photobyphm

With regards to the US telecommunications house, there is not any denying that Verizon Communications (NYSE:VZ) (NEOE:VZ:CA) is likely one of the large gamers. It is an organization that I’m nicely conscious of, having been a buyer of it for my mobile phone service ever since I first bought a mobile phone again in 2008. Having mentioned that, I’ve not, traditionally talking, been the largest fan of the corporate from an funding perspective. I’ve lengthy most well-liked its rival, AT&T (T) which I at the moment personal shares of.

This doesn’t imply, nevertheless, that the image can’t change. You see, again in October of final 12 months, I ended up score Verizon Communications a ‘maintain’. On the time, I used to be centered on the protection of its dividend and its valuation. Since then, the inventory has outperformed even my very own expectations, seeing upside of 33.4% in comparison with the 25.3% rise seen by the S&P 500 over the identical window of time. There have been indicators of weak point on the enterprise. Nevertheless, there have additionally been indicators of energy. Shares stay low-cost and leverage is below management. Given these components and despite my earlier score for the inventory, I consider it is acceptable to improve it to a ‘purchase’ at the moment.

Time for an improve

Creator – SEC EDGAR Knowledge

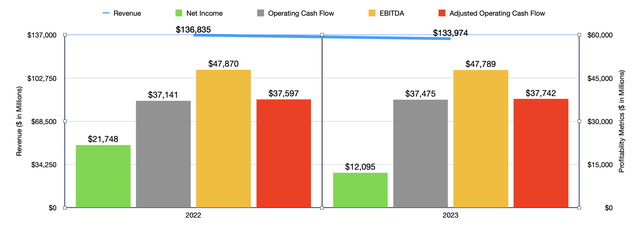

After I final wrote about Verizon Communications late final 12 months, traders solely had knowledge overlaying by means of the second quarter of the corporate’s 2023 fiscal 12 months. That knowledge now extends by means of the primary quarter of 2024. Earlier than we get to the newest outcomes for the enterprise, I believe it will be acceptable to see how the agency completed 2023 and the way that compares to the 2022 outcomes. Throughout 2023, Verizon Communications generated income of $133.97 billion. That is really a decline from the $136.84 billion the corporate generated one 12 months earlier.

This drop in income was pushed by a few key components. For starters, its Shopper section reported a 1.8% decline in income, with gross sales dropping from $103.51 billion to $101.63 billion. Despite the fact that service income managed to rise by 2.4% from $73.14 billion to $74.87 billion, the corporate noticed vital weak point elsewhere. Wi-fi tools gross sales, as an illustration, dropped by 10.9%, plunging from $23.17 billion to $20.65 billion. This decline, in response to administration, was pushed largely by a $3.9 billion hit related to decrease quantity of wi-fi gadgets bought by the corporate. This was due to a 26% discount in upgrades on a year-over-year foundation. The image would have been worse had it not been for a $1.4 billion profit that the agency acquired due to larger pricing on its tools. Different income, in the meantime, dropped 15.2% from $7.20 billion to $6.11 billion. This drop was due to a $1.2 billion decline stemming from a bigger allocation of administrative and telecommunications restoration costs.

Creator – SEC EDGAR Knowledge

As painful as these declines have been, a very powerful factor is the aforementioned enhance in service income. This was largely attributable to a $1.7 billion profit due to postpaid plans that administration was in a position to cost extra for than they have been in a position to cost the 12 months prior.

Creator – SEC EDGAR Knowledge

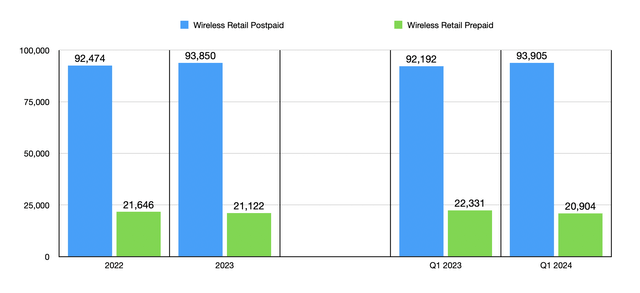

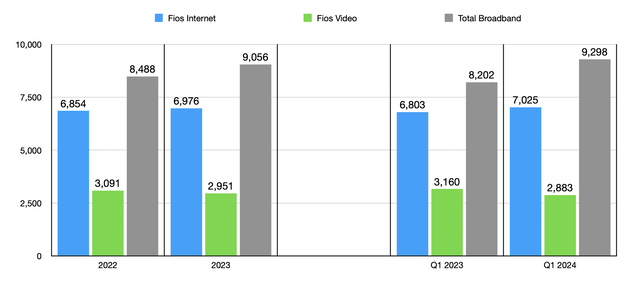

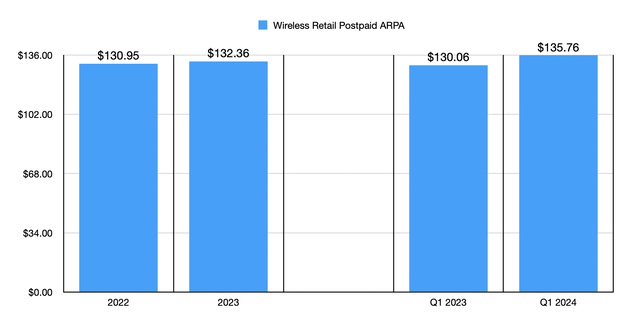

It helps that the variety of wi-fi retail postpaid connections managed to develop from 91.86 million to 93.85 million. This greater than offset the decline in wi-fi retail pay as you go connections from 22.66 million to 21.12 million. For the section as an entire, there have been another shiny spots for traders to take pleasure in. For example, Fios web subscribers grew from 6.74 million to six.98 million, whereas whole broadband subscribers expanded from 7.90 million to 9.06 million. I believe it is also value noting that wi-fi retail postpaid ARPA (common income per account) jumped by 5.1% from $125.97 to $132.36. That is the aforementioned value enhance that the corporate benefited from.

Creator – SEC EDGAR Knowledge

There’s extra to the enterprise than simply this. Its Enterprise section reported a 3.1% drop, with income falling from $31.07 billion to $30.12 billion. The largest ache from this section got here from a 4.3% decline in income for its Enterprise and Public Sector operations, with gross sales falling from $15.69 billion to $15.08 billion. Whereas the variety of broadband connections below this section expanded from 1.04 million to 1.66 million, and the variety of wi-fi retail postpaid connections grew from 28.73 million to 29.78 million, the corporate suffered from a decline in wireline networking income and conventional knowledge and voice communication providers. Skilled providers that it offers additionally took a success due to what administration describes as ‘secular pressures’ out there.

With income dropping, it shouldn’t be a shock to see profitability for the enterprise endure. Web revenue really plunged from $21.75 billion to $12.10 billion. The drop in income actually did not assist. Nevertheless, there have been different components that proved problematic as nicely. Larger rates of interest triggered curiosity expense to leap from $3.61 billion to $5.52 billion. Along with this, the corporate incurred a $5.84 billion impairment cost in 2023. Different profitability metrics have been much better off. Working money stream, as an illustration, rose from $37.14 billion to $37.48 billion. If we alter for adjustments in working capital, we get a slight enhance from $37.60 billion to $37.74 billion. In the meantime, EBITDA for the corporate contracted from $47.87 billion to $47.79 billion.

Creator – SEC EDGAR Knowledge

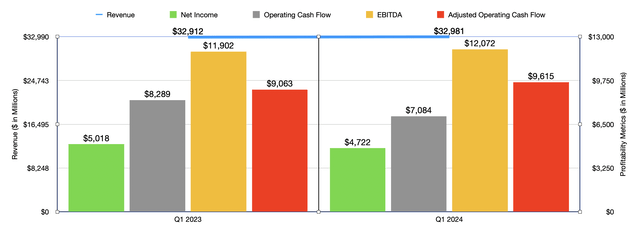

As disappointing as 2023 may need been to some traders, there are some shiny spots in the case of the 2024 fiscal 12 months. Income within the first quarter, as an illustration, totaled $32.98 billion. That’s marginally above the $32.91 billion generated one 12 months earlier. This was due solely to progress on the Shopper aspect of issues, with income inching up by 0.8% from $24.86 billion to $25.06 billion. Digging a bit deeper, we will see that wi-fi tools gross sales really fell by 8% 12 months over 12 months. Nevertheless, service income popped up by 2.9%, rising from $18.46 billion to only below $19 billion. This was largely due to wi-fi service income rising by 3.4% from $15.60 billion to $16.13 billion.

The corporate benefited from a rise within the variety of wi-fi retail postpaid connections from 92.19 million to 93.91 million. Along with this, Fios web connections grew from 6.80 million to 7.03 million, whereas whole broadband connections jumped 13.4% from 8.20 million to 9.30 million. On the pricing entrance, in the case of the wi-fi retail postpaid connections, the corporate benefited from a rise from $130.06 to $135.75. As a observe, these figures are on a month-to-month foundation.

The underside line for the corporate was largely higher on a year-over-year foundation. It’s true the web revenue fell from $5.02 billion to $4.72 billion. Working money stream additionally fell, dropping from $8.29 billion to $7.08 billion. But when we alter for adjustments in working capital, we get an enchancment from $9.06 billion to $9.62 billion. In the meantime, EBITDA for the corporate expanded from $11.90 billion to $12.07 billion.

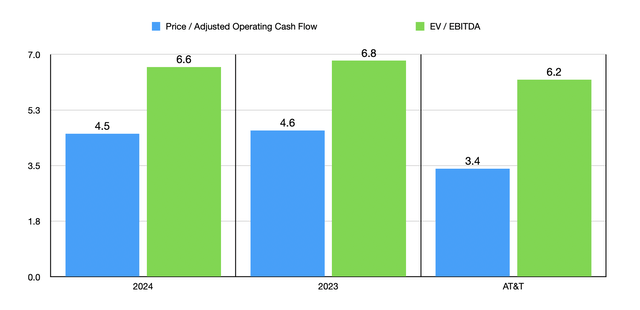

With regards to valuing the corporate, it’s value a minimum of speaking about administration’s expectations for the 2024 fiscal 12 months. They at the moment anticipate wi-fi service income to develop by between 2% and a couple of.5%. This could assist EBITDA to increase by between 1% and three%. If we take the midpoint of this progress and apply it to adjusted working money stream, we’d get a studying of $38.50 billion. In the meantime, this may translate to EBITDA of $48.75 billion.

Creator – SEC EDGAR Knowledge

Taking these figures, I then valued the corporate as proven within the chart above. That is based mostly on historic outcomes for 2023 and projected figures for 2024. At current, Verizon Communications does look attractively priced, with the corporate buying and selling at multiples within the low to mid-single digit vary. However as I acknowledged initially of this text, the agency I like extra has bought to be AT&T. A part of it is because, as that very same chart exhibits, AT&T is buying and selling cheaper than Verizon Communications is at the moment going for. Do not get me incorrect. Each corporations are very attractively priced. However of the 2, AT&T is extra interesting.

Creator – SEC EDGAR Knowledge

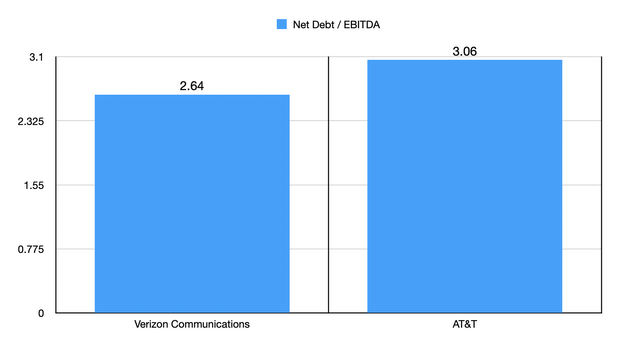

We also needs to be centered some on high quality. And maybe the simplest approach to do that is to take a look at leverage. As of the tip of the newest quarter, Verizon Communications had internet debt of $149.33 billion. It is vital to notice that $23.3 billion of this debt is definitely collateralized by sure receivables. If we strip this out, internet debt falls to roughly $126.03 billion. This offers us, utilizing the 2023 figures, a internet leverage ratio for the corporate of two.64. By comparability, AT&T is larger, with a internet leverage ratio of three.06. However I would not name {that a} vital disparity. This distinction signifies that AT&T would solely want to scale back internet debt by $17.74 billion with the intention to be at parity with Verizon Communications. With the corporate having generated $42.24 billion of EBITDA final 12 months and administration centered on debt discount this 12 months, it will not be lengthy earlier than the 2 companies are comparable on this foundation. And whereas Verizon Communications is anticipated to develop its EBITDA at between 1% and three% this 12 months, AT&T’s administration workforce is asking for a stable 3% progress.

Takeaway

All issues thought of, Verizon Communications is doing fairly nicely for itself. The corporate has seen some weak spots, comparable to when it got here to the sale of sure tools and when it got here to its Enterprise section. Earnings are additionally on the decline, although some money stream metrics have risen properly. The inventory is actually attractively priced on an absolute foundation, and leverage is decrease than rival AT&T. Once you add all of this collectively, and contemplate that I at the moment have a ‘robust purchase’ score on AT&T, I believe it solely acceptable that I improve Verizon Communications to a ‘purchase.’