Iana Miroshnichenko

The Golden Age of Private Credit

Sixth Street Specialty Lending (NYSE:TSLX) is part of a group of private lenders that serve what used to be a big gap in credit markets. Large companies can borrow from commercial banks or public markets. Small businesses have access to SBA loans, which reduce lender risk.

Enter the business development corporations or BDCs. They sell equity privately or on public markets, supplement that with some borrowing, and lend out to medium-sized firms. Some also buy equity, but Sixth Street has relatively little. The BDCs generally keep expenses low and return substantially all free cash flow as dividends. Sixth Street has a regular quarterly dividend plus a varying supplemental, and specials from time to time, like after the 2017 tax bill.

Right now, there are two big tailwinds for the entire sector:

- The pullback in lending at commercial banks since the regional banking issues in February-March.

- The anticipated upcoming increase in capital requirements for commercial banks.

In the Sixth Street Q2 earnings call, the phrase “the golden age of private credit” came up. It began in Q2.

Management addressed the new macro environment at length in their Q2 earnings call prepared remarks. (Emphasis from author).

Credit issuance is primarily driven by refinancing and M&A activity, which have both declined in 2023. Refinancings have dropped off as the higher spread environment essentially represents an asset for issuers holding a lower spread than the market level today. As for M&A activity, there continues to be a bid-ask spread where sellers want yesterday’s price and buyers want today’s price.

With fewer issuers coming to market, the top of the originations funnel [chartered banks] is narrower, but this is offset for us by the shift towards private credit over the past few quarters. Our pipeline has remained robust given the increased market share we are seeing as alternatives for borrowers are generally as constrained as ever before.

Access to the broadly syndicated loan and high-yield markets has generally only returned for near investment-grade credits. This limited access to public markets has increased the number of high quality credits we are seeing as direct lenders. We believe the opportunities that continues to be interesting with plenty to take advantage of while remaining selective.

They are pretty conservative in whom they loan to, but now they are seeing more borrowers who meet their high standards.

Demand Grows

Back on May 10, Sixth Street sold shares, and the stock promptly shaved 4% that day. This was partially a failure of corporate communications. From the press release:

TSLX expects to use the net proceeds of the offering to pay down outstanding debt under its revolving credit facility. However, through re-borrowing under the revolving credit facility, the Company intends to make new investments in accordance with its investment objectives and strategies outlined in the preliminary prospectus supplement and the accompanying prospectus described below in greater detail.

What they failed to highlight was that they needed the liquidity because they were seeing more demand for lending from qualified companies, sort of obscured in that very long second sentence. They had just told us on their Q1 earnings call that they had plenty of excess liquidity in their revolver, and a few weeks later, it was not enough. This is when I began banging a drum on private credit.

As I was writing this, they raised more money, this time from a 5-year bond. The language is identical to what I quoted above from May. They are going to pay down the revolver, so they can fill it back up again with new loans.

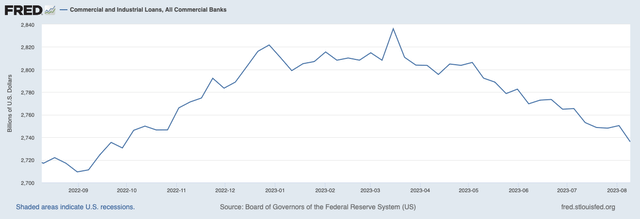

Of course, this is being driven by a pullback in lending at commercial banks

Commercial bank commercial and industrial loans, not seasonally adjusted. (Federal Reserve via FRED)

Since the peak in March, about $100 billion of commercial and industrial loans have been shaved from commercial bank balance sheets. But you can also see that the slowdown dates back to January.

At first, financial conditions tightened in February and March, but in April they began loosening again, and have gotten looser ever since

Chicago Fed National Financial Conditions Index is an index of 105 credit market indicators from all over the US economy. Above zero is tighter than the historical mean, and below zero means looser. Current levels (Aug 11) are still loose, and getting looser. (Federal Reserve via FRED)

What happened was that private lenders stepped in to fill the void in April.

The other moving part is the anticipated increase in capital requirements for banks of all sizes. We still don’t know exactly what we are talking about aside from a July 10 speech by Fed Vice Chair Michael Barr that extolled the virtues of bank capital for banks of all sizes. Whatever is coming will be phased in and probably not begin until 2025 at the earliest.

A few days later, there was this interesting exchange on the JPMorgan (JPM) earnings call:

Mike Mayo [Wells Fargo]

To the extent the capital ratios do go up 20% for you and perhaps others, to what degree would you think about changing your business model in terms of remixing where you do business, repricing, or simply, you know, removing activities that you used to do?

It’s kind of ironic, or maybe it’s not ironic, that Apollo hits an all-time stock price high the same week as this [Vice Chair Barr] speech. So how much business leaves JPMorgan or the industry if capital ratios do go up as much as potentially proposed?

Jamie Dimon [CEO]

[Interrupting] Wait, before Jeremy answers that question, I just want to say this is great news for hedge funds, private equity, private credit, Apollo, Blackstone, and, you know, there’s dancing in the streets.

Jeremy Barnum [CFO]

Yeah, exactly. And I was going to say, Mike, yes to everything.

– JPMorgan earnings call, July 14, 2023

Dancing in the streets. So in addition to the near-term tailwind, we also have a long-term tailwind from new banking regulations.

Sixth Street Q2

Sixth Street is towards the conservative end of the BDCs. Their portfolio:

- 91% first lien debt.

- 4% other debt (second lien, mezzanine, etc.).

- 99% of the debt is floating rate.

- 5% equity.

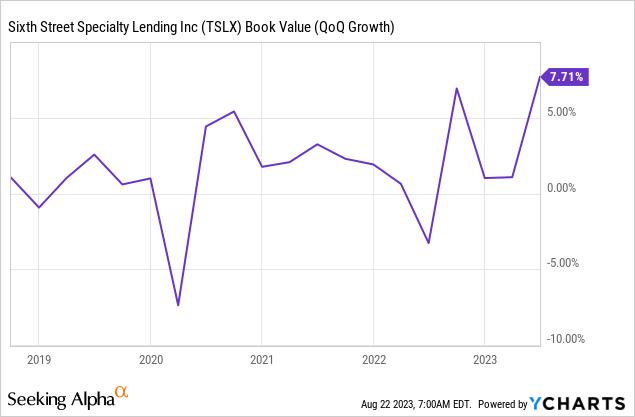

They have pretty high lending standards, so the net portfolio, book value, has tended to grow more slowly than competitors over time. Q2 2023 was a big exception.

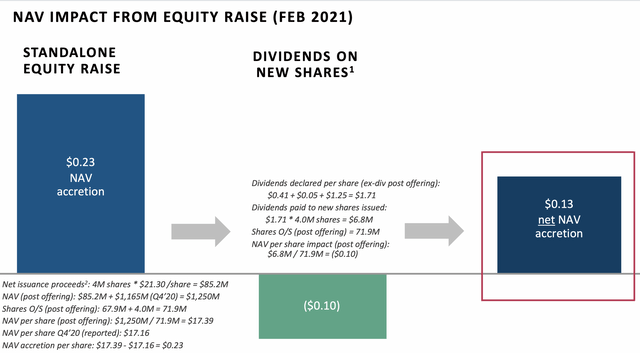

Of course, the equity sale funded that, so the per share metrics are much more modest. But these things are accretive pretty quickly. This was the last equity raise in 2021:

TSLX investor deck

Q2 was their highest growth quarter for the portfolio in a decade. More investment means more investment income means more dividends.

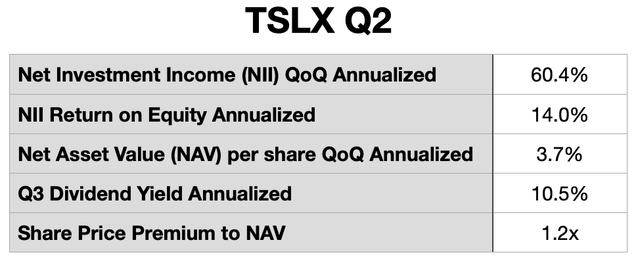

TSLX metrics (TSLX quarterly reports and press releases)

- So Q2 was a bang-up quarter for NII and RoE. If this continues, there is going to be a very fat supplemental dividend paid in Q1 2024. They exited the quarter with spillover income of $0.90 per share (4.5% of share price) after the $0.52 regular+supplementary Q3 dividends. Those Q3 dividends are both still available.

- Note the much more modest rise in NAV per share because of the equity sale.

The last two rows are my main valuation metrics. BDCs are a pretty simple setup: you are buying the balance sheet, the management of that balance sheet, and the cash flows from that balance sheet expressed as dividends.

I always like to see TSLX’s dividend over 9.5%. I reserve buys for 11.5% or greater, but we sort of have a special situation right now with the $0.90 per share spillover that hints at a big reconciliation after they report Q4.

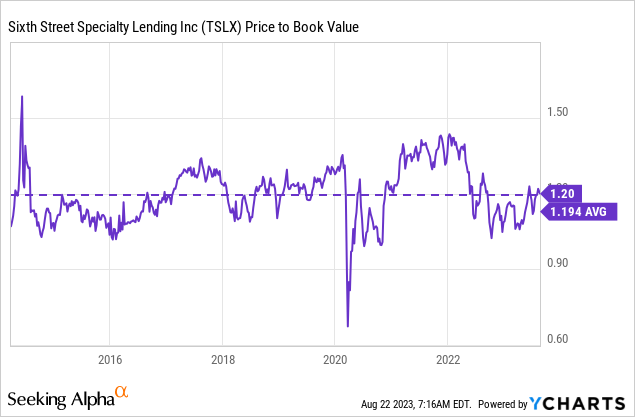

Most BDCs trade at a discount to their balance sheet. But a few like Sixth Street trade higher because they have shown over time that they can manage a portfolio of loans in shifting macro environments, and still deliver double-digit dividend yields, even with a share price premium to book value:

So they are now right around their 10-year average on that premium, 19.4%. But I am also anticipating more balance sheet growth like we saw in Q2, so that will shift if the price stays the same.

That also opens up the possibility of new equity raises, maybe even another this year. They have raised capital in May and August so far. Again, I view these as good news – it indicates that demand for their loans is high, and their revolver isn’t sufficient to meet the demand. They helpfully laid out their criteria for new equity raises:

- After discounts, the share sale price is above book value. After discounts, the May investors paid a 6% premium to book value.

- That the return on equity is greater than their cost of equity (currently 8.6% via Bloomberg). They turned around the May equity for a 13.1% return on equity.

So, in the current environment, with the stock trading at a 20% premium to book, high demand for their loans, and 13% RoE lying around, that certainly meets the criteria.

The BBBY Loan

Sixth Street made the last loan to Bed Bath and Beyond (OTCPK:BBBYQ) before bankruptcy. This was a special type of loan that they have done a few times before where the assumption going into it is default. Sixth Street got clobbered on this back in March.

The terms of the loan are that Sixth Street is in first position for recovery, senior to all other liability holders. There is also a “make-whole” provision that pays them for the interest they were not paid. This is still winding through bankruptcy court.

Risks

High Yield = High Risk

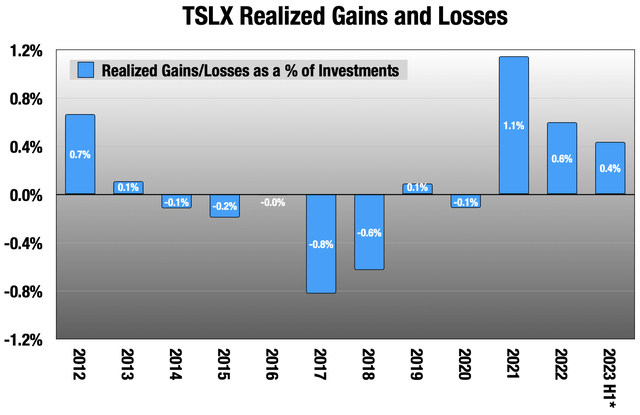

This comes with the territory. There is no free lunch. A 13% RoE doesn’t happen by magic, it happens via high-rate loans. What we want to see is that over time, realized losses, endemic in high yield loans, are modest.

*H1 2023 annualized (TSLX quarterly reports)

Keep in mind that for TSLX, who holds on to loans until they expire or default and has little equity, this metric should skew very heavily towards losses. Their unrealized gains/losses rarely become realized unless there is a default. With that context, and the high yields on their loans, these are exceptionally modest losses. Over the entirety of that chart, they show a realized gain of $28 million over 11.5 years, so substantially zero.

Like I said above, one of the things you are buying is the management of the balance sheet, and my belief is that Sixth Street manages it very well, leaning towards the conservative side in this inherently high risk lending. For what it’s worth, I hear the same opinion from institutional managers regarding their parallel private equity fund.

Concentration Risk

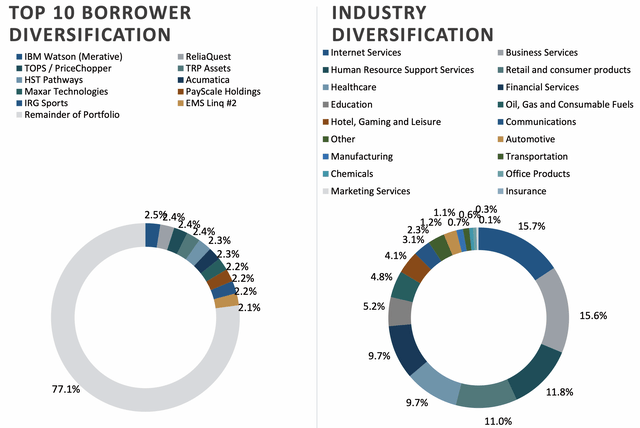

This is the one I am more antsy about.

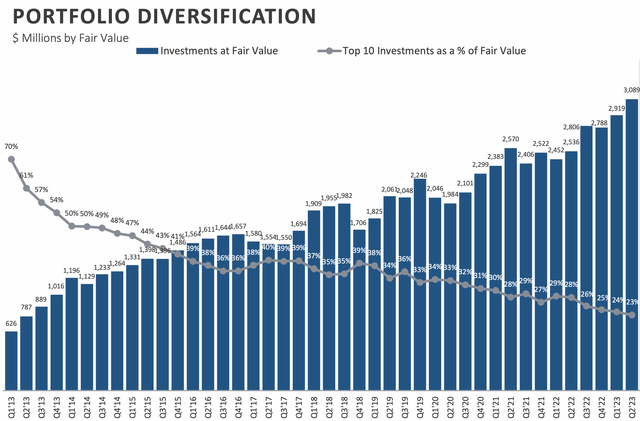

TSLX investor deck

The right chart shows that their diversification across industries is pretty good, but a little skewed towards enterprise-facing markets. It’s the left chart that bugs me; 23% of the portfolio in the top 10 is too much. But this is a metric that has been declining for many years now.

TSLX investor deck

If they keep growing the portfolio with new loans like they have been rapidly for a year now, that number should keep declining.

The Upshot

There is a rising tide that will lift all boats in the private lending space over the next few years, with both near-term and long-term catalysts. I like Sixth Street especially because:

- Their concentration on lending almost to the exclusion of equity is what makes them a little unique. This is a boom for private lending, not private equity (which may also do very well from this).

- A debt portfolio of almost entirely 1st lien debt at floating rates.

- Proven management that keeps expenses and realized losses low.

The downside to Sixth Street’s management style in the past is that they tended to grow their investment portfolio more slowly than competitors. With capital raises now twice in four months, that no longer appears to be an issue.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.