Beo88

Ulta Beauty (NASDAQ:ULTA) is an American retail company that sells beauty and personal care products. Its stock has recovered from last month’s plunge, but buying it could still be a great opportunity.

Business model

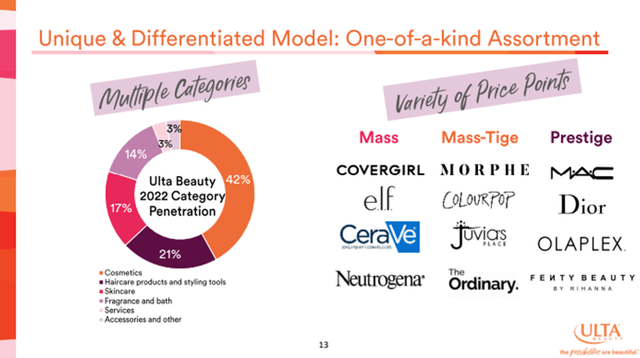

Ulta currently has 1,355 stores throughout the United States, making it the second-largest company in the sector. In their stores, they offer cosmetics (42% of total sales), haircare products (21%), skincare products (17%), fragrances and bath products (14%), services (3%, above all beauty salons) and accessories (3%).

In effect, Ulta offers a whole set of products of various categories. They provide over 25,000 products from over 600 brands, from the most premium (i.e., Dior and Yves Saint Laurent) to the most conventional. It should be noted that Ulta has exclusivity of some brands, which are only found in premium retailers.

Source: Ulta’s Investor Overview

The company knows the primary client is the so-called “beauty enthusiast.” These are primarily young people passionate about beauty and personal care. Although 66% of buyers belong to this group, they are the ones that spend the most, representing 83% of the company’s sales. Therefore, Ulta has designed its business model to appeal to these beauty lovers primarily.

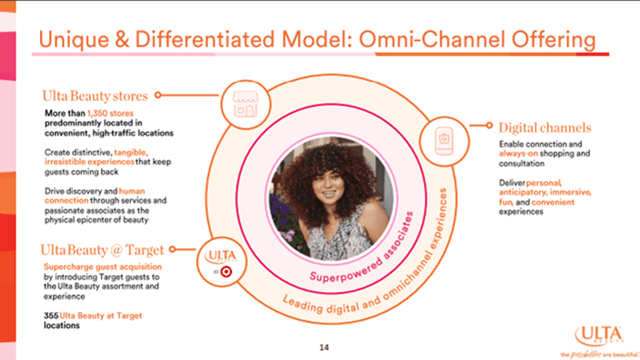

Firstly, the stores are located in high-traffic areas. Furthermore, Ulta has partnered with Target (TGT), resulting in a good alliance of 355 Ulta stores in Target centers.

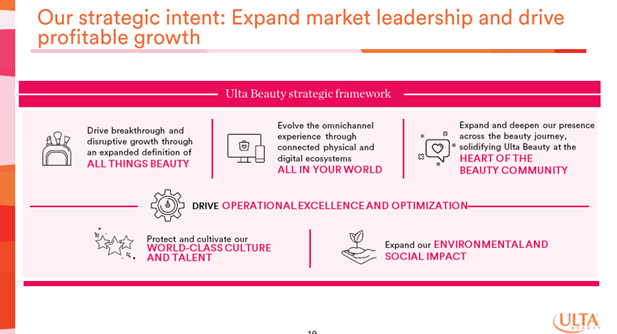

Source: Ulta’s Investor Overview

In addition, Ulta has spent several years developing digital channels, thus increasing online sales, streamlining the in-store purchase process, and making it a more immersive experience (i.e., virtual fitting rooms, interactive store guides, social events in stores).

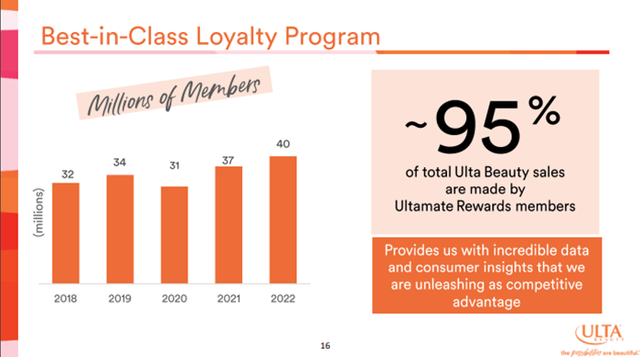

Another way to attract customers is Ulta’s loyalty program. It now has 40M members, up from 32M members in 2018 (+5% annual growth in members), even after having a tough time during the pandemic, when members were down to 31M. In fact, 95% of sales are made by members of this program. This allows the company to obtain additional and precious information for future growth.

Source: Ulta’s Investor Overview

Ulta will keep up his growth runway

In the past, the company’s growth has been backed up by three main reasons, which are also expected to be the primary future sources of growth.

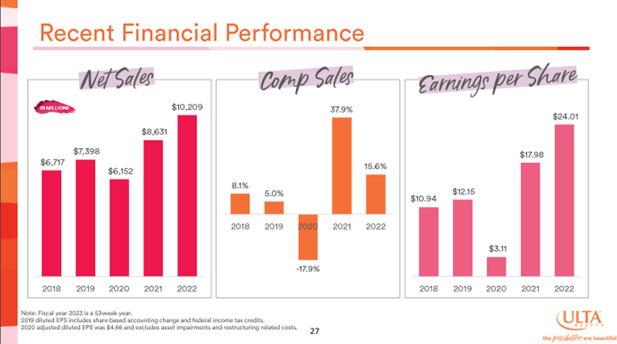

Past growth was remarkable

First, comparable sales (organic growth) have grown at an average of just under 10% over the last 5 years. This organic growth comes from physical stores and online sales (e-commerce). Since 2018, the company doesn’t detail how much it earns from each one. Still, in 2018 store sales grew 7% y/y and online sales 25.1% y/y, giving a total comparable sales growth of 9.4%. We can continue to assume that online sales will grow at higher rates than store sales.

Afterward, Ulta progressively increased the number of stores in the American territory. In 2018 they had 1,174 stores, compared to 1,355 stores in 2022. Ulta has also increased its market share, going from 5% in 2018 to 9% in 2022. As a result, sales have grown 12% annually for the past 5 years.

Source: Ulta’s Investor Overview

Finally, EBIT margins went from 13.5% in 2017 to 12.2% in 2020, a somewhat worrying decline. After that, the company launched a cost savings plan to increase them. They have remarkably achieved that since they now stand at 16%, boosted by the post-pandemic trend. Moreover, the company recently began ambitious share buyback programs, repurchasing between 2% and 6% of the total shares annually. As a result, Ulta’s EPS has grown 17% per year for the past 5 years.

Sustainable future growth to keep gaining share

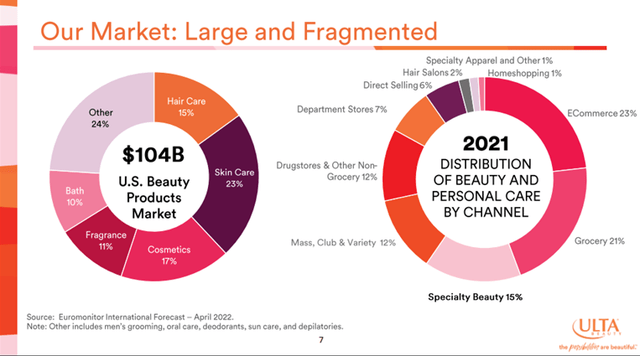

The beauty and personal care market is vast and fragmented. It is estimated to be around $104B, of which Ulta Beauty owns 9% of the total share.

Source: Ulta’s Investor Overview

Market growth estimates vary from 4% to 7% per year. Therefore, on average, we can expect it to grow by at least 5% per year. This market growth will be mainly due to tailwinds related to the growing importance of personal care in the new generations, including fragrance, skincare, and hair care. Nevertheless, the company will obviously try to grow faster than the market.

First, Ulta will continue differentiating itself from the market by offering exclusive brands and products in every category. Then, by developing their sales channels, they are likely to increase growth. They will continue developing their loyalty program and expect to invest more in marketing, boosting online sales.

Moreover, Ulta will continue to increase the number of stores, although at a lower rate. The company aims to have between 1,500 and 1,700 stores in the long term. Last year the store count increased by 2%, and this year’s growth is expected.

Source: Ulta’s Investor Overview

Globally, if the market grows at over 5%, gaining market share and boosted by online sales, Ulta could grow organically at 7% per year. Furthermore, with a 2% increase in stores and the alliance with Target, Ulta should grow its revenue by at least 9% annually.

Nevertheless, margins are expected to narrow. We should see EBIT margins at around 14.7% this year and 14.5% after that. The company has already warned of the margin contraction, mainly due to increased spending on security and more significant marketing investments.

Management alignment isn’t the best

Ulta’s management team has led the company to achieve excellent results. However, its alignment could be better.

On the one hand, I would like the management’s experience with the company to be longer. The CEO has occupied the role since 2021 and has been in the company since 2014 (less than 10 years). The CFO is the most experienced, occupying this position for 10 years and having 18 years of experience.

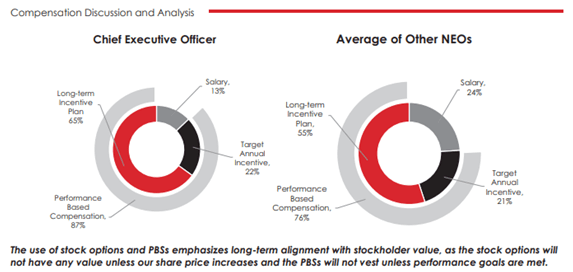

Source: Ulta’s Proxy Statement

On the other hand, executive compensation is acceptable (pages 39 and 40) but could be better. Something positive is that 87% of the CEO’s and 76% of the NEO’s salaries depend on their performance.

Both long-term (3 years) and short-term performance depend on EBT and revenue growth. It also depends somewhat on the TSR. They are not bad references, although I would like it to be conditioned on ROIC or ROIC/WAAC spread.

I am concerned that the EBT and income requirements are not demanding. On the one hand, the target for 2022 was an EBT of $1.3B, the same as they achieved in 2021, that is, a growth of 0%. On the other hand, the revenue target was $9.2B, an increase of 7%. Both were far outclassed as they made an EBT of $1.6B and revenue of $10.2B (page 45).

The percentage of insiders also leaves something to be desired, only 0.14%. Moreover, the CEO owns a fortune of 50M in company shares (page 67). Behind sits the CFO with a wealth of 9M in shares. Another executive has a worth of 6M in shares, but the rest do not exceed 3M. Effectively, the alignment is poor regarding insider ownership.

The possibility of recession is the main risk

Given the growing fear of recession, retail is going through a bitter year. The recession would cause a decline in consumer purchases, thus weighing down the retail sector. In addition, this is compounded by rising interest rates and the high credit card debt of the population. Finally, other bad news for the industry broke out last week when it was learned that student loan payments would resume again. So, without making any macroeconomic prediction, the fear is understandable.

Specific segments of the retail sector could indeed have a hard time. But the risk in the case of Ulta seems much lower due to the nature of the business.

Effectively, Ulta has proven to be a company that can withstand difficult times. No matter how bad the economy is, people will continue grooming themselves. Perhaps, expenses could be reduced, and cheaper brands could be sought, but consumption will continue. Ulta is well positioned, offering products from affordable brands to the most premium ones. In addition, owning premium brands exposes them to the premium and luxury sectors, one of the strongest during recessions.

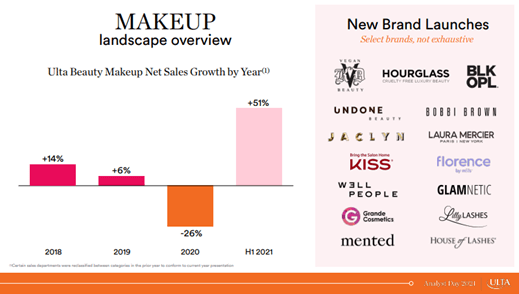

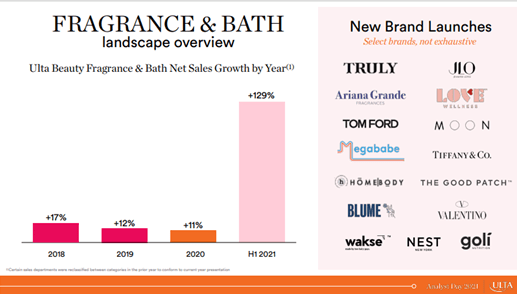

Source: Ulta’s Analyst Day 2021

Two examples show its resilience. First, Ulta increased its revenue in both 2008 and 2009 by 20% in both years. Afterward, Ulta weathered the storm during the pandemic. Its revenues decreased by 17%, mainly due to the 26% drop in revenue caused by the makeup segment (slide 75), the most important. Of course, if people don’t go out, they will spend much less on makeup. But global pandemics and being locked up at home for several months are unusual, so we can assume it will not happen in a few years.

Even during the pandemic, income for “haircare” decreased by 11% (slide 81), and for “skin care,” it fell by only 1% (slide 78). Notably, the fragrance and bathroom segment grew by 11% (slide 84).

Source: Ulta’s Analyst Day 2021

Finally, despite all this recession fear, the company expects to grow revenue by 9% this year. Then, Ulta seems a resilient company in the face of crises. Perhaps the student loan payments could reduce their income, but I think it will hardly affect them since young people will prefer to cut down on other things than their beauty (above all, in the age of social networks, posturing, and narcissism).

Valuation

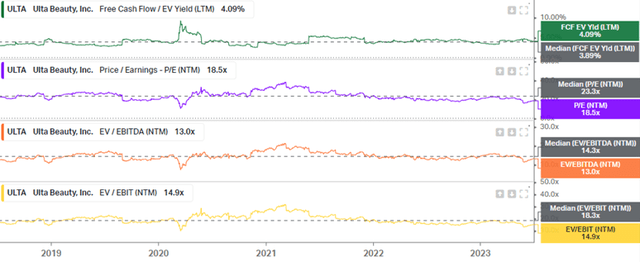

Ulta’s stock had a significant 17% drop at the end of May. As a result, Ulta traded at almost 15x NTM earnings (5-year median of 23x) and 11x NTM EBITDA (5-year median of 14x). Since then, it has recovered all the lost territory, with an almost 20% increase. Despite this comeback, Ulta seems to trade at attractive multiples, all under their 5-year median.

Source: Koyfin Charts

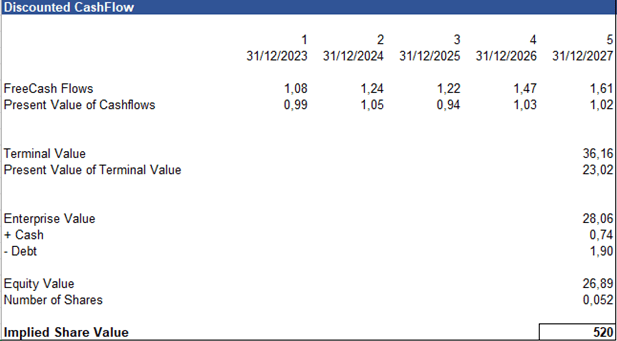

Building a DCF, we can see that Ulta’s stock trades slightly below my estimated fair value for a 10% required return. As I said, I expect its revenue to grow at 9% annually. With the margins contraction, earnings should increase at around 7%. Then, CapEx should represent 3% of sales. Then, with an average 90% FCF/NI conversion, FCF should also grow at 7%. Finally, using a FCF Yield of 4.5% or an LTM EV/EBITDA of 14x (below the 5-year median) as exit multiples, the implied share value is $520.

DCF, Author’s Creation

In addition, Ulta should keep up the buyback pace, repurchasing 4% to 5% of its shares each year (5.7% bought last year). This leads to an EPS growth of 11% to 12%. Ulta’s stock trades at 19x NTM earnings, which, with DD EPS growth and an average ROIC over 30%, seems low.

Overall, I believe Ulta’s stock will probably give +10% long-term returns to its shareholders.

Conclusion

Ulta Beauty is a great, resilient business with a promising future ahead. Today’s price is appealing, and Ulta’s shareholders should get great returns. Because of this, I rate the stock a buy.

I bought the dip and will hold the position. I will buy more shares if the price gets under $450 again. Still, I don’t see myself having a top 5 position in Ulta, as I like my cores to have better management alignment. However, I am happy to be part of this company that will continue its success path.