The world’s greatest stablecoin, tether, noticed greater than $10 billion in redemptions in Could, fueling fears of a 2008-style “financial institution run.”

Justin Tallis | AFP through Getty Photos

Britain needs to ensure stablecoins do not find yourself threatening the broader monetary system following the collapse of controversial crypto undertaking Terra.

The federal government on Tuesday proposed amending present guidelines to handle the failure of stablecoin companies that will pose a “systemic” threat. The proposal is separate from beforehand introduced plans to control stablecoins below legal guidelines governing digital funds.

“Because the preliminary dedication to control sure sorts of stablecoins, occasions in cryptoasset markets have additional highlighted the necessity for acceptable regulation to assist mitigate shopper, market integrity and monetary stability dangers,” the federal government stated in a session paper setting out its proposals.

“The federal government considers that you will need to guarantee present authorized frameworks might be successfully utilized to handle the dangers posed by the attainable failure of systemic DSA [digital settlement asset] companies for the needs of economic stability.”

Stablecoins are cryptocurrencies whose worth is pegged to a conventional asset, most frequently the U.S. greenback. TerraUSD, a so-called “algorithmic” stablecoin, was meant to comply with this association utilizing a mixture of code and partial backing from bitcoin and different digital tokens. However it imploded earlier this month, taking an related token known as luna tumbling with it. Panic over the debacle has erased a whole bunch of billions of {dollars} from your complete crypto market.

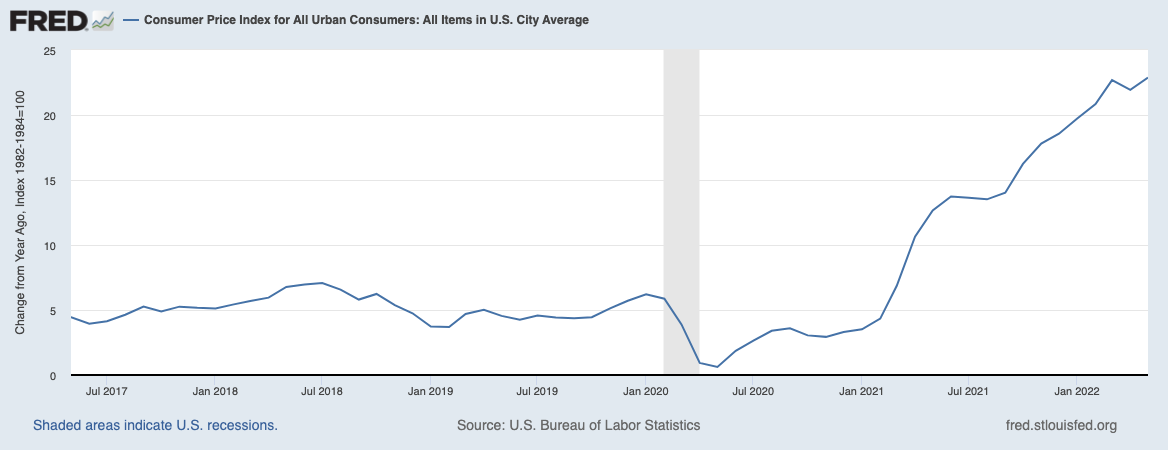

That has, in flip, prompted concern for regulators, who’re fearful concerning the dangers posed by stablecoins to the broader monetary system. Tether, the world’s greatest stablecoin, noticed greater than $10 billion in redemptions within the weeks following Terra’s collapse, fueling fears of a 2008-style “financial institution run” with knock-on results for different monetary markets. Although Tether says its token is absolutely backed by property held in a reserve, critics stay unconvinced and have known as for a full audit.

The federal government is seeking to implement extra safeguards to present laws round insolvency of companies working key monetary market infrastructure. Such a provision would take note of the return or switch of the personal keys that defend customers’ funds. The Financial institution of England would function the lead regulator implementing the foundations. A session on the proposal is at the moment underway and can shut on Aug. 2.

Glen Goodman, a crypto advisor to eToro, stated the proposal was “fairly dramatic.”

The federal government has “successfully accepted that some stablecoins could change into as systemically vital as banks and so must be handled as particular instances and assisted in the event that they’re failing,” he stated.