stevanovicigor/iStock via Getty Images

Introduction

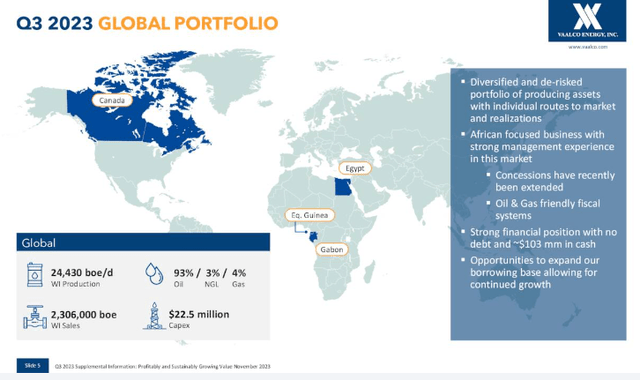

VAALCO Energy, Inc. (NYSE:EGY) is a small, primarily-West-African, oil and gas player with principle producing interests in Egypt and Gabon. We have discussed EGY once before. It has a long-term development prospect offshore Equatorial Guinea, with the Blk-P, Venus discovery, with first oil targeted to 2026. It also has a small position in Canada’s Cardium/Ellerslie play. The Egyptian and Canadian positions came as a result of the merger with TransGlobe in 2022.

VAALCO price chart (Seeking Alpha)

Through Q3 2023, EGY’s gross production came to 24,430 BOEPD, and gave Q4, guidance of 23,950 BOEPD. Analysts are bullish on EGY with a buy rating, and price targets of $7.25-$10.00. Either case bringing substantial growth from current, discounted levels.

EGY will report results for Q4, and full year 2023 on March, 14th. Let’s review what the company told us in Q3 2023 and projections for Q4 and see where we land in relation to the analyst’s projections.

The rationale for VAALCO Energy

For a long time, VAALCO was primarily a one-asset company, with offshore production in the Etame field in Gabon’s waters. That made its revenues and profits have a high beta and strategic investing difficult. Particularly as they seemed to lack an understanding of shallow water completion operations, as I noted in the last report. (Like most things, it is better to do it right the first time, rather than fix it later.) The merger with TransGlobe in 2022 fixed a lot of that, bringing new production into the combined company, and a more diversified asset base.

VAALCO Global Portfolio (VAALCO Energy)

EGY has been growing their dividend and share buybacks as a direct result of their expanded asset base and cash flow generation ability following the TransGlobe acquisition. They are generating almost $90 million in free cash flow year-to-date in 2023. Thus far, EGY has returned 41% of that directly to shareholders. EGY also fully funded Q3 net capital expenditures of $22.5 million on a cash basis.

The company has no debt, and expects to control capital spend in 2024, with it dropping substantially in Q4. Capex should run $9 million and $12 million in this quarter, which will add to free cash flow.

EGY has hedging in place to protect cashflow, while preserving upside for higher products price. Costless collars are in place for Q4 2023, and they have entered into costless oil collars indexed to dated Brent for Q1 and Q2 of 2024. These collars have a floor price of $65, for around 15% of their production, with upside in the collars to between $90 and $100. 85% of their production is unhedged for exposure to higher commodity pricing.

The company has several growth centers that will compete for capital this year.

Eygpt

The 2023 campaign was completed faster and at lower cost than originally forecast. In 2023, they drilled 18 verticals, including one injector well and two exploration wells, as well as a horizontal well.

They saw significantly faster drilling performance in 2023, moving from a 2022 average of about three wells drilled every four months to now drilling two wells per month, which is a 60% reduction in cycle time. Faster wells equal, lower costs and improved the economics. The company believes that Egypt has a lot of value and organic drilling opportunities.

Canada

In Canada, two wells were drilled in the first quarter of 2023, a 1.5-mile lateral and a 3-mile lateral. The wells began flowing in May with good production rates, and in early July the pumps and rods were installed on both wells. Both wells production rates exceeded expectations and are now being monitored for long-term performance.

The plan going forward will be to move to 2.5-mile and 3-mile laterals almost exclusively, which we believe will further improve the economics of our development program. Canada also set a production record in 2023, another reason we are performing so well as a company and exceeding our production targets.

The company is evaluating facility and pad optimization, future development wells, and further refining their completion techniques in anticipation of potential future drilling campaigns in Canada.

Gabon

Drilling saw a lull in 2023 after an intensive campaign in 21/22. Despite no 2023 drilling program, production results stayed strong in 2023.

Last year’s FSO and field reconfiguration projects have allowed the company to operate more efficiently and economically in 2023. The impact of the cost savings from the new FSO are helping to offset some other higher costs from inflationary and industry supply pressures.

EGY is currently evaluating locations for the next drilling campaign at Etame, which is currently projected to be a three-well to four-well program with additional well options. EGY continues to review rig options for our 2024 drilling program.

And, then there is Côte d’Ivoire.

Côte d’Ivoire – a catalyst for EGY

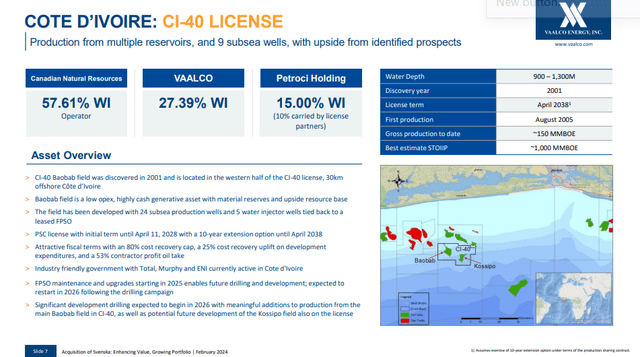

The Svenska acquisition was immediately accretive, with ~4,500 BOPD of 99% oil production added to their output. An increase of some 19%+ at one shot, and a commensurate boost to EBITDA. The Svenska pickup also comes with future development prospects, facilated by infrastructure that came in the deal. West African production gets Brent pricing, adding further to netbacks.

VAALCO Côte d’Ivoire (VAALCO Energy)

Svenska’s primary asset is a 27.39% non-operated working interest in the deepwater producing Baobab field in Block CI-40, offshore Côte d’Ivoire in West Africa. Canadian Natural Resources (CNQ) is the operator.

The purchase price is $66.5 million, with an effective date of October 1, 2023. The gross purchase price will be partially funded by a pre-closing dividend of cash on Svenska’s balance sheet to the Seller with the balance funded by a portion of VAALCO’s cash-on-hand with no issuance of debt or equity. VAALCO currently estimates that the net cash due at closing will be in the range of approximately $30 to $40 million, dependent on timing-expected to be second quarter 2024.

Risks

Companies with a focus on West Africa come with some added political risk that can rear up unexpectedly. Such was the case last year, when in Gabon, a military coup overthrew the previous government. EGY seems to have made the transition with no significant damage, as noted in this SP Global report.

Your takeaway

VAALCO Energy, Inc. is trading for 2.87X EV/EBITDA, and $30k per flowing barrel, both figures putting a solid buy target on the company. This is before the Svenska purchase hit the balance sheet. If you tack those numbers on the ratios, they decline to 2.15X and $26K respectively. Too cheap for a company with no debt and growth prospects.

The analysts have put some ambitious price targets on the stock that might be delivered in a couple of areas. Increasing revenues and margins from higher oil prices and lower capex over the next few quarters could boost EBITDA toward $380 mm on a full-year basis. If you put a 3X on that figure, EGY capitalization becomes $1,114 bn. With 106 mm shares outstanding, you can get a $10.75 share price, slightly exceeding the analyst forecast.

EGY has a fairly long track record of successful operations, and a strong balance sheet. Cash flow is covering the dividend and capex, and the setup for 2024 appears to maintain that outlook for the year. I think that I agree with the analysts and put a buy rating on the company at current levels.