photobyphm

Executive Thesis

Value investors may be interested in buying shares of Verizon (NYSE:VZ) as it is trading at 10 year lows, is guiding for significant reductions in capex in 2023 and 2024, and pays a steadily rising dividend of 7.5% at current market prices. Additionally, capital intensive businesses like VZ are asymmetrically harmed by higher inflation, which is currently showing signs of being tamed. Despite the likely easing of headwinds in the near term, I do not believe current prices offer an adequate margin of safety for investors interested in long term capital appreciation. Our models suggest 20% upside, or a fair value of approximately $40 per share.

Buffett and the Risks of Capital Intensive Companies

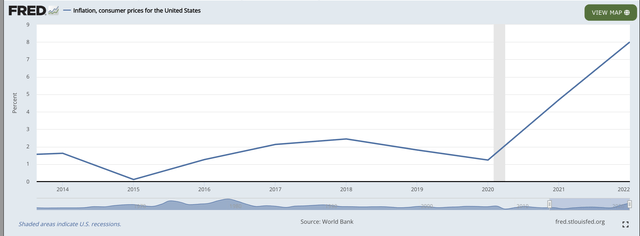

Warren Buffett is known to criticize capital intensive companies as investments, and in particular he mentions that they are among the worst performers during periods of high inflation. The highest inflation in recent history coincided with heavy capital investment by VZ, with recent increases in inflation visualized below.

US CPI (World Bank)

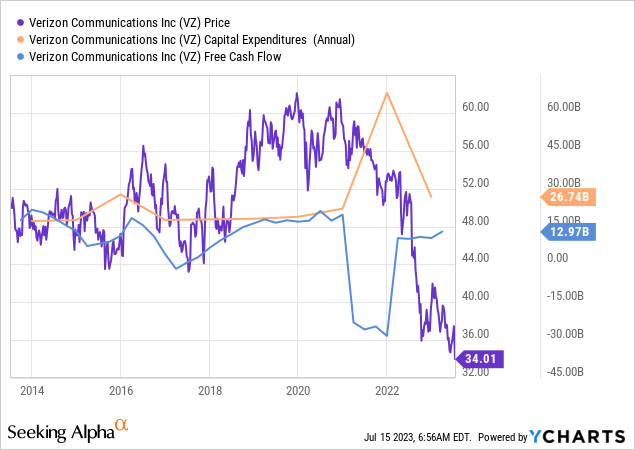

As inflation and capital expenditures increased, the Verizon share price has languished. If you had purchased shares at the beginning of 2020 prior to the capex cycle, you would be down nearly 50% on the investment. Part of this could also be due to the bond like nature of the stock, with large swaths of passive income investors looking to VZ for the consistent dividend yield. Higher risk free rates demand higher yields for investors, so naturally VZ had to correct.

Looking to the Future

It is possible that most of the bad news is already priced in for Verizon. As the investment has bond like characteristics, the company stands to benefit if/when hawkish federal reserve policy is reversed. They also claim to be reducing capital expenditures in the coming years, with an estimated $18.25 to $19.25 billion for FY 2023 and an estimated $17 billion in 2024.

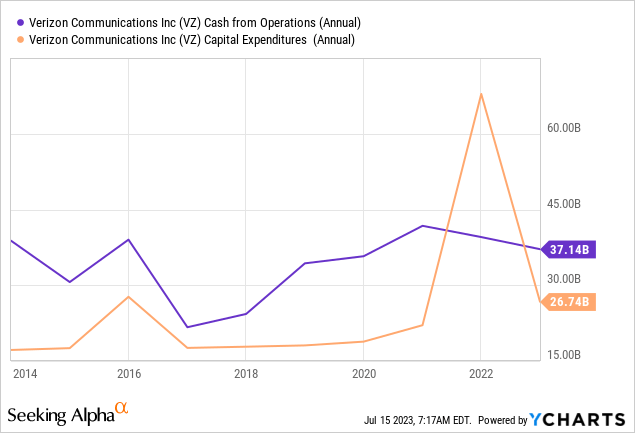

Assuming similar cash flow from operation performance can be achieved over the coming years, Verizon stands to benefit immensely from these aforementioned capex reductions. If similar results of $37 billion can be achieved, this sets the company up for around $18 billion in FCF for 2023 and $21 billion in 2024, which is pretty good for a $140 billion dollar company. This represents yields of approximately 13% and 15% respectively at current prices.

Is Debt a Problem?

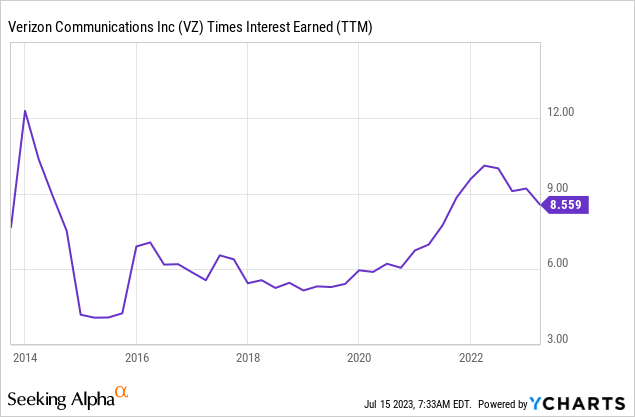

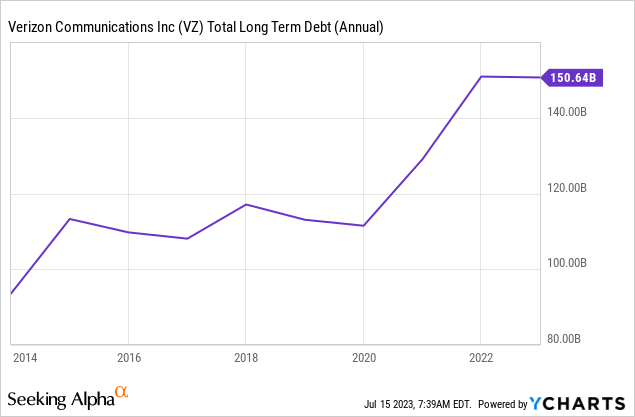

Debt is clearly not an existential near term problem for the company. Verizon’s consistently strong operating income resulting in well covered interest expenses can be visualized below.

It cannot be ignored though, that debt has increased substantially in recent years, and responsibly management should be paying down some of this debt as capex decreases. At the beginning of 2023, the company reported $24 billion in upcoming maturities within the next 4 years. If we assume it is prudent to pay it down in equal installments, this would be a decrease of $6 billion per year in free cash flow available to equity.

It does appear historically, Verizon has not made deleveraging a priority. Based on these data above, from 2016 to 2022 Verizon’s debt increased from approximately $110 billion to $150 billion, a $40 billion increase. Dividends paid, taken roughly, are approximately $10 billion per year within the time period, for a total of $60 billion. So in reality, though an apparently successful dividend growth business, roughly 2/3s of the dividends within the time period were technically funded by debt.

As Buffett would say, investing is best when it is most business like. If you were running a business, it generally would not make sense to draw down debt in order to pay yourself regular increasing income. Perhaps Verizon is a victim of its passive income seeking investor base. The requirement of paying a steady growing dividend forces the hand of management and reduces capital allocation ability. The dividends must continue at all costs, regardless of other opportunities presenting themselves. This may have worked in a lower interest rate environment, but presents major risks if the company is forced to choose between debt principal payments or refinancing at higher rates.

Valuation

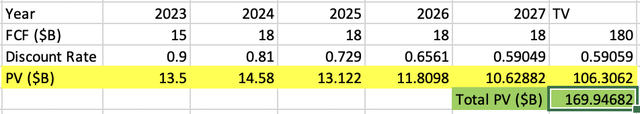

Though it is pretty easy to criticize Verizon, the market may have gone a little too far selling it off in the meantime. If we extrapolate from prior performance as well as management projections of capital expenditures, we can assume Verizon will be ramp up from around $15 billion in 2023 to $18 billion in 2024 of free cash flow net of wireless license acquisitions and debt paydowns (I subtracted a $3 billion impairment per year for both of these). Since Verizon has not shown significant growth in FCF over the last few years and has large periodic capex cycles, i assumed no growth from the $18 billion level. I used a 10% discount rate to be conservative as this is higher than the cost of debt and is likely the lowest return investors should expect. This puts the fair value of Verizon at around $170 billion, or approximately 20% upside at time of writing.

Verizon DCF (This Writer)

Risks

High Debt Load

Though Verizon stands to benefit when inflation reduces and the Federal Reserve returns to more dovish policy, its $150 billion in long term debt could present a problem if interest rates remain higher for longer. Management at some point may feel the need to cut the dividend in order to focus on deleveraging.

Mature Low to No Growth Business

The lack of growth in the business presents its own problems, as interest rates and leverage increases and growth stagnates. The company may find it more difficult to continue its increasing dividend payments, and may turn to acquisitions to spur growth. If this is the case, hopefully the company can continue to avoid value destroying acquisitions.

Competition

Though the wireless industry is an oligopoly of sorts, Verizon faces intense competition from rivals as well as smaller carriers. The top 3 US wireless carriers including Verizon, AT&T (T) and T-Mobile (TMUS) actually have collectively lost market share over the last few years to smaller carriers since 2018. Of the three, T-Mobile was the only large carrier able to increase market share in the time period.

Conclusion

Though potentially suitable for some income oriented investors, I do not consider VZ to be a particularly attractive investment for those interested in long term capital appreciation. Our conservative models suggest 20% upside for equity investors at current prices, which is not a fantastic margin of safety. I also do not find the high capital expenditures combined with aggressive leveraging and constantly increasing dividends to be the most intelligent capital allocation strategy. That being said, VZ stands to benefit in the near term with the projected reductions in capex, evidence of the taming of rampant inflation, as well as the potential for more dovish Federal Reserve policy. The latter has the added benefit of making the coupon like nature of Verizon dividends even more attractive.