Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

It’s now virtually precisely a quarter-century because the economists Barry Eichengreen and Ricardo Hausmann first argued that the “authentic sin” of the creating world was borrowing in abroad currencies just like the greenback.

For hundreds of years, this led to periodic monetary crises. However nations like China, India, Brazil, Mexico and smattering of different smaller creating nations similar to Chile and Poland have labored exhausting to develop their very own native bond markets over the previous 20 years. That is arguably one of many under-appreciated developmental success tales of the previous technology.

As Goldman Sachs highlights in a brand new report on “classes from 20 years of EM fastened earnings investing”, EM native bonds at the moment are a $7tn asset class, vastly outstripping the ca $1.2tn EM greenback bond universe.

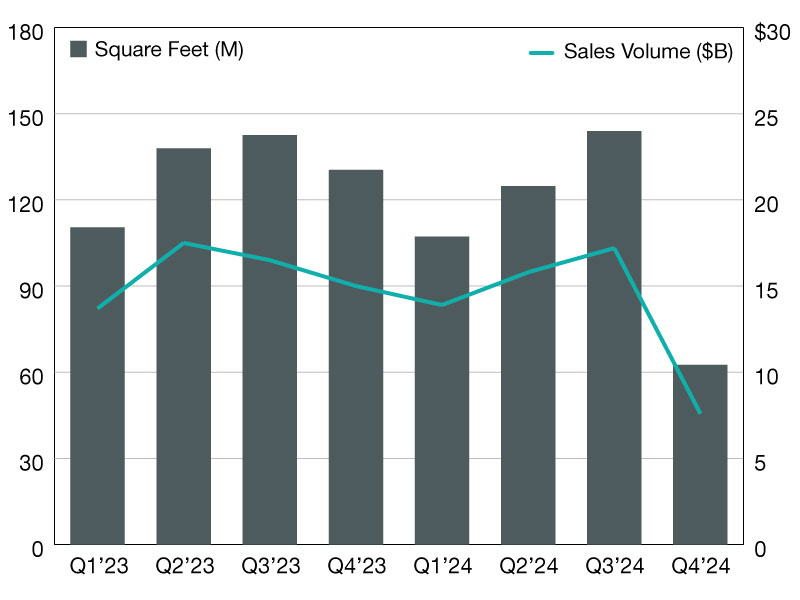

(zoomable model)

In fact, progress isn’t uniform. Many smaller rising markets stay depending on abroad borrowing, and doubtless at all times will, as they lack the dimensions to construct wholesome native debt markets.

And as we’ve famous earlier than, the rising worldwide involvement in native bond markets comes with downsides The forex mismatch danger has merely migrated from debtors to lenders. That’s higher, nevertheless it doesn’t get rid of the risks of monetary crises.

However after weathering plenty of main shocks over the previous 20 years, what was as soon as a dangerous asset class has now grown up.

Goldman Sachs notes that whereas local-currency EM bonds have had a cruddy decade, they really did no worse than developed market bonds when the Fed began jacking up rates of interest, and have now recovered extra of the misplaced floor. Likewise with greenback EM bonds.

(zoomable model)

Goldman has made the report public for us, so you’ll be able to learn the entire thing right here. However listed here are its details:

What have we learnt from 20 years of efficiency? A extra mature asset class, with much less outperformance however extra resilience. Rising up isn’t all it’s made out to be. After a blistering begin within the 2000s, returns throughout EM fastened earnings have been extra modest over the previous decade. However whereas that outperformance has pale, EM fastened earnings has demonstrated a powerful resilience within the face of a number of giant shocks, together with the World Monetary Disaster, the Covid pandemic and the next inflation surge.

In what macro/markets atmosphere does EM fastened earnings flourish? Differentiated danger betas with a excessive yield. EM debt gives a excessive yield — certainly, the next yield than for a lot of different sovereign fixed-income property — however uniquely embeds constructive cyclical publicity. On the similar time, EM fastened earnings tends to learn extra from international price reduction than different cyclical fixed-income property. So one of the best intervals typically are usually a mix the place charges are secure or easing and development prospects are being re-rated larger.

What position can EM fastened earnings play in broader portfolios? Arduous forex EM, specifically, permits for larger returns primarily for considerably larger volatility/danger tolerance portfolios. For native forex EM, nonetheless, the extra differentiated danger publicity in contrast with different non-US Greenback fastened earnings portfolios implies that there are advantages of holding GBI-EM even in portfolios that concentrate on decrease volatility outcomes.

To hedge or to not hedge? Thoughts the forex danger. For EM native debt buyers, administration of FX danger has been a key consideration, particularly via lengthy persistent intervals of Greenback energy. Hedging Greenback danger has been necessary to whole returns in EM and DM. However for EMs, hedging forex publicity utterly comes at the price of giving up cyclical upside.