ipopba/iStock via Getty Images

Investment Rundown

The stock price performance of Trinseo PLC (NYSE:TSE) has been nothing but solid in the last 12 months, down over 63%. The primary cause for this I think has to do with the poor growth prospects of the business in a time when we have higher interest rates, but also the significant amount of losses the company is generating. Last 12 months the net income was a negative $800 million. When the market cap is under $300 million one has to wonder for how long TSE might remain in business if things keep going the way they are right now.

The company had under $300 million in cash last quarter and I think there might be a large amount of dilution in the medium term for shareholders. I covered TSE earlier in 2023, July 18 to be exact. My rating back then was a sell and I am afraid that nothing has changed about my view on the business. There are still some glaring issues that need to be fixed for it ever to receive a better rating I think. In 2024 I think there will be a significant value in holding small caps, but you have to be very selective with these just like large caps. Even though TSE is a small cap, I don’t think it will be a winner and I will stick with my initial rating of a sell here.

Company Segments

TSE functions as a leading specialty material solutions provider with a global presence spanning the United States, Europe, the Asia-Pacific, and other international markets. The company’s operations are organized into six distinct segments: Engineered Materials, Latex Binders, Base Plastics, Polystyrene, Feedstocks, and Americas Styrenics.

Within the Engineered Materials segment, TSE specializes in offering an array of advanced material solutions. These include rigid thermoplastic compounds and blends, as well as soft thermoplastic formulations. The segment also encompasses the production of continuous cast, cell cast, and extruded PMMA sheets. These diverse offerings cater to a range of industries and applications, showcasing TSE’s commitment to providing innovative and customized material solutions to meet the evolving needs of its clientele.

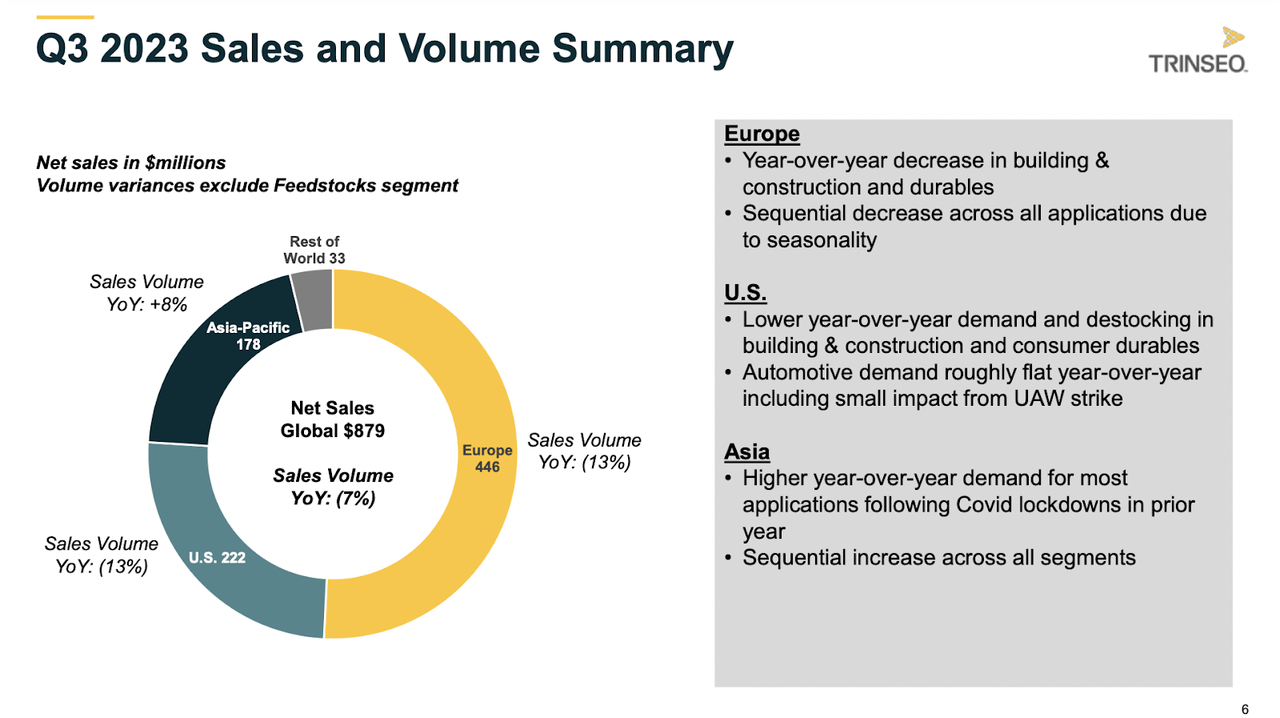

Sales Volumes (Investor Presentation)

Being a global company it also experiences some level of risk associated with regions like China which seems to be cracking down on foreign investments which are making companies look elsewhere. China is a market that is very appealing for TSE but I think changing ways and focusing more on India might be in their favour instead. This country is on the rise and expected to be one of the fastest-growing economies in the next decade.

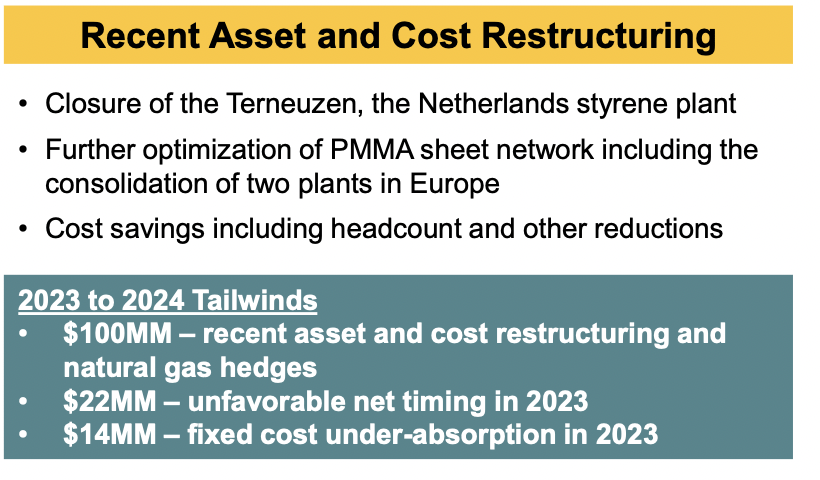

Company Moves (Investor Presentation)

The company has made some asset and cost restructuring which they hope will improve the operations and in turn the margins as well. In their presentation from the last earnings report, they state a few of the tailwinds for the business are natural gas hedges and some fixed cost absorption too. How this will be implemented and benefit the bottom line I think will be left to see, but some proactive moves from the management are a good sign at least.

Earnings Highlights

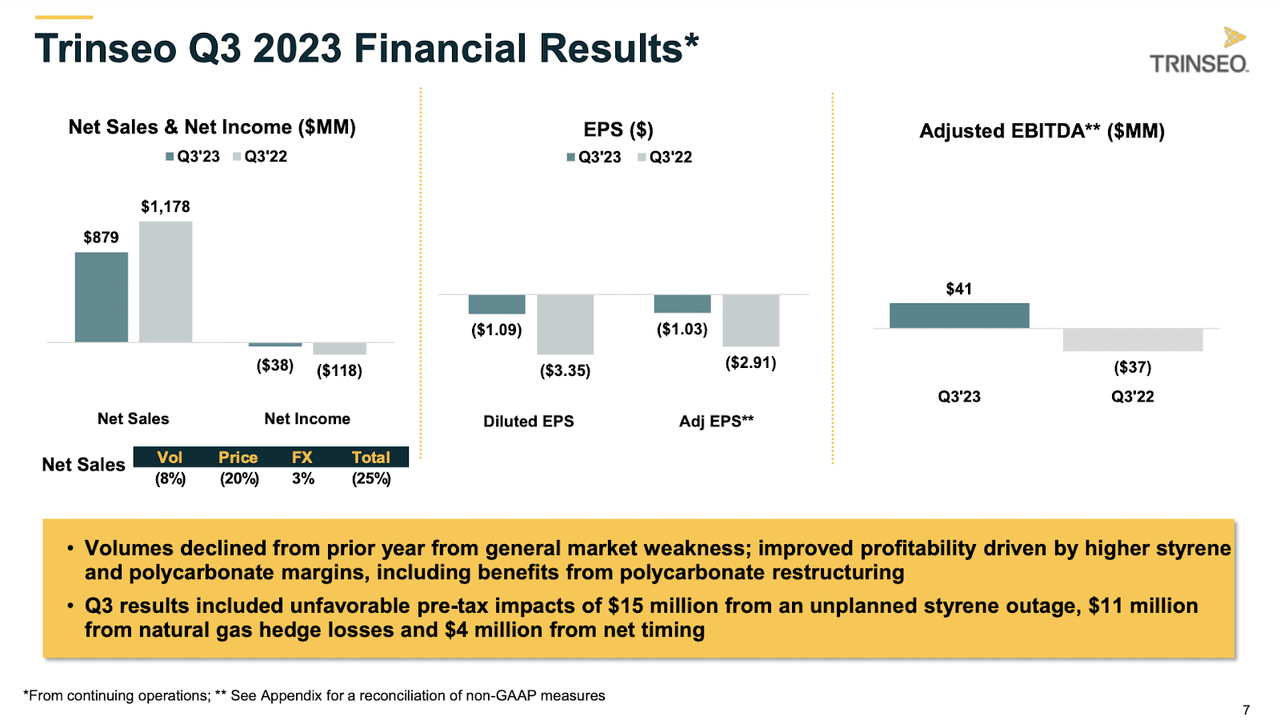

Quarter Results (Investor Presentation)

Let’s take a look at the last earnings report from the company and how they managed to fare. The sales have declined quite significantly YoY. It landed at $879 million for the quarter, down from $1.1 billion. This decline, which has been the theme for most of 2023 for TSE I think is the key factor to the declining stock price. Some key thing to point out though is the improved EPS from last year, which was a negative $3.35, now at negative $1.09 instead. The estimates for EPS are not a lot, but in 2026 it seems TSE would regain its positive bottom line with an EPS of $2.6. This would put it at a FWD p/e of 3.2. Compared to the sector median of 16.6 it leaves a significant factor, but as will be discussed in the risk section of the article, there are some very valid reasons for the poor valuation TSE currently receives.

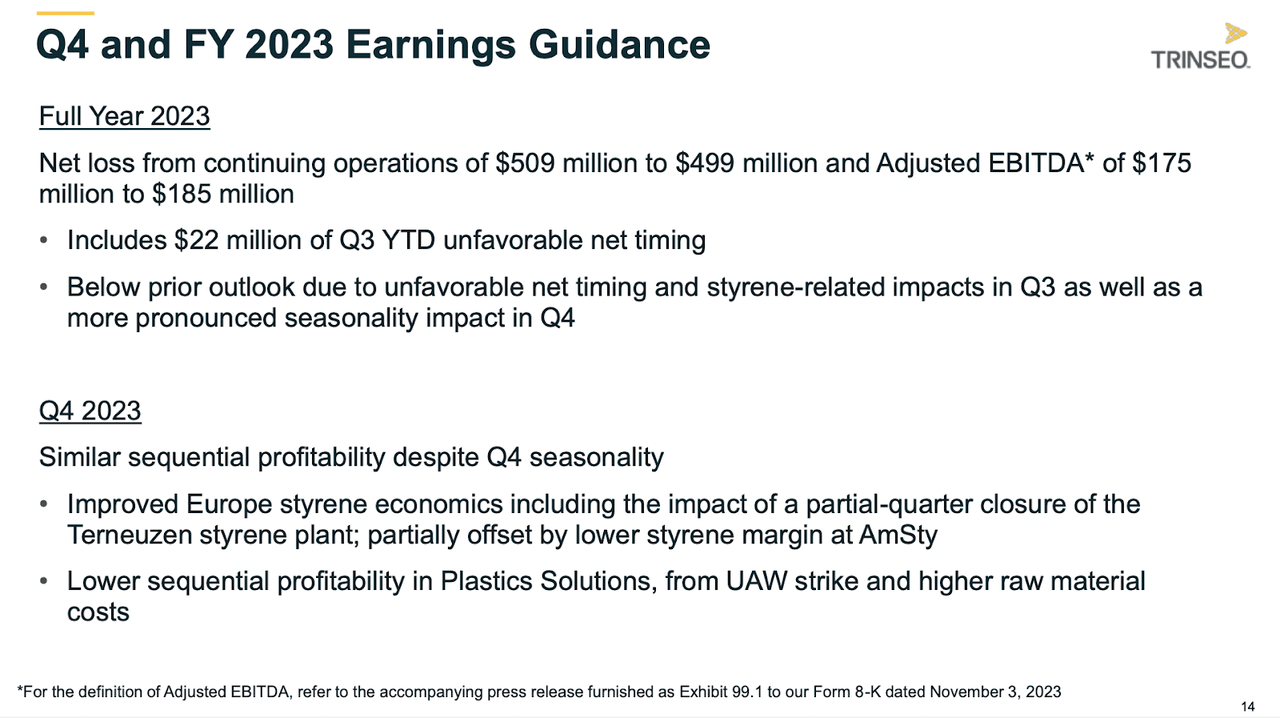

2023 Guidance (Seeking Alpha)

The outlook that was provided didn’t necessarily ensure investors that better times are ahead. The company noted pronounced seasonality impacts in Q4 which will likely result in continued negative earnings I think. Net loss for the full year 2023 is expected to be $509 – $499 million. There is some potential upside for the share price in the short-term I think, which would come from lower seasonality impacts in the fourth quarter of 2023. If that positively impacts the bottom line so TSE posts positive results I think we will see a strong short-term move upwards as the company experienced in mid-2023 when it was briefly mentioned on CNBC.

Risks

A noteworthy challenge for TSE lies in the intricate regulatory landscape within which it operates. Similar to other companies, TSE is subject to a framework of regulations, and any lapses in compliance or violations can result in significant consequences. The company grapples with various regulatory issues that warrant careful consideration. It’s not the first TSE is in trouble with regulators. In late 2022 the company was fined for some malpractises related to purchases of styrene. Europe is a large market and with TSE in conflict with the European Commission is anything but a bullish sign or a tailwind.

One prominent regulatory concern facing TSE is a class action lawsuit that has cast a shadow over its public image. This legal challenge has garnered negative attention in the media, potentially influencing the perception of the company among investors. The fallout from the lawsuit may be a contributing factor to the decline in TSE’s share price over the past 12 months, as investors assess the associated risks. The lawsuit was filed in mid-2023 and seeks to recover losses that occurred as the company misled and didn’t disclose significant portions of the operations. This resulted in some investors being misled and losing money. I think the lawsuit is more a strike on the reputation of TSE and it’s a bit of a hot potato now where I really can’t see any reason for someone to want to get involved. The reputation has been harmed and that will stick with it for a long time I think.

Margin Levels (Seeking Alpha)

Besides the lawsuit against the company, there are also a lot of issues I think with the margins of the company. There has not been a good enough effort to raise margins and generate consistently positive ones either. The lack of margins seems to have been caused by higher interest rates and expenses for TSE now sit at $157 million in that area. But, in the last 12 months, the company has also incurred a $943 million initial items charge which has heavily weighed on the bottom line. Without it, results would have been positive, but I think until we see that clearly in black and white in coming reports, poor sentiment around TSE margins will likely remain I think. Further working on the bottom line was income tax expenses which amounted to $142 million last 12 months.

Final Words

I have covered TSE before and my view of the business back then was pretty poor as it was struggling with positive earnings and bleeding cash as well. This hasn’t changed since then and there haven’t been enough improvements from the management side for me to raise my previous rating. I have laid out some issues that TSE has to attend to before I turn bullish. Until I will be sticking with my sell rating for TSE.