Boston Globe/Boston Globe via Getty Images

I last wrote about Trulieve (OTCQX:TCNNF) in mid-November, saying it was still a buy. At the time, I owned a very large position in my Beat the American Cannabis Operator Index model portfolio. This past week, I sold a lot of it. I still like it relative to the other MSOs, but I don’t like it so much at this higher price. I have reduced my rating from Buy to Neutral, which I explain in this update.

The Chart

Trulieve is near a one-year-high:

Chales Schwab

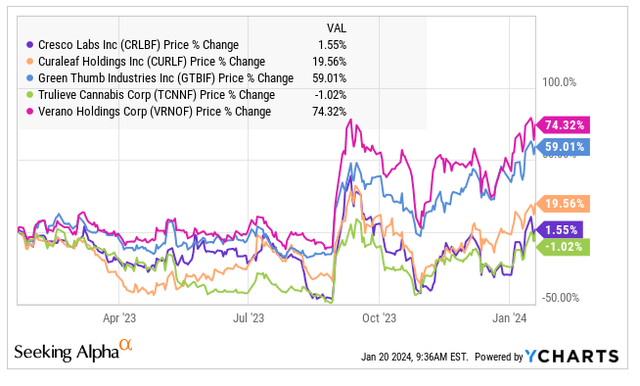

To be near the one-year high isn’t so unusual for MSOs, but the New Cannabis Ventures Global Cannabis Stock Index is nowhere near its one-year-high. It has dropped 15.5% over the past year. Trulieve has done better, dropping just 1%, but it hasn’t done better than the Tier 1 MSOs. In fact, it is the only one to decline:

YCharts

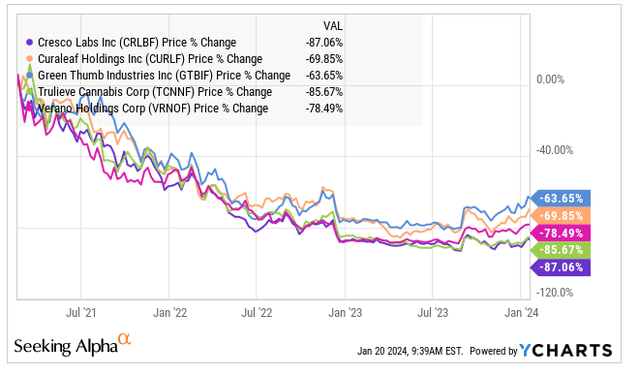

What about a longer time-frame? Since the market peaked, it has fallen about the most. Measured from the end of 2020, Trulieve has dropped 85.7%:

YCharts

Here is the chart since it began trading in 2018:

Charles Schwab

From a technical perspective, I see support near $5 and at $3.50, close to the all-time low set last year. I see resistance at $7.50, which is up only 10.6%.

The Outlook

In the last write-up, I discussed Q3, which was reported on November 9th. The release for Q4 hasn’t yet been scheduled, but it should happen before the end of March.

Analysts were projecting 2024 revenue of $1.114 billion in mid-November. They were projecting then adjusted EBITDA of $313 million. This outlook for flat revenue and 2% higher adjusted EBITDA hasn’t changed. Neither have the estimates for 2025, which I use for my own target projection. Revenue is expected by 5 of the 14 analysts to grow 4% to $1.157 billion, while adjusted EBITDA is expected to increase 2% to $320 million. So, sluggish growth is expected over the next two years.

Trulieve remains highly dependent upon the Florida cannabis market, which is a mature medical-only market currently. In the event the state legalizes for adult-use, it could be good for the company, which is a leader in the number of stores. If it remains medical-only, though, I am concerned. The Florida market is slowing its growth in patients. In the week ended 1/18, the state reported 870,458 patients, and this was up only 10.4% from a year ago. According to BDSA, the state’s cannabis revenue grew just 8.6% from a year earlier in November. Florida has been a great market, but the patient-count is a very high percentage of the population now at 3.8%.

The Valuation

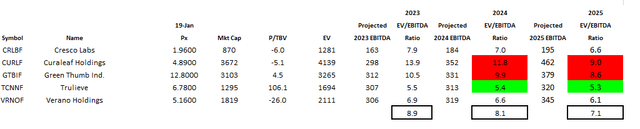

In my view, Trulieve and all of the Tier 1 MSOs are cheap relative to where they have traded historically. The market tends to use enterprise value, which is market cap plus net debt, relative to projected adjusted EBITDA to assess valuation. Here is the current valuations for the top 5 MSOs:

Alan Brochstein using Sentieo

This is more expensive than in mid-November, when it was 4.7X for 2024. Whether 280E goes away or not, the adjusted EBITDAs won’t change, as taxes are not included in adjusted EBITDA. I have written recently about the two expensive ones, Curaleaf (OTCPK:CURLF) and Green Thumb Industries (OTCQX:GTBIF). I have a strong sell on Curaleaf, which is a bad investment. I like GTI better, but it’s not the best way to invest in cannabis. I wrote that Cresco Labs (OTCQX:CRLBF) could be a buy in early October, and I had a big position in both of my model portfolios. Now, I have none. Verano (OTCQX:VRNOF) was bothering me in late July, and I still am not a fan of its valuation. I rated it a sell in late November, suggesting investors avoid it.

A key metric in my view is price to tangible book value, and Trulieve isn’t as bad as its peers, though it’s not as good as GTI. At just $12 million, the Trulieve tangible book value is essentially zero, which is much better than Curaleaf, which is very negative. In the event 280E doesn’t go away, the MSOs will struggle with their debt in my view. Tangible book value can help investors assess downside risk. I also monitor the current ratio, and Curaleaf has higher current liabilities than current assets. Trulieve’s liquidity is better.

In the mid-November piece, I shared a range of targets that depends upon the elimination of 280E or the continuation of it. In the event 280E goes away, my target was $11.31, based on 8X projected adjusted EBITDA for 2025. The negative scenario officered a potential decline to $2.93, a new low. This was based on 3X. I am sticking with these targets for now, which means potential upside of 67% but potential downside of 57%. This is better than its peers, but not great.

Conclusion

I had a buy on Trulieve in mid-November, when it was $5.61. It hasn’t outpaced its peers, but it is higher by 20.9%. I have sells on several of its peers, and I worry about what will happen if rescheduling doesn’t happen precisely. If it takes a long time or goes to Schedule 2 instead of Schedule 3, which would wipe out 280E taxation, MSOs, including Trulieve, will likely decline.

There are some MSOs that I like better right now than Trulieve, but I still own it in my Beat the American Cannabis Operator Index. It is the smallest of the 5 names that I include, currently at 9.2%.

I think that cannabis investors will fare better with some diversification beyond MSOs. My Beat the Global Cannabis Stock Index model portfolio that I share with my investment group has only 11% in MSOs, well below the index at 40%. I am overweight Canadian LPs Organigram (OGI), Village Farms (VFF) and Cronos Group (CRON). My largest holding, OGI, is 20.5% of the model portfolio, and it is up almost 42% year-to-date. I explained why Organigram is my favorite cannabis stock recently.

I have 34% of my model portfolio in ancillaries, which is slightly higher than the index exposure. I have been reducing WM Technology (MAPS) but still have a large position, though it is up 20.7% since I raised it to a strong buy a month ago. My largest ancillary position is now Hydrofarm (HYFM), which I wrote about in September, when it was a bit higher but a strong buy. It was 9.3% of my model portfolio then, and now it is 13.0%.

So, I like TCNNF more than many MSOs, especially the other large ones, but I like some Canadian LPs and ancillary names more. Its future performance is highly dependent upon whether 280E ends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.