US jobs growth slowed in March but not enough to deter the Federal Reserve from considering another interest rate increase as the central bank battles high inflation.

The world’s largest economy added 236,000 positions last month, according to a report from the Bureau of Labor Statistics published on Friday. This was a step down from the upwardly revised 326,000 jobs accrued in February and far below the 472,000 recorded in January. Most economists polled by Bloomberg had forecast job gains of 230,000 in March.

Over the past six months, monthly jobs gains have averaged 334,000, according to the BLS.

The unemployment rate slipped to 3.5 per cent, just above a multi-decade low. Wage growth, meanwhile, remained firm, with average hourly earnings up another 0.3 per cent in March following a 0.2 per cent increase the previous period.

On a year-over-year basis, wages have increased 4.2 per cent. That is the lowest reading since the middle of 2021, suggesting inflationary pressures are easing.

“There are some signs of gradual weakening of labour demand,” said Eric Winograd, an economist at AllianceBernstein. “We might be seeing a little bit of a cooling off, but we aren’t seeing the sort of cooling off that would put the economy back in equilibrium that would take the pressure off of inflation in the short term.”

He added: “The question we’re all wrestling with is whether the turbulence in the banking sector is sufficient to do that, and it’s simply too early to tell.”

US government bonds came under selling pressure, with the policy-sensitive two-year Treasury yield adding 0.15 percentage points to 3.98 per cent in a shortened session. The benchmark 10-year yield rose 0.09 percentage points to 3.39 per cent, according to Bloomberg data. Yields rise when prices fall.

US stock markets are closed for Good Friday. Pricing in the futures markets indicated that investors continued to believe the Fed had implemented its last interest rate rise in this cycle. In a statement released on Friday, President Joe Biden said the recent data indicated that the US “continue[s] to face economic challenges from a position of strength”.

The jobs report follows other data this week that offered tentative signals that a year-long effort by the Fed to tame inflation is starting to weigh on a historically strong labour market. Jobless claims figures, which track new applicants for unemployment aid, came in higher than expected on Thursday and figures over the past 12 months were revised significantly higher as part of an annual review by the BLS.

US job openings also dropped sharply in February, data on Wednesday showed, pushing the ratio of jobs available to unemployed people down to 1.7 from 1.9.

“If I were to provide a theme for this jobs report, it’s clearly on the path to normal,” said Kristina Hooper, chief global market strategist at Invesco.

“This, to me, tips the scales in favour of a more dovish Fed going forward.”

Fed officials have maintained that it would take a period of “below-trend growth and some softening in labour market conditions” to get inflation back down to the central bank’s 2 per cent target. Most policymakers, based on forecasts published last month, project the unemployment rate will rise to 4.5 per cent this year and growth will slow to 0.4 per cent as they advance their monetary tightening campaign.

Following another quarter-point rate rise last month, the federal funds rate hovers between 4.75 and 5 per cent. Most officials see it peaking between 5 and 5.25 per cent this year and forecast no cuts until 2024, suggesting markets are in store for one more quarter-point rate rise.

Complicating the outlook for the Fed, however, is the extent of the economic shock posed by the recent banking turmoil. Fed chair Jay Powell and other officials have suggested there is likely to be a credit crunch as lenders pull back, but the magnitude of the retrenchment is highly uncertain.

“Such a tightening in financial conditions would work in the same direction as rate tightening,” Powell said last month, adding that it could potentially be the equivalent of a “rate hike or perhaps more than that”.

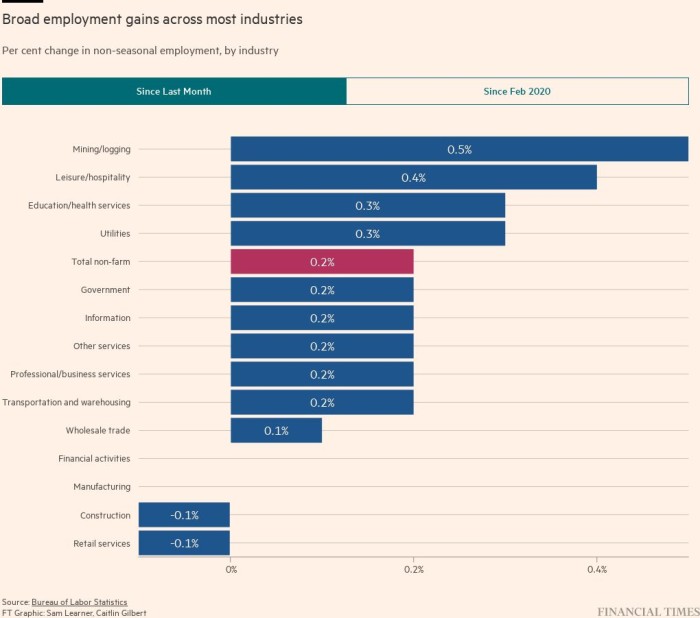

According to Friday’s data, leisure and hospitality jobs led March’s gains, with 72,000 positions added. That is a step down from the average monthly gain of 95,000 over the past six months. Employment across the government rose by 47,000, while that for professional and business services gained 39,000.

Of the sectors to shed jobs, the retail sector had the biggest losses, at 15,000 positions. Warehousing and storage jobs shrank by 12,000.