It’s a provided that nobody is aware of what the longer term holds.

However that doesn’t imply we merely shrug our shoulders and stumble blindly into no matter comes subsequent. We will think about the possibilities, map out larger (and decrease) attainable outcomes, and wargame numerous situations. We will ponder how latest historical past led us to the current circumstances.

Let’s think about two potentialities: One the place many issues go proper, and one other one the place most don’t (avoiding unlikely extremes). Our expectations are that actuality finally ends up someplace in between the 2. That’s the upper chance however any level alongside the spectrum between the extremes is a viable potential end result.

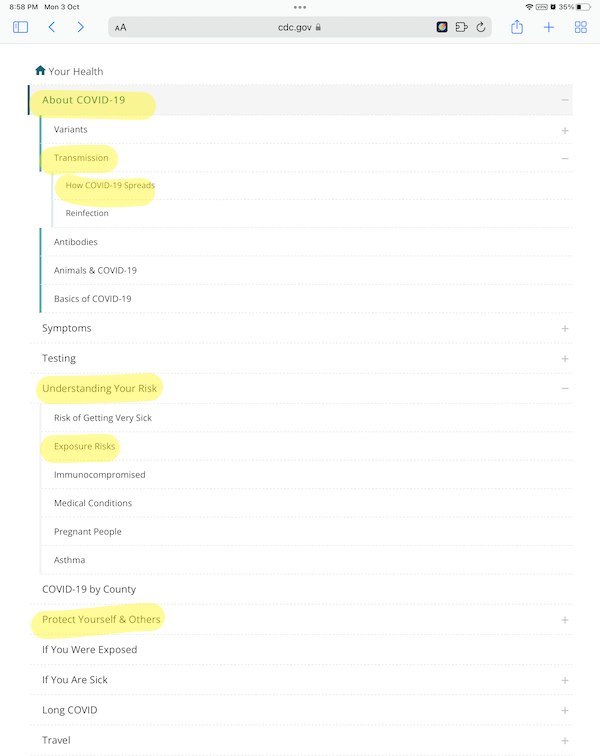

There are infinite challenges going through America and the world, however let’s think about the 5 largest ones: Inflation, Battle, Recession, Covid, and Market Volatility. There are dozens extra, any considered one of which – Monkeypox! – may spiral into one thing terrible. However for our functions, let’s stick with these 5.

Think about what a fairly best-case or worst-case situation may appear like:

Situation 1: Every little thing goes proper: The pandemic that shut down the worldwide financial system in 2020 lastly runs out of steam. Within the US, we obtain herd immunity when greater than 70% of the inhabitants is vaccinated and boosted. Youngsters underneath 5 vaccine is authorised, and most mother and father get their children immunized on the urging of pediatricians and faculties (it seems youngsters have been an enormous vector for transmission). With so few potential new hosts, the pandemic burns itself out.

Life begins to normalize: Economically, the nation returns to a extra services-oriented and fewer goods-based financial system. The facet impact is an untangling of many provide chain snafus. Semiconductors see a ramp-up in manufacturing, which will increase the availability of latest vehicles. Value will increase have already peaked, and throughout a spread of products, they head decrease. House costs stabilize and start to float modestly decrease, as extra single-family houses are constructed and multifamily residence buildings are accomplished.

The Fed acknowledges that the worst of value spikes is already behind us, and they also change their tone from preventing inflation to getting off of zero and normalizing financial coverage. After a 50 bps enhance in June, they go 25bps for the remainder of the 12 months. Fed Funds end 2022 at 2% and keep there for years to return.

Russia begins to acknowledge the futility of their struggle – both Putin declares victory and withdraws, or is forcibly eliminated by insiders. Inside three months, Oil costs fall 30-40%. Hungary is kicked out of NATO, paving the way in which for Sweden and Finland to hitch.

The market finishes the 12 months practically flat (e.g., up 5% to down 9%), an enormous victory contemplating how a lot worry there was. The VIX volatility index drops to the low to mid-20s. The NASDAQ fares much less effectively, however nonetheless makes up greater than half of its peak to trough losses. With most of the extra squeezed out, the tech index ain’t low-cost, but it surely’s a lot much less dear than it was pre-correction.

Situation 2: Every little thing goes mistaken: Delta to Omincron to BA2: Covid retains mutating, together with extra harmful and lethal variants. Rolling lockdowns fail to comprise the outbreaks. Florida refuses to cooperate with the CDC/NIH and stays the nation’s superspreader feeder area. Hospitals replenish, the U.S. suffers one other million deaths.

The pandemic runs amuck and prevents the availability chain from untangling. Making issues worse is China’s Zero Covid coverage. The manufacturing capital of the world suffers a recession, contracting for the remainder of the 12 months. Unable to produce key items, shortages of practically the whole lot change into acute.

Together with meals and power: The Russian invasion of Ukraine has change into a slog, an infinite struggle of attrition: Ukrainians struggle towards the invaders, funded and equipped by western proxies. Ukrainian meals manufacturing plummets, as do Russian power exports. China buys all the Russian output, holding costs excessive and Russia solvent sufficient to proceed prosecuting the struggle. Oil goes to $200 a barrel, and gasoline rises to $9/gallon within the US.

The Fed continues to lift charges, regardless of the shortage of affect the prior will increase have had. At 5% Fed fund charges, the US is already deep in a recession, however costs stay elevated. Stagflation dominates the headlines.

The mix of lockdowns, inflation, and recession sends the markets right into a nosedive. The S&P500 falls one other 35% bottoming round 2500, and the Nasdaq will get minimize in half from right here to underneath 6000. The VIX spikes to 50 then 60, finally kissing 70

Chances: Given all of those potential variables, it’s unattainable to confidently predict what occurs by year-end.1 My wishful pondering is that we end 2022 nearer to Situation 1, which requires a number of issues to go proper whereas avoiding a number of potential disasters. Quite a bit has to go mistaken for Situation 2 to happen – it’s inconceivable, however not unattainable.

I’d put the percentages from greatest to worst one thing like this:

Nice! 20% Threading the needle as inflation fades, struggle and pandemic finish, market volatility ends, indices get well. An ideal Fed dismount they usually stick the touchdown.

Good! 30% A mushy touchdown and no recession. Just a few sectors are in retreat, however total, the financial system stays strong. Inflation seems to be transitory in spite of everything.

Meh! 20% A tough touchdown: The pilot taxis what’s left of the aircraft to the terminal, and we’re grateful issues usually are not worse. Possibly a light recession or flat GDP makes folks nervous, as unemployment strikes larger from 3.6% to five%. Inflation eases, however not as a lot as hoped for.

Dangerous! 20% Solely a handful of points work out, however most don’t. A recession drives unemployment over 6%, however inflation stays principally cussed.

Horrible! 10% Every little thing goes to Hell …

About half of my situations (percentage-wise) are fairly good, and half usually are not so good.

~~~

When enthusiastic about the longer term, we must always know what the attainable outcomes are, what the outliers is perhaps, and think about that are the extra doubtless consequence.

Approaching the world this manner isn’t solely lifelike, however it’s a wholesome method to consider danger and reward.

Beforehand:

No person Is aware of Something, Kentucky Derby Version (Could 9, 2022)

Capitulation Playbook (Could 19, 2022)

Secular vs. Cyclical Markets (2022) (Could 16, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

__________

1. If sufficient forecasters make guesses, one shall be proper by likelihood, giving them a chance to money in on random luck.