anusorn nakdee/iStock via Getty Images

Investment Overview

Vericel Corporation (NASDAQ:VCEL) is demonstrating consistent growth within the company’s core product lines which are proprietary and more effective than traditional competing solutions. VCEL is bringing new products to market and continues to gain share with existing products, with both factors set to drive further expansion in the coming years. Although not without risks, VCEL is a business with competitive advantages and barriers to entry and these factors will help drive significant returns over the next 2 years.

Company Overview

Vericel is a biotechnology business that primarily targets the sports medicine and severe burn markets with breakthrough cures and treatments. VCEL’s two main products are Epicel, a permanent skin replacement option for people with severe burns who have deep dermal or full thickness burns, and MACI, a restorative cartilage repair solution intended to cure cartilage abnormalities of the knee.

MACI is the first tissue-engineered autologous cellularized scaffold product to receive FDA approval. In non-medical terms, MACI develops a repair tissue that permits patients to resume an active way of life. The synthetic tissue restores knee and joint function by repairing damage to the knee (such as cartilage chips and fractures). While lacking the restorative advantages of MACI, competing therapies have historically concentrated more on repair and pain control.

For extensive total surface area burns in both adult and pediatric patients, Epicel is the only autologous epidermal product with FDA approval. When there isn’t much natural skin available for autografts, Epicel provides a crucial alternative to cover and heal damaged tissue.

VCEL’s NexoBrid solution for the removal of scar tissue from burns has completed phase 3 trials and was approved by the FDA in December of 2022. NexoBrid is a biological product administered topically that removes nonviable burn tissue, or eschar, from patients with severe partial and full-thickness thermal burns.

Update Strategic Investment Case & Growth Outlook

Vericel is a business with material competitive advantages. VCEL’s products are highly proprietary and much more effective than competing and traditional approaches. The alternative to MACI, for example, is typically microfracture surgery. Although a full discussion of microfracture surgery is beyond the scope of this article, it is an invasive procedure with a much longer recovery time than MACI. Microfracture surgery also does not restore joint function, thus given MACI a significant leg-up vs. traditional approaches. A similar story emerges when looking at NexoBrid’s competitive advantages. Per the company’s annual report

“The current standard of care for eschar removal of deep partial-thickness and full thickness burns in the U.S. is surgical excision, which can result in both viable and non-viable tissue being removed. Surgical excision involves the use of sharp instruments or hydrosurgery” Source: Company Annual Report

As a topical solution that can be applied directly to the burn area, NexoBrid is far less invasive and more effective than traditional surgical procedures.

Beyond VCEL’s product effectiveness, investors need to consider that competitors face very high barriers to entry when targeting the core markets served by VCEL. MACI, Epicel and NexoBrid are products that all took years to develop and then spent several more years going thru the rigorous regulatory approvals process in both the US and global markets. This is particularly important, as it’s unlikely a competitor could come in and seize market share overnight.

While our previous coverage of VCEL has highlighted the total addressable market opportunities for the company’s products, there are some new positive developments for potential investors to factor into the investment thesis. To begin with, the company is positioning MACI to treat cartilage defects of the ankle. If approved, expanding MACI’s coverage to the ankle could increase MACI’s TAM by $1 billion to $4 billion overall. A phase 3 study for MACI’s treatment of ankle defects is pending. VCEL is also actively ramping up marketing efforts to land further customers for MACI in the knee repair/restoration space.

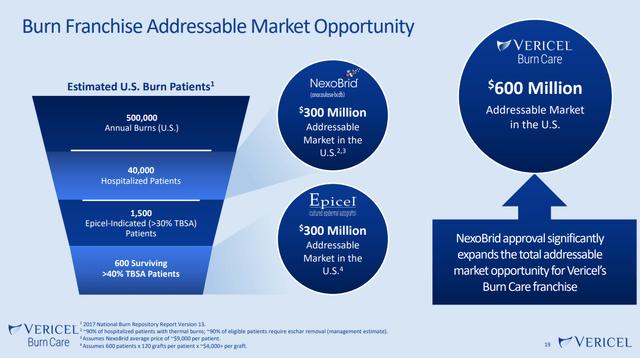

Similarly, NexoBrid represents a meaningful expansion of the TAM for the company’s burn care franchise. With NexoBrid sales and marketing efforts still in the very early stages, it’s reasonable to believe that VCEL could capture at least 10% of the addressable market over time given NexoBrid’s proven abilities to help heal and restore burn damaged skin in a non-invasive manner. $30M of run rate NexoBrid sales would be a material increase to VCEL’s top line which came in at $164M in 2022.

Company Investor Presentation

According to the company’s annual report, all 3 core products have significant runway remaining. Management notes that VCEL is looking to increase MACI revenue by increasing the number of surgeons implanting MACI and the average number of implants per surgeon. Additionally, there’s the possibility that MACI could be delivered arthroscopically in the future, which would further enhance the value proposition of this offering. Turning to Epicel, management is actively targeting additional burn centers and surgeons to further expand market share. Finally, for NexoBrid, the company believes it can leverage many of its existing relationships in the burn care area to make inroads in landing customers for its newest product.

The last area of the investment case to highlight is that VCEL’s product offerings are need based and not subject to market trends or fads. This will likely lead to significant “staying power” for VCEL’s offerings, as those in need will very likely select the option that’s known to be more effective than traditional approaches.

Updated Financial Outlook

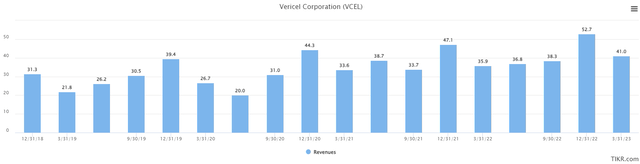

Over the years, VCEL has steadily grown its revenues. The chart below shows quarterly revenues and over the last 5-years, revenue has grown consistently outside of a downturn during the 2020 pandemic. Q1 2023 revenue of $41.0M was up $5.1M YoY vs. Q2 2022 revenue of $35.9M. Compared to the chart below, revenue growth could start to accelerate as more surgeons become familiar with MACI and as the company NexoBrid commercialization efforts ramp-up.

TIKR

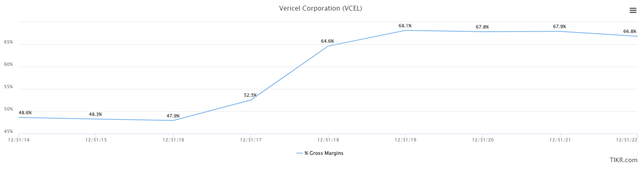

VCEL’s gross margins have also trended up over time and this appears to be a leading indicator of the company’s ability to maintain its pricing power across core product lines. Looking to the longer-term, management has repeatedly highlighted on quarterly earnings calls that they believe a 70%+ gross margin is sustainable.

TIKR

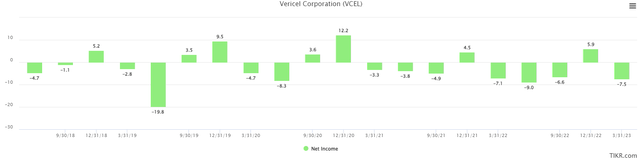

One knock on VCEL financially is that the company hasn’t been able to achieve consistent net profitability just yet. In the most recent quarter, VCEL lost $7.5M. If the company can achieve its targeted 70% gross margins and also level out sales investments, it’s likely that VCEL will start to see consistently net profitability with the next 12-18 months.

TIKR

VCEL continues to exhibit shareholder friendly qualities as well. Weighted average Diluted Shares Outstanding have stayed right around 47 million over the last 3 years. Similarly, Cash and Short-Term Investments was $119M in the most recent quarter, but has also stayed above $100M since Dec 2021. VCEL has been debt free since Dec 2018, another sign that management is fiscally conservating leading day-to-day operations.

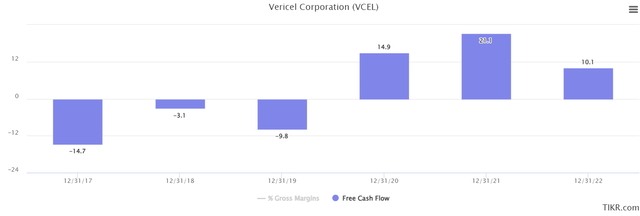

As evidenced in the chart below, free cash flow has also markedly improved over the last 5 years. This lends more credence to the case that VCEL will eventually reach net profitability too.

TIKR

Looking ahead, the Wall Street consensus is that VCEL will reach $233M of revenue next year and also flip to a net profit of $5.3M. If achieved, this would be an acceleration of sales growth to 23% annually. Analysts are also projecting that VCEL will see a sharp increase in profitability in 2025, going to a 10.3% net income margin off of $274M in sales. Overall, VCEL is well positioned from a financial standpoint.

Investment Risks

Although both the financial and strategic investment cases appear solid for VCEL, there are some risks for potential investors to evaluate. Although the company currently has 3 strong product lines which appear to have growing moats, investors need to consider what lies beyond these 3 products. Growth will eventually slow, and at the moment, management has not clarified what efforts are in-flight today as related to new product development. This lack of a product pipeline will need to be addressed in the coming years in order to ensure further growth.

Speaking of growth, VCEL is likely a business with natural growth limits. The market for treatment of severe burns is largely characterized by steady demand. Similarly, while aging global populations are seeking out more restorative cartilage procedures, there are not strong catalysts that are likely to push annual demand significantly beyond today’s current needs.

At the moment, direct competition for VCEL is relatively minimal. For MACI, potential investors will want to keep watching the results of Aesculap Biologics, LLC’s Phase 3 trial of NOVOCART® 3D. VCEL management believes that this product is the only other product in development in the US that uses the ACI approach. For NexoBrid, the company noted the following on competition in its annual report-

“Other non-surgical treatments include clostridial collagenase ointment (CCO/Santyl® ) (Smith & Nephew, plc.), antimicrobial agents (silver sulfadiazine), or hydrogels. Although less invasive than surgical excision, prior to NexoBrid, non-surgical debridement agents have often been considered inefficient, can result in a lengthy sloughing period, and have the potential for the development of granulation tissue and increased infection and scarring. Other than NexoBrid, CCO is the only FDA-approved product for enzymatic eschar removal in the U.S.” Source: Company Annual Report

More general risks for VCEL include being subject to a complex number of medical and health regulations around the world. This dynamic is unlikely to change any time soon and the company will need to continue to navigate the evolving regulatory environment. VCEL is also dependent on a complex global supply chain for its products. At times, this supply chain can be subjected to disruptive forces. Although this is not a problem unique to VCEL, supply chain disruption could dent quarterly financials.

Base, Bull & Bear Outlooks

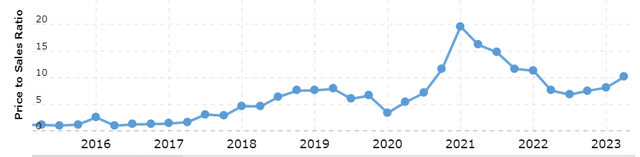

Since VCEL remains unprofitable at the moment and continues to exhibit strong growth, we’ll consider valuation scenarios using the P/S multiple. Currently, the company is trading at multiple of 10.1x, though this valuation has fluctuated consistently in recent years.

Macrotrends

The bear case for VCEL likely involves a lack of adoption for NexoBrid, in combination with growth slowing for MACI. In this scenario, sales growth slows to 5% annually after reaching $190M this year, implying 2025 sales for $210M. The result here is likely significant multiple compression for VCEL down to 4.0-5.0x sales range. VCEL’s market would drop from $1.75B today to $800M+ in the bear scenario.

The base scenario revolves around VCEL continuing to grow steadily at 15% per year. Here sales pop to $250M by 2025, but net margins come in closer to 5% vs. the 10% Wall Street had modeled. As a result of slower growth and lower margins, the P/S multiple comes down to 8.5x, giving VCEL a projected market cap of $2.1 billion.

The bull case occurs if management is able to guide VCEL to 20% growth over the next 2 years. Total sales in this scenario jump to $274M and management hits Wall Street’s targeted 10% margins in 2025. In this scenario, there’s a case for slight multiple expansion to 11.0x sales, bringing VCEL’s market cap to $3.0 billion, a 76% total increase.

Our view is that VCEL likely lands somewhere in the middle of the base and bull scenarios, and therefore achieves a valuation in the $2.3B – $2.5B range. Since VCEL’s product offerings are best-in-class, management has demonstrated an ability to operate and scale the business and because significant growth opportunities remain, VCEL is assigned a buy rating. Given current market conditions, it wouldn’t be surprising to see a better entry point in the coming months. For investors seeking a larger margin of safety, a targeted entry point would be around $30 per share or a market cap of less than $1.5 billion.