Commerce with nominal rigidities: Understanding the unemployment and welfare results of the China shock

Andres Rodríguez-Clare, Mauricio Ulate, Jose P. Vasquez 17 Could 2022

Considerations about worldwide commerce have grown, as current research doc a unfavorable impact of Chinese language import competitors on US labour markets. This column offers a brand new framework to elucidate this statement, which depends on the presence of downward nominal wage rigidity in US labour markets. The elevated competitors from China improves US phrases of commerce, however nominal wage frictions forestall the labour market from adjusting, in order that each employment and labour pressure participation fall within the brief run. The welfare implications fluctuate considerably throughout states, however the beneficial terms-of-trade shock drives a constructive general impact.

One concern about worldwide commerce typically raised by the general public and the favored press is that it could destroy jobs and result in unemployment. The talk in regards to the potential positive factors from commerce has turn into more and more salient within the mild of the rising proof inside high-income nations in regards to the adversarial employment results in labour markets which can be comparatively extra uncovered to import competitors from low-income nations akin to China. These labour market results are notably essential in localities whose employment depends comparatively extra on manufacturing, since corporations on this sector have turn into much less aggressive towards their Chinese language counterparts (Dorn and Levell 2022, Grossman and Oberfield 2022).

Within the US, the influential paper by Autor et al. (2013) finds that elevated import competitors from China (additionally known as the ‘China Shock’) triggered relative will increase in unemployment and reduces in labour pressure participation in commuting zones that have been extra uncovered to the China Shock in contrast to those who have been much less uncovered. These relative results are laborious to sq. with the predictions of normal commerce fashions that don’t characteristic unemployment. They recommend the presence of frictions that preclude the labour market from instantly adjusting after a commerce shock.

To grasp the labour market results of commerce, we current a mannequin that enables us to quantify the combination implications of commerce shocks whereas being per the empirical details uncovered by Autor et al. (2013) (Rodríguez-Clare et al. 2022). The important thing characteristic of this mannequin is downward nominal wage rigidity, constraining the nominal wage to lower not more than a sure p.c per 12 months and producing involuntary unemployment each time the constraint is binding. We embed this characteristic right into a dynamic commerce and migration mannequin within the spirit of Caliendo et al. (2019), which we lengthen additional to permit for a distinction between the elasticity governing employees’ mobility throughout sectors and the elasticity governing their mobility throughout native labour markets. Permitting for these completely different elasticities is essential to match the empirical proof from Autor et al. (2013). These elasticities, along with the diploma of downward nominal wage rigidity, are the important thing parameters of the mannequin.

The presence of downward nominal wage rigidity requires us to introduce a nominal anchor that forestalls nominal wages from rising a lot in every interval as to make the constraint at all times non-binding. We select a easy nominal rule that makes an attempt to seize the concept that central banks are unwilling to permit inflation to be too excessive (due to its associated prices) whereas on the identical time being amenable for quantification in our commerce setting. Specifically, we assume that world nominal GDP in {dollars} grows at a relentless and exogenous price (which we set to zero with out lack of generality). Then, as is frequent within the literature, we deal with the China Shock as a productiveness enchancment in China that varies throughout sectors and years. We calibrate these productiveness modifications and the important thing mannequin parameters to match the modifications in US imports from China that we observe within the knowledge (when projected on different wealthy nations modifications in imports from China) in addition to the regression outcomes from Autor et al. (2013) on how labour pressure participation, unemployment, and inhabitants throughout US labour markets are affected by the China shock. This calibration process results in a level of downward nominal wage rigidity that suggests that – with fixed world nominal GDP – wages can fall as much as 2% yearly with out the constraint turning into binding. This worth is much like the one in Schmitt-Grohe and Uribe (2016).

Armed with the calibrated model of our mannequin, we simulate the results of the China Shock for the 2000-2007 interval utilizing dynamic precise hat algebra, in order that we don’t have to explicitly calibrate sector-level commerce prices and productiveness ranges within the preliminary 12 months. We discover that downward nominal wage rigidity has essential qualitative and quantitative implications for the way US states regulate to the China shock. Particularly, we discover that though the China shock improves the phrases of commerce for all however one US state, employment really falls in most states through the transition, each because of a rise in unemployment and a decline in labour pressure participation. Which means that downward nominal wage rigidity is not only amplifying the terms-of-trade results, however it might additionally reverse these results. As an illustration, a beneficial terms-of-trade shock that requires a big sufficient nominal wage decline for the labour market adjustment would activate the nominal wage constraint and generate unemployment, which might be detrimental to the financial system.

Intuitively, in a world with versatile wages, the rise in China’s relative productiveness would require a downward adjustment within the US relative wage. Downward nominal wage rigidity prevents this adjustment from going down via a big decline within the US nominal wage, and the nominal anchor prevents it from occurring via a big improve within the Chinese language greenback wage. The result’s non permanent unemployment within the US. In flip, this unemployment triggers additional declines in labour participation, as extra employees want to opt-out of the labour market moderately than face the opportunity of being unemployed. Our mannequin quantification implies that the China Shock results in round half 1,000,000 jobs misplaced within the US between 2000 and 2007. Nevertheless, for the reason that unemployment impact is reversed over time because the nominal wage adjusts downward, employment finally will increase after the financial system totally adjusts to the constructive terms-of-trade shock in the long term.

The spatial heterogeneity within the employment and revenue results of the China Shock implied by our mannequin is much like that implied by the empirical leads to Autor et al. (2013). This stands in distinction to earlier quantitative commerce fashions, akin to Caliendo et al. (2019) and Galle et al. (2022), which ship too little dispersion, as proven in Adao et al. (2020) and Autor et al. (2021). The principle motive we receive the next dispersion is that, due to the downward nominal wage rigidity, our mannequin results in a lot bigger declines in employment in probably the most uncovered areas, each immediately via greater unemployment and not directly via discouraging labour participation.

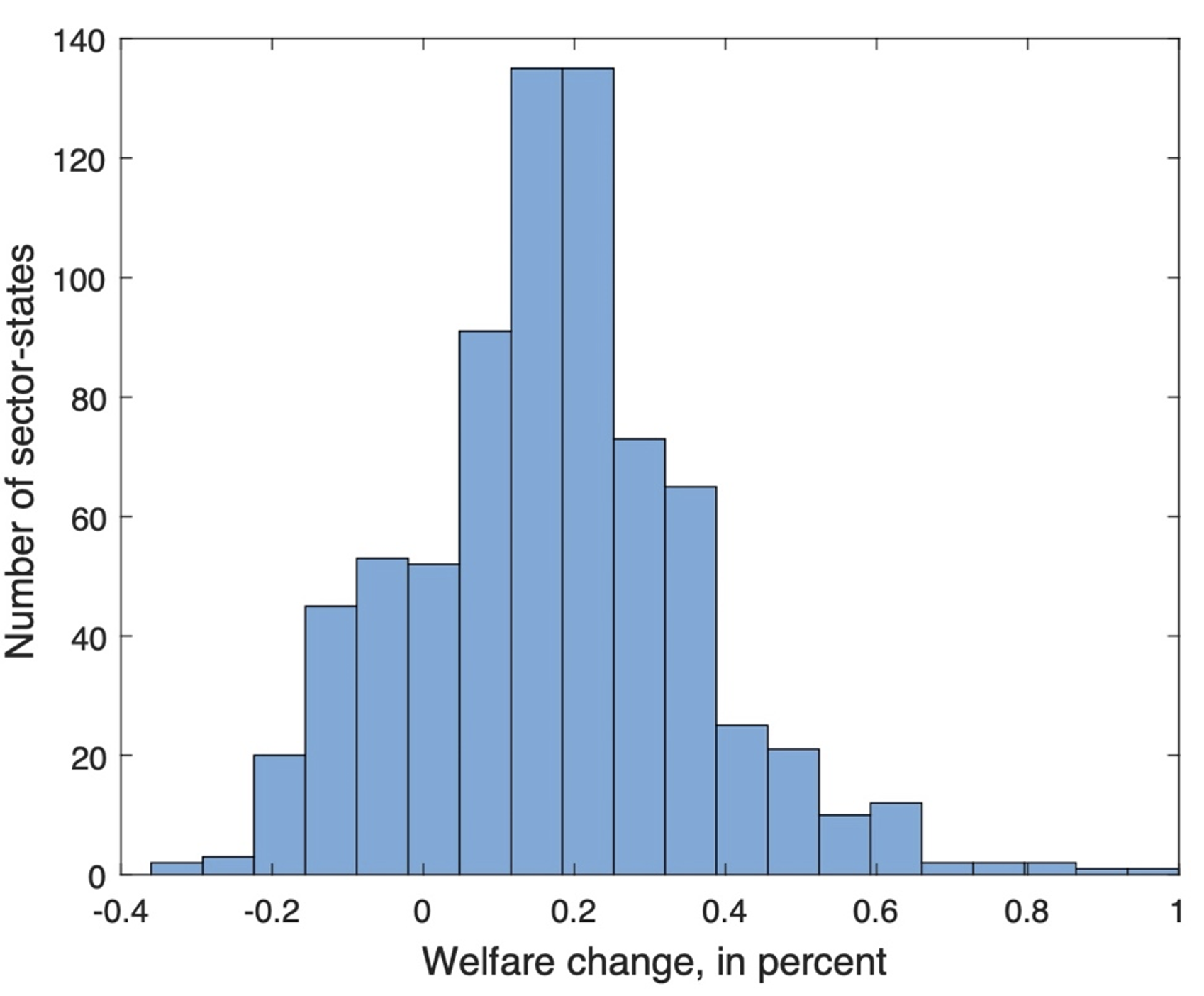

One profit of getting the construction of a normal equilibrium mannequin is that we will research the impact of the China Shock on welfare. We discover a unfavorable relation between welfare modifications and import publicity to China (see Determine 1). On the one hand, we discover that an extra $1000 per employee in imports from China decreases state-level welfare by eight foundation factors. However, we discover that regardless of the dispersion in welfare results throughout state-sector pairs (see Determine 2), welfare will increase in most US states, together with many that have unemployment through the transition. Because of this, the China Shock is useful to the US, even with downward nominal wage rigidity. Nevertheless, downward nominal wage rigidity has important welfare implications, because it results in a 25% discount within the US positive factors from the shock (from 31 to 23 foundation factors) and to absolute welfare losses in seven states that may have benefited from the China Shock in any other case.

Determine 1 Welfare change versus publicity to the China Shock throughout US states

Determine 2 Histogram of welfare modifications throughout completely different sector-states of the US

References

Adao, R, C Arkolakis and F Esposito (2020), “Common equilibrium results in area: Principle and measurement”, NBER Working Paper No. w25544.

Autor, D H, D Dorn and G H Hanson (2013), “The China Syndrome: Native Labor Market Results of Import Competitors in america”, American Financial Evaluation 103(6): 2121-2068.

Autor, D H, D Dorn and G H Hanson (2021), “On the Persistence of the China Shock”, NBER Working Paper No. w29401.

Caliendo, L, M Dvorkin and F Parro (2019), “Commerce and Labor Market Dynamics: Common Equilibrium Evaluation of the China Commerce Shock”, Econometrica 87(3): 741-835.

Dorn, D and P Levell (2022), “Altering views on commerce’s influence on inequality in rich nations”, VoxEU.org, 14 February.

Galle, S, A Rodríguez-Clare and M Yi (2022), “Slicing the Pie: Quantifying the Mixture and Distributional Results of Commerce”, Evaluation of Financial Research, forthcoming.

Grossman, G and E Oberfield (2022), “Making an attempt to account for the decline within the labour share”, VoxEU.org, 13 January.

Schmitt-Grohe, S and M Uribe (2016), “Downward Nominal Wage Rigidity, Forex Pegs, and Involuntary Unemployment”, Journal of Political Economic system 124(5): 1466-1514.

Rodríguez-Clare, A, M Ulate and J P Vasquez (2022), “Commerce with Nominal Rigidities: Understanding the Unemployment and Welfare Results of the China Shock”, CEPR Dialogue Paper 17141.