Natali_Mis

Apartment REIT stocks have had a hard time as of late, with many seeing a substantial downturn in price over the past 12 months. This brings me to UDR Inc. (NYSE:UDR), which as shown below, is trading far closer to its 52-week low than its high of $60 achieved in April of last year. In this article, I highlight what makes now a good time to layer into the stock while it appears to be undervalued.

UDR Stock (Seeking Alpha)

Why UDR?

UDR is a member of the S&P 500 (SPY) and is a leading multifamily REIT with a long operating track record. It’s been around for over 50 years and at present, owns over 58K apartment units, including 899 properties under development.

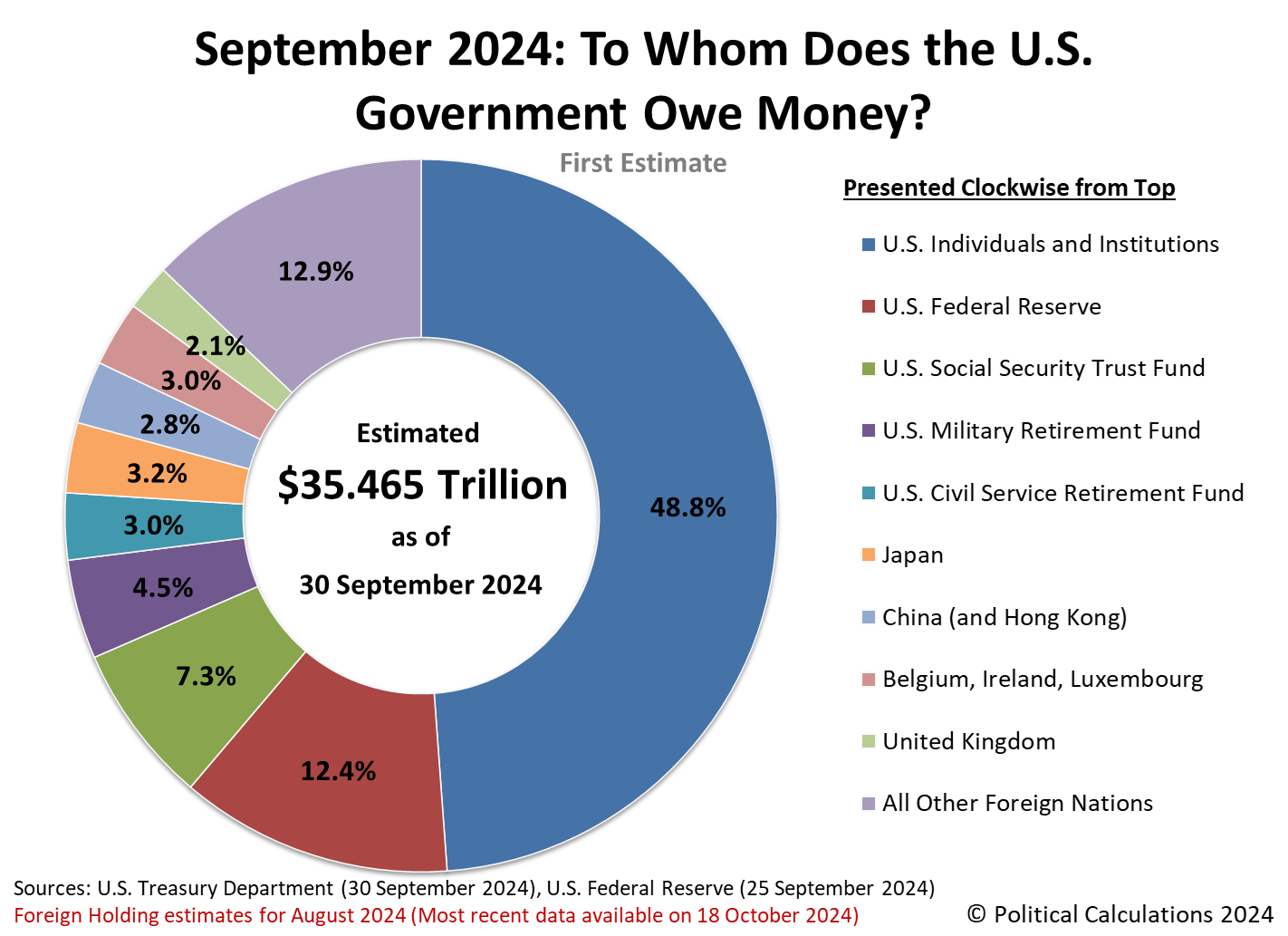

UDR’s portfolio is centered around 21 high growth and population dense markets in the Northeast, Sunbelt, and West Coast regions of the U.S. These markets are attractive in that they are centered around markets with attractive income demographics.

UDR Markets (Investor Presentation)

This includes average annual household income of $160K, which is 165% above the median MSA income. Moreover, incomes UDR’s markets soared 23% since the start of COVID and tenants have strong coverage, with an average rent to income ratio in the low 20%. This helps to ensure a high rent collection rate, which management expects to land in the high 90% in the fourth quarter.

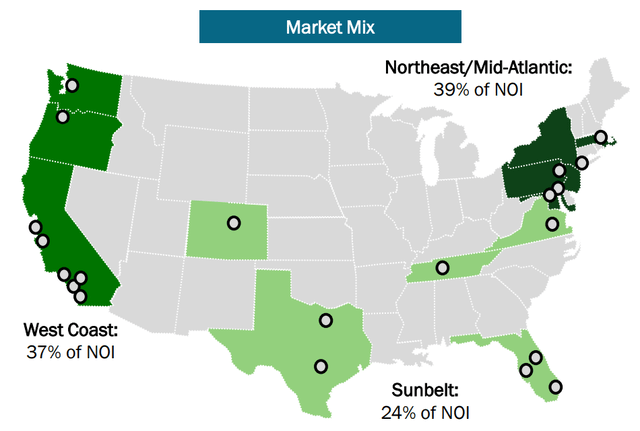

UDR also benefits from cost efficiencies over peers, with a 300 basis point operating margin advantage over its peers. As shown, UDR’s cost savings initiatives have driven 3.9% average annual NOI growth since 2014 and the average number of apartment homes managed per UDR employee has risen to 44, which is well above the peer average.

UDR Operating Metrics (Investor Presentation)

Meanwhile, UDR continues to demonstrate healthy operating fundamentals, including a very strong 97% occupancy rate. Same store revenues grew by 13% YoY, outpacing the 7% expense growth. This positive operating leverage resulted in SS NOI growing at a faster rate than revenue, at an impressive 15.5% YoY growth. The top line growth was driven in part by a strong blended lease growth rate of 13% on new and renewal leases, as tenant demand remains high.

Looking ahead, UDR is well positioned from a balance sheet standpoint, including no debt maturities this year, thereby mitigating near-term interest rate risk. It has strong BBB+ and Baa1 credit ratings from S&P and Moody’s and a sector-leading weighted average interest rate of 3.1%, which lowers its cost of capital. Moreover, UDR carries safe net debt to EBITDA and fixed charge coverage ratios, both of which are expected to land at 5.5x in the upcoming Q4 earning release.

Having said that, management is being conservative with external growth prospects by planning to dial back on acquisitions. Nonetheless, UDR should have no issue with funding its redevelopment pipeline of 1,638 homes, which includes densification features, as noted by the CEO during the last conference call:

Our cost of capital has increased materially since the first quarter. As such, we pivoted to a capital-light strategy and pared back opportunistic external growth. Our balance sheet remains fully capable of supporting all planned capital uses and with less than 2% of consolidated debt maturing over the next 3 years, our interest rate risk is minimal. I remain optimistic on UDR’s future prospects. We have a highly talented experienced team with a track record of performance irrespective of the economic environment, combined with our culture that fosters collaboration and innovation mindsets.

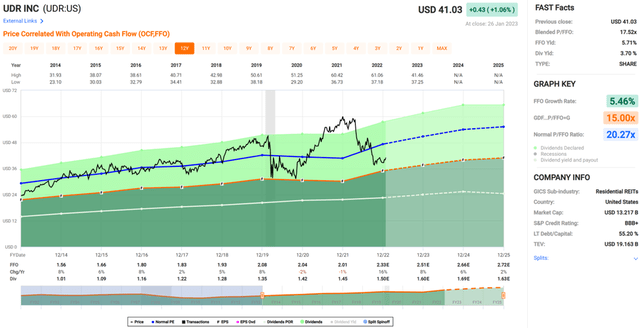

Importantly, UDR pays a respectable 3.6% dividend yield that’s well-covered by a 67% payout ratio, based on FFO per share of $0.57 in the last reported quarter. I also see value in the stock at the current price of $41.97 with a forward P/FFO of 18.1, sitting well below its normal P/FFO of 20.3. Analysts expect a respectable 8% FFO/share growth this year, and have a consensus Buy rating on the stock with an average price target of $45.55, implying potential for double-digit total returns in the near term.

UDR Valuation (FAST Graphs)

Investor Takeaway

UDR is well positioned to capitalize on the current strength in multifamily markets due to its large presence in desirable locations and inherent cost efficiencies. It also exhibits strong operating fundamentals with high lease spreads and has attractive income demographics in its key markets. Lastly, UDR carries a strong balance sheet with very low debt maturities in the near term, and is attractively valued at present for potentially strong total returns over the long run.