Jeremy Poland

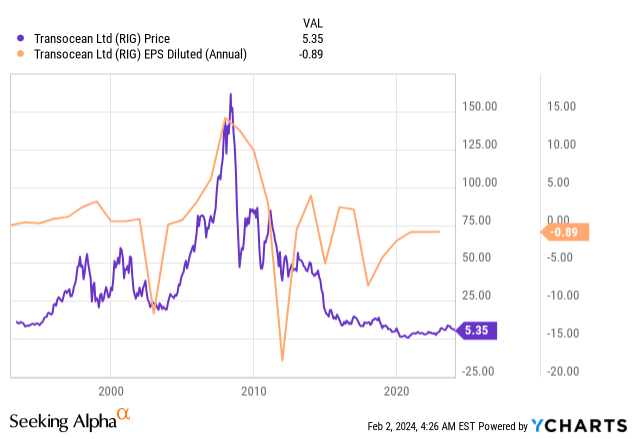

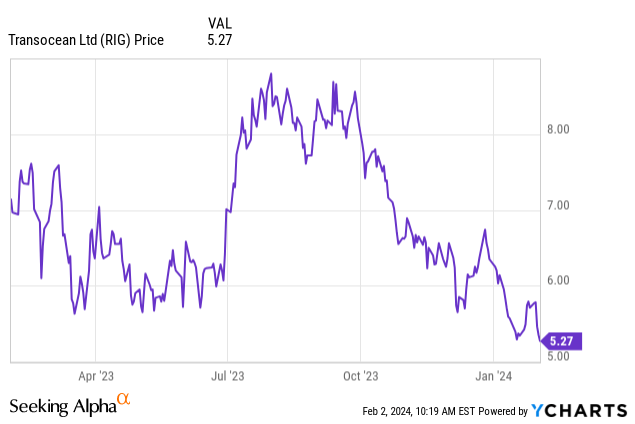

Transocean (NYSE:RIG) stock price has been really struggling in the last couple of months. Despite the Red Sea crisis, oil prices have not exceeded the $100 mark. Brent is just in the $80s as I am writing this. The recent fleet status report and the quarterly earnings results disappointed the market, although these were not all bad news. So, RIG’s stock is trading near 52-week lows. In this article, I will discuss the upside factors, RIG’s valuations, and any key risks surrounding the company.

My previous article

In my previous article, I explained the debt exchange announcement and also commented on the recent quarterly earnings results. I explained why the results were not all bad news: the fact that Transocean’s clients were willing to pay a premium on the company’s services relative to peers, the high utilization ratios, and more possible contract announcements. The debt exchange organized by Transocean did not only lead to share dilution but also to improved financials, including the company’s better cash position. But let us go to bears’ key arguments.

Bears’ key arguments

Amongst the key arguments that most Transocean bears mention are the following:

Challenges with profitability

It has been mentioned many times by different authors here on Seeking Alpha that the recent quarterly earnings were not quite impressive. This would in turn threaten Transocean’s 2024 profitability. But this is not true.

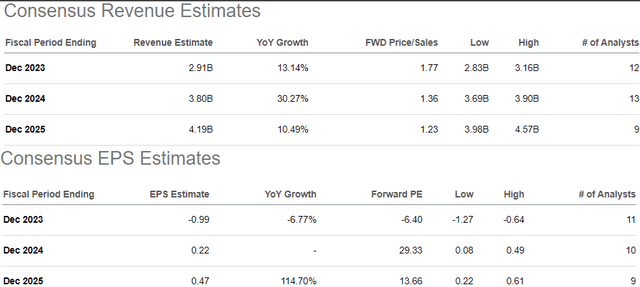

Seeking Alpha

In fact, most analysts expect Transocean to earn $0.22 per share in 2024. Indeed, it does not sound like too much money. But it is really good for a company that has been recording negative earnings for a while.

Moreover, earnings are expected to rise further.

Another argument mentioned by many bears is that Transocean has a heavy debt load. I would not argue with that. But the most important thing is that RIG’s debt is manageable.

The management has substantially improved the company’s liquidity profile. For example, the revolving credit facility was extended to mid-2025. Certain bonds were exchanged as well. Four secured notes with improved amortization worth $1.175 billion were refinanced. $25 million of 2.5% senior guaranteed exchangeable bonds due 2027 were converted into RIG shares. I wrote about Transocean’s debt exchange in my other article. $101 million of the outstanding 2025 and 2029 exchangeable bonds have also been equitized. And the management expects to decrease the debt to approximately $3 billion. The cashflow-producing ability of the company’s current fleet supports long-term company debt of about $4 – $4.5 billion. The stacked rigs are obviously not taken into account. So, if the debt is lower than that, the extra cash flows can easily be shared with the company’s shareholders. Moreover, a fleet of 25 – 30 ultradeepwater rigs requires a breakeven average day rate of $275000 – $300000. Free cash above this level could be used to repay debt.

Even if the company finds it hard to pay interest on its debt (it may only happen in a few years’ time; it is highly unlikely to happen in 2024), its management has already organized many debt exchanges, reducing the debt load and the annual interest paid. So, the debt load is well manageable, given the positive cash flows and the positive net results expected in 2024. Moreover, the offshore sector’s recovery should also make Transocean’s debt sustainable in the years to come.

The question of whether Transocean would reactivate its cold-stacked rigs often gets asked by analysts attending Transocean’s earnings conferences. RIG’s CEO, Jeremy Thigpen, normally says the company would do so only if it is profitable to do so. Many bears say that it will never make economic sense to reactivate rigs. In their opinion, this means Transocean’s potential revenue and profit growth is highly limited. Indeed, if no more rigs get reactivated, then the company will be unable to substantially increase its backlog. Although Transocean’s fleet is the largest in the industry, its utilization is less than 50%. So, most of the fleet is cold-stacked. I agree with the bears that if the oil prices and the offshore sector decline, then there will be no incentive to reactivate the cold-stacked fleet. But in my view, the company’s potential reactivation costs are somewhat exaggerated. In one of the last earnings conferences, Thigpen named a number between $75 million and $125 million. Even if the actual costs are somewhat higher, it will still make economic sense to reactivate rigs if the day rates for deepwater and ultra-deepwater ships move further upward.

Another popular bearish argument is RIG stock’s overvaluation. I will compare Transocean’s valuations to those of its peers in the “Valuation” section of this article. However, right now, Transocean’s stock is lingering near 52-week lows.

So, the overvaluation problem seems to be less of an issue than it used to be at the end of September when the stock was worth almost $9 per share.

Upside factors

The Red Sea crisis seems to be largely underappreciated by the entire oil market. Everyone seems to be concerned with high levels of oil production in the US and many central banks’ rather restrictive policies. Investors are afraid of oil demand destruction due to economic conditions. But it is really premature to say that the oil supply is very secure. For example, it was announced that the US Congress was demanding that Joe Biden strike Iran after three US soldiers were killed in Jordan in a drone strike claimed by the Islamic Resistance in Iraq, a militia group backed by Iran. The point I am making is that the situation is escalating, while many market players are simply ignoring this.

Offshore drilling market’s recovery

Most authors and analysts admit the offshore market is recovering at a fast pace. For example, even the Bank of America predicts the market for offshore drillers is promising much more upside potential than onshore drillers.

New contract announcements

New contract announcements can also obviously push prices upward.

For example, in December, Transocean announced a minimum 540-day contract for the Transocean Barents with OMV Petrom S.A. in the Romanian Black Sea at a rate of $465,000 per day, excluding additional services. The day rate is quite high and proves the offshore sector’s recovery. But more contract awards are likely ahead. Here is what Jeremy Thigpen said during the earnings press conference:

The company is discussing “follow-on work for the Deepwater Atlas upon completion of its current contract.” The management is “already having conversations with numerous customers regarding additional 20-K programs, many of which are not expected to start for up to three years, once again demonstrating” the “customer’s belief in a prolonged upcycle. The Invictus is currently competing for multiple local campaigns, including one that” will most probably “require a high hook load seventh-generation drillships, the available supply of which is very limited.”

In addition, Transocean’s CEO expects Brazil, Africa, the Mediterranean region, and even Australia to provide plenty of contract opportunities for the company.

As I have mentioned above, Transocean has been very creative in retiring its debt. In some cases, it managed to do so without issuing more shares. Ideally, the management aims to decrease its debt to $3 billion. So, it means the debt will get easy service, the profitability will rise, and the company might even share some profits with its shareholders either in dividends or stock buybacks.

Valuations to peers

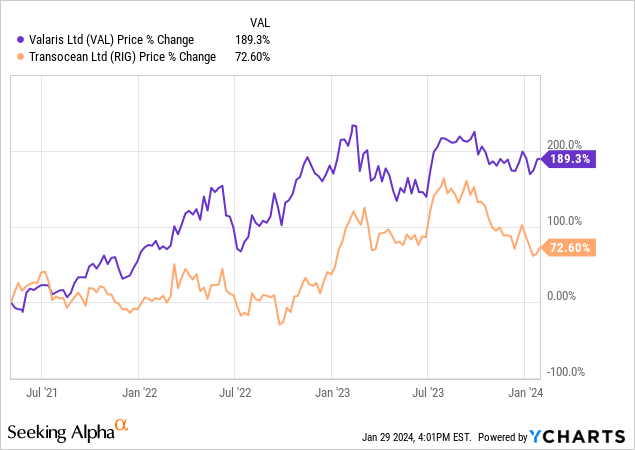

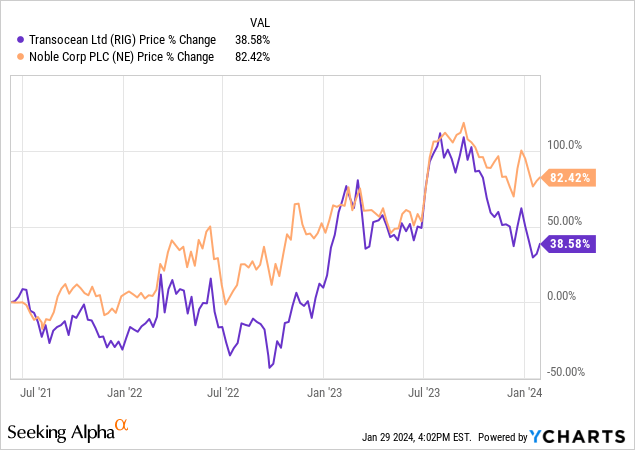

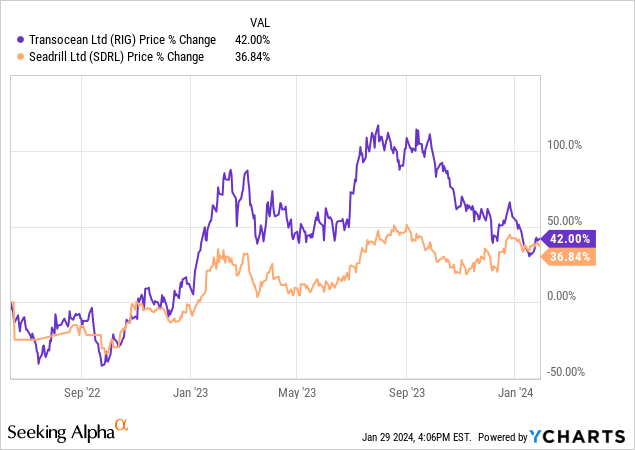

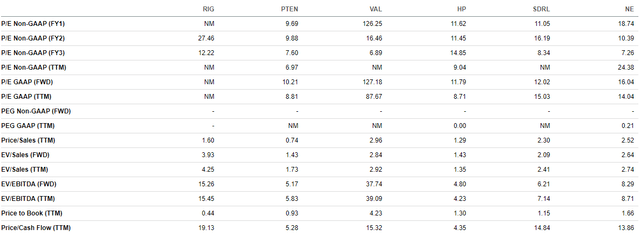

As I have mentioned before, RIG is not very expensive compared to its peers. This is particularly obvious if we compare RIG to Valaris (VAL).

Below, I have inserted diagrams comparing RIG’s stock to those of its peers.

If we look at the company’s valuation multiples and compare those to its peers, we will clearly see that RIG is not profitable now, unlike other companies in the sector. But in some respects, Transocean’s stock is not much more expensive than its competitors. This is especially true of Valaris. RIG is much cheaper than VAL in terms of EV/EBITDA, P/S and P/B. In fact, RIG is cheaper than many of its competitors in terms of P/S due to the fact that it is not profitable right now. However, this too shall pass. As I have mentioned above, the company is expected to earn a positive net income as early as this year.

Seeking Alpha

Indeed, RIG’s stock might not be as cheap as some might want it to be. But it is not particularly overvalued, especially given its leading position as an offshore driller.

Risks

First of all, Transocean is not a cash cow just yet and has some debt to manage. Very conservative investors might prefer to stay away from it and buy companies with an AAA credit rating. But RIG is a very sound bet on the offshore’s recovery. In other words, there are solid gains to be made. Leveraged companies can appreciate much more than those carrying very little debt.

Obviously, the extra debt is an additional risk if the recovery is not as fast as expected. There could be no gains but losses to be made. This is possible if there is a recession risk. Many countries, most notably China, are facing an economic slowdown. But central banks usually intervene when the economic indicators deteriorate significantly. So, it is not impossible that we will avoid a global recession in the next couple of years. Moreover, as many Seeking Alpha analysts have mentioned before, offshore drilling requires long-term investments and reasonably long contract awards. That is why short-term economic fluctuations will likely have no major impact on the future of offshore oil.

Another risk is that of an oversupplied oil market. US onshore drillers seem to ignore the capital discipline and the obvious interests of their stockholders and produce too much oil and gas. OPEC+ members, however, are rather reluctant to oversupply the oil market. So, it is likely there will be some sort of balance here.

Conclusion

Transocean is the leading offshore driller. It has the largest fleet. Although it is a leveraged business, investors can gain a lot, thanks to the fact that RIG’s stock can rise substantially on any piece of good news. Unlike so-called “blue chip stocks,” high-debt companies’ shares can either drop substantially on any bad news or soar on any positive announcements. The company is expected to turn profitable this year and has no significant debt maturities in the near future. RIG is a very good bet for investors betting on offshore oil’s recovery. Finally, the stock is not overvalued compared to peers, especially after the recent price correction.