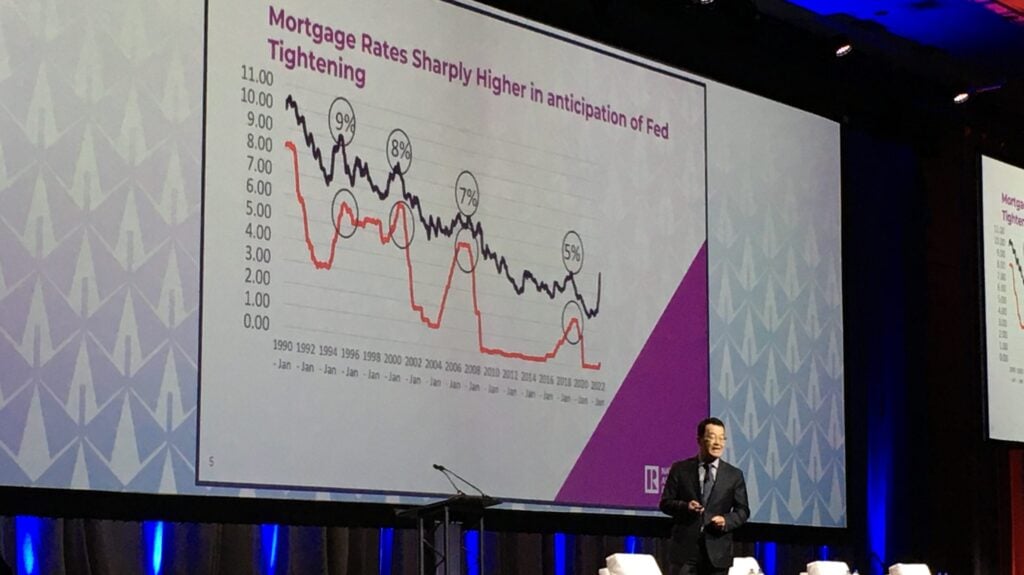

The typical US 30-year mortgage fee declined for a sixth straight week to the bottom stage since early December, sparking a pickup in buy and refinancing exercise.

The contract fee on a 30-year mortgage slipped 6 foundation factors to six.67% within the first week of March, in line with Mortgage Bankers Affiliation knowledge launched Wednesday. The speed on a 15-year mounted mortgage decreased to six.04%, the bottom since October, whereas the typical on a 30-year jumbo was the most cost effective in additional than 5 months.

The decline in borrowing prices forward of the busy spring promoting season is a much-needed enhance for a housing market that’s been struggling for traction. Decrease charges assist to ease the monetary burden for potential consumers at a time when residence costs stay elevated.

Mortgage charges monitor Treasury yields, which have stabilized just lately after declining considerably in February. Traders are flocking to the protection of presidency securities as President Donald Trump’s tariff coverage and considerations in regards to the economic system spur a stock-market selloff.

MBA’s index functions for residence purchases elevated 7% to the very best stage since January after a 9% advance every week earlier. The refinancing gauge jumped greater than 16% to the very best since early October.

The MBA survey, which has been carried out weekly since 1990, makes use of responses from mortgage bankers, industrial banks and thrifts. The info cowl greater than 75% of all retail residential mortgage functions within the US.

Extra tales like this can be found on bloomberg.com

©2025 Bloomberg L.P.