Xesai/iStock by way of Getty Photos

UGI: Funding Thesis

There are a variety of things I imagine are more likely to trigger an enchancment in UGI Company (NYSE:UGI) share worth within the interval forward. These embody –

- a probable SA Quant ranking change from Maintain to Purchase

- improved profitability as a result of constructive administration actions

- a strengthening within the stability sheet, together with enchancment within the debt ratio

Fundamentals are vital, however market sentiment has a big influence on a inventory’s share worth efficiency. UGI has traditionally loved P/E multiples within the double digits till comparatively just lately. UGI has a dividend yield over 6%. The dividend is effectively lined by earnings. It has been paid constantly for the final 140 years, with a dedication to proceed paying. The corporate has failed to satisfy optimistic EPS projections made by administration in 2021. I imagine this is a significant factor contributing to the present depressed share worth. The current a number of is 7.36, primarily based on non-GAAP EPS TTM at March 31, 2024. I imagine the market has overshot to the draw back with UGI inventory worth, and I price the shares a Purchase. Extra element for the assorted elements mentioned above seem under.

UGI: Market sentiment

We are able to analyse the basics, however share worth of a inventory can also be closely influenced by market sentiment towards that inventory. In my February 1, 2024 article, “UGI Company: Dashed Expectations Create Purchase Alternative”, I got here to the conclusion the depressed share worth was as a result of EPS development not matching expectations created by administration again in 2021. Since then, market sentiment in direction of the inventory has been in decline. The impact of this on UGI’s inventory worth has been extreme. Between 2021 and 2024, the P/E ratio for UGI has averaged round 11.5, with the median round 12.0. That could be a far cry from earlier years when the inventory commonly traded at P/E ratios over 20.0. However 11.5 is the common a number of for the interval 2021 to 2024, and the pattern has been downward all through this era. UGI’s ahead P/E ratio is presently 7.99, and it has been decrease than that.

UGI: Assessing the route of market sentiment –

I like to take a look at SA Quant scores for elementary quantitative evaluation mixed with an evaluation of parts of that evaluation ascertained as potential influences on market sentiment. Determine 1 under reveals SA Quant evaluation of market sentiment at Feb. 1, 2024, the date of my earlier evaluation, in contrast with the present SA Quant evaluation at Jul. 12, 2024.

Determine 1

SA Premium

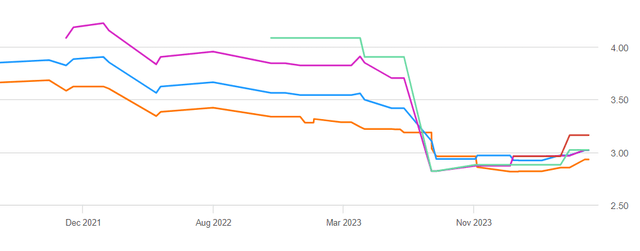

As will be seen, “Revisions” are certainly one of 5 Issue Grades thought of influential on investor sentiment, and thus share worth. Again in June 2021, UGI administration supplied some bullish steerage for 2021 and 2022, which triggered SA and different analysts to considerably raise ahead EPS estimates for the subsequent few years. That steerage has not been met. This has resulted in subsequent downward revisions by analysts, as proven in Determine 2 under.

Determine 2

SA Premium |

Supply: Searching for Alpha Premium Quant Earnings Revisions – UGI Company |

By October 2023, hopes for the excessive EPS development charges anticipated again in mid-2021 had been utterly dashed. As well as, rate of interest will increase had impacted the share costs of utility shares throughout the board.

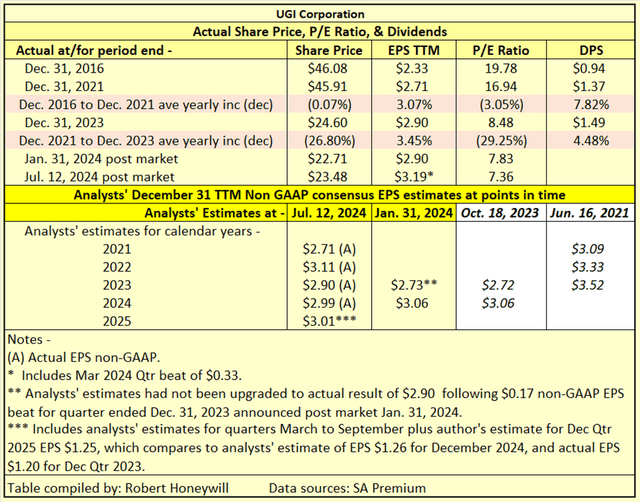

The influence on share worth is proven in Desk 1 under.

Desk 1

SA Premium

Desk 1 reveals UGI grew non-GAAP EPS by a mean 3.07% per yr between 2016 and 2021, whereas share worth remained nearly unchanged over this era. Between finish of 2021 and finish of 2023, regardless of non-GAAP EPS growing by 3.45%, share worth fell by 26.80%, from $45.91 to $24.60.

Trying again to Determine 2, we will see a begin of some upward revisions to analysts’ EPS estimates. This has already had an influence on SA Quant scores with “Revisions” upgraded from a “D” at Feb. 1, 2024, to an “A+” at Jul. 12, 2024. Improved revenue as a result of sturdy EPS beats towards estimates for each December 2023 and March 2024 quarters has seen SA Quant “Profitability” ranking enhance from a “C-” at Feb. 2024 to the present “B” ranking. Determine 2 reveals the general SA Quant ranking has improved from 2.68 at Feb. 1 to the present 3.32. This isn’t far under a 3.50 ranking, which might see Quant ranking flip from the current “Maintain” to “Purchase”. One drag on the Quant ranking has been “Momentum” which has gone from a “C-” at Feb. to the present “D-” because the share worth of $22.71 at Feb. 1 continued to fluctuate and reached a low of $22.01 on July 9. The share worth has ticked upward since then, and we may very well be reaching a tipping level the place we see some sustained upward momentum within the share worth.

UGI: Revenue Efficiency FY2016 to FY2023

UGI is a utility with each regulated and unregulated operations. Common yearly EPS development during the last 7 years has been modest, within the low single digits, however nonetheless constructive. The regulated operations have proven regular earnings development, averaging 9.5% per yr during the last 7 years. Excerpted from the Firm’s March Quarter earnings name,

…we’re focusing on a 4% to six% EPS development price… Fiscal 2025 and 2026 shall be rebuilding years …anticipate investing capital of roughly $3.9 billion throughout UGI throughout that interval. A major driver of the focused EPS development is our deliberate funding of roughly $2.6 billion on the regulated utilities, which is able to facilitate 9%-plus price base development…

The prospect of 9%+ returns must be tempered with the actual fact regulated operations contribute solely round one-third of earnings, therefore the decrease total focused development price.

Of the non-regulated operations, Midstream & Advertising and marketing has carried out effectively, however the nature of the enterprise results in appreciable volatility in year-to-year earnings. AmeriGas Propane and UGI Worldwide confirmed good earnings development via FY 2021, however have struggled since, with vital earnings decline for AmeriGas Propane particularly. A plan is in place to stabilize and optimize AmeriGas Propane operations.

UGI: Dividend issues

The present quarterly dividend of $0.375 per quarter ($1.50 per yr) supplies a wholesome dividend yield of 6.40% per yr at present $23.42 share worth. Per Desk 1 above, dividend development has exceeded share worth development by a large margin during the last 7 years. Excerpted from the corporate’s March quarter earnings name transcript in relation to earnings and dividends,

With a sturdy efficiency within the first half of the fiscal yr, we’re on monitor to ship inside our fiscal 2024 adjusted EPS steerage vary of $2.70 to $3. We’re additionally happy to mark the a hundred and fortieth yr of consecutively paying dividends, demonstrating our dedication to returning worth to shareholders…. Between fiscal 2024 and 2026 as we give attention to strengthening the stability sheet and stabilizing AmeriGas, we count on that dividends will keep flat, whereas nonetheless reaching a payout ratio near 50%. Now as we transfer to fiscal 2027, we anticipate returning to our focused 4% dividend development price over the long run.

Regardless of the proposed suspension of dividend development over the subsequent three years, the dividend yield is more likely to stay very engaging, and the dividend cost seems very protected.

UGI: Stability Sheet

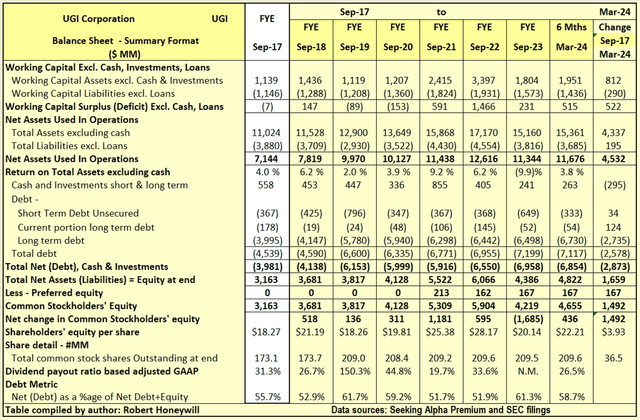

Desk 2.1 UGI Stability Sheet – Abstract Format

SA Premium & SEC filings

Over the 6.5 years finish of September 2017 to the tip of Mar. quarter 2024, UGI’s shareholders’ fairness elevated by $1,659 million. This $1,659 million enhance, plus a rise of $2,873 million in debt web of money was used to fund a rise of $4,532 million in Internet Belongings Used In Operations. Internet debt as a proportion of web debt plus fairness elevated from 55.7% on the finish of September 2017 to 58.7% on the finish of Mar. quarter 2024. Excellent shares elevated by 36.5 million from 173.1 million to 209.6 million, over the interval. Shares issued for worker compensation exceeded share repurchases. Nevertheless, the good majority of the rise in shares got here from share points for the CMG acquisition in 2019 (see p. F-28 of FY-2019 10-Ok for particulars of acquisition). The $1,659 million enhance in shareholders’ fairness was comprised of $167 million from a most popular share challenge and a rise of $1,492 million enhance in widespread inventory shareholders’ fairness. The $1,492 million enhance in widespread inventory shareholders’ fairness during the last 6.5 years is analyzed in Desk 2.2 under.

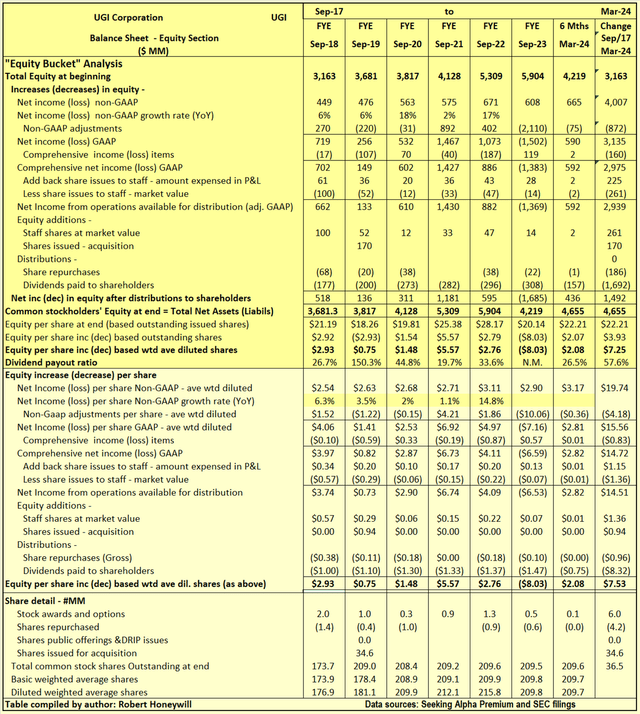

Desk 2.2 UGI Stability Sheet – Fairness Part

SA Premium & SEC filings

I typically discover corporations report earnings that ought to move into and enhance shareholders’ fairness. However typically the rise in shareholders’ fairness doesn’t materialize. Additionally, there will be distributions out of fairness that don’t profit shareholders. Therefore, the time period “leaky fairness bucket.” I search for proof of this in my evaluation of adjustments in shareholders’ fairness.

Explanatory feedback on Desk 2.2 for the interval finish FY-2017 to finish Mar-2024.

- Reported web revenue (non-GAAP) over the 6.5-year interval totals $4,007 million, equal to diluted web revenue per share of $19.74.

- Over the 6.5-year interval, the non-GAAP web revenue excludes $872 million ($4.18 EPS impact) of things thought to be uncommon or of a non-recurring nature to be able to higher present the underlying profitability of UGI. This stuff are primarily impairment fees for goodwill, amortization of intangibles, and restructuring fees.

- Different complete revenue consists of things like overseas trade translation changes with respect to buildings, plant, and different amenities positioned abroad and adjustments within the valuation of belongings within the pension fund – these are usually not handed via web revenue as they fluctuate with out affecting operations and might simply reverse in a following interval. Nonetheless, they do influence the worth of shareholders’ fairness at any cut-off date. For UGI, these things have been damaging, reducing fairness by $160 million over the 6.5-year interval.

- There have been share points to workers, and these have been a big expense merchandise. The quantities recorded within the revenue assertion and in shareholders’ fairness, for fairness awards to employees totaled $225 million ($1.15 EPS impact) over the 6.5-year interval. Nevertheless, the market worth of those shares is estimated to be $261 million ($1.36 EPS impact). The understatement of expense by $36 million shouldn’t be materials within the context of non-GAAP earnings complete of $4,007 million over the 6.5-year interval, and never overly regarding from a “leaky fairness bucket” side.

- By the point we take the above-mentioned gadgets into consideration, we discover, over the 6.5-year interval, the reported non-GAAP EPS of $19.74 ($4,007 million) has decreased to $14.51 ($2,939 million), added to funds from operations out there for distribution to shareholders.

- Dividends of $1,692 million and share repurchases of $186 million have been adequately lined by the $2,939 million generated from operations, leaving a $1,061 million enhance in fairness. This $1,061 million from operations, along with the $261 million capital raised via share points to employees, and the $170 million associated to shares for the CMG acquisition, resulted within the $1,492 million web enhance in shareholders’ funds per Desk 2.1 above.

Abstract and conclusion

Sentiment towards this inventory is probably going coloured by failure of administration to satisfy the excessive expectations set for EPS development in mid-2021. Judging the corporate’s efficiency towards its long term historic efficiency, it is believed the inventory is considerably undervalued by the market. The potential of rate of interest cuts in 2024 could be an extra constructive. It additionally wouldn’t take a lot for SA Quant scores to flip to the constructive and to a Purchase suggestion. At a P/E ratio of 12.0 the share worth would enhance from its current $23.42 to ~$35.00. A P/E ratio of 12.0 is under UGI sector median of 16.61 and likewise under UGI’s longer-term common a number of. I price the inventory a Purchase.