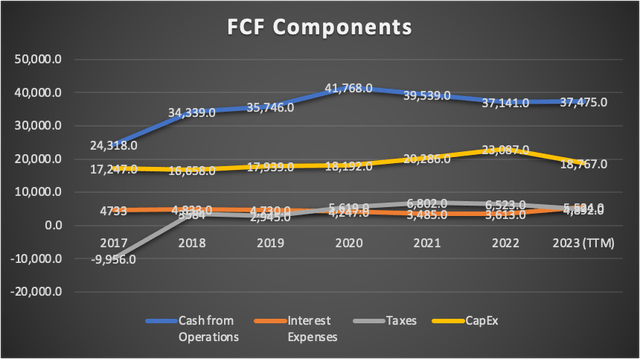

Examining free cash flow, Verizon boasts a respectable $19.34 billion, marking a 49.6% increase since Q2 2023 when TTM free cash flow stood at $12.97 billion. The FCF margin, currently at 14.4%, outperforms the Q2 2023 TTM FCF margin of 9.6%.

Author’s Calculations

Despite these positive metrics, the bulk of free cash flow is channeled into dividend payments, with Verizon allocating approximately $11 billion, representing around 57% of the FY2023 generated FCF. This practice puts Verizon on a trajectory of perpetual debt increase, given the insufficient cash reserves to cover debt maturities.

The company is forced to issue more long-term debt, complicating its financial position further. A detailed look at Verizon’s debt maturities, available on their website up to 2060, underscores the gravity of this issue.

Debt maturing within one year: $12.44 billion

Debt Maturing 2025: $4.6 billion

Debt Maturing 2026: $6.8 billion

Debt Maturing 2027: $5.6 billion

Debt Maturing 2028: $10.58 billion

Debt maturing 2029: $7.2 billion

Debt Maturing 2030:$8.3 billion

If we subtract those $11 billion from the $19 billion free cash flow, we get that there are $8 billion left to pay debt, which is already insufficient to pay the debt maturing in 2025, 2028, and 2030, and if no debt was issued, Cash reserves would probably stay below $5 billion throughout 2029. This is not good since if new technologies in the telecoms market is released, Verizon will not have enough cash to increase CapEx, and competitors could take advantage, and if Verizon loses its “excellent connectivity” reputation, that means they will need to decrease prices.

Seeking Alpha Author’s Calculations Author’s Calculations

In summary, Verizon’s financials reveal a business in stagnation. While attempts to enhance value involve increased dividends and net income growth, the dividend strategy has inadvertently led to a substantial debt burden. Cutting dividends could trigger a stock decline, with investors refocusing on the looming debt load, creating challenges for the stock price in the foreseeable future.

Valuation

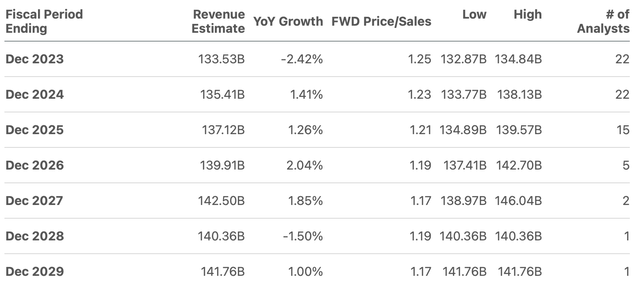

Commencing with revenue, FY2024 estimates indicate a revenue of $135.4 billion, and $137.12 billion for FY2025. In the table below you will find the estimates up to FY2029, which is the top year of my DCF.

Seeking Alpha

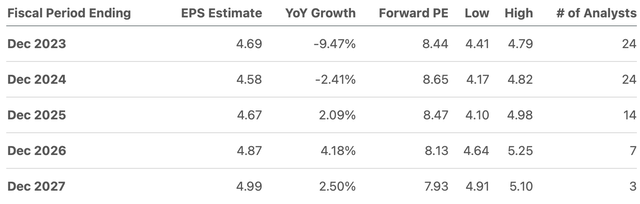

The, I will project net income using EPS. For FY2024, the estimates indicate an EPS of $4.58, and $4.67 for FY2025. You will also find EPS estimates up to FY2027. Beyond that year, I will use the expected 3 to 5-year EPS growth rate of 0.08%, which will also be used to calculate the perpetuity growth rate in combination with WACC.

Seeking Alpha

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2024 | $135,400.0 | $19,254.78 | $24,799.86 | $39,730.11 | $45,312.90 |

| 2025 | $135,995.8 | $19,633.15 | $25,287.20 | $40,283.13 | $45,890.49 |

| 2026 | $139,910.0 | $20,473.97 | $26,370.16 | $41,797.71 | $47,566.46 |

| 2027 | $142,500.0 | $20,978.46 | $27,019.94 | $42,733.08 | $48,608.62 |

| 2028 | $140,360.0 | $20,995.24 | $27,041.55 | $42,518.72 | $48,306.03 |

| 2029 | $141,760.0 | $21,012.04 | $27,063.19 | $42,694.73 | $48,539.76 |

| ^Final EBITA^ |

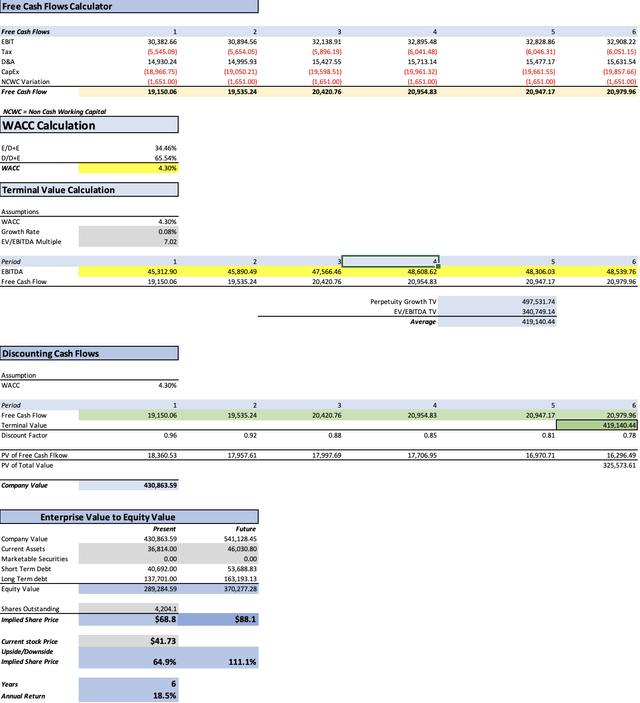

The provided table encapsulates all current data pertinent to Verizon. Using this data, I will calculate the Weighted Average Cost of Capital [WACC] by factoring in Equity value, Debt value, and Cost of debt. Additionally, Depreciation and Amortization (D&A), Interest, and Capital Expenditures [CapEx] will be computed based on margins linked to revenue growth. This method ensures that as Verizon’s revenue expands, these expenses will also increase, providing a more pragmatic and coherent projection.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 93,799.00 |

| Debt Value | 178,393.00 |

| Cost of Debt | 3.10% |

| Tax Rate | 28.80% |

| 10y Treasury | 3.93% |

| Beta | 0.44 |

| Market Return | 10.50% |

| Cost of Equity | 6.82% |

| Assumptions Part 2 | |

| CapEx | 18,767.00 |

| Capex Margin | 14.01% |

| Net Income | 12,095.00 |

| Interest | 5,524.00 |

| Tax | 4,892.00 |

| D&A | 14,773.00 |

| Ebitda | 37,284.00 |

| D&A Margin | 11.03% |

| Interest Expense Margin | 4.12% |

| Revenue | 133,974.0 |

Author’s Calculations

The models indicate that Verizon is undervalued, by a precise margin of 63.8%. This implies a fair price of $68.8 and a future price derived from projecting the table’s aspects, averaging variances observed from 2017 to 2023. Without incurring additional debt, the total debt load is estimated to reach around $216 billion. Consequently, this scenario projects a future price of $88.1, translating into a noteworthy 18.5% annual return throughout 2029.

Risks to Thesis

The primary risk to my thesis lies in the theoretical notion that dividends might not significantly impact the valuation, as they are merely a form of value distribution to shareholders, just distributed in another form.

However, this theoretical scenario holds true only if dividend payments do not necessitate an increase in long-term debt, which could subsequently dampen the company’s valuation—a situation currently unfolding with Verizon.

Another risk on the horizon is the stock’s continuous ascent, driven largely by market sentiment. Despite the current appearance of stability, I remain cautious about diving into this stock, as the situation may take an unfavorable turn because nothing can be possible without market sentiment.

Conclusion

In conclusion, my analysis of Verizon paints a cautious picture, with a “hold” recommendation stemming from the company’s substantial debt and financial challenges but positive momentum. Despite the revised fair price of $68.8 and a future price projection of $88.1, based on an evaluation of financial data, my apprehension persists due to Verizon’s ongoing struggle with considerable debt, aggravated by substantial dividend spending. The risk of perpetual debt looms large, compelling me to maintain a “hold” rating as the company may face the necessity of cutting dividends to alleviate any financial strain.