jaanalisette

Back in April, I started Twilio (NYSE:TWLO) with a “Buy” rating saying that the stock was in the bargain bin and that while it faces some headwinds, the bar had been set pretty low for 2023. The stock is up over 35% since then. More recently in August, I maintained my rating, saying the stock remained cheap and that the company was showing signs of stabilizing its business. Since then, the company has seen an activist get involved in pushing for the sale of the company, it’s gotten a new CEO, and it has said its Q4 earnings will exceed guidance. Let’s catch up on the name given all the recent action surrounding the company.

Company Profile

As a reminder, TWLO operates a cloud communication platform that lets developers insert voice, messaging, and email into apps. The company operates in two segments: Communications and Data & Applications. Within its Communications segment it has four core products. Its programmable messaging product is an API that enables the sending and receiving of various types of messages for things like order confirmations and marketing. Its programmable voice product, meanwhile, lets developers create solutions where people can receive phone calls through apps and browsers.

Its Verify product is used to send codes through text, voice, and push notifications for second-factor authentication. These three products are usage based, while its SendGrid Email API, which helps bulk emails reach their in-box destinations, is a subscription service.

Within its Data & Applications segment, the company has several emerging products, such as Segment, Flex, and Engage. These products are mainly sold via subscriptions.

Activist and New CEO

In late November, it was reported that hedge fund Anson Funds had bought a stake in the firm and was pushing for a sale of the company or a divestiture of its Data & Applications segment. The move comes shortly after Anson hired Sagar Gupta to build out its activist strategy. Gupta had been at Legion Partners previously, which had also taken an activist stake in TWLO.

According to reports, Anson has taken a $50 million stake in TWLO, while Legion has maintained a similarly valued stake in the company. In December, meanwhile, CNBC reported that TWLO had hired Qatalyst Partner to help defend the company from activist investors. Ironically, Qatalyst was the advisor that helped TWLO acquire customer data platform Segment in 2020 for $3.2 billion, which makes up a large part of the Data & Applications segment that Anson and Legion want TWLO to divest.

While TWLO has engaged with the activist investors, it does not seem to be moved to act, at least at this time. Meanwhile, combined Anson and Legion only own around 1% of the company, so they can rattle TWLO’s cage all they want, unless they get support from much larger holders, they aren’t going to have much say.

Now the Data & Applications business that the activists want divested hasn’t exactly lived up to expectations. Growth in the segment has slowed, with revenue growth of only 9% in Q3, down from 12% in Q2.

On its Q3 call in November, co-founder and former CEO Jeffrey Lawson laid out the vision for business saying:

And so if we are able to take the data assets in Segment and bring them together with our Communications assets, what we have the opportunity to do is add a lot more value to our customers, drive a lot more software value to the company and really competitively differentiate in a market where this is what customers want. Customers want more effective communication. So I love these stories about how … customers using Segment’s predictive traits were able to bring down the cost of customer acquisition by 85%, right? Like those are the types of stories and business results I think we can drive when we bring together data, which allows companies to be a lot smarter, and Communications, which is the vehicle to actually drive a lot of those outcomes in terms of how you talk to a customer. And so when I think about the opportunity ahead, look, so far, the conversation has been very much focused on the stand-alone nature of the Segment business. And obviously, we’ve been focused on making sure that we drive growth as a stand-alone. But the next step for us is to really start talking about what we can unlock together. And that’s the better story. And I’m really looking forward to using especially AI and all the things we talked about with CustomerAI as the vehicle to fuse communications and data together in a way that’s extremely differentiated and honestly is emerging, right?”

To me, this seems like a proposition with potential, but at this point, the company has not even started implementing it. You can certainly argue what has taken so long, but I’d still like to see the company implement its vision before selling the business at a loss.

Instead of looking to sell its Data & Applications business, the company has consistently trimmed its workforce in 2023. TWLO cut -17% of its workforce in February of 2023, followed by -11% in September, and then in December it cut another -5%. This has led to a much leaner company heading into 2024.

Meanwhile, CEO and co-founder Jeffrey Lawson stepped down immediately in early January from both his role as CEO and from the board. He will be replaced by Khozema Shipchandler, who has served as President of TWLO Communication since March 2023. He has been with TWLO since 2018 and had prior stints as the company’s COO and CFO. Meanwhile, long-time board member Jeff Epstein of Bessemer Venture Partners will become Chairman.

The activist investors had been pushing for Lawson’s departure, as well, which may have prompted his departure. However, the appointment of a long-term exec as CEO doesn’t exactly point to major changes ahead. I’d expect Shipchandler to largely stay the course.

Along with its announcement that it was changing CEOs, TWLO indicated that it had a strong Q4. It said that its Q4 revenue and adjusted income for operations would come in above the high end of its original guidance. As such, there shouldn’t be any surprises with its results when the company reports next month. It earlier forecast Q4 revenue of between $1.03-1.04 billion and adjusted EPS of between 53-57 cents. A year ago, it posted revenue of $1.02 billion, so its initial guidance wasn’t exactly looking for a lot of growth. Notably, though, organic growth guidance was for 5% growth at the high end, after taking into account some recent divestitures.

Valuation

Since TWLO overall doesn’t have SaaS-type gross margins, I prefer to value the company on an EV/gross profit metric. On this front, it trades at 4.5x the approximate $2.2 billion in gross profit it will generate in 2024. I think this is one of the best ways to value the company.

On an EBITDA basis, it trades at 11.8x the 2024 estimates of $858.6 million, and 10.2x the 2025 estimate of $993.9 million.

It is projected to grow revenue by over 7.8% this year, and 12.5% in 2025.

Given its high single-digit organic growth rate, I’d value TWLO between 4-6x 2025 gross profits of $2.2 billion and 10-12x ’25 EBITDA of $993.9 million. As noted above, I like to use gross profits to value TWLO because its gross margins (~50%) are much lower than SaaS companies (75%+). Its consumption model also adds a bit more unpredictability. The midpoint of both those metrics (gross profit and EBITDA) gets you right around a $79 price target.

Conclusion

After a nice run, I’m going to take TWLO down to “Hold” with a target of $79. There is some potential upside, but not enough to keep it a “Buy” rating given the risks.

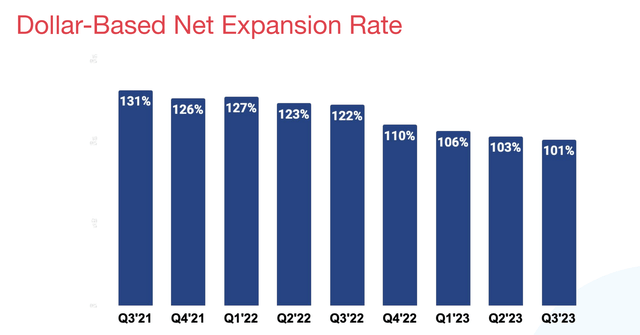

The company did a nice job leaping past low expectations in 2023, but its new CEO will have some higher expectations for 2024. With its next dollar retention near 100% (it was 101% in Q3), I think 2024 estimates could prove more difficult. This would be a key metric I’d monitor when it reports Q4 results to see if there is any improvement or if it keeps weakening. Meanwhile, if the company wants to set the bar low again for 2024 when it issues guidance, the stock could take a hit when it reports its Q4 results in February.

Company Presentation

I also don’t see the company looking to sell itself or its Data & Applications business at this time. I also think the sale of its Data & Applications business could be shortsighted, as the company hasn’t really even implemented its vision of marrying its two segments together yet. Meanwhile, it already has a ton of cash on its balance sheet, so it doesn’t exactly need more. – it needs growth. As such, I view the activist investor more as a distraction than a help at this time.