Arseniy45 | Istock | Getty Pictures

President Donald Trump could hope his tariffs jump-start a renaissance in manufacturing in america, however the actuality is just not so easy, in keeping with specialists.

The president introduced sweeping tariffs Wednesday, together with a baseline 10% levy throughout the board on all imports. He additionally focused particular international locations with steep tariffs, akin to 34% on China, 20% on the European Union and 46% on Taiwan.

Trump stated “jobs and factories will come roaring again.”

“We are going to supercharge our home industrial base, we are going to pry open overseas markets and break down overseas commerce obstacles and in the end extra manufacturing at house will imply stronger competitors and decrease costs for customers,” he stated throughout his information convention.

The U.S. has misplaced about 6 million jobs over the past 4 or 5 many years as firms moved operations abroad, largely as a result of enterprise could possibly be executed cheaper elsewhere, stated Harry Moser, president of the nonprofit Reshoring Initiative.

He stated the tariffs are a great begin to overcoming that downside however that coping with a robust greenback and build up the workforce is the most effective answer.

Moser stated he would have most well-liked decrease levies than these Trump introduced.

“Smaller can be simpler to defend, however nonetheless sufficient to drive reshoring and FDI [foreign direct investment] in extra of our means to construct and employees factories,” he stated.

He stated he expects Trump’s preliminary salvos to end in negotiations.

“So long as he convinces the opposite international locations that he’ll maintain attacking the issue till it is solved, then they’ll come ahead and perhaps let their forex go up a bit bit,” Moser stated. “Perhaps they’re going to decrease their tariff obstacles to our merchandise. Perhaps they’re going to encourage their firms to place factories right here in america.”

Companies anticipated to ‘proceed cautiously’

Nonetheless, there are a selection of points to beat to convey firms again to america, together with uncertainty across the tariffs and the way lengthy they’ll keep in place, specialists stated.

“Given the unpredictable nature of the trail ahead and the lengthy lead occasions to construct industrial capability, we count on most companies to proceed cautiously following this announcement,” Edward Mills, Raymond James’ Washington coverage analyst, stated in a be aware Wednesday. “New capability will be added the place possible, however with out certainty on longer-term coverage, bigger investments are tougher.”

“These are investments, and as a businessman you have to justify them and rationalize it,” stated Panos Kouvelis, professor of provide chain, operations and expertise at Washington College in St. Louis. “If there’s important uncertainty, you would possibly make some investments, however fairly conservative, since you wish to see how it is going to play out.”

Kouvelis’ analysis on Trump’s 2018 focused tariffs discovered that they didn’t have a huge impact on reshoring or the return of jobs to the U.S. He stated there was a adverse impact for producers, who needed to pay extra for uncooked supplies, with decreased demand and capability in some circumstances. Completed items was a blended story, relying on demand, he stated.

The most recent levies are seen as “fluid and fickle” as a result of they’re primarily based on government orders from the president and weren’t executed via Congress, stated Christopher Tang, distinguished professor on the UCLA Anderson College of Administration.

Until we remedy the disaster of confidence, the potential investments, the introduced investments won’t occur at a quick tempo. It should decelerate.

Manish Kabra

Societe Generale’s head of U.S. fairness technique

“Plenty of firms, then, usually are not positive actually tips on how to redesign the provision chain when the commerce coverage is unclear, and in addition what occurs 4 years down the street,” Tang stated. “So as a result of these are many, many billions of {dollars} in investments, they can not change on a lurch.”

Morgan Stanley analyst Chris Snyder stated he thinks tariffs are a “constructive catalyst” for reshoring however that he does not count on an enormous wave of initiatives returning to the U.S. within the close to time period. Proper now, he expects small, fast turnaround investments that would enhance output by about 2%, he stated.

“Once we speak to firms, there’s a whole lot of uncertainty about what coverage will probably be in three months,” he stated.

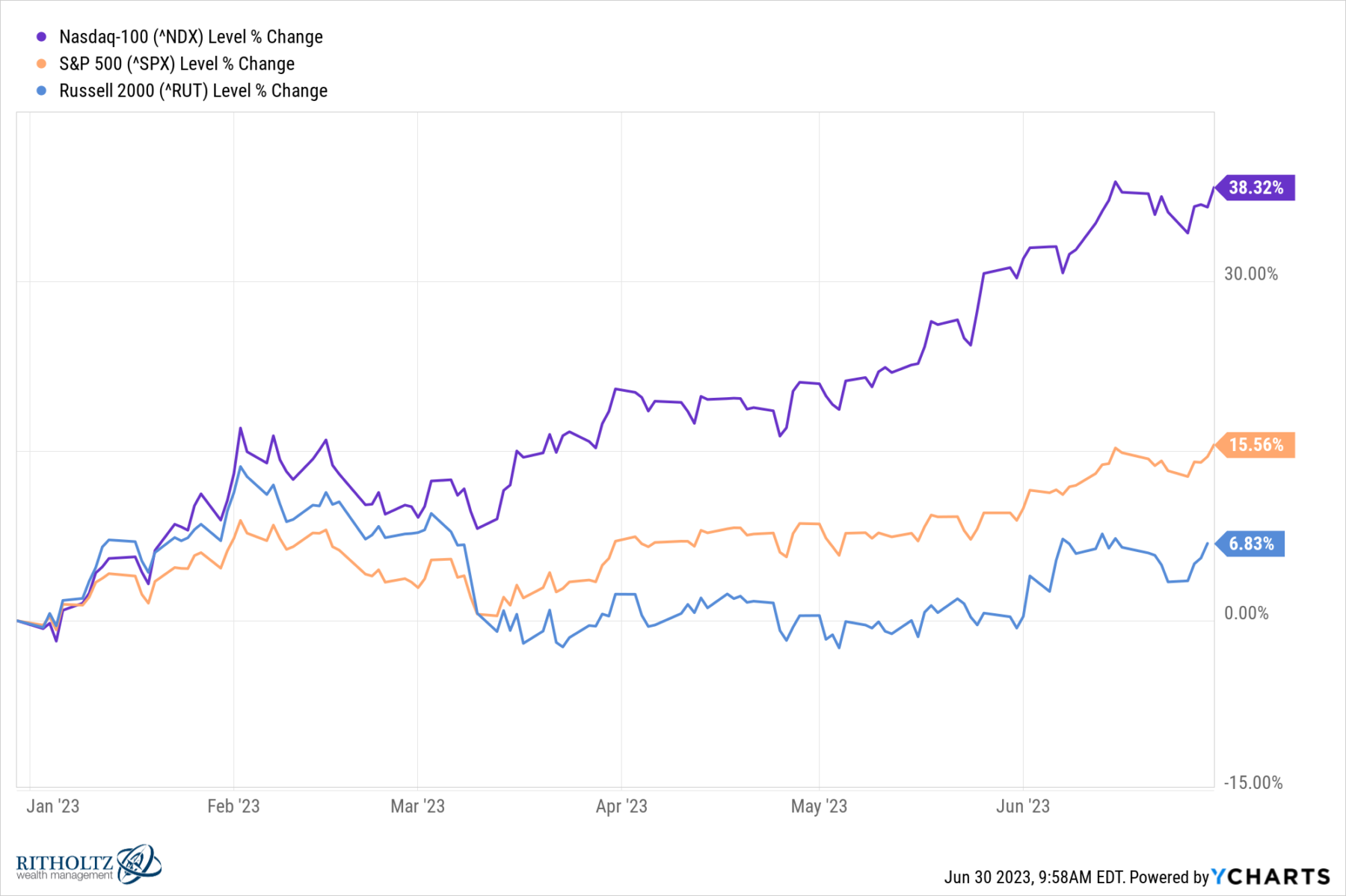

As well as, shopper confidence has taken successful — and that will probably be a consider enterprise’ selections on whether or not and when they’ll reshore, stated Manish Kabra, Societe Generale’s head of U.S. fairness technique. The Convention Board’s month-to-month shopper confidence index hit a 12-year low in March.

“When you’ve disaster of confidence, the arrogance of world firms which have introduced investments within the U.S., they’ll pause,” Kabra stated. “Until we remedy the disaster of confidence, the potential investments, the introduced investments won’t occur at a quick tempo. It should decelerate.”

Speeding reshoring could possibly be ‘harmful’

Rather a lot must occur earlier than manufacturing can actually ramp again up once more within the U.S., specialists stated.

“The US is just not able to reshore. We do not have the infrastructure, we do not have sufficient employees, and in addition, we have to study what number of Individuals are keen to work within the manufacturing facility,” Tang stated. “Should you rush it, it could possibly be fairly dangerous and harmful.”

He stated he expects some firms to return because of Trump’s tariffs however that there are nonetheless a whole lot of obstacles for a lot of. Executives are underneath stress to point out short-term ends in quarterly earnings, he stated, and managing an American workforce will be sophisticated.

“There’s so many rules, so many legal guidelines, and in addition the price is sort of excessive, so the motivation for them to return again is just not excessive,” Tang stated.

There additionally must be a big funding in coaching America’s workforce, Moser stated.

Trump’s tariff program “will fail until the nation commits to a vastly elevated recruiting and coaching program for expert manufacturing employees and engineers,” he stated. “We have to go from ‘School for all’ to ‘A terrific profession for all.'”

Morgan Stanley’s Snyder stated he believes when firms are able to construct their subsequent mission, they’ll now be extra prone to flip to the U.S.

“The U.S. is in the most effective place to get the incremental factories than it has been within the final 50 years,” he stated. Plus, the wave of producing begins that has occurred for the reason that pandemic has stalled and the tariffs will give them extra urgency to complete, he stated.

What could possibly be reshored

Corporations have introduced investments value $1.4 trillion for the reason that election, in keeping with Societe Generale’s Kabra. That provides as much as about 200,000 new jobs, he stated.

Hyundai tops the checklist with its $21 billion greenback funding in U.S. services, together with a $5.8 billion plant in Louisiana.

Car makers are seemingly among the many industries that may reshore, specialists stated. Trump imposed a 25% tariff on imported automobiles and has additionally vowed to tax key auto elements.

Producers of gas-powered automobiles should weigh their choices, since they have already got a really streamlined provide chain, stated College of Washington’s Kouvelis.

“The gas-powered automobile business is in bother with hard-to-adjust provide chains and never sufficient incentive to do it,” he stated.

Electrical autos are a unique story, as a result of they’ve fewer elements, the battery being a very powerful, so these firms usually tend to shift operations, he stated.

“Everyone understands the U.S. market is profitable to lose, and the opponents with a bonus [such as Chinese companies] kind of are saved out,” Kouvelis stated.

Snyder additionally stated that EVs are amongst these prone to come to the U.S., however as a result of they’ll want extra capability. His thesis is that industries that have to increase — fairly than shut up store out of the country and transfer — would be the ones that return to the U.S. That features industrial tools and semiconductors, he stated.

Whereas semiconductors and prescribed drugs have been exempt from the tariffs, they might nonetheless be focused at a later date. Specialists stated they count on each industries to reshore.

Semiconductor producers bought the motivation to return after Congress handed the CHIPS Act in 2022, which supplied monetary help and tax credit to these constructing and increasing services nationally. The pc and digital merchandise business noticed essentially the most reshoring jobs introduced in 2024, in keeping with the Reshoring Initiative.

“These are excessive tech, high-end expertise and a whole lot of automation. They do not want that many employees,” stated Tang.

With pharma firms, simply among the provide chain could come again, Kouvelis stated.

“The query is, the place are you going to use the tariff? Will you apply to the ultimate or to the chemical substances? As a result of proper now, you need the chemical substances and the energetic components to be sourced from China,” Kouvelis stated.

Formulation and packaging, nevertheless, will be executed within the U.S., if that is sufficient to keep away from tariffs, he stated.

“If you need them to convey all the provide chain, you bought to be very aggressive on the way you apply tariffs on all the things within the provide chain,” Kouvelis stated.

Some pharma firms, together with Eli Lilly and Johnson & Johnson, already started increasing within the U.S. earlier than Trump took workplace.

Get Your Ticket to Professional LIVE

Be part of us on the New York Inventory Alternate!

Unsure markets? Achieve an edge with CNBC Professional LIVE, an unique, inaugural occasion on the historic New York Inventory Alternate.

In as we speak’s dynamic monetary panorama, entry to skilled insights is paramount. As a CNBC Professional subscriber, we invite you to hitch us for our first unique, in-person CNBC Professional LIVE occasion on the iconic NYSE on Thursday, June 12.

Be part of interactive Professional clinics led by our Execs Carter Value, Dan Niles and Dan Ives, with a particular version of Professional Talks with Tom Lee. You may additionally get the chance to community with CNBC specialists, expertise and different Professional subscribers throughout an thrilling cocktail hour on the legendary buying and selling ground. Tickets are restricted!