uschools

By James Knightley and Chris Turner

Unanimous decision to keep rates on hold at 5.25-5.5%

As fully expected, there is no policy change from the Federal Reserve with the target rate range left at 5.25-5.5% in what was a unanimous decision by the FOMC. The key story is in the Fed’s updated economic projections in which it continues to forecast three rate cuts this year – the market was concerned they could switch to just two – but instead are now penciling in only three cuts next year versus the four they had in their December update. This leaves their end-2025 rate median forecast at 3.9% (up from 3.6%), with 2026 at 3.1% (from 2.9%). Interestingly, they have tweaked their long-run forecasts for Fed funds to 2.6% from 2.5%, which we will come to later.

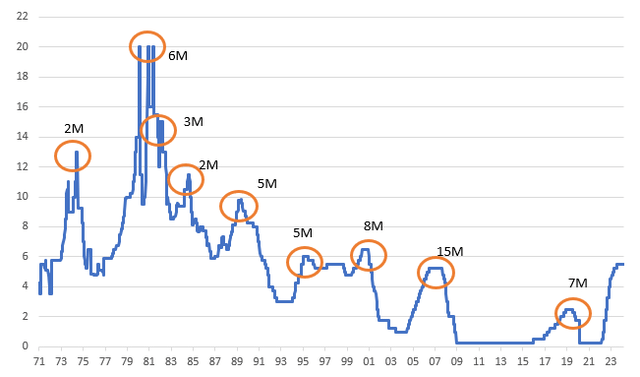

Fed funds target rate ceiling 1971-2024 (%) and period of time between last rate hike and first rate cut

Macrobond, ING

Forecasts reveal more positivity on growth with the need for higher rates over the longer term

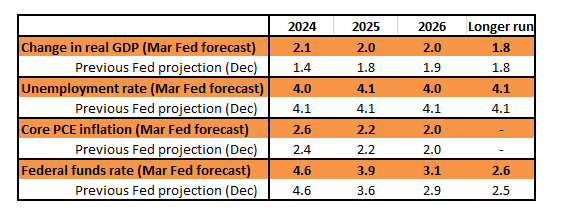

The Fed’s growth forecasts are revised up a fair bit more than anticipated to 2%+ for the next three years, and they have lowered their unemployment rate projection for end-2024 to 4% from 4.1% (we are currently at 3.9%). Core inflation has been revised to 2.6% from 2.4% for end-2024. The table below contains the projections versus what they were saying in December.

Federal Reserve’s economic projections versus December

Federal Reserve, ING

Rate cuts expected “at some point this year” and QT set to slow “fairly soon”

The accompanying statement was little changed, repeating that “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent”. Within the press conference, Chair Jerome Powell was a little more open, suggesting that the policy rate is likely at its peak and that it would be appropriate to begin easing policy back towards a more neutral level “at some point this year”. This is pretty similar to his commentary from earlier in the month before Congress that “We’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction”.

In terms of what they may do with the run-down of their balance, or quantitative tightening, there was no decision made today, but Powell did acknowledge that they would likely start the process of slowing this process “fairly soon”. Ahead of the meeting, the Bloomberg consensus of 40 or so banks favoured a June announcement of such action with implementation shortly afterwards. This is likely to remain the case.

June cut still our call with Fed cuts expected to exceed 75bp

Initial reaction was muted with market pricing for the June FOMC meeting remaining at 18bp of cuts, as it was just before the announcement, but comments on inflation potentially being impacted by seasonality issues and strong labour data not being a barrier to rate cuts means we are now up at 21bp priced for June. Meanwhile, the reaffirmation of three rate cuts this year means we are now at 82bp of cuts priced for the year versus 74bp just before the announcements (remember, we had nearly 175bp priced in early January). The next key macro report will be the core PCE deflator on March 29 (Good Friday, so market conditions will be thin), but that will likely be 0.3% month-on-month, so still too hot for the Fed. As such, the risk is that yields stay flat to slightly higher until the jobs report in early April where we will be looking to see if the weakness in all the employment components of business surveys (NFIB, ISMs, Homebase, ADP and weakening quits rates) finally starts to show up in the official data.

Putting it all together, it suggests the Fed is still inclined to cut rates to a more neutral level, but it needs to see the data to back that up and we aren’t there yet. We continue to expect the jobs story to cool and inflation to return to the 0.2% MoM rates we require. The Fed doesn’t want to cause a recession if it can avoid it, and we believe they will be in a position to start moving monetary policy from a restrictive position to a more neutral stance before the summer. They are suggesting the neutral Fed funds rate is around 2.6%, so there is room for up to 300bp of cuts just to move to “neutral”. We think they won’t want to go quite that far given the prospect of ongoing loose fiscal policy irrespective of who wins the November presidential election, but we expect 125bp of cuts this year starting in June, with a further 100bp in 2025 as hopes rise for a soft landing for the economy.

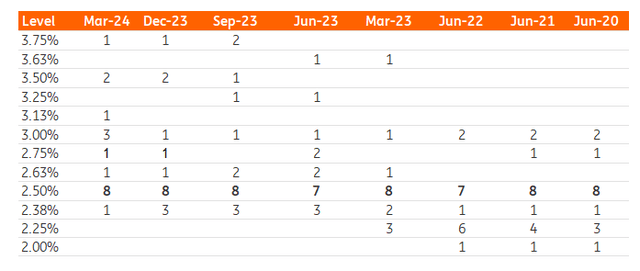

Fed tweaks longer-term outlook for Fed funds – we think it should be 3%

As briefly mentioned, a change that was touted ahead of the meeting was the Fed potentially upping the median expectation for the Fed funds target rate over the longer term. Having been left at 2.5% for several years, any change should be a big story given the anchor this provides for longer-dated Treasury yields, but at this stage it is only tentative – moving 10bp higher to 2.6%. As can be seen in the table below, we have indeed seen another couple of FOMC members raise their forecast, and the momentum over the past 18 months suggests it is likely to move even higher.

Our own assessment is that it should be closer to 3%. Fiscal policy has been loosened significantly under the Trump and Biden administrations, and we don’t see that changing anytime soon – the Congressional Budget Office projects 5%+ deficits in each of the next ten years. Given the impetus this provides, we suggest monetary policy will need to be more restrictive in order to keep inflation under control. On top of this, the policy thrust of reshoring manufacturing back to the US and the investment in decarbonising the economy, while benefiting the growth story, are also likely to add to inflation pressures. So too would be the threat of tariffs under a potential Trump presidency. As such, while we believe there is scope for more interest rate cuts than the Fed and the market expects both this year and next, we think the risks are skewed towards higher interest rate over the medium to longer term.

Evolution of individual FOMC member forecasts for the long-run Fed funds rate forecast

Dollar softens as Fed stays on track for rate cuts

The dollar is generally softer after today’s Fed event risk. It seems that the market had been positioned for an upward revision in the Dot Plots and even though 2025, 2026 and long-run expectations were revised slightly higher, the bigger story has been the Fed continuing to expect three cuts this year.

The dovish press conference saw the dollar soften a little further with markets reacting to remarks from Chair Powell that the sticky early-year inflation may have been something of an aberration due to “seasonal problems”. Those January and February inflation readings had been major drivers of the repricing of the Fed easing expectations this year.

Additionally, in the middle of Chair Powell’s press conference, Nikkei Asia released a story suggesting that the Bank of Japan could possibly hike again in October or even July – undermining the consensus view that the BoJ tightening cycle would be glacial. USD/JPY came lower on this news.

Where does that leave us? The market is left with a little more confidence that the Fed will deliver 75bp of cut this year. US two-year yields are off 7bp and 10yr yields off 2bp to deliver some bullish steepening of the curve, typically a dollar negative. However, long-end yields are perhaps proving sticky on the back of the upward revision to the long-run (terminal) Fed funds rate.

What was interesting as well was Chair Powell heavily focusing on the inflation data and suggesting strong employment growth would not be enough to see the Fed delaying rate cuts. The market then will be squarely focusing on forthcoming inflation data, which, should it show signs of softening back to 0.2% MoM, would likely kickstart the dollar bear trend we have long forecasted to start in the second quarter.

So, no reason today to change our gently bearish dollar forecast which could see EUR/USD ending the year near 1.14/15 and USD/JPY near 140. Also, over the next twenty-four hours, we will see rate meetings in the UK, Switzerland, Brazil and Mexico. A few quick comments here. Unchanged forward guidance from the Bank of England could see GBP/USD head back to 1.2850/2900. There is outside chance of a Swiss National bank rate cut. And despite “all systems go” for the Mexican peso, we are a little concerned Banxico might cite a strong currency when it cuts rates tomorrow.

For the bond market, Chair Powell today said the Fed would discuss slowing the Fed’s sales of its Treasury holdings fairly soon, but that the end point for the Fed’s balance sheet would be the same.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post