All interest rate increases are not created equal. Interest rates can go up due to expectations of improving economic prospects. Alternatively, they can be pushed up by rising inflation expectations. Or they can also increase due to expectations of more aggressive central bank policy. Interest rate increases in advanced economies—especially the United States—can create financial pressures in emerging market and developing economies (EMDEs). Our work indicates that the types of shocks that have driven U.S. interest rates upward during 2022 are especially likely to trigger financial crises in the developing world.

Shocks behind rising U.S. interest rates

In a recent paper, we distinguish between three potential drivers of rising U.S. interest rates:

- “Real shocks,” which are prompted by improved prospects for U.S. economic activity;

- “Inflation shocks,” which reflect expectations of rising U.S. inflation;

- “Reaction shocks,” which reflect investors’ assessments that the Federal Reserve’s reaction function has become more hawkish.

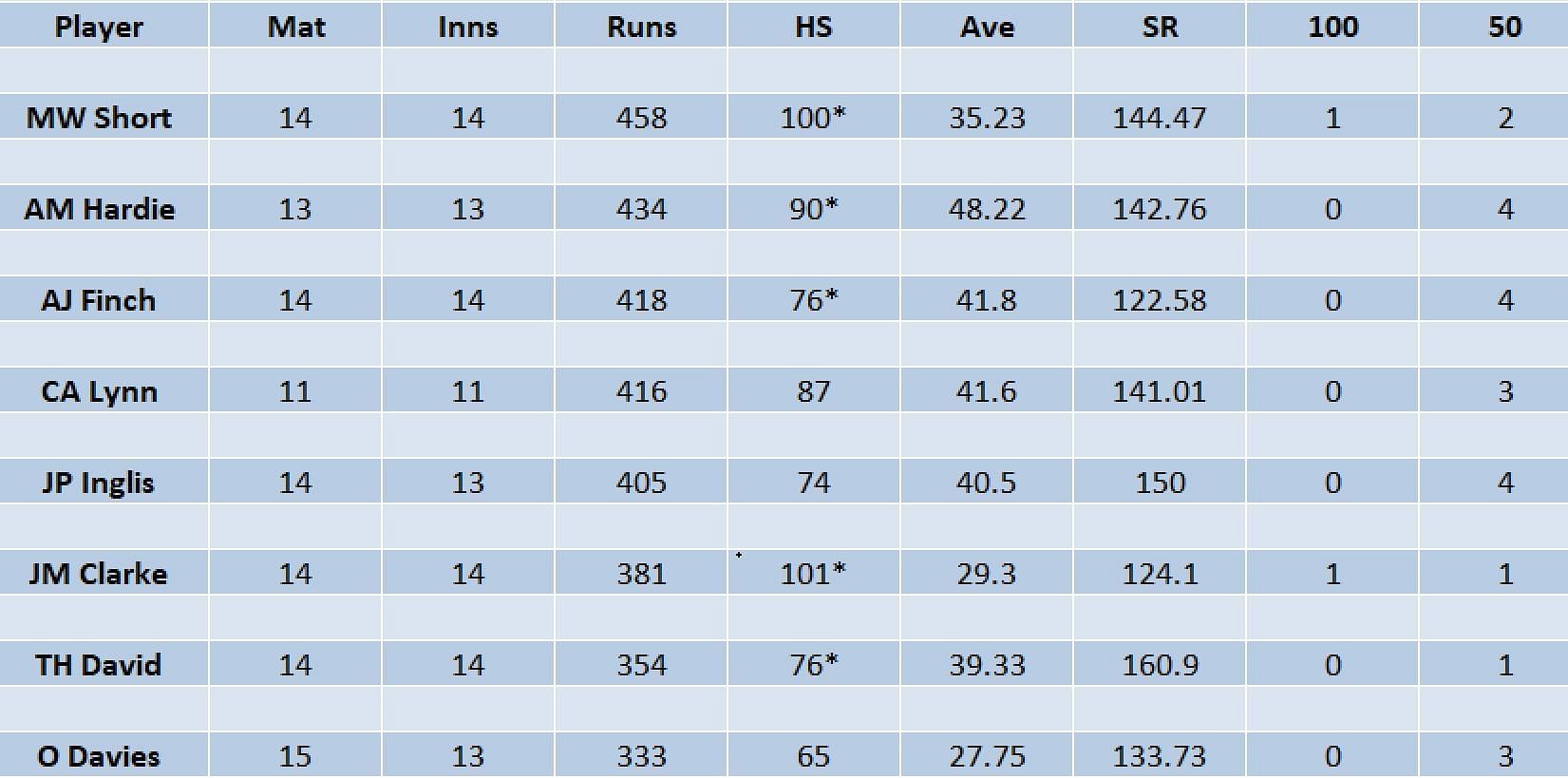

We find that, over the past year, rising U.S. interest rates have been driven mainly by reaction shocks, as the Fed has pivoted toward more aggressive action to rein in inflation (figure 1).

Figure 1. Drivers of two-year U.S. interest rate yields in 2022

Note: Shocks are estimated from a sign-restricted Bayesian vector autoregression (VAR) model with stochastic volatility. Real shocks raise U.S. interest rates, inflation expectations, and equity prices (a proxy for economic prospects). Inflation shocks raise U.S. interest rates and inflation expectations but lower equity prices. Reaction shocks raise U.S. interest rates but lower inflation expectations and equity prices. Figure shows cumulative change in underlying shocks and yields since January 2022.

Rising crisis probabilities in developing countries

We then estimate the impact of these shocks on the probability of EMDE financial crises. We explore three types of financial crises: sovereign debt, banking, and currency. We find that rising U.S. interest rates driven by real shocks lead to small changes in the likelihood of a crisis. In contrast, reaction shocks (the anticipation of more hawkish Fed policy) substantially boost the probability that an EMDE will experience a financial crisis (figure 2).

Figure 2. Impact of increase in 2-year U.S. interest rate yield on EMDE crisis probability

Note: Based on results from panel logit model with random effects. “0” indicates the probability of a crisis in a given year when there is no change in the underlying shock and all other variables included in the model are at their sample means. “+0.25%”, “+0.50%”, and “+1.40%” indicate the crisis probabilities in the hypothetical case of 25, 50, and 140 basis point increase in the 2-year U.S. treasury yield driven by the underlying shock.

What is worse, our results suggest that a doubling of the size of the reaction shock leads to a more-than-doubling of the increase in financial crisis probability. An increase of only 25 basis points in U.S. two-year yields driven by a reaction shock raises the probability of a financial crisis in a given EMDE moderately, from 3.5 percent to 6.6 percent. But during 2022, reaction shocks have boosted two-year yields by about 140 basis points, which has resulted in an increase of 51 percentage points in the probability of EMDE financial crisis, to almost 55 percent.

Further increases in U.S. interest rates can result in more widespread currency distress, given the increase in EMDE debt and the depletion of foreign currency reserves that has taken place of late.

More currency crises may lie ahead

The impact of reaction shocks on the probability of a currency crisis is even larger—reaction shocks in 2022 have pushed the likelihood of currency crises to 78 percent. In 2022, seven EMDEs experienced a currency crisis, and 21 EMDEs reached agreements with the IMF for additional financing. Further increases in U.S. interest rates can result in more widespread currency distress, given the increase in EMDE debt and the depletion of foreign currency reserves that have taken place of late.