visualspace

Investment thesis

My first thesis about Uber (NYSE:UBER) worked really well since the stock significantly outperformed the broader market. Today I want to reiterate my bullish thesis. The company finally achieved the scale, which is enough to start generating positive financial metrics and substantial operating cash flow. Being the market leader in ridesharing and the second-largest player in food delivery makes the company well-positioned to benefit from the favorable secular shifts toward greater digitalization and higher demand for the company’s offerings. The ridesharing market is expected to compound at 19.2% by the year 2030, and the food delivery market to grow at an 18.7% CAGR. The management pays a lot of attention to increasing cost-efficiency which also gives me additional confidence that Uber’s profitability is poised to expand at a rapid pace. Last but not least, my valuation analysis suggests that the stock still has almost 50% upside potential even after a massive year-to-date rally. All in all, I assign the stock a “Strong Buy” rating.

Recent developments

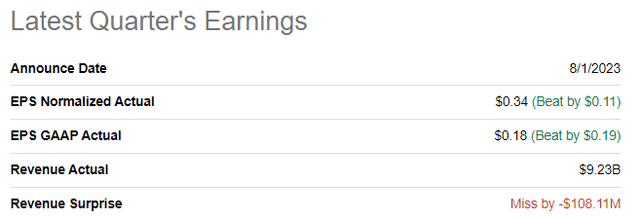

The company reported its latest quarterly earnings on August 1, when Uber missed consensus revenue estimates but outnumbered the bottom line expectations. Revenue grew 14% YoY, which looks impressive amid the harsh environment. The adjusted EPS improved substantially, from -$1.33 to $0.18.

Seeking Alpha

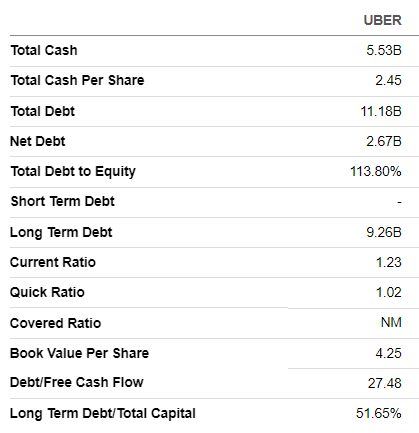

The gross margin has improved significantly, from 28.5% to 33.1%. So did the operating margin, which turned positive for the first time over multiple quarters. Profitability metrics expansion allowed Uber to generate almost $1.2 billion in cash flow from operations, which is more than two times higher on a YoY basis. Profitability expansion and substantial improvement in the operating cash flows are big bullish signs to me. The company’s balance sheet is solid, with over $5 billion in cash. Uber is in a net debt position, though the major part of the debt is long-term. Short-term liquidity metrics are in excellent shape as well.

Seeking Alpha

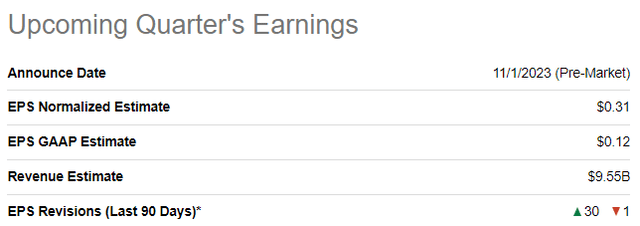

The upcoming quarter’s earnings are scheduled for release on November 1. Quarterly revenue is expected by consensus at $9.55 billion, which indicates an impressive 14.5% YoY growth. The adjusted EPS is expected to follow the bottom line and expand from -$0.61 to $0.31.

Seeking Alpha

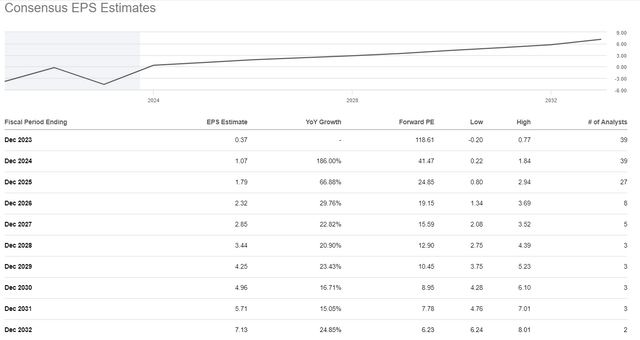

Uber’s investors have suffered a lot of pain since the company went public in 2019, since the stock appreciated by a mere 6% since the IPO. This was due to the “rich” history of substantial losses and multiple disappointing earnings surprises together with scandals related to the previous CEO. However, the company’s losses were not due to poor management but due to heavy investments in R&D and marketing. But things are different in 2023 as the company reaches the scale which is enough to generate positive financial results. The company’s profitability is poised to expand from now on, and it is a massive bullish sign for investors.

Seeking Alpha

Being the largest ridesharing and the second-largest in food delivery makes Uber well-positioned to achieve the ambitious profitability trajectory. The company’s significant size gives it strong scale advantages over competitors. Uber has strong brand recognition and is highly likely to help sustain double-digit revenue growth over the long term. From the costs side, the company now enjoys economies of scale effect, which will help expand profitability. It is also crucial to mention that during the latest earnings call, the management reiterated its commitment to improving the company’s cost-efficiency.

Valuation update

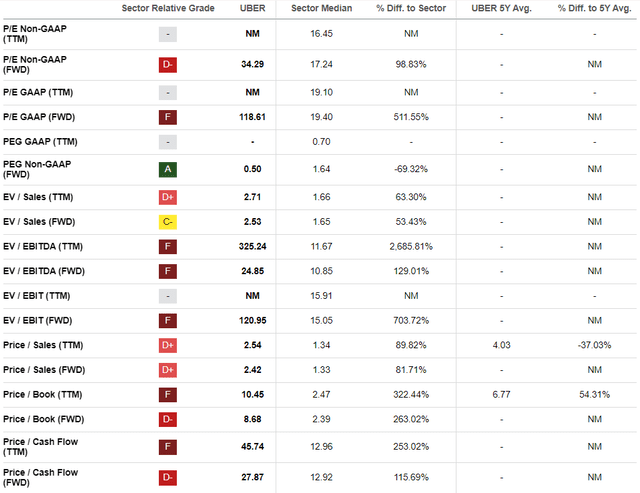

The stock rallied 75% year-to-date, significantly outperforming the broader market. Seeking Alpha Quant assigns the stock a low “D” valuation grade because multiples are substantially higher than the sector median.

Seeking Alpha

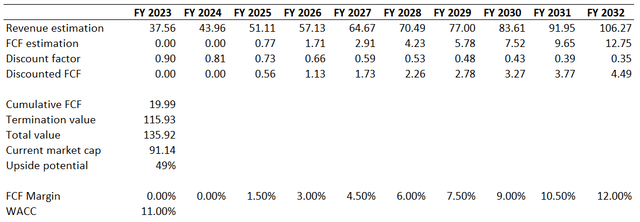

Uber is an aggressive growth company, so I want to simulate the discounted cash flow [DCF] model. I use an elevated 11% WACC since the company still does not generate positive, stable FCF. Consensus revenue estimates forecast a 12.3% revenue CAGR for the next decade, which I consider conservative enough. To be conservative, I use a zero FCF margin for the next two years and a 150 basis points yearly expansion. I ignore net debt because the amount looks insignificant compared to the company’s scale.

Author’s calculations

According to the DCF, the business’s fair value is approximately $136 billion. That said, the upside potential is almost 50%, which suggests the stock’s fair price at $66.

Risks update

As a growth company, Uber’s investors face a significant risk of its underperformance compared to its revenue growth expectations. The company’s valuation significantly depends on revenue growth and profitability expansion assumptions. That said, if the company starts demonstrating even insignificant signs of falling behind the growth trajectory, it might lead to investors’ disappointment, ultimately leading to a massive stock sell-off. While Uber is still one of the major players in the industry, entry barriers are relatively low. Therefore, a new disruptive company might enter the race and capture the industry growth at Uber’s expense. This will also lead to downgrades in the company’s long-term earnings estimates which will weigh on the valuation.

Uber also faces risks associated with the classification of workers as independent contractors by employers. If regulations force treating independent contractors as full-time employees, this will increase the company’s costs. Therefore, the company’s journey towards profitability will be postponed.

The company also faces substantial reputational risks since there were cases when drivers allegedly harassed and assaulted passengers. Apart from reputational risks, these cases also might lead to litigation for the company. Uber might be charged with penalties and fines which would be unexpected costs and undermine the company’s profitability.

Bottom line

To conclude, UBER is a “Strong Buy”. The business has achieved the scale sufficient to generate positive operating profit and positive industry trends suggest to me that the company is poised to continue enjoying the “economies of scale” effect. Apart from the expected solid revenue growth I like the management’s strong commitment to keep an eye on costs, which will also ultimately lead to profitability improvement. Moreover, my valuation analysis suggests that the stock is still massively undervalued, even after a massive year-to-date rally.