Thomas Barwick

Investment Thesis

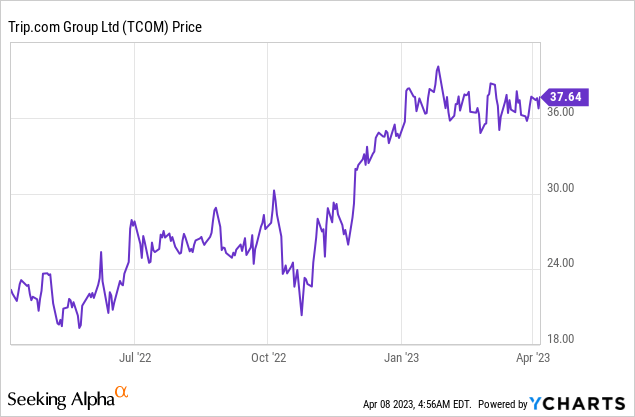

Trip.com Group (NASDAQ:TCOM) has rallied nearly 100% from the bottom in October, as the China reopening news completely changed the sentiment of the travel industry. The company is one of the biggest beneficiaries of this news as China remains by far its largest market. The ongoing recovery of travel volume should continue to be a massive tailwind in the near term.

The momentum is starting to show up in its latest earnings with triple digits growth in China’s outbound bookings. While I do think the company’s near-term outlook is pretty upbeat, the stock price seems to have front run the optimism. The current valuation looks stretched with multiples meaningfully above other traveling peers, which limits the upside potential. Therefore I rate the company as a hold and will wait for pullbacks.

Reopening Tailwinds

Trip.com Group is a China-based online marketplace that provides different travel services through multiple brands including Trip.com, Skyscanner, Ctrip, and Qunar. While both Trip.com and Skyscanner have a strong presence in the international market, the majority of the company’s revenue is still generated in China. This is why I believe the company should benefit substantially from the country reopening, especially in the near term.

The company has been seeing excellent momentum since the reopening announcement last year, thanks to three years of pent-up demand. Domestic travel has been recovering extremely quickly, as limited international flight capacity forced customers to turn to domestic options. Domestic hotel bookings and air bookings have now surpassed pre-pandemic levels.

Outbound travel should be the major growth driver moving forward, as China was the largest outbound travel market in 2019 with over 150 million trips recorded. The demand for outbound travel has been very strong, with bookings increasing over 300% year over year in the first two months of 2023. Outbound bookings have now recovered roughly 40% compared to pre-pandemic levels. Not to mention this is happening when the company is facing a bottleneck due to flight capacity constraints, as the airline industry was caught off guard by the sudden reopening decision. According to the management team, the current flight capacity is only at 15% to 20% of pre-pandemic levels. As flight capacity improves throughout the year, we should see a massive explosion in bookings and revenue.

Jane Sun, CEO, on flight capacity recovery

We anticipate that the aviation industry will set in motion plans to restore flight capacity and that outbound travel will pickup the pace in the coming quarters.

Encouraging Earnings

Trip.com announced its fourth-quarter earnings last month and the results are encouraging. Revenue was RMB 5.03 billion, up 7% YoY (year over year) compared to RMB 4.68 billion. Most of the growth is attributed to transportation ticketing, which increased 45% YoY from RMB 1.52 billion to RMB 2.2 billion, as domestic travel rebounded quickly. This was partially offset by the decline in accommodation reservations, which dropped 12% YoY from RMB 1.92 billion to RMB 1.69 billion. It is worth noting that lockdowns were still active for roughly half of the quarter therefore the results do not reflect the full picture. Bookings were extremely strong due to pent-up demand. China’s outbound air ticket bookings increased by 200% while outbound hotel bookings increased by 140%.

The bottom line also recovered nicely as operating leverage improved. Despite revenue being up, operating expenses still declined 4.7% YoY from RMB 4.27 billion to RMB 4.07 billion. The decline is mainly attributed to S&M (sales and marketing) expenses, which dropped 12% YoY from RMB 1.3 billion to RMB 1.15 billion as organic demand recovered. Product development expenses also dipped 6% YoY from RMB 2.24 billion to RMB 2.1 billion. The lowered spending resulted in the net income flipping from negative RMB (883) million to positive RMB 2.08 billion, or 41.4% of revenue. The diluted EPS was RMB 3.12 compared to RMB (1.29). The company’s balance sheet remains very healthy with $8.6 billion in cash and equivalents and $7.6 billion in debt.

Lofty Valuation

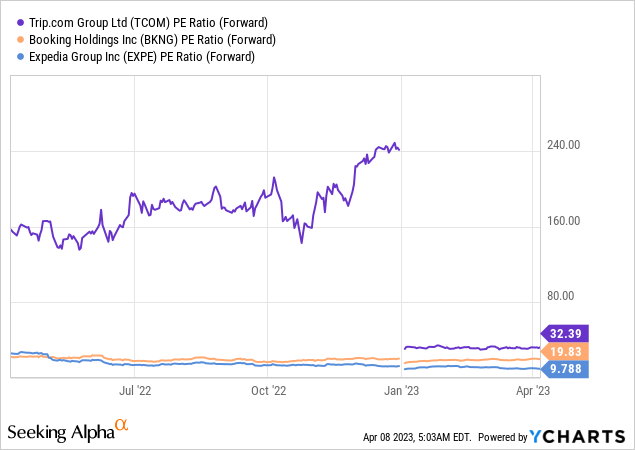

After the massive rally, the company’s valuation looks very lofty. It is currently trading at an fwd PE ratio of 32.4x, which is significantly higher than other online traveling companies such as Booking Holdings (BKNG) and Expedia (EXPE). As shown in the chart below, you can see that the two companies are trading at an fwd PE ratio of just 19.8x and 9.8x, which represent a discount of 38.9% and 70% respectively. While Trip.com’s revenue growth is expected to be much higher in the coming year at 67.3% compared to mid-teens from peers, this will likely normalize in FY24. For instance, Seeking Alpha’s estimate forecasts its growth rate to slow to 22.3% in FY24. I believe the current valuation gap is too big and most optimism should already be priced in.

Investor Takeaway

I believe Trip.com is well-positioned to benefit from the China reopening trend, especially from outbound travel as the segment remains constrained by the limited flight capacity. As the bottleneck eases, earnings should see a further boost upward. However, I do not think the current risk-to-reward ratio is particularly attractive, as the share price has already rallied and most catalysts are likely priced in. Its valuation is also meaningfully above peers and the expectation for the company is much higher now. I believe it would be best to stay on the sidelines and wait for a pullback. Therefore, I rate TCOM stock as a hold.