Editors’ be aware: This column is a part of the Vox debate on the financial penalties of conflict.

Inhabitants dynamics, and extra particularly human capital formation, are the figuring out issue for financial development (Angrist et al. 2021). Earlier than the Industrial Revolution, financial development was virtually aligned to inhabitants development (Murphy et al. 2008). Later, from 1913 to 2010, common annual inhabitants development amounted to 1.4% worldwide, whereas actual GDP development stood at 3% (Peterson 2017). This means that inhabitants change nonetheless amounted to virtually half of complete financial development, however the dramatic technological advances and productiveness adjustments that the world noticed within the twentieth century (Evenett and Baldwin 2021).

Inhabitants development issues much more when capital is destroyed as a result of conflict. Germany had a talented workforce previous to WWII, however its capital and human inventory had been largely destroyed. Nonetheless, Germany obtained greater than 12 million refugees from former German territories east of the Oder and from areas with substantial German ethnic populations in central and jap Europe. This inflow of individuals contributed to the financial development growth within the succeeding a long time (Hazlett 1978).

The price of conflict is typically masked by nationwide earnings accounting, which ignores the lack of lives and the destruction of bodily and human capital related to conflict (Broadberry and Harrison 2018).

Ukraine’s demographic development earlier than the conflict

Within the spring of 2020, when the Covid-19 pandemic erupted, there was hypothesis that Ukraine would see a child increase on the finish of the yr as home-locked households spent extra time collectively. As a substitute, within the interval December 2020 to February 2021 there have been 5,000 fewer births than within the comparable interval a yr earlier. Covid-19 additionally had a pointy, upward impact on the loss of life fee (Determine 1).

The pandemic solely added to a pronounced downward demographic development. A decade earlier, in 2012, Ukraine’s annual inhabitants lower (with out migration) was estimated at 142,400 individuals. By 2020, this lower grew to 323,400 individuals and expanded to 442,300 individuals in 2021 (State Statistics Service 2022). Which means that the nation misplaced over 1% of its residents the yr earlier than Russia’s invasion.

Determine 1 Beginning and loss of life charges in Ukraine (per 100,000 inhabitants)

Supply: State Statistics Service of Ukraine, accessed 17 June 2022.

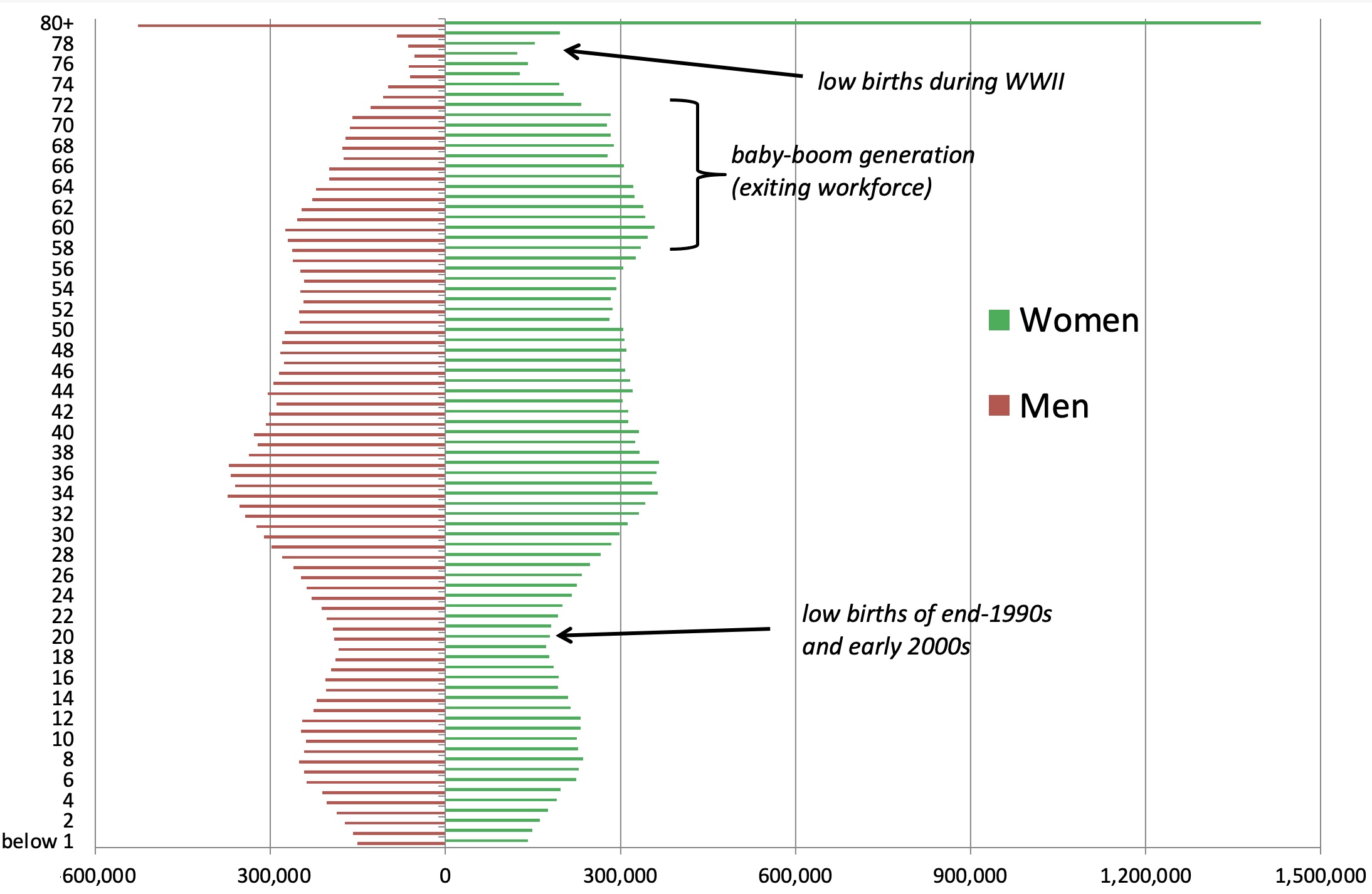

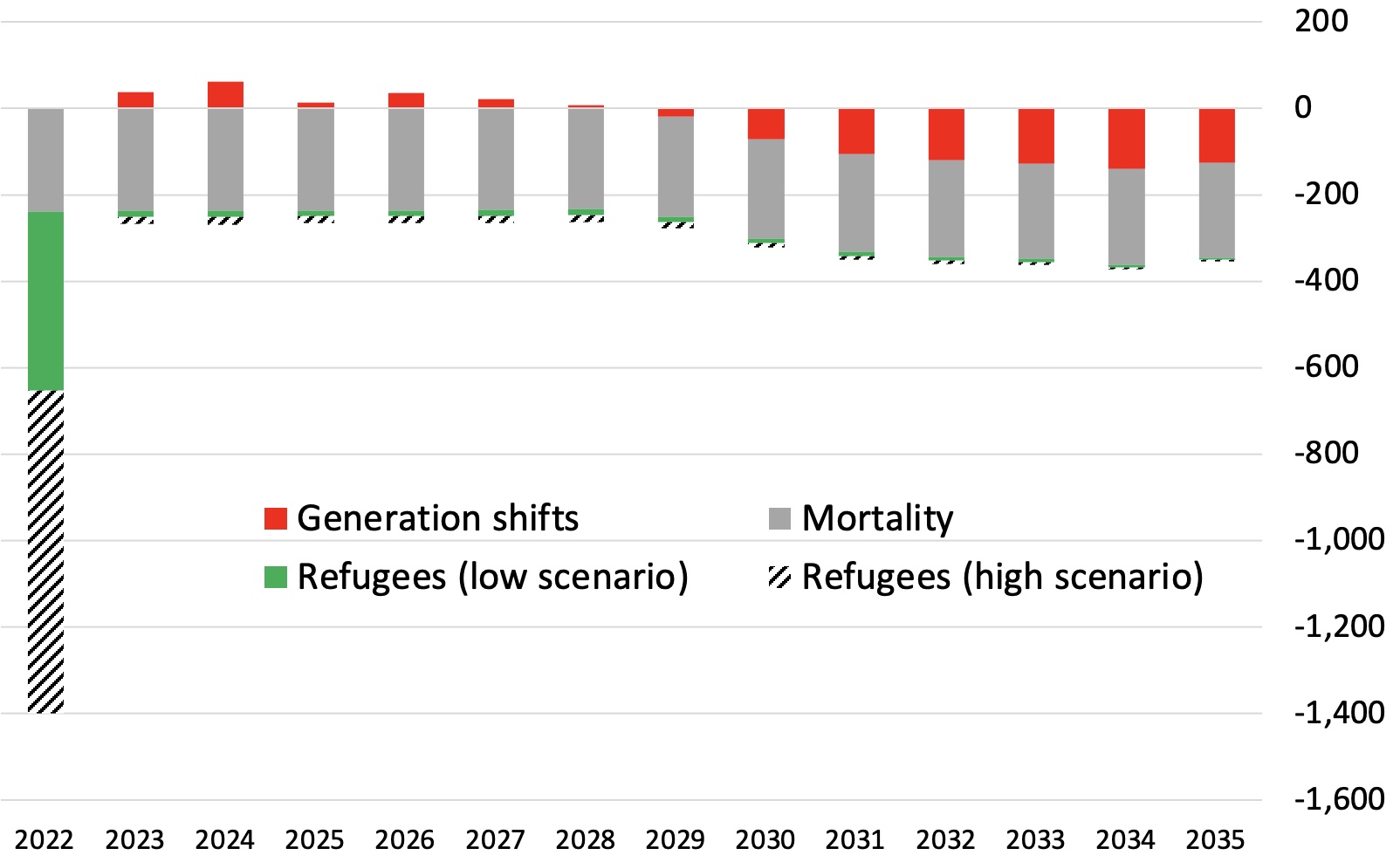

Ukraine’s inhabitants has been ageing quick: in 1990, its median age was 35; by 2010, it surpassed 39; and in 2022, at the beginning of the conflict, it was 41 years. The newborn-boomer technology born after WWII has joined the ranks of pensioners (Determine 2). This generational shift implies that Ukraine can not substitute its retiring staff with youthful ones. General, by 2030, the overall demographic toll on the financial system (mortality and technology shifts mixed) would improve to over 300,000 individuals exiting the workforce a yr (Determine 3). And that was the development earlier than the conflict began.

Determine 2 Age-sex inhabitants construction in Ukraine as of 2021

Supply: State Statistics Service of Ukraine, accessed 17 June 2022.

Conflict and refugee disaster in 2022

Wars result in deep demographic crises. Throughout WWI, the fertility charges of European nations collapsed (Vandenbroucke 2012). In assist of this discovering, Caldwell (2004) exhibits that fertility declined in 13 different episodes of crises resembling wars and revolution in varied international locations and durations of time.

The proof means that Russia’s invasion of Ukraine will additional deepen the inhabitants decline. Already, a 3rd of Ukraine’s inhabitants is on the transfer. Some 7.6 million Ukrainians have left the nation and 5.1 million are nonetheless residing in different international locations as of mid-June 2022 (UNHCR 2022). The latter is equal to 12–15% of the nation’s inhabitants.

Within the quick time period, this refugee wave lowers consumption and tax revenues in Ukraine. Ukrainians in Europe act as hundreds of thousands of particular person importers, producing a day by day international alternate drain of $100 million (Nationwide Financial institution of Ukraine 2022). Evaluation of transactions in one among Ukraine’s main banks means that the share of abroad funds with its debit and bank cards elevated from 8% pre-war to twenty-eight% in Could 2022 (Alfa-Financial institution 2022).

Almost all grownup Ukrainian refugees are ladies. Each third Ukrainian youngster is overseas. These households are briefly separated from about 2 million males both ready for them to return to Ukraine or contemplating becoming a member of them overseas after the conflict. A few of these refugees are prone to turn out to be long-term emigrants, particularly because the conflict drags on they usually discover employment in different European international locations. Even when solely 15% of refugees and their household stay overseas as soon as the conflict ends, this conservative estimate implies a robust one-off further minimize of round 400,000 to the quickly dwindling workforce in Ukraine (Determine 3).

Determine 3 Annual change in Ukraine’s inhabitants aged 15-70

Supply: authors’ estimates

Insurance policies to ameliorate the inhabitants problem

First, authorities insurance policies ought to give attention to creating incentives for Ukrainians overseas to return to Ukraine as soon as the conflict is over. These insurance policies might embody financial rewards to rebuilding properties and companies. There must also be a world effort to deliver again these over 1 million Ukrainians who had been forcefully displaced into Russia for the reason that begin of hostilities.

Second, the federal government, with grants from the worldwide group, ought to assist these refugees who’ve misplaced household. These people ought to be supplied with precedence assist within the type of welfare funds.

Third, youngster assist insurance policies could be aimed toward growing fertility charges. Insurance policies can particularly decrease the associated fee to ladies of childcare. A typical mode of childcare is supplied by day-care centres and preschools, which could be public or personal. If such childcare is extensively obtainable, covers the working day, and is reasonably priced, ladies with kids have a better time returning to work and may be extra prone to have bigger households consequently (Doepke et al. 2022).

Lastly, the post-war restoration ought to be geared in direction of the creation of a brand new, inexperienced financial system (Weder di Mauro 2021). The continued disaster presents an opportunity to reinvent Ukrainian financial system, away from dependence on imported power and in direction of the manufacturing of higher-value merchandise. Funding in schooling is the core of this development technique.

References

Alfa-Financial institution (2022), “Ukrainians Overseas: How A lot Do They Spend, The place and What they Purchase”, Alfa-Financial institution.

Angrist, N, S Djankov, P Goldberg and H Patrinos (2022), “The lack of human capital in Ukraine”, VoxEU.org, 27 April.

Broadberry, S and M Harrison (2018), “New eBook: The economics of the Nice Conflict: A centennial perspective”, VoxEU.org, 6 November.

Caldwell, J (2004), “Social Upheaval and Fertility Decline”, Journal of Household Historical past 29(4): 382-406.

Doepke, M and F Kindermann (2016), “Why European ladies are saying no to having (extra) infants”, VoxEU.org, 3 Could.

Doepke, M, A Hannusch, F Kindermann and M Tertilt (2022), “A brand new period within the economics of fertility,” VoxEU.org, 11 June.

Evenett, S and R Baldwin (2021), “Memo to the brand new WTO Director-Common: By no means waste a disaster”, VoxEU.org, 10 February.

Hazlett, T (1978), “The German Non-Miracle”, Purpose 9(3): 33–37.

Murphy, Ok M, C Simon and R Tamura (2008), “Fertility decline, child increase, and financial development”, Journal of Human Capital 2(3): 262-302.

Nationwide Financial institution of Ukraine (2022), “Each day Outflow by way of Ukrainian-Issued Playing cards Overseas round $100 mln”.

Peterson, E (2017), “The Position of Inhabitants in Financial Progress”, Sage Open 7(4).

State Statistics Service of Ukraine (2022), “Inhabitants (1990-2021)”.

UNHCR (2022), Operational Information Portal, Ukraine Refugee State of affairs.

Vandenbroucke, G (2012), “On a demographic consequence of the First World Conflict,” VoxEU.org, 21 August.

Weder di Mauro, B (ed) (2021), Combatting Local weather Change: A CEPR Assortment, CEPR Press.