Investing.com– U.S. inventory index futures steadied in night offers on Monday following a optimistic session on Wall Road, with focus turning to the Jackson Gap Symposium and the Democratic Nationwide Congress this week for extra cues.

Wall Road pushed larger amid easing considerations over a U.S. recession, whereas merchants purchased into heavyweight expertise shares after a extreme rout earlier this month.

rose barely to five,630.50 factors, whereas rose 0.1% to 19,869.25 factors by 19:10 ET (23:10 GMT). steadied at 41,015.0 factors.

Jackson Gap awaited for fee minimize cues

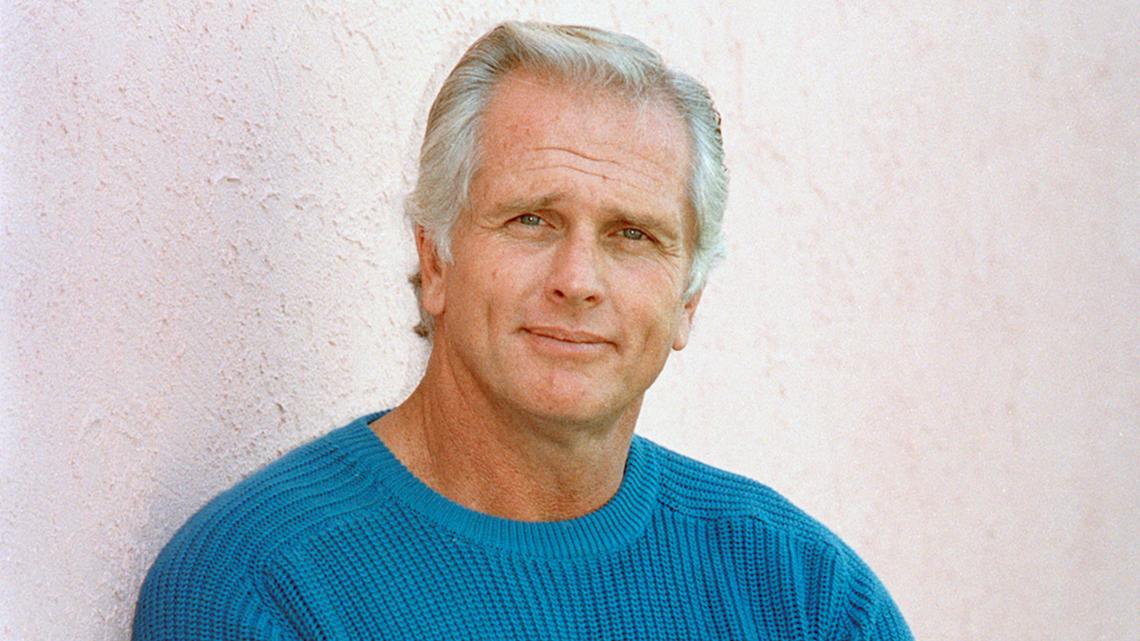

The Jackson Gap Symposium- a gathering of main central financial institution leaders and finance ministers- begins later this week, with an tackle from due on Friday.

Powell’s tackle will probably be intently watched amid rising conviction that the central financial institution is getting ready to chop rates of interest by 25 foundation factors in September, as current financial readings confirmed some cooling in inflation.

Powell may doubtlessly flag the potential of a 50 bps minimize, Evercore analysts mentioned, though they don’t anticipate the Fed chairman to explicitly point out simply by how a lot the Fed plans to start trimming charges.

Any feedback on a possible recession can even be in focus, particularly whether or not Powell nonetheless sees a tender touchdown for the U.S. economic system.

DNC in focus as 2024 presidential race heats up

Focus this week can also be on the Democratic Nationwide Conference, with President Joe Biden set to talk on the occasion in a while Monday.

Vice President Kamala Harris was formally nominated because the celebration’s presidential candidate earlier in August, and picked Minnesota governor Tim Walz as her operating mate.

Harris was endorsed by Biden in July, and was seen swiftly catching up with Republican frontrunner Donald Trump in current polls, presenting a good 2024 presidential race.

Wall St at 1-mth excessive as recession fears ease

Wall Road indexes hit one-month highs on Monday, buoyed by rising optimism that the U.S. economic system remained resilient.

The rose 1% to five,608.25 factors, whereas the rose 1.4% to 17,873.38 factors, with each indexes hitting one-month highs. The rose 0.6% to 40,896.53 factors and hit a three-week excessive.