William Barton/iStock Editorial by way of Getty Photos

Funding Thesis

Unibail-Rodamco-Westfield (OTCPK:UNBLF), which I’ll discuss with as URW right here after, is rising as a speculative purchase as I estimate that though its Adjusted Recurring Earnings per Share (AREPS) run-rate will probably decline to about 6 EUR/share as soon as US operations are considerably lowered, solely to enhance to 7 EUR/share as redevelopment initiatives and normalized operational efficiency kick in, the shares will command the next money movement a number of as soon as the steadiness sheet is so as. Therefore I believe a 12.5 a number of on my 7 EUR/share medium time period AREPS goal might increase the shares some 25-30% larger within the subsequent 3-4 years. Nevertheless this upside potential hinges on the US disposals being made inside a 20-25% low cost of appraisal worth and rates of interest remaining in verify, each of that are considerably unsure.

Firm Overview

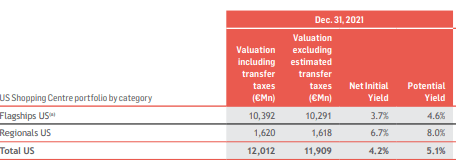

URW operates in 4 principal segments with a complete portfolio worth of 54.5B EUR, specifically retail properties (86% of complete), workplaces (6% of complete), conference & exhibition facilities (5% of complete) and providers (2% of complete). The US procuring heart portfolio is valued at circa 12B EUR as of December 31 2021 and represents round 22% of complete portfolio worth.

Operational Overview

URW noticed continued operational enchancment in H2 2021, with emptiness enhancing by 1.9% to 7%, and tenant gross sales operating at 93% of 2019 ranges. Nevertheless with a market capitalization of 9.5B EUR towards a internet debt of about 22B EUR on the finish of Q1 2022 (My estimate for IFRS internet debt as of Q1 2022. Proportionate internet debt, accounting for possession shares in joint ventures, is even larger at circa 24B EUR) the corporate stays laser targeted on debt discount. Therefore regardless of the sturdy money movement forecast when it comes to Adjusted Recurring Earnings per Share (AREPS) of about 8.2-8.4 EUR/share for 2022 traders are cautious as they wait to see the character and type of the a lot anticipated US portfolio downsizing to happen in 2022 and 2023.

Market-implied Internet Preliminary Yield Valuation

To calculate the market-implied internet preliminary yield I’ll use the EPRA Internet Disposal Worth (NDV) which I estimate stood at 112.5 EUR on the finish of Q1 2022:

Market-implied internet preliminary yield = Valuation internet preliminary yield / Division issue the place:

Division issue = Worth/NDV Ratio * ( 1 – Mortgage-to-value ratio) + Mortgage-to-value ratio

Substituting with my estimates for Q1 2022, specifically:

1. EPRA NDV = 112.5 EUR

2. Mortgage-to-value = 42%

3. Valuation internet preliminary yield = 4.2%

4. Closing value on the time of writing = 68.58 EUR

You get a Worth/NDV Ratio of 68.58 /112.5 = 0.61, a division issue of 0.774 (0.61 * (1-0.42) + 0.42 ) and a market implied internet preliminary yield of roughly 5.43%. For comparability, I estimate largest peer Klepierre (OTCPK:KLPEF) presently trades round a market implied yield of circa 5.66% whereas smaller peer Wereldhave (OTCPK:WRDEF) is at 6.64%.

Valuation primarily based on present money flows

I believe present money movement valuation is just not very appropriate for URW since its capital construction may be very debt-heavy. Nonetheless, at simply 8.3 occasions the 8.2 – 8.4 EUR/share administration outlook for AREPS, URW among the many most cost-effective retail REITs. Largest peer Klepierre trades at about 10.3 occasions its money movement outlook. Curiously, you could have some smaller friends equivalent to Wereldhave Belgium buying and selling at 12.65 occasions their money movement outlook. Nevertheless the distinction is basically defined by a diametrically completely different capital construction, i.e. Wereldhave Belgium has a market capitalization of about 522M EUR towards internet debt of circa 240M EUR.

Disposal Situations

Following the most recent sale of a growth parcel in Los Angeles I estimate the remaining US portfolio is presently price round 11.85B EUR after switch taxes:

URW 2021 Registration Doc

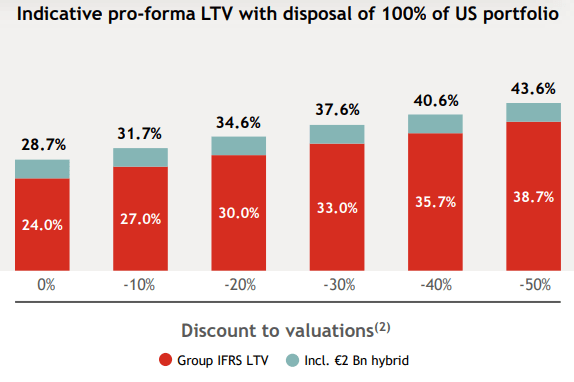

As you possibly can see from the investor day presentation, even a 50% low cost to appraisal values won’t cease URW from reaching its 40% loan-to-value goal:

URW 2022 Investor Day Presentation

Combining the above state of affairs evaluation, a 2% value of debt, a 8.3 EUR/share common administration outlook for AREPS (Adjusted Recurring Earnings Per Share) and my estimate of three.6 EUR/share impression from US disposals on AREPS (11.91B EUR multiplied by the 4.2% internet preliminary yield, divided by 139 013 166 shares), offset by rate of interest financial savings between 1.71 to 0.86 EUR/share, brings us to the next impression on AREPS beneath the 6 situations for valuation low cost:

| Proportion Low cost | Detrimental impression on AREPS from misplaced earnings | Constructive impression on AREPS from lowered curiosity expense | Internet impression |

| 0% | 3.6 | 1.71 | 1.89 |

| 10% | 3.6 | 1.54 | 2.06 |

| 20% | 3.6 | 1.37 | 2.23 |

| 30% | 3.6 | 1.2 | 2.4 |

| 40% | 3.6 | 1.03 | 2.57 |

| 50% | 3.6 | 0.86 | 2.74 |

As you possibly can see from the desk above, the bigger the low cost on US valuations, the smaller the rates of interest financial savings will probably be, and therefore the web impression from the disposals on AREPS grows in step with the low cost.

To sum up, the present 8.3 EUR/share outlook could possibly be adjusted to six.41 EUR/share in a 0% low cost state of affairs, or 5.56 EUR/share in a 50% low cost state of affairs. Primarily based on my market-implied internet preliminary yield estimation above, the market is presently pricing in a roughly 23% low cost, with the almost certainly internet impression on AREPS from a possible US disposal of about 2.23 EUR/share, bringing AREPS to six.07 EUR/share.

Whereas the above situations are purely theoretical and don’t account for rental development, redevelopments, larger value of US funding (as of December 31 2021 value of debt was 1.5% for EUR and SEK denominated debt, and three.9% for USD and GBP denominated debt respectively) and new income traces, I believe the outlined situations are a very good psychological experiment concerning the optionality surrounding a possible sale of US operations.

Progress Alternatives

The above calculations are considerably conservative in that they don’t account for the expansion alternatives outlined on the 2022 Investor day. What I believe will really occur is that among the capital launched from the US operations will fund the recognized development alternatives in Europe. As acknowledged within the 2022 Investor Day press launch:

By 2024, URW will ship €2 Bn of its dedicated pipeline which is able to generate €125 Mn in stabilized NRI. As well as, URW will unlock additional growth alternatives embedded in its property in the course of the plan horizon, with a possible €1 Bn in initiatives so as to add to its managed pipeline, with restricted predevelopment bills.

Supply: URW 2022 Investor Day Press Launch

If we assume these 3B EUR of initiatives are developed over the medium time period at a yield on value of 6.25% towards a value of debt of two%, we are able to estimate a lift to AREPS of about 0.92 EUR/share.

The Backside Line

I believe the present AREPS run-rate of about 8.3 EUR/share will probably take successful within the subsequent 1-2 years as soon as the US footprint is dramatically lowered. Therefore I estimate the AREPS run-rate ought to backside at about 6 EUR/share, and regularly enhance to 7 EUR/share as soon as redevelopment alternatives are finalized and operational efficiency returns to 2019 ranges:

URW expects tenant gross sales to return to pre-COVID ranges in 2022, occupancy and variable earnings in the midst of 2023, and retail NRI on a run charge foundation in 2023, with full impact in 2024. In 2024, the Group forecasts Retail NRI of €1.56 Bn and EBITDA of circa €1.9 Bn for its streamlined European portfolio.

Supply: URW 2022 Investor Day Press Launch

Moreover, present inflation charges might help larger AREPS figures ought to they proceed over the medium time period. Likewise promoting revenues ought to restrict the draw back impression on present money flows.

Investor Takeaway

Whereas I believe lots of issues might go unsuitable for URW, my base case is that AREPS ought to stabilize at about 7 EUR/share over the medium time period, and so long as traders understand the brand new capital construction as sufficiently sturdy the shares ought to rerate larger to account for the upper asset high quality of the underlying portfolio. Personally, I’ll proceed to watch the shares and should provoke a place on weak spot.

Thanks for studying.