claudiodivizia/iStock via Getty Images

Friends, Romans, countrymen, lend me your ears;

I come to bury Caesar, not to praise him.

-William Shakespeare, from Julius Caesar.

High Yield

In this case, “Caesar” represents many high-yield investments.

High-yield investments get a lot of play on Seeking Alpha and many other investing sites. After all, it’s an easy sell. On the surface, who wouldn’t choose a 10% yield over a 2% yield? Add to this the claim that the goal isn’t to beat the market, and voilà!

But it isn’t that simple.

High yields often come with a price, such as:

- Erosion of principal;

- Risk associated with leverage;

- High-risk equities;

- Dividend cuts; and

- Opportunity cost.

Keeping an open mind

Confirmation bias: The tendency to interpret and favor information that confirms our beliefs.

The older I get, the more I have to fight my inherent biases. Confirmation bias is a tough one.

It’s comforting to read articles that confirm what we already think – especially when it comes to something as important as our hard-earned money. We can also get stuck in echo chambers, surrounding ourselves with like-minded investors. We feed off each other, hardening our biases.

I force myself to read articles that conflict with my views on a stock and (try my best to) examine it objectively before dismissing it. I hope you will do the same.

Is Verizon a good dividend stock?

With this in mind, let’s look at a very popular high-yield stock, Verizon Communications Inc. (NYSE:VZ).

Verizon just raised the dividend for the 17th consecutive year, delighting many investors. However, this streak comes with a price. Investors buy Verizon stock only for the dividend and expect an annual raise. This means that no matter how tight cash is, the company cannot cut or fail to raise the dividend without the stock crashing. Management is backed into a corner.

And this has adverse effects on the company over time.

Every dollar paid out is one that cannot be invested in expanding the company, competing, or innovating. So, what happens over time? Companies fall behind, don’t properly manage the balance sheet, and begin a slow spiral to obsolescence and complacency. Imagine if Microsoft (MSFT) had stopped innovating after developing Windows; there would be no Office, no subscription sales, and definitely no Azure.

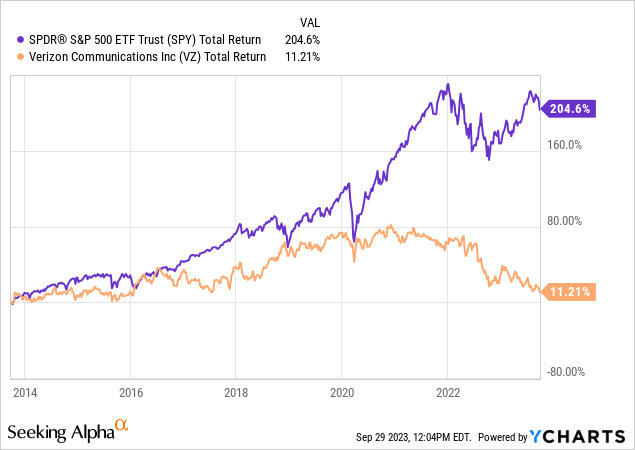

This is why a simple investment in the SPDR® S&P 500 Trust ETF (SPY) has outperformed Verizon 2 to 1 over the last ten years (including dividends!), as shown below.

Wait, you say. You are only interested in income. Well, there are much better alternatives, which I will discuss below. But let’s finish up with Verizon first.

Stagnating growth

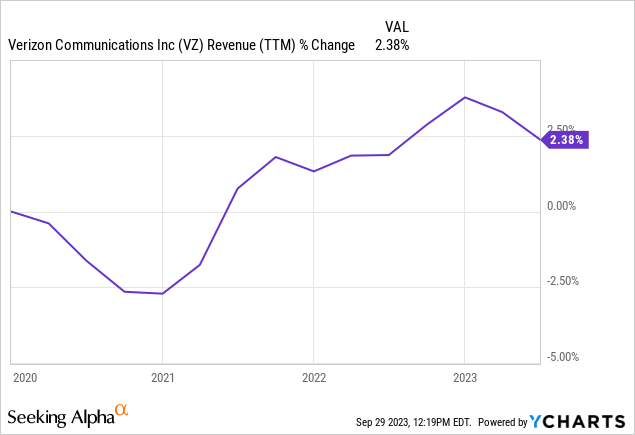

Verizon’s sales growth is dismal – especially when measured against inflation. As shown below, sales have risen a paltry 2%, while inflation has caused a cumulative price increase of 20% economy-wide.

This is partially a result of what we discussed above.

Another reason is the saturated cell phone market. It is often argued that this is a terrific investment since everyone needs a cell phone carrier. But that isn’t the case. The fact is that everyone already has a carrier, so there is little room to grow. Instead, the companies compete for the same static group of customers by offering heavy discounts for switching. This is not the road to riches.

The balance sheet is in shambles

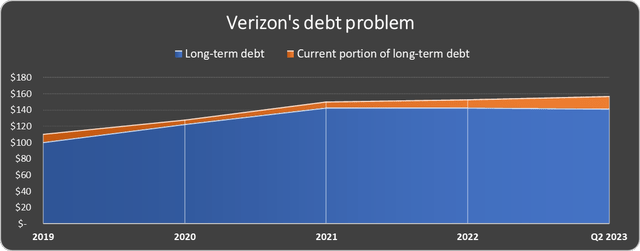

Unlike revenue, Verizon hasn’t had problems growing the debt, + 40% since 2019, as depicted below.

Data source: Verizon. Chart by the author.

A quick check of the 10-K shows that the rates range from favorable to as high as 8.95%, with some debt tied to a floating rate (it rises as interest rates rise). You can also see that the current portion is increasing.

The more the debt rolls over, the more will be refinanced at unfavorable rates. Verizon continues to issue more than it repays, and the interest expense alone ate up 15% of operating income over the past 12 months. This will likely get worse.

It is a capital-intensive business

Capital expenditures (CapEx) are incredibly important but often overlooked. CapEx is the purchase of property and equipment and is not an expense on the income statement. However, it is cash out the door that reduces free cash flow. The general formula for free cash flow is: Cash from operations – CapEx = Free cash flow.

When we say a company is “capital-light,” this means that a high percentage of its cash from operations (CFO) goes into the company’s pocket as free cash flow. For instance, Airbnb (ABNB) is extremely capital-light. It is a software company with little need for purchases of property and equipment. Of its $4 billion TTM CFO, only 29 million, or 7%, was spent on CapEx.

Verizon is in a capital-intensive business. 60% of its CFO went toward CapEx over the last twelve months.

Verizon consistently runs at a cash deficit, debt creeps higher, innovation stagnates, and there is no end in sight.

It is a quintessential value trap.

Verizon isn’t alone.

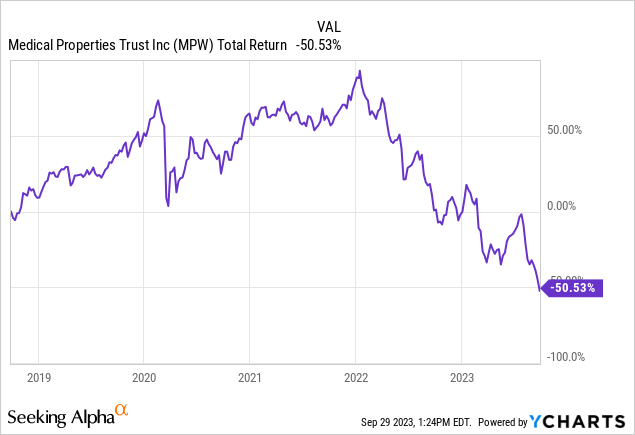

Verizon is not the only high-yield stock costing investors. I have watched the battle over Medical Properties Trust (MPW) with equal parts amusement and despair. It has been a Seeking Alpha battleground stock for years, and the only people making money are the analysts writing about it.

The yield continued to rise, the stock continued to fall, and the unsustainable dividend was eventually cut.

The red flags include over-reliance on certain tenants, major tenants with financial issues, and an inability to fund the dividend when all was said and done. If you have to lend money to a tenant in order for them to pay you, this is a dangerous situation.

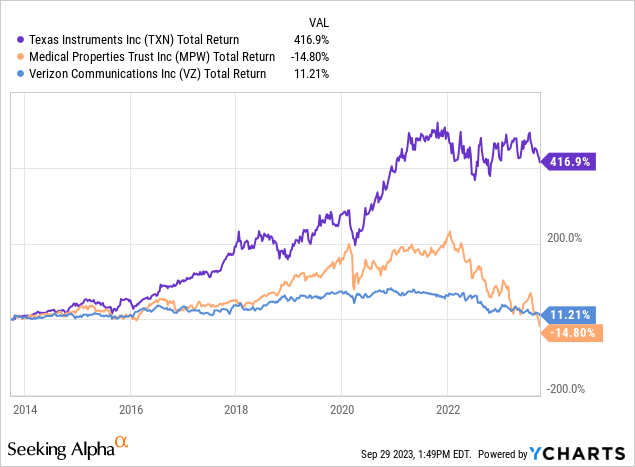

Still, the yield was too enticing for many. Unfortunately, the principal eroded faster than the dividend returned, as shown by the total return below.

Simply put, investors betting on yield lost a bundle.

There is an alternative.

High yields are tempting because they provide instant gratification for income. But buying dividend growth is a much better alternative in the long run (and often in the short run).

Here is one example.

Texas Instruments Incorporated (TXN) produces analog semiconductors. The product isn’t exciting, but it is used in many products and industries, from thermostats to manufacturing systems to cars.

The current yield is 3.27%.

Texas Instruments is known as one of the best cash management companies out there, and over the last 19 years:

- The dividend has grown at 25% CAGR;

- Free cash flow per share grew 11% CAGR;

- Nearly half of the outstanding shares were repurchased; and

- The debt is easily manageable.

Total returns have crushed the high-yielders above looking back ten years:

But what about the income?

As promised, I understand that many rely on income, especially in retirement. Investing for several years out is still critical when planning and even in retirement.

Some have told me they don’t care about growing the principal as long as they get the check. But dividend growth still wins over time.

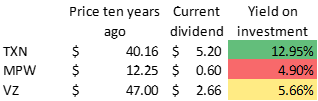

Anyone who purchased Texas Instruments ten years ago today makes 13% on that principal, much higher than MPW or Verizon. It is like buying a bond whose yield increases over time. The capital gains are a (giant) cherry on top.

Data source: YCHARTS

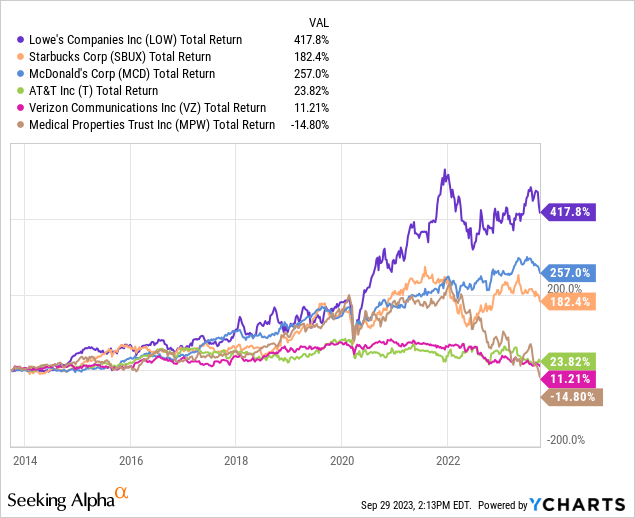

In case you think I am cherry-picking. Here are some other quick examples. Lowe’s (LOW) (2% current yield, 59 years of growth), Starbucks (SBUX) (2.5% yield, 12 years of growth), and McDonald’s (MCD) (2.3% yield, 21 years of growth).

High yield is enticing and an easy sell. But dividend growth is king over the long haul. The next time someone tells you to back up the truck to buy ridiculous yields hand over first, it might be best to drive away.