Millions of British households’ energy bills will rise by more than £100 a month from April next year, after new chancellor Jeremy Hunt signalled big changes to the government’s support package.

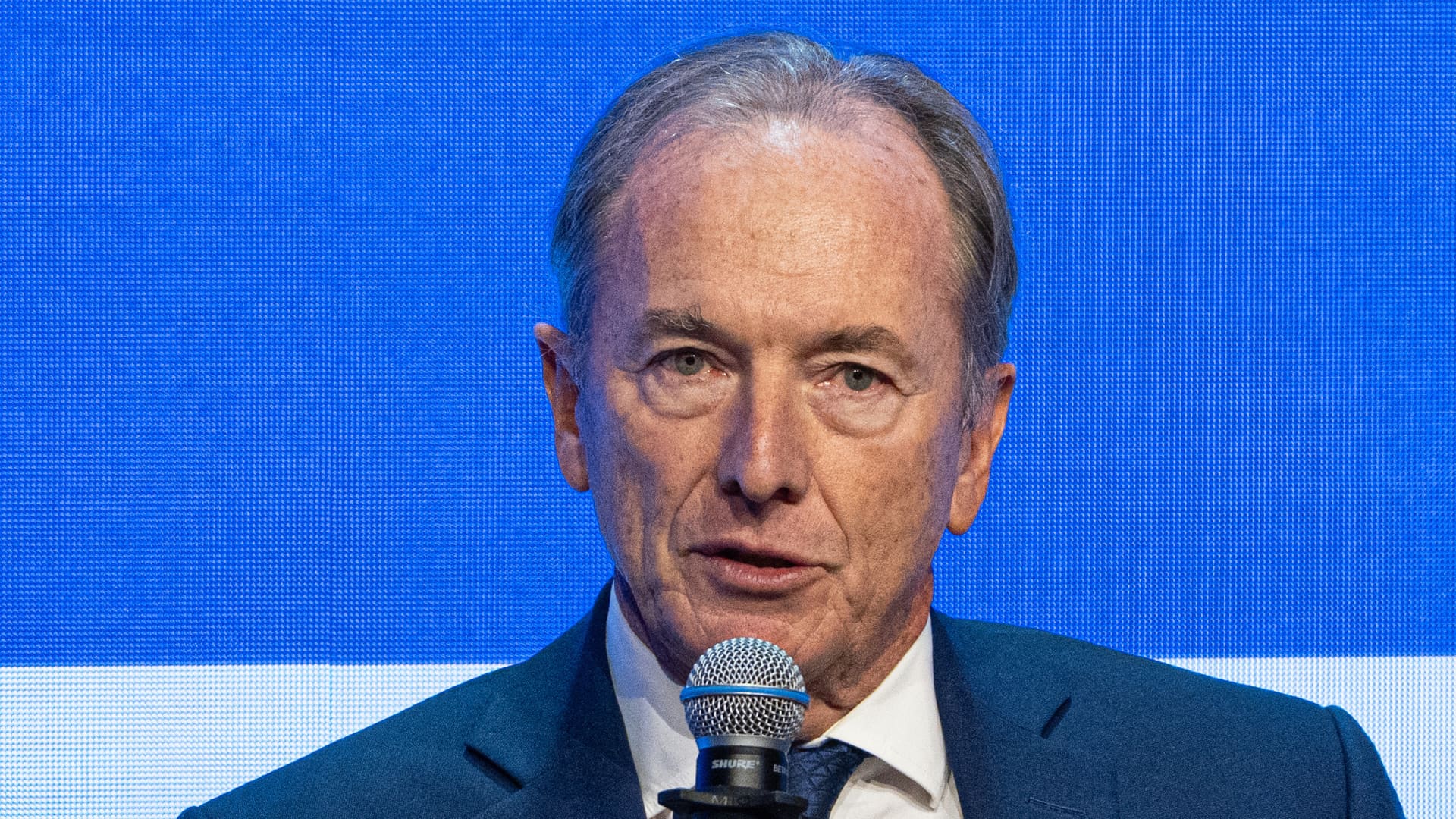

Hunt on Monday confirmed that the energy price guarantee, which was announced in September and limits average annual household bills to £2,500, would continue through the winter. But he said that from April support would target “the most vulnerable”.

The decision to reduce support to six months — Liz Truss had promised the price freeze would last for two years — comes as the prime minister seeks to calm financial markets destabilised by her “mini” Budget.

A full Treasury-led review will determine how the government will ration support in future, but timings have yet to be confirmed.

Hunt said the new measures would cost “significantly less” than the previous £150bn estimate for helping households and businesses over the next two years and prioritise energy efficiency measures.

The revised programme is expected to help at least the 8mn low-income households on benefits such as universal credit, tax credit and pension credit. Last year, they were given a £1,200 one-off payment to help them amid the cost of living crisis.

All households will continue to receive a £400 credit on energy bills between October and next April.

Beyond that, however, ministers face a test in identifying which households deserve to have their energy bills capped, especially since millions of middle-class families are struggling with rising mortgage rates.

Wholesale natural gas and electricity prices remain at exceptionally high levels, meaning bills would rise significantly for any household cut off from government support next year.

Investment bank Investec on Monday said the average yearly household bill without government subsidy would probably near £4,000 between next April and June — 60 per cent higher than the government’s current cap.

Energy consultancy BFY Group forecast the typical yearly bill would, based on current forward prices, be £4,500 in April. It warned that the rise risks hitting middle-class households not included as part of the targeted support.

“While a targeted scheme could provide more sustainable support in the longer term, there is a ‘stretched middle’ who earn too much for typical support yet not enough to face £4,500 energy bills,” said Matt Turner, a consultant at BFY.

Adam Scorer, head of the charity National Energy Action, said that “in seeking the confidence of markets, the government has created huge uncertainty for households”.

Labour MP Darren Jones, who chairs the House of Commons business, energy and industrial strategy select committee, urged the government to reduce support for households slowly and invest more in cutting energy usage.

“Any end to support for all bill payers should be tapered off, instead of facing a cliff-edge,” said Jones, adding that a national home insulation plan should be fast-tracked.

As well as rising energy costs, households can no longer look forward to falling income tax bills. Hunt on Monday indefinitely postponed proposals to reduce the basic rate of income tax from 20p in the pound to 19p and reversed a planned cut to dividend tax.

One of the few “mini” Budget tax measures to survive the cull was the decision to scrap the health and social care levy, meaning national insurance rates for millions of taxpayers will not increase next April.

Although Hunt did not commit to uprating benefits in line with inflation next year, he vowed to “prioritise the most vulnerable” and did not rule out future spending cuts or tax rises. “There will be more difficult decisions,” he added.

Tax experts think these tax rises could include reinstating measures to increase national insurance for higher rate taxpayers, when Hunt announces a medium-term debt-cutting plan on October 31.

Cuts to stamp duty will also remain. Home buyers in England and Northern Ireland now pay no stamp duty on the first £250,000 of a property’s value — double the previous £125,000 threshold. First-time buyers, meanwhile, pay no tax on the first £425,000, up from £300,000 previously.

In another break with his predecessor Kwasi Kwarteng, Hunt vetoed freezing alcohol duty, meaning duty rates will increase in line with the retail price index next February. Plans for VAT-free shopping incentives to draw foreign tourists were also shelved.

Additional reporting by Nathalie Thomas in Edinburgh