David Smith, Americas Head of Occupier Research, Cushman & Wakefield, emphasizes the importance of planning in advance. Image courtesy of Cushman & Wakefield

Although the reshoring and nearshoring of manufacturing are surging in the U.S., a significant obstacle to these trends is on the real estate side, according to a new report from Cushman & Wakefield.

Noting that “the composition of real estate will need to change,” the report explains that only 80 million square feet of manufacturing space is currently under construction in this country. And of that, half will be owner-occupied and a further one-quarter is non–owner-occupied build-to-suit.

Cushman & Wakefield therefore predicts that “tight leasing market conditions will be an issue for occupiers who have not already secured their facilities.”

Another limiting factor is electrical power, a crucial need for manufacturing. The report points out that “many greenfield land sites lack sufficient power to host the manufacturing sites needed,” further complicating development site selection.

READ ALSO: Top Markets for Industrial Deliveries in H1

Manufacturing job announcements in 2022 that were related to reshoring and foreign direct investment topped 360,000, which the report describes as “a record-breaking 53 percent increase from 2021.”

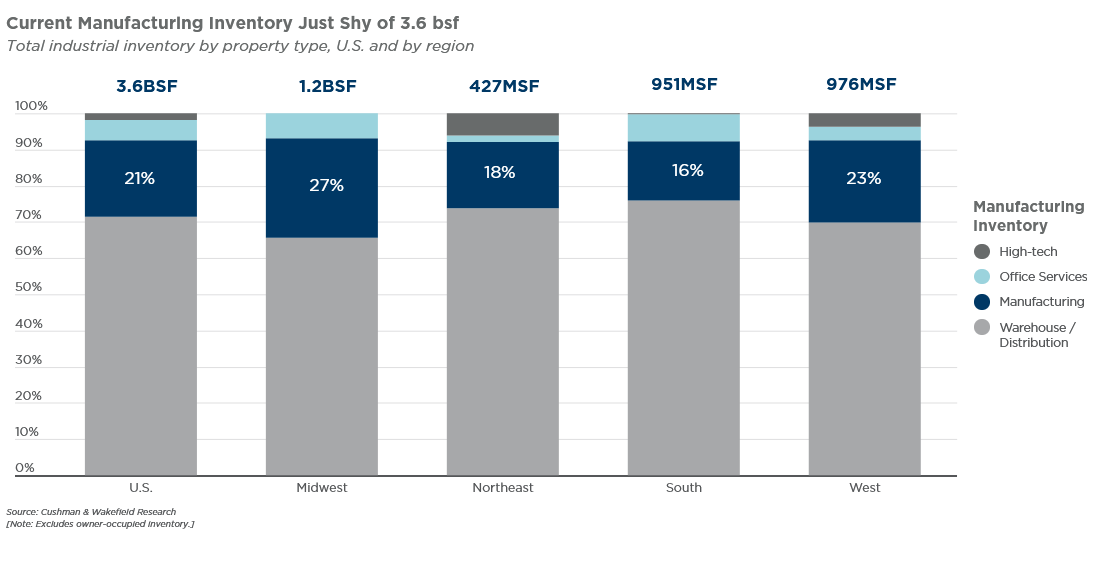

Industrial inventory by property type (excluding owner-occupied inventory). Chart courtesy of Cushman & Wakefield

Investments in manufacturing and clean energy of $470 billion by private companies since 2020, plus a further $220 billion by the federal government over the same period, have helped to drive “manufacturing employment to 13 million as of midyear 2023, its highest level since 2008,” Cushman & Wakefield states.

Regional shifts, too

On an absolute basis, manufacturing job demand is strongest in California and Texas, at 24,000 and 17,000 unique postings, respectively. The Midwest has the most job postings, at 66,000, an impressive increase of 28 percent year-over-year, lagging only the Southeast, at 31 percent.

The report attributes the ongoing shift of manufacturing from the perennially strong Midwest to the Sun Belt to “the strong growth in auto-related manufacturing; the 50 metro areas with the highest concentration of employment in auto-related manufacturing are all located in either Southern or Midwest states.”

As reshoring and nearshoring trends gradually take hold, “it will be important to consider the state of manufacturing real estate,” David Smith, Head of Americas Insights for Cushman & Wakefield, said in a prepared statement. He added that working strategically on location, understanding labor needs and the cost of operations and materials will be more important than ever, and the planning should start now.