Josh Hendrickson has a brand new Substack publish that discusses the implications of the US greenback’s function as a world reserve forex. This caught my eye:

When you find yourself taught a typical mannequin of worldwide commerce with versatile change charges, dialogue of the stability of commerce goes one thing like this. If a rustic runs persistent commerce deficits, its forex will start to depreciate. The depreciation of the forex makes overseas items dearer. This tends to scale back imports and push the nation towards balanced commerce. The essential level right here is {that a} typical textbook argument is that versatile change charges alter to the stability of commerce and these changes have a tendency to scale back the commerce deficit and push the nation in direction of balanced commerce.

In contrast, the U.S. runs persistent commerce deficits that don’t self-correct. Actually, many instances, the greenback appreciates whereas the U.S. is operating commerce deficits. How can we clarify this phenomenon?

The explanation that the U.S. is completely different is that the greenback is the first forex utilized in international commerce.

Two feedback:

- The US isn’t completely different.

- Josh Hendrickson ought to get a brand new textbook.

Right here’s the US present account as a share of GDP:

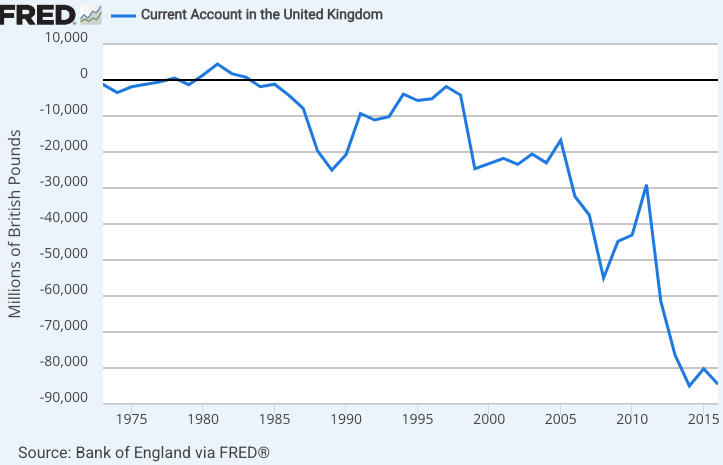

Now let’s have a look at Nice Britain:

Sadly, the British FRED collection ends in 2016 and is in cash phrases, not share of GDP. Nonetheless, one other supply confirms the UK present account deficits have continued at roughly 3% of GDP.

And right here’s New Zealand:

And right here’s Australia:

In equity, a more moderen Fred collection reveals a quick interval of surplus, earlier than returning to deficit in 2024:

Actually, the US is pretty typical of English-speaking international locations that draw a number of immigration—it runs pretty persistent deficits. The outlier is Canada, which ran present account surpluses from 1999-2008, however even they’ve seen present account deficits for the previous 16 years, and 52 of the previous 65 years.

A present account stability merely displays the distinction between saving and funding; there’s no motive why it can’t proceed indefinitely. It might be related to extreme borrowing, particularly extreme authorities borrowing, however that isn’t all the time the case. (Australia tends to have small funds deficits.)

The US present account deficits are most likely brought on by the identical kind of components that designate present account deficits in different English-speaking international locations: low saving charges, extremely productive capital investments and excessive charges of immigration. I see no proof that the greenback’s function as a reserve forex performs a lot of a task, except you imagine that the New Zealand greenback can be an vital reserve forex.

Hendrickson continues:

The brief reply is that different international locations should be web importers of {dollars} and subsequently web exporters to the U.S.

What this suggests is that the U.S. should run persistent commerce deficits with the remainder of the world to be able to present the world with {dollars}.

This isn’t correct. A present account deficit will not be a web circulation of {dollars}; it’s a web circulation of property. We may pay for imports by promoting actual property or equities or junk bonds. A overseas nation may accumulate US greenback reserves (Treasuries) by promoting property like shares or actual property or overseas authorities bonds.

The US present account deficit displays the discrepancy between home saving and home funding. The US will not be “compelled” to run a deficit, even with the greenback serving as a world reserve forex.

I don’t fear about present account deficits, but when the Trump administration needs to deal with the difficulty then they need to think about decreasing the federal government funds deficit (which is damaging saving.) As a substitute, they’re planning to enact a large tax reduce. A recession may also scale back the present account deficit, by decreasing home funding.

PS. I’m not sure why Australia’s present account has just lately change into extra optimistic; maybe it displays a cultural change related to in depth immigration from (excessive saving) Asian nations. However that doesn’t clarify Canada.