DNY59

Utilities stocks came under significant pressure for most of 2023, as the Fed interest rate hikes knocked much-needed sense into over-optimistic investors. However, the battering in utilities stocks has also created opportunities for investors in late 2023 as the utilities sector (XLU) bottomed out. Accordingly, XLU bottomed out in early October 2023, well before Fed Chair Jerome Powell indicated the Fed’s expectations of three rate cuts in 2024 at his mid-December press conference. In other words, astute utilities investors have prepared two months ahead of a long-term bottom in the rate-sensitive sector, believing that the worst hammering in utilities stocks is likely over.

Cohen & Steers Infrastructure Fund (UTF) is a CEF primarily focused on infrastructure companies in its capital allocation. It has an objective of “total return with an emphasis on income.” Therefore, the CEF’s targeted investors are likely income investors looking to benefit from the secular themes in infrastructure investing. Moreover, the fund uses leverage (effective leverage: 30.1%) with the intent of “increasing net income available for shareholders.” UTF highlights its prudent use of leverage to “potentially increase dividend yield for shareholders.” Accordingly, 85% of its financing is based on fixed rates with an average term of three years. However, with 15% of its financing based on variable rates, the market likely needed to reflect execution risks on its investment strategy, given the Fed’s unprecedented rate hikes.

Given the Fed’s communication of rate cuts in 2024, I believe it lent credence to the bottoming process in UTF in early October 2023, in line with XLU’s bottom. That’s right; the market had anticipated the Fed pivot well ahead of Powell’s pressor, reminding investors why they must look forward, not backward, when assessing the most attractive entry levels for an investment thesis.

By the time you read this article from me, UTF has already recovered nearly 26% (including dividend adjustments) from its October lows through its recent December highs. It’s well above UTF’s 5Y and 10Y total return CAGR of 8.8% and 8.7%, respectively. Therefore, risk/reward matters, even for a leveraged CEF like UTF. Based on Morningstar’s moat classification, UTF’s portfolio mainly consists of companies with at least a narrow moat. Accordingly, more than 58% of its portfolio is attributed to wide- and narrow-moat companies. Therefore, I gleaned that UTF is still a solid income-generating investment at the right levels to deliver its total return premise. With a TTM distribution yield of 8.65% against its 10 average of 7.7%, I believe the medium-term recovery thesis in UTF remains valid for income-focused investors looking to outperform on a total return basis.

Why? I believe the main concern with UTF’s thesis isn’t predicated on the quality of the companies in its portfolio, as I indicated earlier. The market de-rated UTF in sync with the hammering in utilities stocks, as UTF has more than 50% exposure in the sector as of Q3. Moreover, utilizing leverage is a double-edged sword that could lead to more losses than anticipated, particularly when UTF needs to refinance its variable and fixed rate leverage. As a result, it could result in UTF being less able to defend its current distribution payout if its leveraged investment strategy proves to be less successful than expected. These critical factors merit further assessment for investors considering using UTF to gain leveraged exposure to infrastructure stocks.

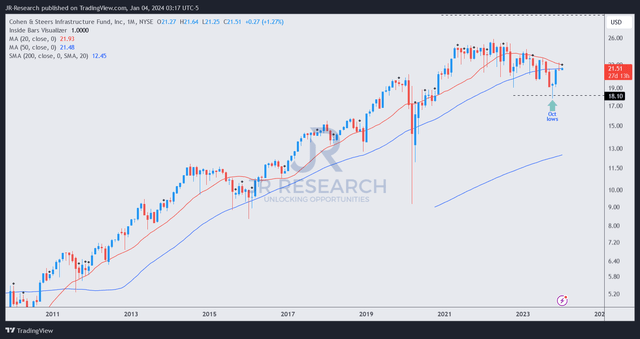

UTF price chart (monthly) (TradingView)

Based on my assessment that UTF bottomed out in October 2023, as seen above, I have confidence that it should regain composure and resume its long-term uptrend continuation.

It should be clear to price action investors that UTF’s long-term uptrend remains undefeated. Its October low was an astute bear trap (false downside breakdown) that demonstrated dip buyers have returned convincingly, defending those lows resolutely.

While I don’t expect UTF to regain its all-time high anytime soon, the risk/reward remains favorable, supported by its attractive yields. However, investors must be cautious about being too aggressive. UTF’s surge from its October lows could be primed for profit-taking by investors who bought its dips, leading to increased near-term volatility. As a result, a more controlled cadence of buying in phases is encouraged, allowing investors to buy steeper near-term pullbacks, partaking in UTF’s potential long-term recovery thesis.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!