JackF/iStock by way of Getty Pictures

I’m all the time on the hunt for property that compound and are much less correlated to the market. The concept is that it counters market volatility to a sure extent, however many instances, it’s way more essential to know the standard of the enterprise itself. Whereas trying to find such names, I got here throughout Tyson Meals (NYSE:TSN) and thought this was a purchase within the present surroundings. Whereas its efficiency throughout recessions has not been nice, it nonetheless provides me the boldness to speculate and keep in it throughout robust instances. My thesis boils all the way down to the next elements –

1. Important high quality enterprise that can proceed to thrive over the long run with returns much less correlated to the index (24M beta of 0.45)

2. Their capital allocation technique signifies nice worth return for shareholders.

3. Inventory is attractively valued whereas ignoring the short-term distortion in its earnings

Tyson’s Enterprise and demand for protein

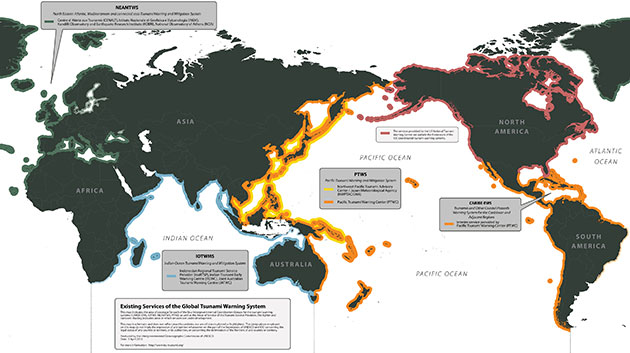

Tyson Meals is among the world’s largest meals corporations and a acknowledged chief in protein. The corporate operates by 4 foremost segments: Beef, Rooster, Pork, and Ready Meals, and is concerned in varied elements of manufacturing, processing, and advertising and marketing in these segments. What places this enterprise in a first-rate place for the long run is the world demand for protein.

The worldwide demand for protein is projected to extend considerably on account of a number of elements.

1. The worldwide inhabitants is predicted to succeed in 8.6B by 2030, up from 7.9B immediately. This enhance will naturally drive increased meals demand, together with protein.

2. As incomes rise and urbanization continues, particularly in creating international locations, dietary patterns are shifting in direction of increased protein consumption. This pattern is clear in international locations like China and India, the place meat consumption is rising quickly. Moreover, there’s a rising consciousness of the well being advantages of protein-rich diets, which supplies the appropriate catalyst for progress.

In 2024, the Contemporary Meat market within the U.S. is projected to generate $88.12B in income, with an anticipated annual progress price of 4.61%, whereas the Processed Meat market is predicted to succeed in $42B, rising at an annual price of 3.46% (CAGR 2024-2029)

Over the world, the Contemporary Meat market is predicted to generate $1.11T in income, with an annual progress price of 6.49%, whereas the Processed Meat market is projected to succeed in $336.40B, rising yearly by 5.04%.

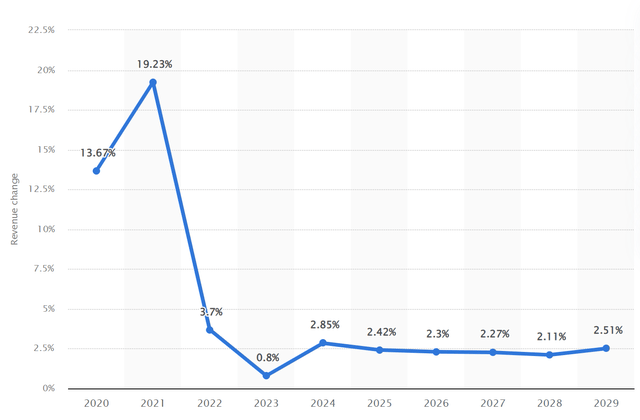

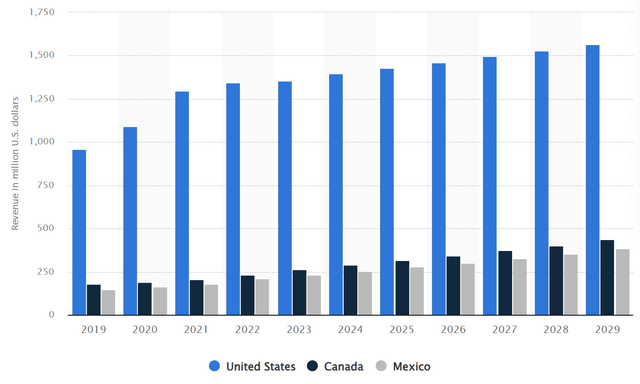

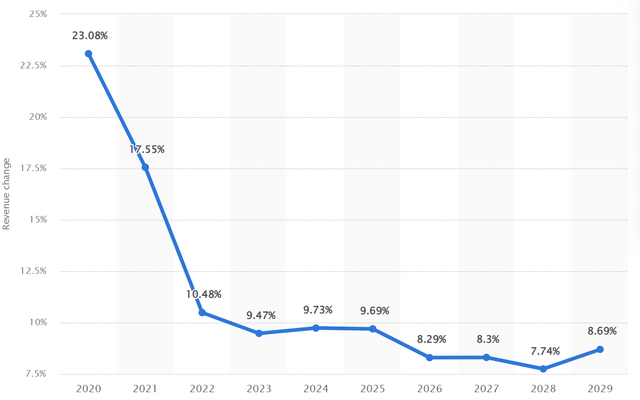

Naysayers could level to meat options and the way it’s good for the surroundings. However this phenomenon has largely fizzled out. Income within the Meat Substitutes market solely quantities to $1.40B in 2024. The market is predicted to develop yearly by solely round 2%. This case continues to be comparable even whenever you broaden to the continent and likewise the world (2024 revenues $10.3B with a CAGR of 8.5% until 2029)

Income progress of the meat substitutes market in america (Statista) Revenues of meat substitutes in North America (Statista) Income progress of the meat substitutes market worldwide (Statista)

However how does Tyson’s personal financials look on this world of meat?

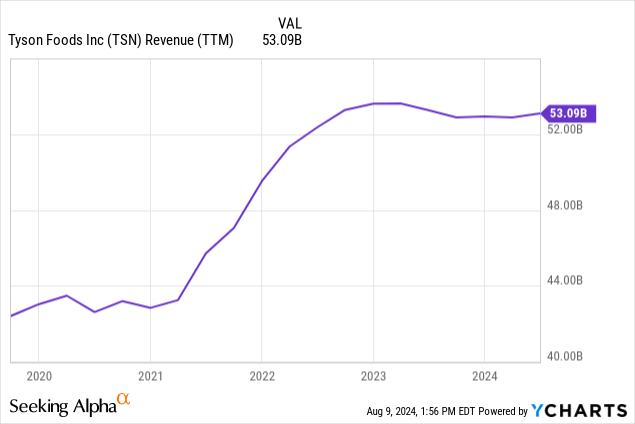

The corporate has grown its revenues by a mixture of its personal product choices and strategic acquisitions. They haven’t solely expanded their product strains but in addition expanded globally.

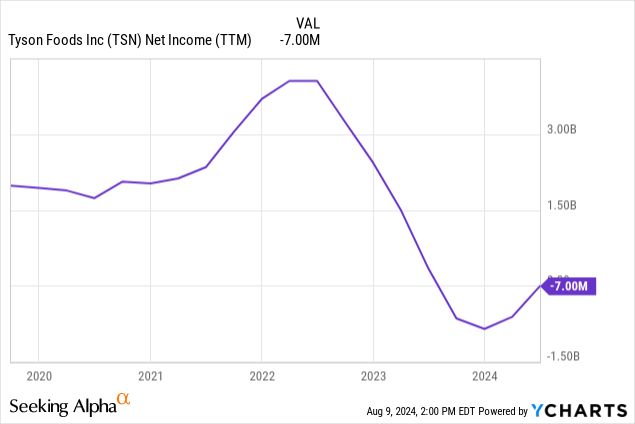

When internet earnings, it is pure to ask the explanations for the massive dip in 2023. These have been short-term associated to a mixture of goodwill impairment costs, restructuring prices, and decrease working earnings in key segments similar to beef and rooster, pushed by increased enter prices and difficult market circumstances. So not too fearful right here.

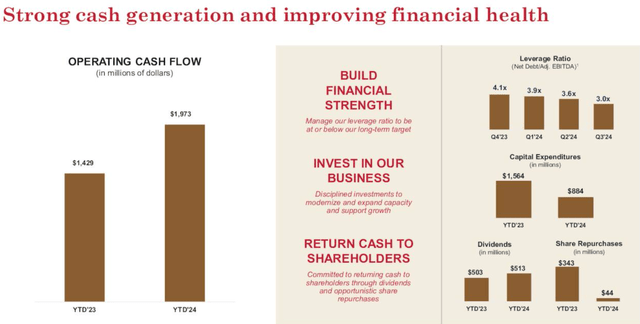

When it comes to its stability sheet, whereas its debt is noticeable, its debt to fairness has proven a substantial lower within the final 5 years (89% to 60.5%) and can be effectively coated by operational money stream. Through the firm’s Q3 fiscal 2024 name, it showcased its dedication to cut back prices, enhance monetary well being, concentrate on capex and dealing capital, drive cashflow, and help dividends.

Investor Presentation

Returning Worth for Shareholders

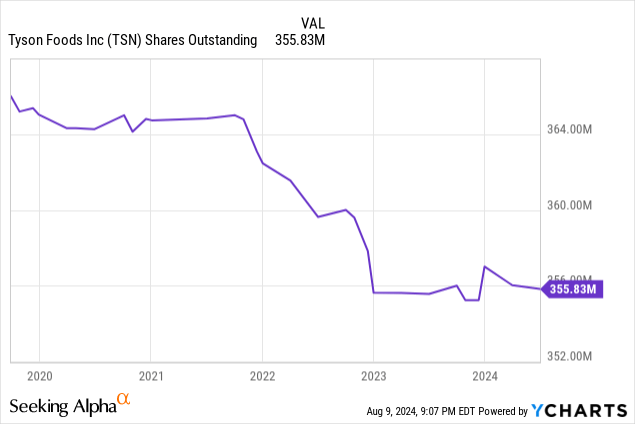

Tyson Meals has an extended historical past of paying dividends and pays a quarterly dividend of $0.49 per share, yielding at present 3.17%. The dividend funds have been on an upward trajectory for the final decade and are effectively coated by cashflows. Moreover, the corporate has engaged in a inventory buyback program and maintains a disciplined capital allocation technique (The tempo of share buybacks has significantly slowed in 2024 nevertheless)

The valuation for Tyson Meals is honest and can proceed to get higher

Valuing Tyson Meals firm by the PE ratio is unimaginable because it has confronted challenges sustaining profitability, as indicated by its unfavorable internet revenue margin and diluted EPS. Even then, I hesitate to make use of the ratio for prime Capex corporations, which trigger earnings to be unstable. There’s additionally the issue of debt, which isn’t taken under consideration. In mild of all this, we’ll decide three valuation ratios to judge this firm.

EV/EBITDA

- The trailing twelve-month EV/EBITDA ratio for Tyson Meals is 11.9x and the ahead EV/EBITDA ratio is 10.3x, suggesting an enchancment in EBITDA within the coming 12 months, which might decrease the a number of. However in comparison with its personal historical past, that is on the upper finish.

- The ratios are nearer to sector medians and an business comparability would make extra sense

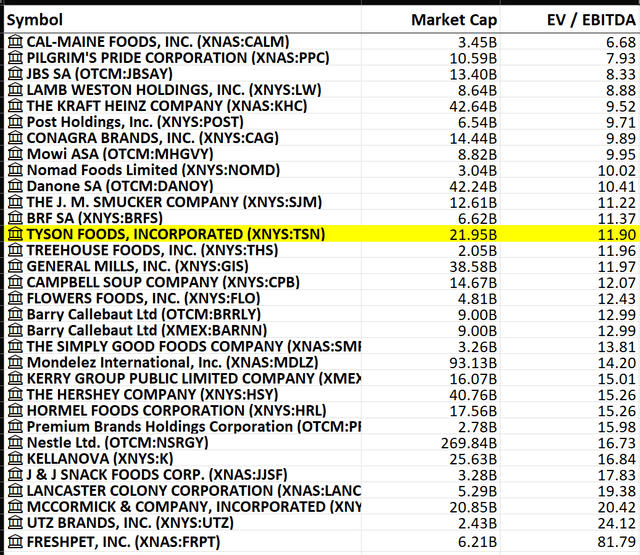

- I’ve taken business comparables for Tyson from In search of Alpha and regarded solely shares which are mid-cap and above. This leads to a Rank of 13 out of 32 candidates within the business.

Trade parts for EV/EBITDA comparability (SA)

P/B

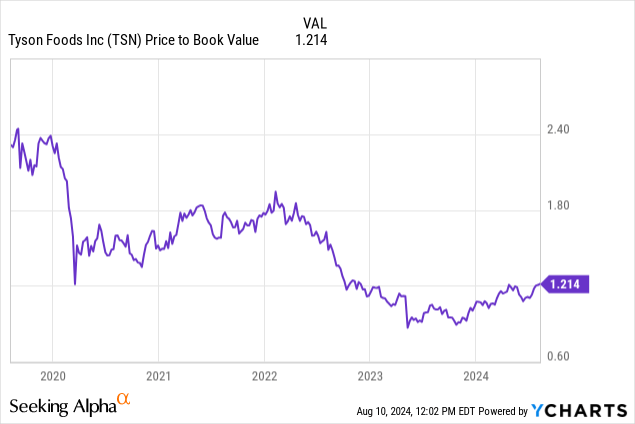

- The present PB ratio is 1.2x and is buying and selling fairly near its lowest in its historical past. It is great to assume that we might have gotten this enterprise lower than its ebook worth lower than a 12 months in the past.

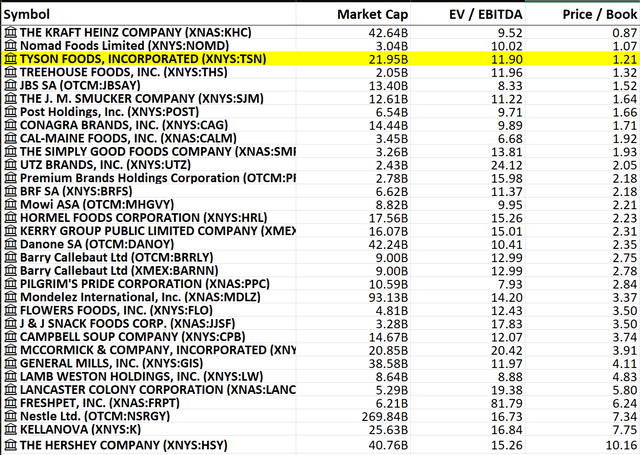

- Clearly there isn’t any excellent timing, however whenever you evaluate it towards the identical business comparables this ratio appears to be like extraordinarily favorable to Tyson Meals.

Trade parts for P/B comparability (SA)

P/CF

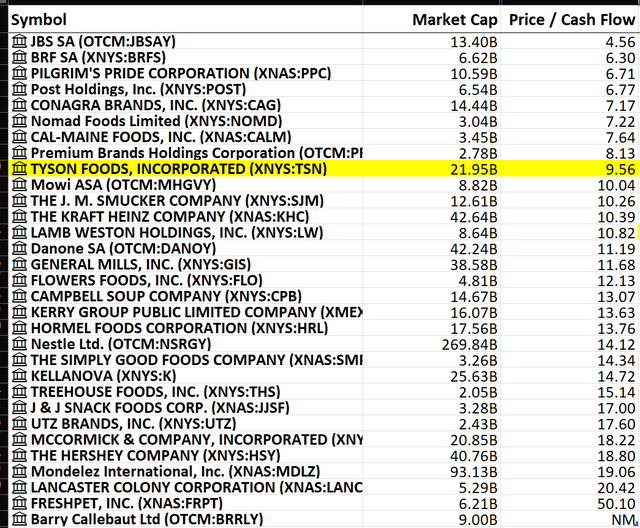

When evaluating market cap to its operational money flows, we see its 9.56x, which places it at ninth place amongst its business parts. It additionally means that the corporate’s money stream technology is in step with or higher than business norms. With its upward pattern in internet earnings, I think this ratio will solely get higher this 12 months.

Trade parts for P/CF comparability (SA)

Dangers to this thesis

Right here I’m extra involved about dangers related to the business usually slightly than company-specific dangers in relation to Tyson Meals.

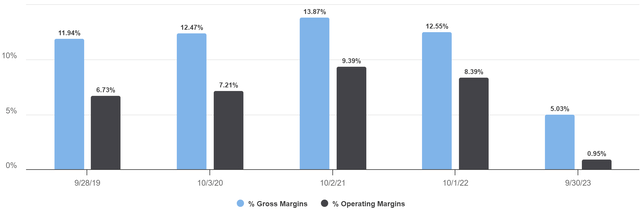

The large downside is the margins on this business. Meals manufacturing is a low-margin business, and a rise in enter prices can squeeze margins. Tyson isn’t any exception, as seen under.

Tikr

We already noticed the associated fee construction being affected by variability within the enter. The corporate won’t ever be proof against the sort of threat even sooner or later as there may be heavy reliance on commodities similar to corn, soybeans, and livestock. Fluctuations within the costs of those commodities can as soon as once more influence the corporate’s price construction and profitability. On the flip aspect, this may increasingly not final lengthy, and a dip in inventory value may very well be a major shopping for alternative.

Tyson Meals Inventory Is a Purchase

In a top-heavy index dominated by overvalued tech mega-caps, my decisions are restricted if I’m searching for high quality publicity to the inventory market. The enterprise of Tyson Meals is a client staple which provides me consolation not solely in investing of their inventory now but in addition in staying invested throughout a market breakdown. The long-term demand for its merchandise which we mentioned at the start and its excessive dividends imply this may go to my long-term buy-and-hold portfolio.