DNY59

By Paul Mielczarski

During the last a number of quarters, we’ve got made each a cyclical and structural case for being lengthy mounted revenue. The cyclical case has been based mostly on the view that inflation is returning to focus on, progress is slowing, and cracks are beginning to seem within the labor market. The medium-term case revolves round the concept that U.S. actual yields are fairly engaging, each in absolute phrases and significantly relative to U.S. fairness valuations, the place the fairness threat premium is simply too low.

In the previous few weeks, two shocks have been reverberating throughout markets concurrently. The primary market shock has been a dramatic unwinding of some common trades. One commerce was a broad wager on Japan, the place traders typically had been brief the yen, lengthy the Nikkei inventory index (NKY:IND), and brief Japanese authorities bonds. Markets even have seen a violent unwinding of the lengthy AI commerce, as most of the anticipated beneficiaries of AI have underperformed not too long ago. Lastly, there clearly has been a brief U.S. fairness volatility commerce unwinding, evidenced by the dramatic upswing within the CBOE Volatility Index, or VIX, in a brief time period.

These dramatic shifts are making a flight-to-quality bid for bonds. Nevertheless, these trades primarily signify overleveraged positions, and these excesses will ultimately be cleaned up. So, whereas markets could overshoot additional, we don’t anticipate these excessive strikes to final for much longer.

The second shock, which could possibly be extra extended, is that markets are once more pricing in greater odds of a deeper slowdown or perhaps a recession. Whereas the flight-to-quality dislocations ought to ultimately run their course, this second pattern is prone to be slower transferring, with back-and-forth gyrations in markets because the macroeconomic information fluctuates between weaker and stronger readings.

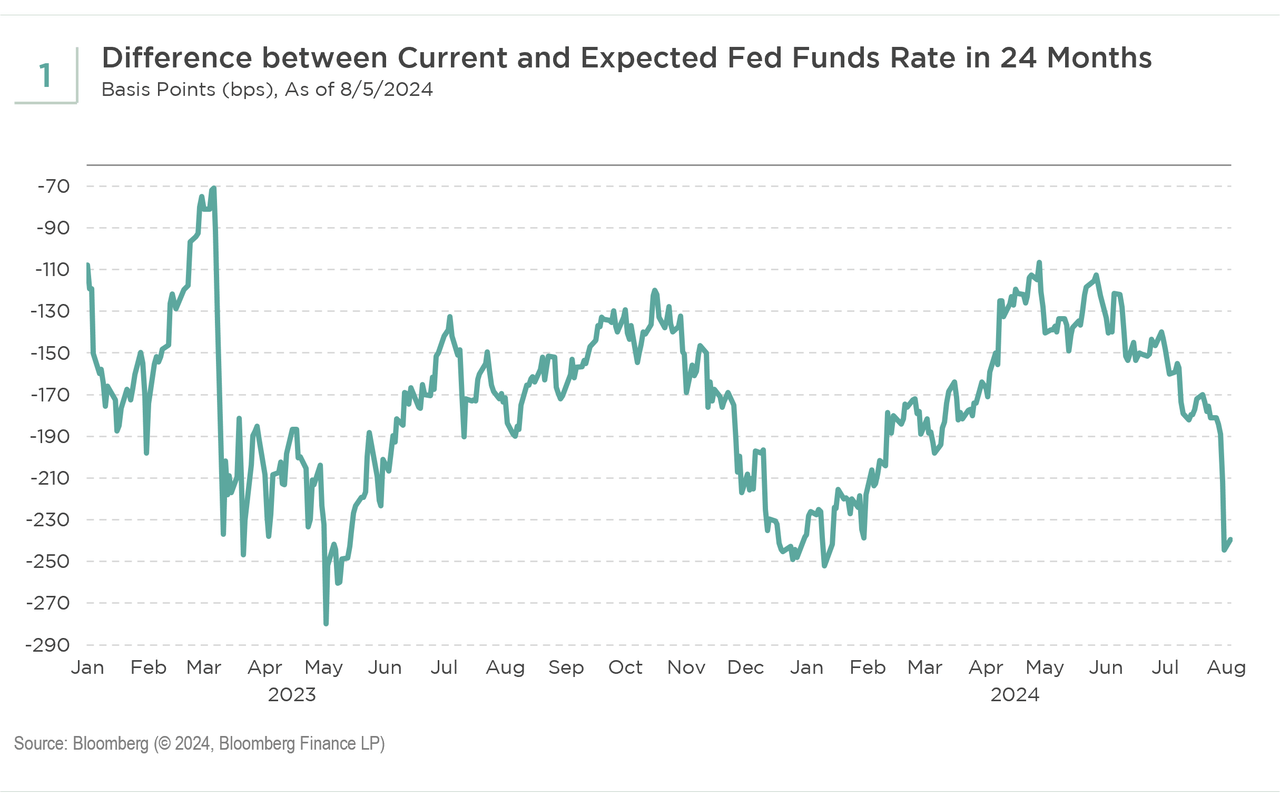

In response to those two shocks, yields have dropped considerably. Till not too long ago, the Federal Reserve (Fed) was priced for a modest easing cycle, which has been justified by the inflation story (see Exhibit 1). Nevertheless, for yields to drop materially additional or to assist the place front-end Treasury charges are at the moment, the Fed possible must shift into a much more aggressive easing cycle. Whereas doable, we might anticipate to see a extra dramatic deterioration within the financial information than what has been reported thus far. Therefore, the abrupt change in price lower expectations is overdone, in our view.

Whereas we’ve got seen a large repricing within the shorter-term cyclical story, the medium-term view, or the relative valuation story, has not modified a lot. Fairness threat premiums have gone up barely, however equities are nonetheless typically costly. Equally, our views have shifted barely on the margin because the cyclical case has performed out. Nevertheless, we’ve got not but dramatically rerated the percentages of a recession. Absent a considerable deterioration in macro circumstances or one thing else “breaking,” a recession isn’t our central case at this level.

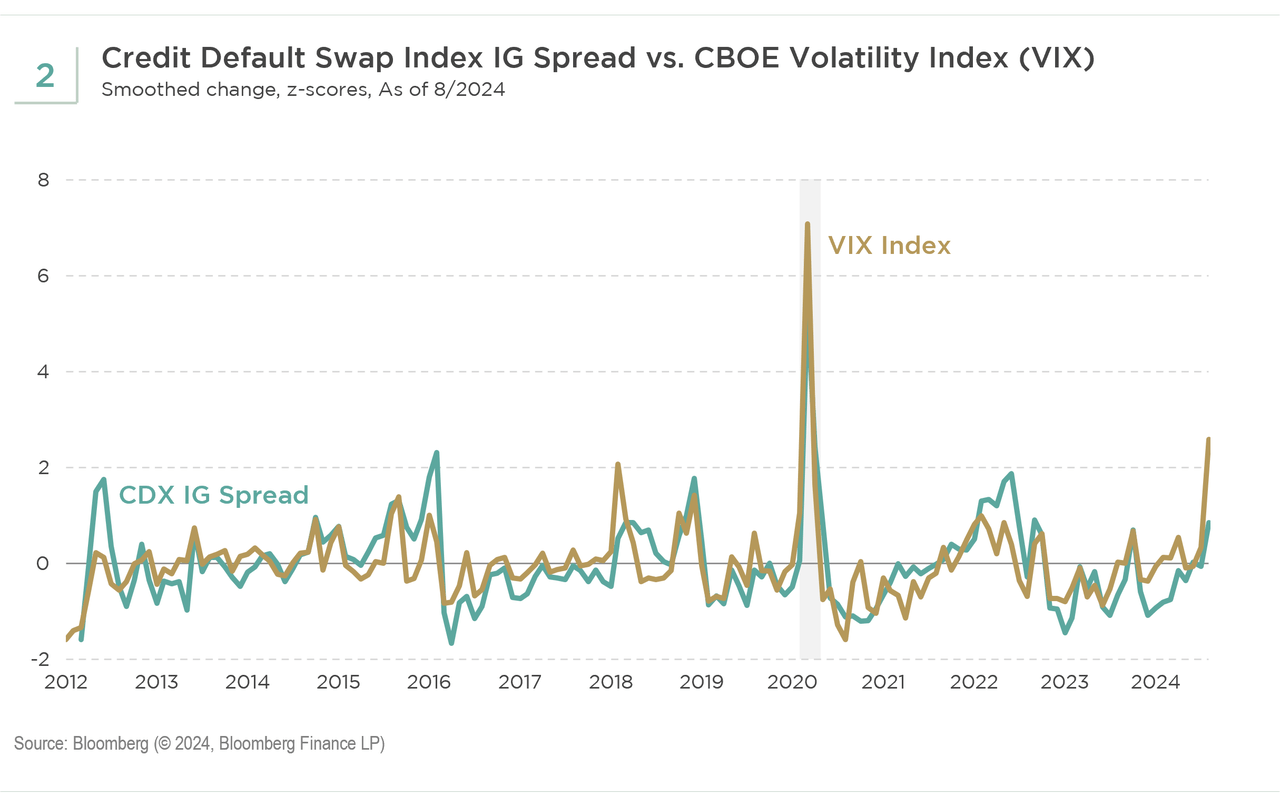

Along with watching how the leveraged positions play out throughout markets, we additionally might be monitoring credit score spreads for a extra significant widening, which could substantiate the necessity for extra aggressive Fed intervention. Usually, VIX and credit score spreads transfer roughly in tandem, however the current spike within the volatility index has been way more excessive whereas credit score spreads have remained nicely contained (see Exhibit 2). The employment image could maintain one other different clue to what might come subsequent. The labor market and jobless claims might be significantly vital indicators, and we might be awaiting early indicators that corporations have gotten extra cautious on hiring.

Index Definitions:

The CBOE Volatility Index (VIX) is a monetary benchmark, revealed by the Chicago Board Choices Alternate, designed to supply a real-time market estimate of anticipated 30-day ahead volatility of the S&P 500 Index. It’s calculated through the use of the midpoint of present S&P 500 Index choice bid/ask quotes.

The Credit score Default Swap Index ((CDX)), previously the Dow Jones CDX, is a benchmark monetary instrument made up of credit score default swaps (CDS) which have been issued by North American or rising market corporations.

Unique Publish

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.