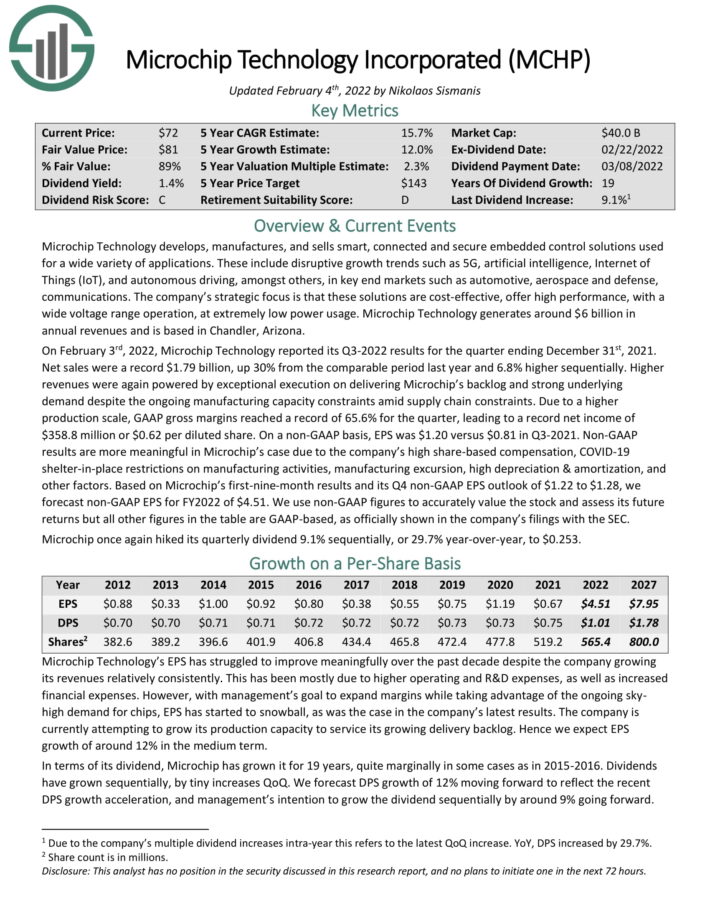

Key Takeaways

- The US authorities is finalizing a complete audit of its Bitcoin holdings this Saturday.

- This audit would be the first full accounting of government-held Bitcoin throughout federal companies.

Share this text

The US Division of the Treasury and different federal companies are anticipated to reveal their holdings of Bitcoin and different crypto property on April 5, according to President Trump’s latest directive.

Whether or not XRP, Solana, and Cardano—the digital property that the president beforehand talked about—will likely be included within the nationwide digital asset stockpile may also be clarified quickly.

On March 6, Trump issued an govt order forming a Strategic Bitcoin Reserve and a Digital Asset Stockpile.

In keeping with a presidential doc printed on March 11, all federal companies should report their holdings of Bitcoin and different digital property to the Treasury Secretary inside 30 days of the order.

The Treasury Secretary can be directed to determine two workplaces to handle government-held digital property. The Strategic Bitcoin Reserve will maintain Bitcoin acquired by way of prison or civil forfeiture and won’t promote Bitcoin, positioning it as a “digital Fort Knox” for long-term worth storage.

David Bailey, CEO of BTC Inc, recommended that the audit outcomes may make clear Bitcoin’s latest value actions.

Regardless of the announcement of a strategic Bitcoin reserve, Bitcoin volatility remained excessive and its value continued to say no, primarily pushed by commerce warfare and recession considerations. For the reason that institution of the reserve, Bitcoin’s value has fallen roughly 10%, dropping from over $92,000 to $82,000.

“Relying on what we study, would possibly reply lots of the open questions in regards to the latest value motion,” stated Bailey.

In keeping with information tracked by Arkham Intelligence, the US authorities presently holds 198,012 BTC price round $16 billion.

David Sacks, the White Home’s crypto czar, stated that the federal government beforehand held roughly 400,000 Bitcoin by way of civil and prison asset forfeitures over the previous decade.

Nonetheless, about half of this quantity—195,000 BTC—was bought, producing $366 million in proceeds. If the federal government had retained all 400,000 BTC, its worth as we speak would exceed $17 billion.

Share this text