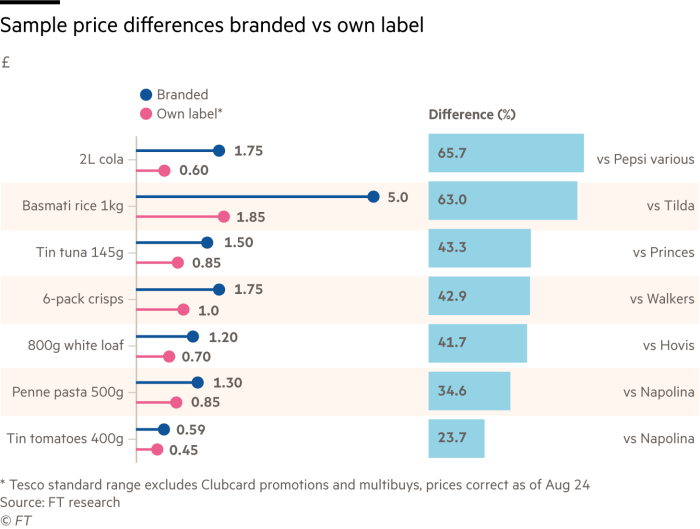

A loaf of branded, white sliced bread prices about £1.20 at Tesco. The retailer’s own-label equal prices 70p, or 42 per cent much less. It’s not shocking that Tesco’s chief govt, Ken Murphy, just lately flagged bread as one of many classes the place clients are beginning to commerce all the way down to cheaper alternate options.

That pattern is already being felt by the businesses that make own-label merchandise — they usually anticipate it to speed up. “We’re seeing a rise in our own-label volumes, particularly in bread the place the worth for cash hole may be very clear,” stated the managing director of 1 bakery merchandise group.

“The rise within the vitality worth cap is more likely to focus minds much more,” he added, noting that the hovering value of vitality within the UK meant this downturn was “transferring at a far faster tempo” than earlier ones and that “lots of households must batten the hatches down”.

Through the pandemic and earlier than inflation took off, folks sought the reassurance of branded items. However Mike Watkins, head of retailer and enterprise perception at consultancy NielsenIQ, stated that habits had been shifting once more, with own-label gross sales outgrowing branded in current months amid the largest squeeze on UK wages in 20 years.

Final month Unilever, one of many world’s largest producers of branded items, warned that gross sales had been hit by shoppers selecting cheaper variations as costs of its merchandise rose.

Fraser McKevitt, head of retail and client perception at one other consultancy, Kantar, stated own-label items now made up 51.6 per cent of grocery gross sales by worth, the best degree it had ever recorded.

Its figures present own-label gross sales rising 7 per cent within the 12 weeks to August 7, whereas a current survey by consultancy Retail Economics steered that half of all consumers had been planning to purchase extra own-label merchandise.

A lot of the expansion in personal label over the previous decade has been pushed by the growth of discounters Aldi and Lidl, which between them have an 18 per cent market share, in contrast with 8 per cent in 2011. Each promote nearly solely own-label merchandise underneath names equivalent to Village Bakery for bread and Baresa pasta.

Some own-label merchandise are made by huge firms that additionally make branded items. Hovis and Kingsmill, for instance, each make own-label bread. However the sector is dominated by comparatively small and normally privately owned firms. Some are vital producers particularly classes, equivalent to Veetee in rice and Lovering Meals in canned fish.

The shift to personal label is broader than simply buying and selling down on staples.

The expansion of Tesco’s Best, J Sainsbury’s Style the Distinction and different ready-meal affords as a less expensive various to eating places and takeaways has been an enormous issue within the greater than common gross sales of own-label meals within the UK in contrast with Europe and the US.

“That is the place personal label comes into its personal,” stated Lydia Gerratt, a guide and former purchaser at an enormous grocery store chain. “These merchandise will not be developed to be the most cost effective, however to supply your core clients one thing they need that they don’t seem to be getting elsewhere.”

Nevertheless, greater demand for own-label merchandise is unlikely to translate into larger earnings for producers, as a result of they’re already engaged on skinny margins and face rampant inflation.

The bakery merchandise producer stated that rising gross sales had been “by no means offsetting the rises in costs of virtually every part we contact”.

“Wheat is up however the huge factor is fuel,” he added.

James Logan, UK business director at Refresco, which provides water, fruit juice and fizzy drinks to supermarkets throughout Europe, agreed the fee will increase had been throughout the board. “Prior to now you may need bought a spike in a single specific commodity due to one thing like El Niño affecting harvests,” he stated.

“This time there isn’t any respite, prices are rising all over the place within the provide chain.”

The query of how the additional prices are shared has led to high-profile stand-offs between retailers and suppliers of branded items, equivalent to a current dispute between Tesco and Heinz that briefly took some merchandise off cabinets. Disagreements with own-label suppliers are much less probably on the entire.

“A great own-label provider could have shut contact with the retailer and preserve them knowledgeable about any developments that may require a tough dialog,” stated Logan.

Clive Black, head of analysis at Shore Capital, stated asking suppliers to take the hit on worth was not a straightforward possibility. Earlier strain from retailers had led to consolidation, he added, which means there have been fewer alternate options, whereas switching provider can be not as straightforward because it was.

The bakery govt stated he was having “smart and constructive dialogue” with clients whereas McBride, a listed provider of own-label family cleansing merchandise, just lately stated it had secured “vital” worth will increase to assist offset the upper prices of chemical substances and vitality.

Tesco and Sainsbury’s have indicated they’ll sacrifice some earnings this yr to soak up worth will increase from suppliers.

Logan stated media protection of the price of residing disaster had made worth discussions simpler to provoke. “No person can argue they had been unaware of what’s taking place.”