Jetlinerimages

I’ve been following Cathay Pacific (OTCPK:CPCAF, OTCPK:CPCAY) for almost two years and whereas I’ve been seeing essentially pushed upside for the inventory, the truth is that the inventory isn’t performing wherever close to the place it ought to commerce primarily based on historic EV/EBITDA multiples. Maybe with larger prices within the business and softening of yields pushed by macroeconomic issues, larger capability out there and world conflicts it’s not that odd that airline shares are underperforming.

On this report, I will likely be discussing the latest outcomes for Cathay Pacific and overview my score and worth goal for the inventory.

Cathay Pacific Earnings Decline Regardless of Income Development

Cathay Pacific

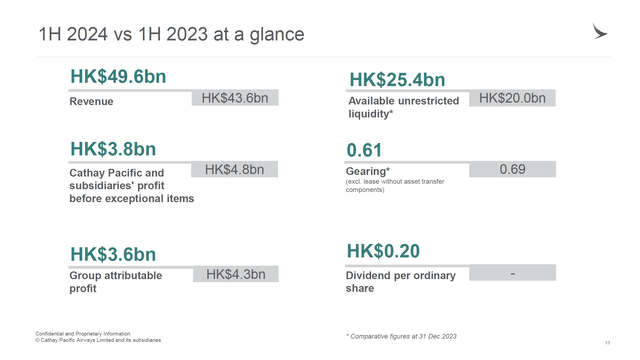

A primary take a look at the outcomes exhibits that the revenues elevated 13.8% to HK$49.6 billion and whereas which may look spectacular it’s not. The income elevated was pushed by a 22.8% enhance in capability, and it didn’t translate to larger earnings. In actual fact, the revenue attributable to the Cathay Pacific Group decreased by 15.3% to HK$3.6 billion. For an airline, that isn’t a nasty margin to be working at, however we do see continued normalization of yields as a major risk to the margins. Unit revenues for passengers declined 15.9% whereas cargo unit revenues declined 8.5%.

Cathay Pacific

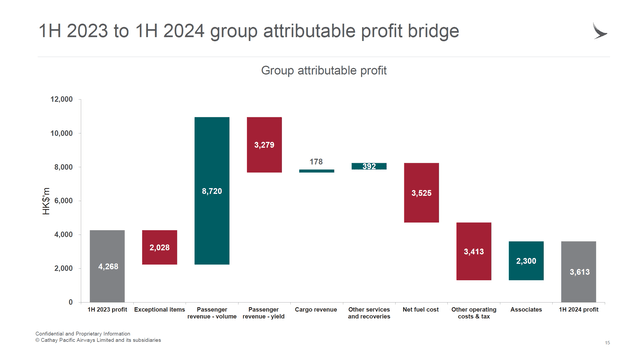

The earnings bridge fairly clearly demonstrates that passenger income will increase have been totally offset by decrease passenger yield, larger internet gasoline prices and different working prices. In different phrases, the capability enhance didn’t translate to the underside line in any respect.

Cathay Pacific noticed passenger revenues enhance 20% to HK$30 billion, however that was pushed by a 42.7% enhance in capability for the airline, pointing to a 11% decline in passenger yields. The cargo enterprise grew revenues by 1.5% whereas capability grew 11.4%, so additionally in that enterprise section we’re seeing yields and unit revenues average.

HK Categorical, which is Cathay’s low-cost arm, elevated revenues by 22.1% to $HK3.175 billion, however that was on a capability growth of 57.1% whereas the corporate noticed its after-tax swing from a HK$333 million revenue to a HK$73 million loss. Ex-fuel unit prices declined by 9.4% for the airline group and if we preserve the numerous enhance in capability in thoughts, it exhibits fairly clearly how laborious it’s to convey these unit prices down considerably and Cathay Pacific is already seeing its yield drop. So, what is basically taking place right here is that Cathay Pacific has been capable of considerably enhance capability at a time when rivals have already got performed so, and it’s doing that on the expense of unit revenues whereas prices are elevated. Whereas its cargo enterprise has performed effectively through the pandemic, the corporate, attributable to pandemic restrictions was merely not capable of scale up as quick to strongly profit from the uptick in journey demand seen globally up to now two years or so.

Cathay Pacific Inventory Is Considerably Undervalued

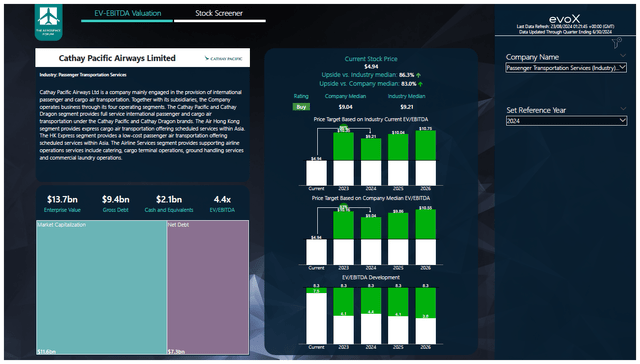

The Aerospace Discussion board

To find out multi-year worth targets The Aerospace Discussion board has developed a inventory screener which makes use of a mixture of analyst estimates on EBITDA, CapEx and free money movement together with the latest stability sheet knowledge, money movement statements and my assumptions on debt reimbursement, share repurchases and dividends. Every quarter, we revisit these assumptions and replace accordingly.

EBITDA for 2023 got here in considerably decrease than anticipated. Free money movement, nevertheless, got here in a lot stronger and for the years forward, EBITDA is anticipated to be decrease in 2024 however steady from there on with important free money movement. That may suggest a $9.04 worth goal, or 83% upside. Nonetheless, at this level there are additionally quite a lot of pressures such because the yield on stress pushed by both macroeconomic or geopolitical turbulence globally. Because of this, whereas the upside is important, I’m placing my worth goal at $6 per share or $1.19 per odd share.

How To Purchase Cathay Pacific Inventory?

If you’re nonetheless serious about shopping for Cathay Pacific inventory, there are 3 ways. You should purchase CPCAY which is traded OTC, which represents 5 odd shares, and that ticker has a good quantity however nonetheless comparatively low at 1,100. The opposite method is shopping for CPCAF, which represents one odd share however lacks any important quantity and which may give buyers a tough time shopping for and promoting at desired costs and in desired portions. If you wish to purchase the ticker with the very best quantity, the best choice is to purchase Cathay Pacific inventory through the Hong Kong Inventory change, the place it has a 10-day common quantity of 6.72 million items in response to CNBC.

Conclusion: Cathay Pacific Is Recovering Slowly However Has Upside

The restoration at Cathay Pacific is gaining traction. Nonetheless, if we take a look at how friends have recovered and the place yields have been heading, we will solely conclude that Cathay Pacific recovered to slowly to learn from robust yields and sees a lot of its restoration measured by flights and locations accomplished by Q1 2025 at a time the place yields will doubtless have normalized additional. In essence, it implies that Cathay Pacific largely missed the boat on a robust revival in air journey demand. My purchase score stays, however seeing upside within the inventory worth truly materialize is likely to be tough as airline shares are considerably pushed by short-term sentiment and swings in capability and prices, and people are usually not in Cathay Pacific’s favor.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.