Justin Sullivan/Getty Images News

Introduction

As travel worldwide is on the rebound there are winners and losers, the days of “Netflix and Chill” are seemingly in the rearview mirror as many now look to explore the world beyond the comfort of their homes. One of the greatest beneficiaries of the resurgence of travel is, no doubt, United Airlines Holdings (NASDAQ:UAL) as air travelers flock back in droves.

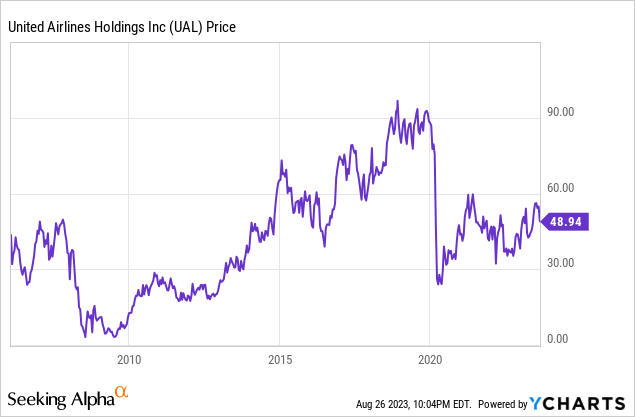

But while travel is on the rebound, United’s stock continues to lag behind, still far below its pandemic highs, so what gives?

Within this article, I’ll explore that question, dive into the airline industry, and provide my assessment as to where I believe United Airlines might go from here.

United and the Airline Industry

First, I like to start with the macro before I move into the micro, so let’s get to know the airline industry. Let’s start with a question: What do airline companies have in common?

High capital intensity, a similar/commoditized product offering, and boosted demand driven by a resurgence in travel demand.

Capital Intensity

The airline industry’s capital-intensive nature, driven by aircraft acquisition, maintenance, and infrastructure development, forms a financial backdrop that demands strategic finesse. Acquiring and maintaining aircraft involves significant financial commitments, for a large airline, that number is in the billions! Without constant investment into modernization and safety, the airline’s passengers will move to other carriers if they are allowed to fly at all.

But the financial investment does not stop with the airplane itself, building and upgrading airport infrastructure to meet rising demand is crucial (and costly) too. Airlines must balance expansion with financial stability.

Perhaps it’s for those extreme capital demands that so many airlines have failed over time… anyone remember Pan Am?

Overspending on capacity leads to debt and costly inefficiency, while underinvestment risks missed opportunities and customer dissatisfaction.

Successful airlines navigate this delicate balance, aligning expansion plans with projected demand, adapting to market trends, and maintaining financial resilience. In this high-stakes industry, adept decision-making is essential to leverage investments for growth while ensuring long-term stability.

Commoditized Offering

Another significant for United is the commoditization of their core product offering – a flight. In an arena where flights are essentially interchangeable, airlines grapple with the reality that a flight is, at its core, a mostly standardized service. This dynamic all but eliminates customer loyalty, except among frequent fliers, leading travelers to prioritize convenience and cost-efficiency over brand allegiance.

Since brand loyalty is so weak, a recurring theme in the industry is the race to the bottom on price, as airlines compete by reducing fares and offering competitive deals. This drive for cost leadership can erode profit margins, posing obstacles to sustained growth. Airlines are compelled to pursue operational efficiency to strike a balance between affordability and profitability, intensifying pressure on various aspects of the business, including fuel efficiency and workforce optimization.

More on the profitability and workforce optimization to come…

Demand Resurgence

Following the extensive Covid-19 lockdowns, the travel industry is experiencing a resurgence. This renewed interest in travel, fueled by a longing for exploration and escape from confinement, is advantageous for the airlines, hotels, and hospitality industries that cater to those customers.

Unlike other domestic carriers, United caters to both domestic and international travel which was headwind in 2020-2021 but is tailwind in 2023. Furthermore, United offers many long-duration non-stop flights across the country and beyond which is a unique feature compared to Southwest (LUV), for example, which specializes in shorter runs and a more decentralized fleet.

However as great as that tailwind is, it’s critical that we investors adopt a long-term perspective, as the present surge in demand may not go on forever. As the world gradually returns to a semblance of normalcy, I expect that this heightened demand will level off gradually as more travelers sufficiently scratch that travel itch.

Financials

Revenue and EPS

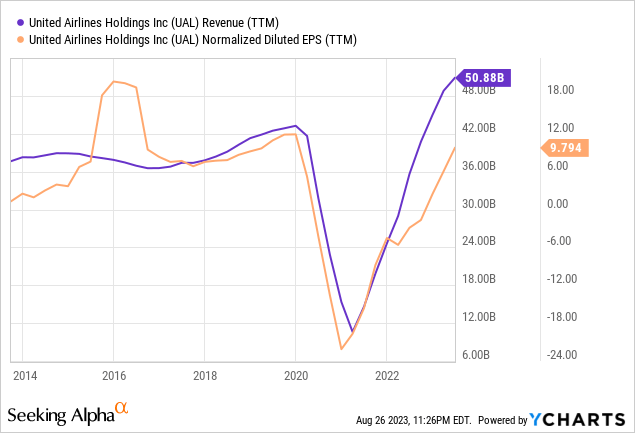

As you can see in the chart above revenue is clearly on the upswing, even surpassing the pre-pandemic highs in late 2019, now swelling up to nearly $51 Billion.

EPS has recovered, but clearly, not to the same extent as revenue has rebounded. Even today, earnings per share are still below the pre-pandemic level showing the company may have more work to do.

Margins

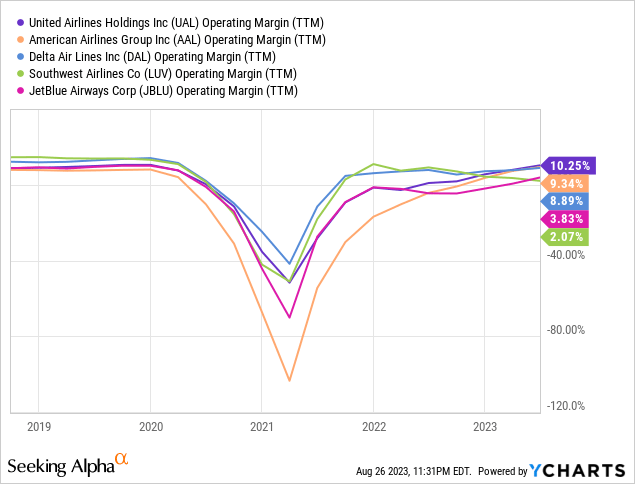

While perhaps weak compared to most other industries, United’s operating margins are actually among the highest within the airline industry at 10.25%. For the sake of comparison, American Airlines’ (AAL) operating is at 9.34% while Southwest is down at 2.07% as of their most recent quarter.

United’s margins have rebounded nicely, up significantly from their pandemic-era lows but there may not be as much room to run from here. Looking back at their pre-pandemic margins these companies often top out, margin-wise, in the low double digits.

Without significant consolidation in the industry, it’s hard for me to imagine how United could transform its business model into one that might yield higher margins.

Return on Invested Capital

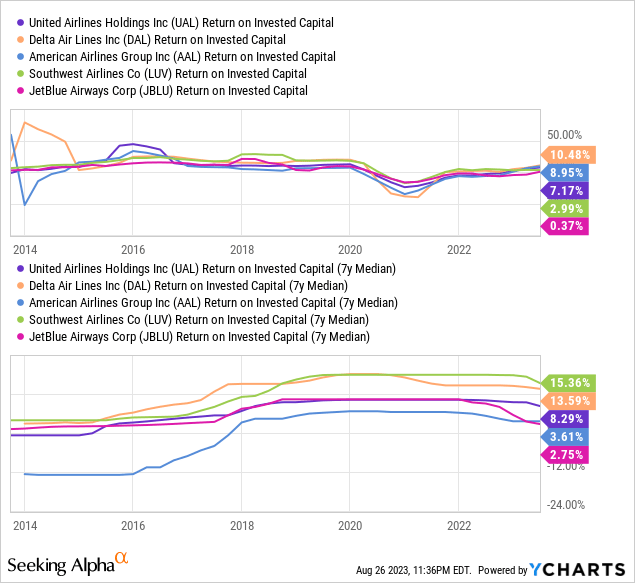

Over the long term, United has been able to generate roughly 8% returns on capital which is about average compared to its peers. An 8% return on capital when treasuries are yielding above 5% is far too low for me. As an investor, we allow the companies we invest in to allocate our capital for us. I demand more than 8% from the companies I invest in, others may have a different perspective.

Over the past 10 years, Southwest has delivered the highest median returns on invested capital (15.36%) followed by Delta (DAL) at 13.59%. Recently though, Southwest’s returns have suffered (2.99% over the last year) while delta has remained relatively strong at 10.48%.

Big Risks: Economic Woes and Pilot Negotiations

As the travel industry recovers, the potential impact of economic uncertainties driven by inflation on future travel demand weighs. Since the current rebound largely stems from a desire to compensate for lost time, the industry must grapple with the threat of the looming influence of economic factors that could temper this newfound enthusiasm.

Elevated economic concerns, often entwined with inflation, might reshape consumer preferences towards saving money for hard times and away from splurging on trips with United.

Pricey Pilots

Airlines are also struggling to balance competitive pricing with the cost pressures of fuel, labor, and operations. Negotiations with pilots of the airline shine a bright light on this issue. Given the barriers to becoming a pilot (large number of required flight hours), there is a limited supply, and since supply is limited these pilots have a strong negotiation position.

Recently, United Airlines and its pilots’ union reached a deal resulting in a potential pilot pay increase of up to 40% over four years. This comes after more than four years of contentious negotiations, which involved strike discussions.

The deal, valued at around $10 billion, highlights the powerful position of labor groups, as airlines experience a robust recovery in travel revenue. The agreement aims to align United pilots’ compensation with those at Delta Air Lines, who approved a similar pay-raising deal earlier in the year.

The agreement includes substantial raises in pay, retirement benefits, and job security. Immediate wage-rate hikes of 13.8% to 18.7% would be followed by smaller annual raises, totaling a potential rise of 34.5% to 40.2% over the contract term. This agreement was hailed as a historic achievement by the pilots’ union. Huge pay raises like this, reinforce just how hard it is to operate in this industry.

Valuation

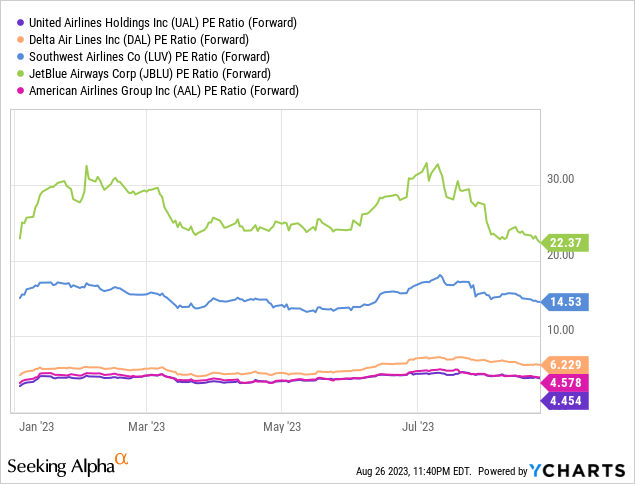

The biggest thing working in United’s favor is its exceptionally low valuation. Its 4.454x future earnings works out to a 22% earnings yield. But buyer beware, if we enter a recession there is a high likelihood these earnings won’t materialize just as they did not in 2020. United is also the most cheaply priced compared to peers in the industry, that’s a plus.

Perhaps United is the best apple in a bad batch?

Conclusion

United Airlines stands at the crossroads of opportunities and challenges as the travel industry rebounds post-pandemic. While benefiting from resurging travel demand, United grapples with industry-wide issues like capital intensity and commoditization. The current demand surge, though encouraging, needs to be evaluated against potential economic uncertainties.

United’s financial trajectory shows revenue recovery, but the challenge lies in fully restoring earnings per share and achieving sustainable profit margins. The recent pilot negotiations, resulting in significant pay raises, highlight the delicate balance airlines must strike between cost management and customer-friendly pricing.

United’s attractive valuation presents a positive aspect, though economic uncertainties remain a factor. As the travel industry charts its recovery, United Airlines’ ability to adapt, innovate, and navigate these complexities will determine its success in a transformed landscape of exploration and adventure.

I rate United a Hold.