Maksim Labkouski

Introduction

Unity Software program Inc. (NYSE:U) belongs to the high-growth and no-income tech section of the inventory market. It traded at an all-time excessive of $210 per share just a little greater than half a 12 months in the past again in November of final 12 months, whereas right this moment it’s buying and selling at $32.8 per share, down virtually 84% from its all-time excessive. Right this moment, the worth to gross sales ratio nonetheless stands at 7.8 in comparison with roughly 50 in the course of the peak days. So, the corporate is not precisely low-cost, particularly not in an surroundings the place they’ve needed to cut back income outlook greater than as soon as – extra on that later.

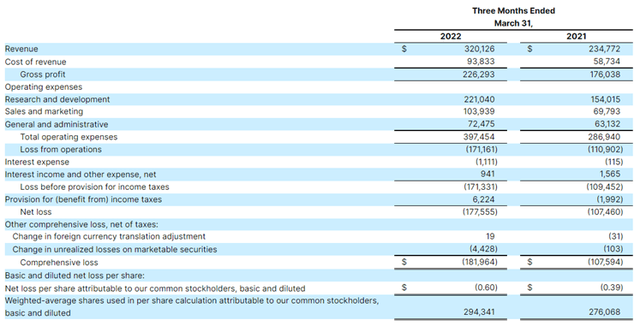

Unity has had its justifiable share of issues this 12 months, posting its Q1 outcomes on Could eleventh with shares crashing 36% resulting from a miss on income and a diminished income outlook for the 12 months.

On June twenty ninth, it was reported that Unity had determined to put off individuals within the a whole lot, not usually one thing we anticipate to see out of a high-growth firm. That quantity represented a considerable chunk of the worker pool for a corporation having fewer than 6.000 workers.

July thirteenth was speculated to carry some excellent news, as Unity introduced that Unity and ironSource Ltd. (IS) merge. As an alternative, Unity’s inventory tumbled one other 17.5% intraday, not least as a result of the information got here with an announcement in regards to the Q2 efficiency, with a brand new income reduce introduced.

I have been taking a look at Unity because it was buying and selling at roughly $90 per share, however saved my distance. Right this moment’s information did not carry me nearer, as I am not a right away fan of the mathematics behind this deal. Let’s take a look.

The Deal – Strategic Observations & Outlook

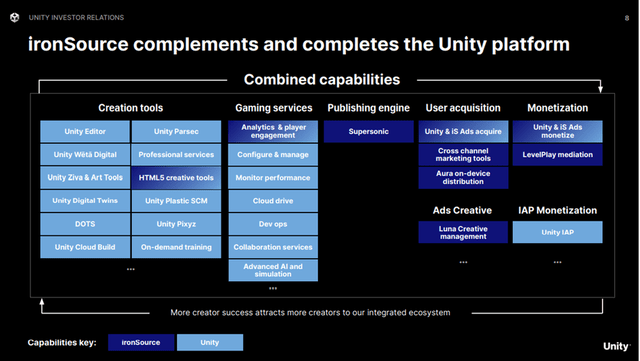

To begin with, Unity’s enterprise mannequin focuses on a platform, often called “creation instruments,” geared toward primarily recreation builders, whereas having branched exterior gaming to the metaverse usually. Right here, builders can receive entry to instruments for improvement, primarily based on a subscription mannequin. What Unity does, is so worth including, {that a} very important quantity of the most well-liked cellular video games are developed on the idea of Unity software program. Moreover, Unity additionally helps builders to run and monetize video games, known as “gaming providers.”

Unity Buyers Centre

Unity’s present enterprise mannequin is highlighted in gentle blue, with the addition of ironSource being highlighted in darkish blue. As may be seen, Unity may be very heavy on the creator aspect of issues in addition to working the video games, however missing the downstream capabilities regarding publishing, consumer acquisition, and monetization.

When it comes to monetary synergies, administration highlighted the next optimistic expectations in regards to the deal

- Extremely accretive merger is predicted to ship a run fee of $1 billion in Adjusted EBITDA by the tip of 2024, and $300 million in annual EBITDA synergies by 12 months three.

Strategically, administration highlighted the next

- Combining the 2, creates an organization able to each creation and development, putting a extra balanced posture, securing a extra value-adding course of for builders.

As such, I additionally consider this deal is smart from a strategic perspective, not least as a result of it could additionally alleviate the issues related to the Q1-2022 efficiency.

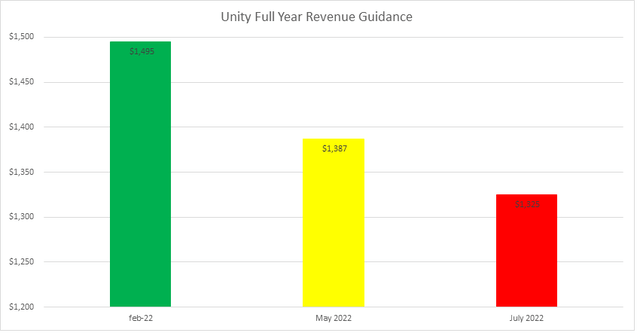

- Again in February of 2022, administration reported its This fall-2021 and launched the FY-2022 steerage, with a midpoint income expectation of $1.49 billion, which represented a 35% YoY development fee.

- Then Q1-2022 outcomes had been launched in Could 2022 and administration needed to revise the steerage on account of knowledge points inflicting provides to not present the clicks anticipated, inflicting much less income for builders and Unity. Unity employees needed to intervene on behalf of the software program malfunction to wash the information. New midpoint steerage was $1.38 billion representing a 25% YoY development fee.

- July thirteenth, as a part of the announcement was a brand new steerage. Unity expects to carry out barely higher for Q2 than its steerage issued throughout Q1, which was a spread between $290-$295 million. I will make use of $296 million as you may see in a minute. As well as, full 12 months steerage was revised to $1.3-$1.35 billion. New midpoint steerage representing simply above 19% development YoY.

There wasn’t any convention name, so we cannot know for positive what induced this revised steerage till the upcoming quarterly outcomes. Nonetheless, visualizing the event seems the next.

Authors Personal Creation

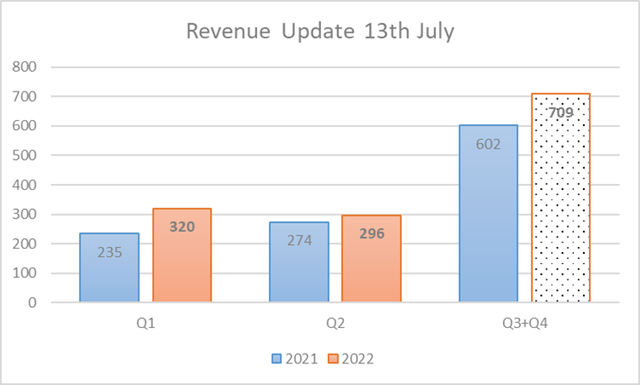

Given what we all know right this moment, the already printed Q1 outcomes, and simply printed communication for anticipated Q2 outcomes, it is potential to take a look at what’s anticipated for the remainder of this 12 months.

Authors Personal Creation

Q1 secured a 36% YoY development fee, with Q2 anticipated to offer development of roughly 8%, barely higher than the adjusted steerage in the course of the announcement of Q1. Earlier than having obtained the brand new steerage, Q3 and This fall must safe $774 million in income to dwell as much as the earlier FY-2022 steerage, requiring a development fee of 29%. This was below the idea that Unity had resolved the problems reported throughout Q1 and managed to supercharge the expansion to get again on observe – bear in mind, Q1 confirmed 36% development, so this wasn’t unreasonable.

Nonetheless, with the brand new steerage, Q3 and This fall will now must safe roughly $709 million in income, equivalent to a development fee of 19% development. Going from 29% to 19% development, that is fairly a hair reduce and with every new downwards revised steerage, we start to belief administration much less and fewer. This causes uncertainty as to what’s the actual development for Unity going ahead, and in addition a part of the reply as to why the inventory responded to strongly to the information.

The Deal – Monetary Observations

Right here I will concentrate on three areas of curiosity.

- Institutional investor help

- Share buyback program as a part of the deal

- Dilution of shareholders.

Unity Buyers Centre

To begin with, the 2 largest institutional traders endorsed the deal, by pledging a $1 billion funding within the firm within the type of senior convertible notes. Right here I might like to spotlight the favorable 2% rate of interest supplied by SilverLake and Sequoia, maybe not shocking given they’re a number of the largest shareholders. As an alternative of paying again the mortgage, Unity may have the choice to transform to shares, inflicting dilution.

Moreover, as a part of the deal, to fight share dilution, a buyback program of $2.5 billion, speculated to happen over the approaching 24 months, has been approved. This corresponds to roughly 21.2% of the prevailing float primarily based on the present market cap between $11-$12 billion.

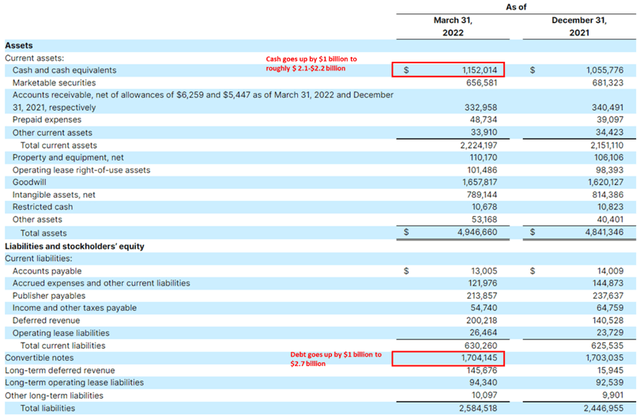

If we take a look at the mathematics, nonetheless, it begins to get a bit worrisome. Each time I printed articles for corporations within the high-growth, no-income area, I at all times emphasised the necessity to spend money on corporations with strong steadiness sheets. A wholesome money to debt place is what carries an organization via intervals of financial uncertainty. In favor of Unity is the truth that they’ve been money movement optimistic lately, however it’s after all unsure if that can persist given the continued revised steerage. Supposedly, shedding individuals would strengthen the money movement, time will inform.

Bear in mind, within the steadiness sheet illustration beneath, that these funds will go in direction of a share buyback program, leaving the debt alone on the steadiness sheet. My guess can be that these notes are certainly transformed to shares at one level.

Unity Q1-2022 Steadiness Sheet

In terms of dilution, here’s what we all know.

Entered right into a definitive settlement below which ironSource will merge right into a wholly-owned subsidiary of Unity by way of an all-stock deal, the place every odd share of ironSource will likely be exchanged for 0.1089 shares of Unity frequent inventory. As soon as closed, present Unity stockholders will personal roughly 73.5% and present ironSource shareholders will personal roughly 26.5% of the mixed firm

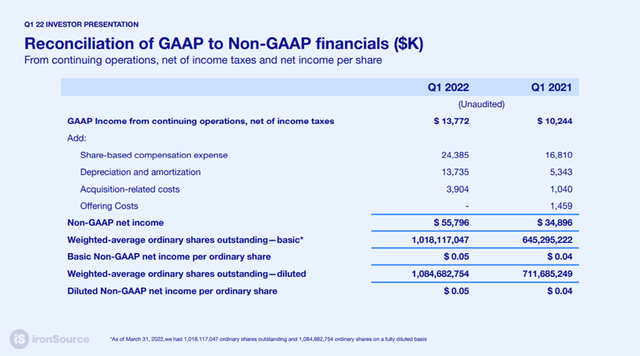

ironSource Q1-2022

By the tip of their Q1, ironSource had 1.084 billion shares excellent. Assuming that degree is roughly the identical right this moment, that corresponds to an extra 118 million new Unity shares. If we assume Unity made full use of their newly accredited buyback program, they might be capable to purchase again roughly 76 million shares with the $2.5 billion, which means an extra 42 million shares that stand to dilute shareholders.

The query is, then, how a lot does this dilute present shareholders?

Unity Q1-2022 Revenue and Loss Assertion

If we take a look at Unity’s Q1, we are able to see they’d roughly 294 million shares at that cut-off date. Throughout their Q1 announcement, it was said they anticipated to have roughly 350 million shares on a completely diluted foundation by finish of 2022. Including the extra 118 million shares to that determine, dilution is available in at 33%. Once more, assuming they purchased again all of the shares right this moment, dilution would nonetheless are available at 13% on a ahead foundation. If we take departure within the 294 million shares, the dilution is after all bigger.

I am not a shareholder right this moment, however I by no means like, as a shareholder, to be diluted by such a margin. I additionally do not like seeing my high-growth tech shares tackle a variety of debt if the steadiness sheet is not tremendous robust. On this occasion, debt is taken on to carry out buybacks. That does not sit properly with me. As traders in excessive development and immature tech shares, we have now to simply accept dilution, it is a part of the sport. The query is, after all, to what extent – that is a person evaluation.

What Are We Left With?

Unity goes the course of what seems to make a variety of sense from a strategic perspective. That is me saying so, with out being accustomed to ironSource as an organization. Nonetheless, primarily based on the fabric disclosed by the businesses, there seem like synergies to the good thing about their clients, which I like. Probably, administration is making a metaverse powerhouse, however that’s one other unsure parameter that we will not know for positive right this moment given the immaturity of {the marketplace}.

On the opposite aspect, administration disclosed one other discount in FY-2022 outlook, the second of this 12 months. This hollowed belief in administration additionally by way of what the actual long-term development fee is for this firm, inflicting the inventory to drop 17% intraday.

Unity’s steadiness sheet is not pristine, and administration is taking up a considerable quantity of debt to pay for the ironSource merger within the type of combating dilution. That transfer will not be substantial sufficient to fight the precise anticipated dilution, at the least not when primarily based on right this moment’s excellent variety of shares and value per share, which after all can change loads by the point the deal is closed. Successfully, administration is raiding debt to pay for share buybacks, probably changing that debt to new shares ought to that be most well-liked versus repaying the debt.

I am not a right away fan of this method given the state of the worldwide economic system and a possible drawdown in exercise. This is able to require robust steadiness sheets for particular person corporations to be able to keep away from being compelled into making undesirable strikes to maintain the boat afloat.