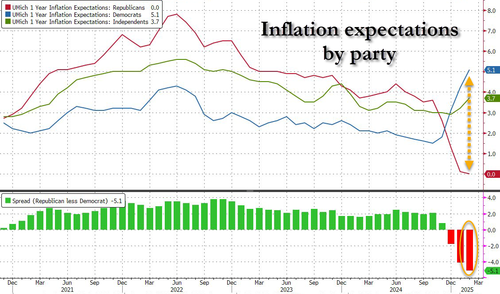

Again in February, economists and strategists have been surprised by the February UMichigan client sentiment survey which indicated a completely ridiculous surge in 1Yr inflation expectations (from 3.3% to 4.3%), however not as a result of everybody expects extra inflation however as a result of Democrats now anticipate one thing approaching hyperinflation at 5.1%, at the same time as Republicans anticipate 0.0% inflation in 1 12 months (and the way the common of those two provides as much as 4.3%, perhaps socialist UMich “professor” Justin Wolfers can inform us). But regardless of the clearly political, and thus unreliable, nature of the print the market moved dramatically, and a whole bunch of billions of market cap was worn out as shares offered off on worry of extra Fed tightening in coming months.

Simply because the quantity was so galactically silly, we stated that when the NY Fed’s inflation expectations printed final month that they might present an unchanged print and “dunk on the UMich idiocy.”

Watch as NY Fed 1Yr inflation expectations are flat and dunk on the Umich idiocy.

— zerohedge (@zerohedge) February 10, 2025

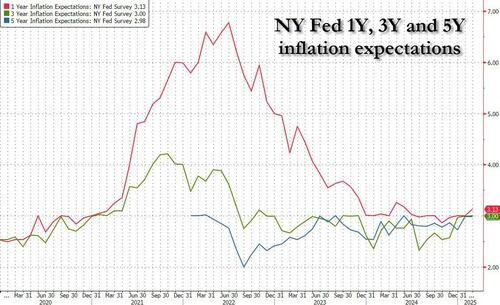

That is exactly what the Fed revealed when it confirmed that removed from hovering, 1-12 months inflation expectations weren’t solely unchanged at 3.00% – as we stated they might be – however they got here in under the median analyst estimate of three.1%.

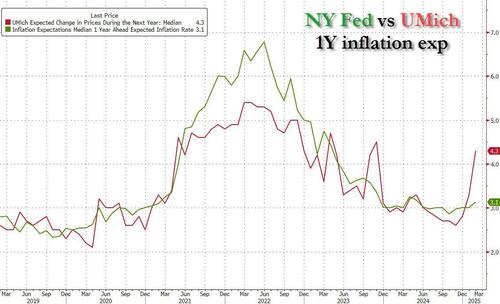

So quick ahead one month to at this time, when this time we did not even trouble to dunk on the ridiculously ineffective and politicized UMich “information”, and as a substitute we knew that the newest NY Fed numbers would present continued normalization, and that is exactly what occurred, when in response to the New York Fed’s survey of client expectations, inflation expectations on the one-year horizon have been simply barely increased at 3.1% in Feb. from the earlier month’s 3.00%. On the identical time, each 3Y and 5Y inflation expectations have been unchanged! A lot for some imaginary surge in inflation.

In consequence, the hole in 1 12 months inflation expectations between the NY Fed survey and the UMich survey – which is able to ship its newest pile of steaming horse shit “information” later this week – has exploded so broad…

… even WSJ Fed mouthpiece Nikileaks Timiraos was compelled to touch upon it for the second month in a row (and mock it).

That massive soar in inflation expectations within the U-Mich survey? It is not registering within the NY Fed’s client survey for February.

Median 1-year-ahead inflation expectations elevated by 0.1 pp to three.1% and have been unchanged on the three-year and five-year horizons (each at 3.0%) pic.twitter.com/uUc7YE5gBz

— Nick Timiraos (@NickTimiraos) March 10, 2025

And for many who declare that that is all because of confusion by the respondents, the NY Fed dunked on that as nicely, reporting that the the measure of disagreement throughout respondents (the distinction between the seventy fifth and twenty fifth percentile of inflation expectations) decreased on the one-year horizon and was unchanged on the three- and five-year horizons.

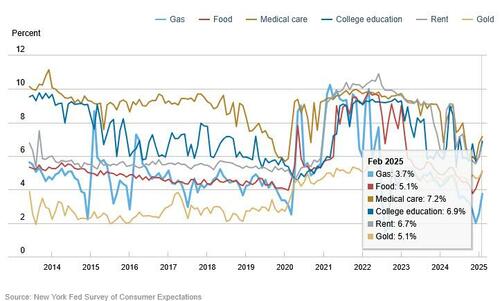

The report additionally confirmed that People now see sooner value development for fuel, meals, medical care and lease. Taking a more in-depth have a look at the composition, year-ahead commodity value expectations elevated for all commodities. Median anticipated value development elevated by 1.1 share factors for fuel to three.7% (its highest stage since June 2024), 0.5 share level for meals to five.1% (its highest stage since Might 2024), 0.4 share level for the price of medical care to 7.2%, 1.0% share level for the price of a school diploma to six.9%, and 0.7 share level for lease to six.7%.

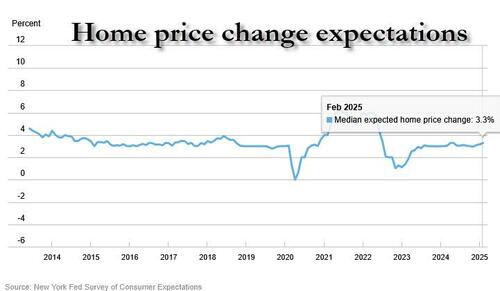

Rising inflation expectations usually are not simply dangerous information: in deed, the median house value development expectations elevated by 0.1% level to three.3%, suggesting family consider they may have extra house fairness sooner or later. That stated, this collection has been transferring in a slim vary between 3.0% and three.3% since August 2023.

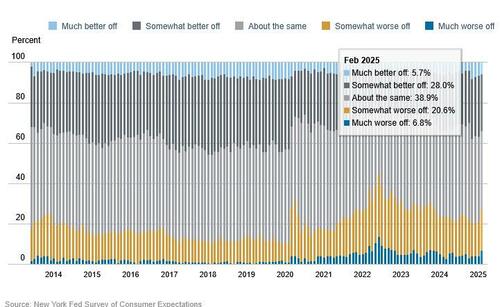

Whereas expectations of inflation rose ever so barely, shoppers appear to be extra pessimistic about their funds, and in response to the newest survey, shoppers’ year-ahead expectations about their households’ monetary conditions deteriorated significantly because the share of households anticipating a (considerably or a lot) worse monetary scenario one 12 months from now rose to 27.4%, its highest stage since November 2023.

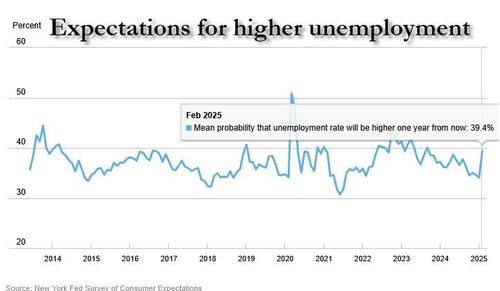

On the identical time imply unemployment expectations, or the imply likelihood that the U.S. unemployment fee can be increased one 12 months from now, jumped up by 5.4% to 39.4% in February, its highest studying since September 2023.

“Households expressed extra pessimism about their year-ahead monetary conditions in February, whereas unemployment, delinquency and credit score entry expectations deteriorated notably,” the New York Fed wrote in an announcement.

Employees have been additionally extra downbeat about their job prospects. The common likelihood of quitting a job within the subsequent 12 months — usually an indication of how assured shoppers are within the labor market — fell to 17.6%, the bottom stage since July 2023. The percentages of discovering a job in three months after turning into unemployed additionally declined, remaining under its 12-month common.

Other than the job market, the report confirmed shoppers dimmed their outlook for the inventory market. The anticipated likelihood that inventory costs can be increased in a 12 months fell once more to simply 37%, the bottom since December 2023.

Lastly, a bigger share of shoppers, 14.56% vs 13.32% in prior month, anticipate to not have the ability to make minimal debt funds over the following three months

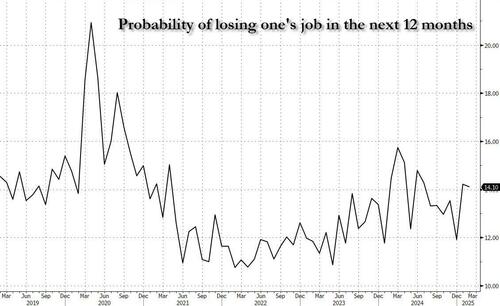

There was some excellent news: the survey discovered that the imply perceived likelihood of shedding one’s job within the subsequent 12 months dropped by 0.1% to 14.1%, after rising by 2.3% in January, to 14.2%, which on the time was the very best since July

Listed here are some extra observations from the newest survey, first trying on the Labor Market:

- Median one-year-ahead earnings development expectations have been unchanged at 3.0% in February. The collection has been transferring inside a slim vary between 2.7% and three.0% since January 2024.

- Imply unemployment expectations—or the imply likelihood that the U.S. unemployment fee can be increased one 12 months from now—jumped 5.4 share factors to 39.4%, its highest studying since September 2023. The rise was broad-based throughout age, training, and revenue teams.

- The imply perceived likelihood of shedding one’s job within the subsequent 12 months decreased by 0.1 share level to 14.1%. The imply likelihood of leaving one’s job voluntarily (anticipated give up fee) within the subsequent 12 months decreased by 2.3 share factors to 17.6%, its lowest studying since July 2023. The lower within the anticipated give up fee was broad-based throughout training and revenue teams.

- The imply perceived likelihood of discovering a job within the subsequent three months if one’s present job was misplaced decreased by 0.3 share level to 51.2%, remaining under its trailing 12-month common of 52.5%.

… and Family Finance

- The median anticipated development in family revenue elevated by 0.1 share level to three.1% in February. The collection has been transferring in a slim vary between 2.9% and three.3% since January 2023.

- Median nominal family spending development expectations rose by 0.6 share level to five.0%, transferring simply above its trailing 12-month common of 4.9%. The rise was broad-based throughout age, training, and revenue teams, however most pronounced for these with at most a highschool training and people with an annual family revenue under $50,000.

- Perceptions of credit score entry in comparison with a 12 months in the past confirmed a bigger share of households reporting it’s tougher to get credit score, and a smaller share reporting it’s simpler. Expectations for future credit score availability deteriorated significantly in February, with the share of respondents anticipating it will likely be tougher to acquire credit score a 12 months from now rising to 46.7% from 35.6%. This studying is the very best since June 2024.

- The common perceived likelihood of lacking a minimal debt fee over the following three monthsincreased by 1.3 share factors to 14.6%, the very best stage since April 2020. The rise was pushed by these and not using a school diploma and largest for these below age 40.

- The median expectation relating to a year-ahead change in taxes at present revenue stage elevated by 0.2 share level to three.4%.

- Median year-ahead anticipated development in authorities debt decreased by 1.0 share level to five.0%, the bottom studying since July 2017.

- The imply perceived likelihood that the common rate of interest on saving accounts can be increased in 12 months elevated by 0.4 share level to 25.4%.

- Perceptions about households’ present monetary conditions in comparison with a 12 months in the past have been largely unchanged, however year-ahead expectations about households’ monetary conditions deteriorated significantly. The share of households anticipating a worse monetary scenario in a single 12 months from now rose to 27.4%, the very best stage since November 2023.

- The imply perceived likelihood that U.S. inventory costs can be increased 12 months from now dropped by 3.3 share factors to 37.0%, the bottom stage since December 2023.

Extra within the full survey accessible right here.