You’ve heard about the blue pill and the red pill. But have you heard about the blue line and the green line?

You should. Because they recently crossed. Which could be disastrous for some real estate investors. And no, I’m not talking about an inverted yield curve.

I recently wrote an article about the strange time we are in. There is a predictable disconnect between sellers and buyers, and I warned that it could worsen before it improves.

When that article was published, BiggerPockets CEO, Scott Trench, made the following insightful comment:

This was a great insight, and my hat’s off to you, Scott (and I’m certainly not buttering you up as the BiggerPockets boss. Certainly not).

We Are In The Negative Equity Zone

Green Street is a premier data provider and analyst for the commercial real estate space in the U.S. and Europe. Green Street did a webinar in September called “Navigating the ‘Upside Down’ in Commercial Real Estate.” If you’ve seen Stranger Things, you know this is a strange time indeed.

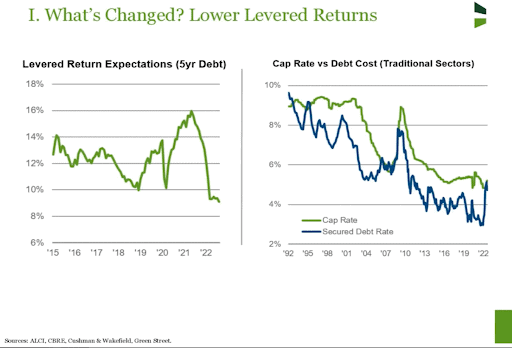

In this webinar, they made a lot of comments about the current strange environment. Similar to what I said in my article in August. The following graph jumped out at me:

First, the graph on the left shows a significant decline in the projected levered returns. Commercial real estate investors should expect lower returns if currently investing in conventional commercial real estate. Popular investments like multifamily are especially at risk.

I’ve been sounding an alarm bell on this topic for years (even though I wrote a book called The Perfect Investment about multifamily investing in 2016). Multifamily investing is not perfect if you must overpay to get there! It’s just a fact of life.

When interest rates go up, investors should expect lower ROIs unless purchase cap rates expand accordingly. That’s the situation we are in for syndicators and investors who are paying “full price” for multifamily and many other commercial assets. Be sure you don’t do this, especially right now. Why?

I recently heard a multifamily syndicator lament that he had been outbid on a $20 million+ apartment deal in the Midwest. He said the winner outbid him by approximately $2 million and acquired this asset at a 3% cap rate! He said there was not that much value-add available. I can’t imagine how that will end up for their investors. It’s hard to imagine how that will end well.

Look at the second graph. As I warned and Scott Trench clarified a few months ago, we are in a strange time where interest rates have gone up dramatically, but cap rates have yet to follow, at least not much.

The blue line (interest rate) should never meet or exceed the green line (cap rate). For the most part, the cap rate should always exceed the interest rate by what I will refer to as a “risk premium.” In other words, the risk of investing in commercial real estate, or any real estate, is higher than investing at the risk-free rate (buying U.S. Treasuries). Therefore, it should significantly exceed the blue line (interest rate) here.

It’s actually a little worse than that in this situation, however, because current commercial loans are priced with an additional premium reflecting the additional risk institutional investors see in the commercial space right now.

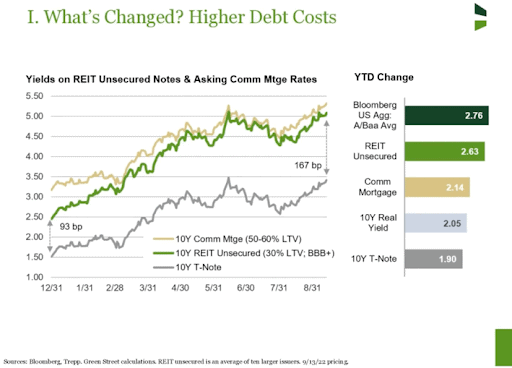

The following graph shows what I mean. Note the spread from 0.93% to 1.67%, an increase of almost 80%. It’s just a fact that credit markets are tightening, and lenders want to get paid more than they did when “everyone was happy, and nothing could go wrong” over the past decade.

So, interest rates have shot up from 3% to 5%. Cap rates have not followed yet. Why?

I think part of the reason is that there’s been substantial training, coaching, and excitement in the syndication world over the last decade, especially in multifamily. All kinds of new players have thrown their hats in the ring. And many of them didn’t experience the pain of the last several recessions, while many of the more experienced cohorts remember those quite well.

Many syndicators and their investors are so excited to finally get a chance at a deal! They proceed to pay full asking price or thereabouts for suddenly overpriced commercial real estate assets. Instead of bidding against 60 other well-funded players, as before, perhaps they’re only duking it out with three or four others. After studying and courting investors and longing for a deal for years, they finally have their chance.

But the question is, who is getting the short end of the stick? It may not even be the syndicator because they often charge hefty acquisition fees, asset management fees, property management fees, and more.

Their investors could be victims. I’m writing today so that you don’t become one of them.

These “newrus,” as I call them (new gurus), sometimes tell investors, “it’s different this time.” Unfortunately, they may believe that themselves.

But trees don’t grow to the sky. And as economist Howard Stein wryly remarked, “If things can’t go on forever, they will eventually stop.”

As I often say, the tide has risen for everyone over the past decade. But as Warren Buffett often says, “Someday the tide will go out, and we will see who is swimming naked.”

We might be coming into a time like this.

Negative Leverage

Many commercial real estate deals and their investors have entered an era of “negative leverage.” Negative leverage is when an asset is acquired at a cap rate below the interest rate on the debt used to finance it. Our Wellings Capital Director of Investments, Troy Zsofka, explained this situation to me.

In this case, leverage is no longer accretive to the return profile and becomes a burden that puts downward pressure on equity returns (hence the term “negative leverage”). Furthermore, increased debt service reduces the LTV at which lender-required Debt Debt Service Coverage Ratios (DSCRs) can be met, thereby requiring additional equity in the capital stack, further diluting investor returns.

One may ask how, then, it could ever make sense to purchase properties using negative leverage.

In my experience, one way these sponsors get the investment to pencil is to assume continued rent growth. This growth will eventually result in a “forward-looking cap rate,” if you will, that is higher than the interest rate on the debt. In other words, they grow their NOI out of the problem.

But this is clearly a risky endeavor when downside potential is governed by market forces outside an operator’s control.

Another way to justify negative leverage, as Scott Trench said, is with a heavy value-add deal that relies on expeditious execution so that the upside potential mitigates the negative leverage position.

Relying on execution to go exactly to plan to protect the downside is also a risky endeavor, especially for many less experienced syndicators, and it often doesn’t make sense from a risk-adjusted return perspective.

To the first point, I often see offerings that tout the market’s historical rent growth, highlighting that Phoenix or Austin, for example, have experienced 18%+ rent growth over the past two years. The inference is that this is somehow indicative of the future as if this growth rate will continue. This justifies using 8-10% rent growth in the pro forma underwriting assumptions and calling it conservative!

In my opinion, the fact that a market has experienced outsized rent growth in recent years is, if anything, indicative of the exact opposite—it can be unsustainable. Rent growth typically stagnates to some extent for equilibrium to be reached.

Decreasing housing affordability is a headwind to continuing in-migration to a market, and continued demand growth should, therefore, not be relied upon to sustain outsized rent growth.

How can you fail in this environment? Let me count the ways…

- Acquire a “market rate” (often brokered) deal with “typical” leverage at the current interest rate.

- Make a bad situation worse by adding an extra layer of preferred equity to compensate for increased rates, lower allowable leverage, and falling return projections.

- Drag a bunch of unsuspecting passive investors into the mix, promising them a great opportunity to create income and grow their wealth. These are known as victims.

- Worst of all: be that unsuspecting victim.

How can you succeed in this environment?

- Acquire an off-market under-managed, underpriced deal with lots of predictable upside.

- Create that upside through your experienced team and well-honed process.

- Acquire the above through preferable loan terms (like owner-financed or assumable debt). Or acquire for cash and refinance someday. Or hold in cash.

- Invest with an experienced syndicator or fund manager who specializes in the above.

A Final Word About Banks

Banks aren’t stupid. As the largest investors in most commercial real estate deals, banks are obviously wary of making bad deals and losing money. Many of their junior staff weren’t around for past downturns. Some are still eager to make loans, hit their quotas, etc.

But most banks have some seasoned professionals who have been around the block. Many of them are tightening the commercial lending noose as we speak. So watch for a significant decrease in lenders willing to make commercial loans in the coming days. It has already started.

Conservative bankers often overreact to cover their risk. So it is possible that many of these bad deals won’t even get to closing, which could protect some of you from a bad investment.

But please don’t trust bankers to protect you from harm. Instead, do your own due diligence. Learn to be an intelligent investor and partner with others who have successfully weathered these storms in past decades. Pain + Years = Wisdom. At least in some cases.

Are you tired of overpaying for single and multifamily properties in an overheated market? Investing in self-storage is an overlooked alternative that can accelerate your income and compound your wealth.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.