The UK economy rebounded by more than expected in January, driven by growth in the services sector, according to official statistics published ahead of the Budget next week.

Gross domestic product rose 0.3 per cent between December and January, following a contraction the previous month, the Office for National Statistics said on Friday. This was higher than the 0.1 per cent expansion forecast by economists polled by Reuters.

The services sector rose 0.5 per cent, propelled by education, transport and storage, and human health activities.

“The main drivers of January’s growth were the return of children to classrooms, following unusually high absences in the run-up to Christmas, the Premier League clubs returned to a full schedule after the end of the World Cup and private health providers also had a strong month,” said Darren Morgan, ONS director of economic statistics.

He added that the partial recovery of postal services after strikes in December also helped boost output.

The higher than expected growth will reinforce expectations of a 25 basis point rate increase at the Bank of England’s next Monetary Policy Committee meeting on March 23.

However, output was still 0.2 per cent below its level in February 2020 and unchanged from January 2022, reflecting the negative impact of high inflation and rising interest rates on household finances.

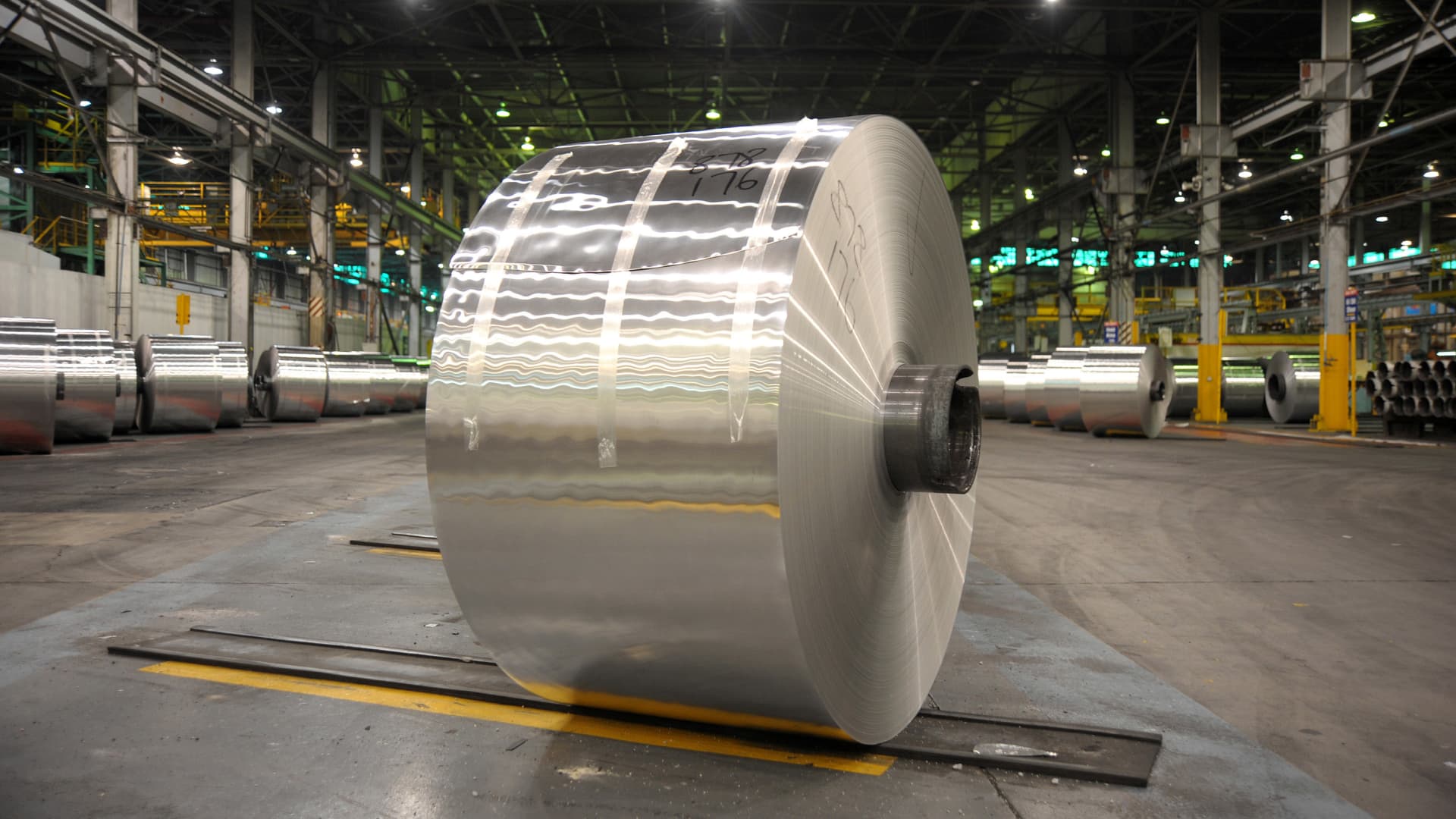

UK manufacturing production fell 0.4 per cent in January and was down 5.2 per cent compared with January last year. This showed “some underlying weakness as a result of high inflation and high interest rates,” said Ruth Gregory, economist at Capital Economics.

The UK is the only G7 economy that has not yet recovered to pre-pandemic levels. In the final three months of 2022, the US economy was 5.1 per cent larger than in the fourth quarter of 2019, before the first Covid-19 restrictions were put in place; the eurozone was up 2.4 per cent in the same period.

The figures come ahead of chancellor Jeremy Hunt’s first Budget on March 15. Commenting on the data Hunt said: “In the face of severe global challenges, the UK economy has proved more resilient than many expected, but there is a long way to go.

“Next week, I will set out the next stage of our plan to halve inflation, reduce debt and grow the economy,” he added.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said the Budget “could have a significant impact on the UK’s near-term growth prospects”. He cautioned that “while extending energy support will provide some relief to struggling households, aggressive tax rises would risk eliminating any lingering momentum from the economy”.

Many economists have revised up their UK growth forecasts for this year because of the recent fall in wholesale energy prices and the resilience of the economy.

But Yael Selfin, economist at KPMG, said the “welcome boost” provided by the fall in energy prices “may not be sufficient to stave off a recession in the first half of this year, as consumer spending remains weak with households continuing to be squeezed by elevated prices and higher interest rates”.