Hans-Peter Merten

The Tortoise Energy and Power Infrastructure Fund (NYSE:TPZ) is a closed-end fund, or CEF. It could be employed by traders who’re in search of to acquire some publicity to utilities and midstream vitality corporations whereas nonetheless incomes a reasonably excessive stage of present revenue. The fund definitely does fairly properly by way of offering traders with a gorgeous yield, as its 7.33% present yield is a bit larger than a lot of its friends possess:

Fund Identify | Morningstar Classification | Present Yield |

Tortoise Energy and Power Infrastructure Fund | Hybrid-U.S. Allocation | 7.33% |

Allspring Utilities and Excessive Earnings Fund (ERH) | Hybrid-U.S. Allocation | 7.17% |

Franklin Common Belief (FT) | Hybrid-U.S. Allocation | 7.22% |

John Hancock Tax-Advantaged Dividend Earnings Fund (HTD) | Hybrid-U.S. Allocation | 7.83% |

Tri-Continental Corp. (TY) | Hybrid-U.S. Allocation | 3.78% |

Duff & Phelps Utility and Infrastructure Fund (DPG) | Fairness-Sector Fairness | 7.98% |

As we will see, the Tortoise Energy and Power Infrastructure Fund boasts a yield that could be very aggressive with its friends. The fund, admittedly, doesn’t boast the best yield out of its peer group, however we’d probably not need it to since outsized yields sometimes imply that the market perceives a danger of a near-term reduce. This fund’s yield is above the median stage, although, in order that ought to be enticing to income-focused traders.

The Tortoise Energy and Power Infrastructure Fund is a bit completely different from another members of the Tortoise household of funds. Specifically, this one claims to give attention to utilities moderately than pipeline corporations. The fund particularly states that it’s going to put money into renewable vitality corporations, however it isn’t a renewable vitality fund, strictly talking. It additionally invests in additional than simply equities, as fixed-income securities comprise a not-insignificant proportion of its portfolio. It will have a noticeable impression on the fund’s efficiency available in the market and, sadly, might cut back its capacity to guard traders in opposition to the inflationary pressures that might simply stay sticky going ahead. I defined the reasoning behind this declare in a latest article:

One of many good issues about this fund is that it invests in fairness securities, so it supplies a specific amount of safety in opposition to inflation, which can be a much bigger drawback going ahead than it has been prior to now. In spite of everything, the projections for big fiscal deficits going ahead are well-known, and it’s tough to see any method for these deficits to be funded other than the creation of recent forex. Traditionally, equities, actual property, and gold have been the perfect methods to protect the buying energy of your cash in opposition to inflation.

Yesterday, economist Daniel Lacalle printed an article on his web site that additionally claimed that traders are frightened concerning the inflation that can inevitably be brought on by giant fiscal deficits going ahead. Thus, I’m not alone on this perception. We’ll subsequently need to pay particular consideration to the asset allocation of the Tortoise Energy and Power Infrastructure Fund over the rest of this text. That is to find out how properly the fund ought to have the ability to defend in opposition to the ravages of inflation.

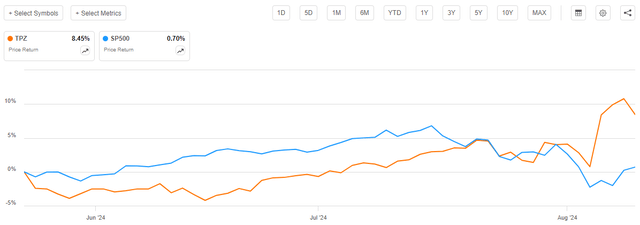

As common readers would possibly bear in mind, I beforehand mentioned the Tortoise Energy and Power Infrastructure Fund in the midst of Might of this 12 months. The fairness markets since that point have usually been fairly robust, though they’ve been weakening since late July. Nonetheless, the earlier power was such that we will most likely assume that the fund has delivered a reasonably enticing return.

That is certainly the case, as shares of the Tortoise Energy and Power Infrastructure Fund have appreciated by 8.45% since my earlier article was printed:

Looking for Alpha

As we will instantly see, this fund outperformed the S&P 500 Index (SP500) by a substantial margin. This alone is stunning for just a few causes. First, utilities and midstream corporations have principally lagged the broader S&P 500 Index for many of the previous fifteen years. Secondly, Tortoise funds specifically should not extremely popular with traders, so it appears moderately unlikely that giant numbers of individuals would all of the sudden flee to it in a flight to security. However, that seems to be what occurred as shares of the fund spiked on August 6 after which proceeded to rise over the subsequent two days regardless of the broader market weak spot.

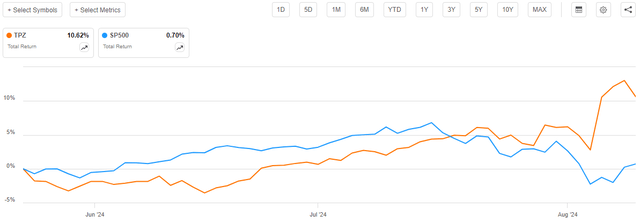

The truth that this fund has outperformed the S&P 500 Index over the previous three months has undoubtedly been a supply of pleasure for many traders. Nonetheless, traders on this fund have truly performed fairly a bit higher than the above chart suggests. As I acknowledged in my earlier article on this fund:

A easy take a look at a closed-end fund’s value efficiency doesn’t essentially present an correct image of how traders within the fund did throughout a given interval. It is because these funds are likely to pay out all of their internet funding income to the shareholders, moderately than counting on the capital appreciation of their share value to offer a return. That is the explanation why the yields of those funds are typically a lot larger than the yield of index funds or most different market property.

Once we embody the distributions paid out by the Tortoise Energy and Power Infrastructure Fund over the previous three months, we get this different chart:

Looking for Alpha

This makes the fund look even higher than the earlier chart did. As we will clearly see, traders on this fund have benefited from a ten.62% complete return over the interval. In the meantime, the S&P 500 Index has been virtually flat (up a meager 0.70%). This alone would possibly make the fund significantly interesting to any potential investor, not solely those that are in search of to earn a excessive stage of revenue from their property.

Naturally, although, a fund’s previous efficiency isn’t any assure of its future outcomes. This fund underperformed the index by a big diploma over the previous ten years, in any case:

Looking for Alpha

As such, we must always check out its present positioning and its property to make an clever dedication of the place it is perhaps sooner or later. In spite of everything, its future efficiency is way more related than its previous efficiency for anybody who’s contemplating buying the fund immediately.

About The Fund

Based on the fund’s web site, the Tortoise Energy and Power Infrastructure Fund has the first goal of offering its traders with a excessive stage of present revenue. This appears a bit unusual for an fairness fund, because of the easy truth that almost all equities don’t ship a lot in the way in which of dividend or distribution yields. Grasp restricted partnerships and pipelines are an exception, although, as most of those corporations boast yields exceeding 5%. That’s truly a greater yield than some long-dated bonds possess proper now.

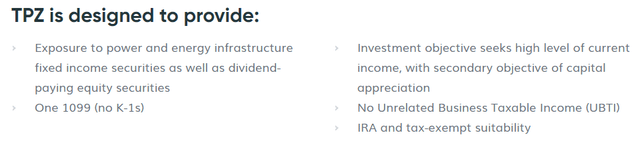

The web site, surprisingly, appears to recommend that the Tortoise Energy and Power Infrastructure Fund invests primarily in fixed-income securities. Please take a look at the primary bullet level (screenshotted from the web site):

Tortoise EcoFin

The primary bullet level reads:

[The fund] supplies publicity to energy and vitality infrastructure fastened revenue securities in addition to dividend-paying fairness securities.

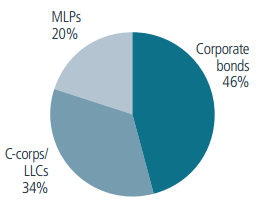

The way in which during which that’s phrased means that fixed-income securities take precedence within the fund’s portfolio, and dividend-paying widespread equities are an afterthought. The fund’s semi-annual report disagrees with this evaluation, because it supplies the next asset allocation:

Asset Kind | % of Internet Property |

Company Bonds | 56.2% |

Frequent Shares | 41.0% |

Grasp Restricted Partnerships | 24.7% |

Cash Market Funds | 0.4% |

There are 5 grasp restricted partnerships whose securities are listed within the fund’s Schedule of Investments: Western Midstream Companions (WES), Power Switch (ET), Enterprise Merchandise Companions (EPD), MPLX (MPLX), and Sunoco (SUN). In all of those instances, the fund is holding the widespread fairness items. Thus, each the widespread inventory allocation and the grasp restricted partnership allocation include widespread equities. This offers the fund the next weighting to widespread fairness than to fixed-income securities:

Fund Semi-Annual Report

Thus, whereas the outline on the web site appears to suggest that the fund’s administration is extra excited by investing in fixed-income securities than in fairness securities, this doesn’t truly look like the case proper now. The assertion that I made within the introduction concerning the Tortoise Energy and Power Infrastructure Fund providing some safety in opposition to inflation subsequently seems to be appropriate. Nonetheless, you will need to notice that many of the different Tortoise funds do higher than this one on this respect, as many of the others are virtually solely invested in fairness securities. Thus, this fund most likely is not going to be nearly as good at offering inflation safety as the opposite funds from this fund home, however on the similar time the bonds ought to cut back its volatility in comparison with different choices.

The fund’s semi-annual report is dated Might 31, 2024, so it’s a cheap assumption that the fund’s portfolio nonetheless appears fairly just like what the report reveals. The fund’s semi-annual report additionally reveals a ten.24% annualized portfolio turnover price for the primary six months of the present fiscal 12 months. This provides additional confidence that the fund’s portfolio appears very related in composition immediately because it did on the cut-off date of the report. In spite of everything, that could be a very low turnover, so it appears unlikely that the fund might have modified a lot.

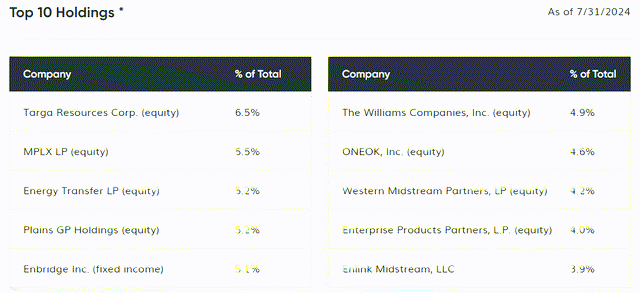

Listed here are the biggest positions within the fund’s portfolio as of the time of writing:

Tortoise EcoFin

All of those are midstream corporations, which is probably a bit stunning. In spite of everything, the fund’s prospectus explicitly states that the fund invests in each utilities and renewable vitality corporations. From the prospectus (emphasis mine):

We search to offer stockholders with a car to put money into a portfolio consisting primarily of securities issued by energy and vitality infrastructure corporations. The securities during which we’ll make investments embody income-producing fastened revenue and fairness securities. Underneath regular circumstances, we plan to speculate at the least 80% of our complete property in securities of corporations that derive greater than 50% of their income from energy or vitality infrastructure operations. Energy infrastructure operations use asset programs to offer electrical energy technology (together with renewable vitality), transmission, and distribution. Power infrastructure operations use a community of pipeline property to move, retailer, collect and/or course of crude oil, refined petroleum merchandise, pure fuel or pure fuel liquids.

The prospectus’s definition of an influence infrastructure operation is mainly an electrical utility. Nonetheless, we don’t see any of those corporations within the fund’s largest positions proper now. That’s fairly stunning because it at the moment seems that the fund is neglecting half of its funding mandate.

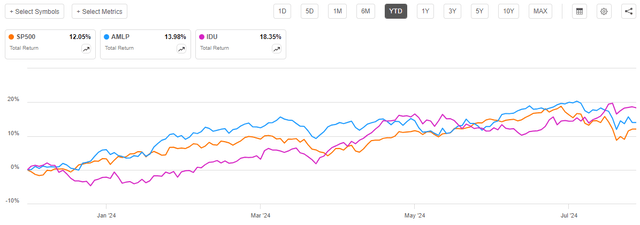

That is maybe much more stunning on condition that utilities have outperformed midstream corporations year-to-date. This chart supplies the year-to-date complete returns of the S&P 500 Index, the U.S. Utilities Index (IDU), and the Alerian MLP Index (AMLP), the latter of which primarily tracks midstream partnerships:

Looking for Alpha

As we will see, utilities have been the highest performers of the group up to now this 12 months. Thus, the fund would most likely have been higher off shopping for electrical utilities moderately than loading up on midstream. Whereas it’s true that midstream corporations have considerably larger yields than most utilities, the chart above truly takes the distributions into consideration. The truth that the fund is closely weighted to midstream corporations would possibly give it the next stage of revenue than it might have had if it had overweighted utilities, although. It needed to sacrifice complete return to get that larger stage of revenue.

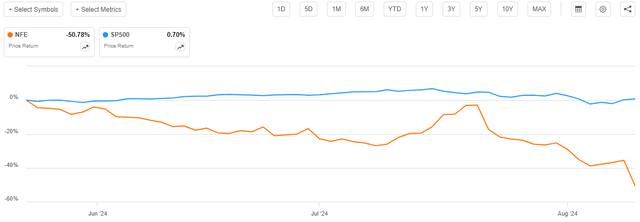

There has solely been one important change to the fund’s largest positions checklist because the final time that we mentioned this fund. That is that New Fortress Power (NFE) was faraway from its former place among the many largest positions within the fund. As a replacement, we now have EnLink Midstream (ENLC). As readers would possibly anticipate, I moderately like this modification, as I used to be pretty harsh on New Fortress Power in my final article on this fund.

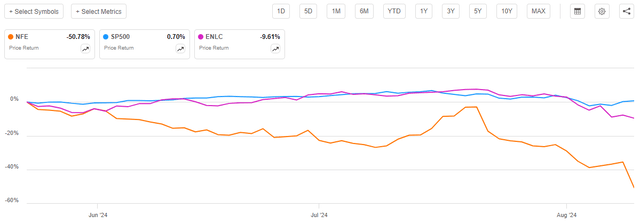

New Fortress Power has solely continued to deteriorate since that earlier article was printed. As we will see right here, the corporate’s widespread inventory has declined by 50.78% because the earlier article was printed:

Looking for Alpha

That’s clearly nothing that we need to see with an organization held by a fund that we’re invested in. Admittedly, the Tortoise Energy and Power Infrastructure Fund was holding New Fortress Power’s bonds and never its widespread inventory. Nonetheless, one can not assist however marvel concerning the security of the bonds when the widespread inventory will get reduce in half over a three-month interval. This kind of decline solely occurs when there may be some actual bother on the firm.

EnLink Midstream, alternatively, was one thing of a capital markets darling final 12 months as a consequence of excessive expectations surrounding its carbon seize expertise. I mentioned this in a earlier article on that firm. Whereas that thesis does nonetheless maintain true, the corporate’s unit value did get reasonably forward of itself throughout the mania final 12 months and the corporate’s membership items are down barely year-to-date. Nonetheless, over the three-month interval since we final mentioned this fund, it did outperform New Fortress Power:

Looking for Alpha

Total, I think that EnLink Midstream shall be a greater funding than New Fortress Power going ahead, even when its value is below stress now that some hype over its carbon seize expertise has worn off. The fund definitely made the best selection, swapping the New Fortress Power bonds for EnLink’s widespread fairness.

Leverage

As is the case with most closed-end funds, the Tortoise Energy and Power Infrastructure Fund employs leverage as a technique of boosting the efficient yield and complete return of its portfolio. I defined how this works in my earlier article on this fund:

Briefly, the fund is borrowing cash and utilizing that borrowed cash to buy widespread equities and fixed-income securities issued by corporations which might be engaged within the vitality infrastructure area. So long as the full return that the fund earns from the bought property is larger than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly properly to spice up the efficient yield of the portfolio. This fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges. As such, this can usually be the case.

Nonetheless, using debt on this style is a double-edged sword. It is because leverage boosts each positive factors and losses. As such, we need to make sure that the fund is just not using an excessive amount of leverage as a result of that will expose us to an extreme quantity of danger. I usually desire {that a} fund’s leverage be lower than a 3rd as a proportion of its property because of this.

As of the time of writing, the Tortoise Energy and Power Infrastructure Fund has leveraged property comprising 18.90% of its total portfolio. It is a very slight improve over the 18.80% leverage that the fund had the final time that we mentioned it, which is moderately complicated. The fund has delivered a robust share value efficiency over the interval, so we’d logically assume that its leverage has gone down.

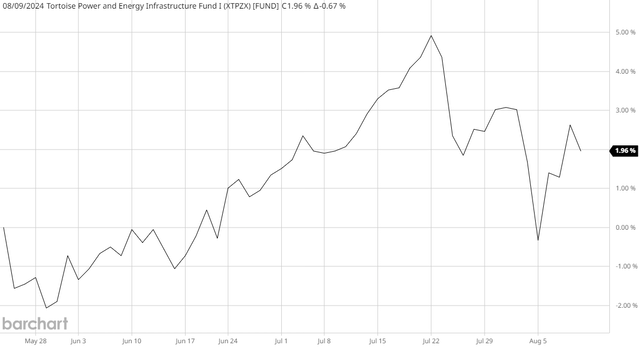

Nonetheless, the fund’s portfolio has not come anyplace near matching its share value efficiency over the interval. This chart reveals the fund’s internet asset worth from Might 22, 2024 (the publication date of my earlier article on this fund) till immediately:

Barchart

As we will see, the fund’s portfolio solely elevated in dimension by 1.96% over the interval, which is considerably lower than the fund’s share value improve. That has a reasonably important impression on the fund’s valuation, which we’ll talk about later on this article.

It’s nonetheless considerably stunning that the fund’s leverage elevated together with its internet asset worth. In actual fact, the one attainable method for this to happen is that if the fund borrowed some extra money, successfully attempting to make the most of the power that existed available in the market throughout components of this era. That is one thing that may fear some potential traders, given the historical past of a few of this fund supervisor’s different leveraged vitality infrastructure funds.

Nonetheless, the Tortoise Energy and Power Infrastructure Fund nonetheless has a considerably decrease stage of leverage than the one-third most that we sometimes deem to be acceptable for a closed-end fund. That doesn’t essentially imply that the fund’s leverage is acceptable for the fund’s technique, although, so allow us to evaluate it to its friends:

Fund Identify | Leverage Ratio |

Tortoise Energy and Power Infrastructure Fund | 18.90% |

Allspring Utilities and Excessive Earnings Fund | 23.10% |

Franklin Common Belief | 23.63% |

John Hancock Tax-Advantaged Dividend Earnings Fund | 34.90% |

Tri-Continental Corp. | 2.00% |

Duff & Phelps Utility and Infrastructure Fund | 27.95% |

(All figures from CEF Knowledge.)

As we will see, the Tortoise Energy and Power Infrastructure Fund employs a decrease stage of leverage than most of its friends. It is a good signal because it means that the fund is just not excessively leveraged given its specific technique. We should always not want to fret an excessive amount of about this fund proper now, at the least so far as the risk-reward trade-off concerning its leverage is anxious.

Distribution Evaluation

The first goal of the Tortoise Energy and Power Infrastructure Fund is to offer its traders with a excessive stage of present revenue. In accordance with this goal, the fund pays a month-to-month distribution of $0.1050 per share ($1.26 per share yearly). This offers the fund’s shares a 7.33% yield on the present value, which usually compares fairly properly with its friends.

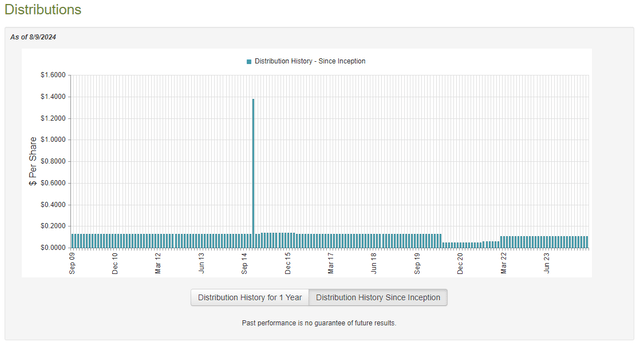

Sadly, this fund has not been particularly constant concerning its distribution through the years, nevertheless it has definitely performed higher than most vitality infrastructure funds:

CEF Join

As I acknowledged in my earlier article on this fund:

We are able to see a big distribution in the reduction of in 2020. Most funds that had investments in vitality infrastructure did as properly, although. The fund has since been capable of principally restore its distribution, though it’s nonetheless properly beneath the $0.1250 month-to-month that it had earlier than the pandemic.

As of the time of writing, the latest monetary report that’s accessible for the Tortoise Energy and Power Infrastructure Fund is the semi-annual report for the six-month interval that ended on Might 31, 2024. A hyperlink to this doc was supplied earlier on this article. As it is a newer doc than the one we had after we final mentioned this fund, it ought to work fairly properly to offer an replace on the fund’s efficiency and talent to maintain its distribution.

For the six-month interval that ended on Might 31, 2024, the Tortoise Energy and Power Infrastructure Fund obtained $2,070,770 in dividends and distributions together with $1,699,217 in curiosity from the property in its portfolio. As is often the case with funds like this, a few of this cash got here from grasp restricted partnerships and so is just not thought of to be funding revenue for tax functions. Subsequently, the fund solely reported a complete funding revenue of $2,555,628 for the six-month interval. The fund paid its bills out of this quantity, which left it with $954,388 accessible for shareholders. This was not enough to cowl the $3,710,805 that the fund paid out in distributions throughout the interval.

Happily, this fund was capable of make up the distinction by capital positive factors. For the six-month interval that ended on Might 31, 2024, the Tortoise Energy and Power Infrastructure Fund reported internet realized losses of $192,759 however was capable of greater than offset this with $11,756,303 in internet unrealized positive factors. Total, the fund’s internet property elevated by $8,807,127 after accounting for all inflows and outflows throughout the interval.

Thus, we will see that the Tortoise Energy and Power Infrastructure Fund did technically handle to cowl its distributions throughout the interval, though it needed to depend on unrealized capital positive factors to do it. This isn’t essentially an issue so long as the market doesn’t appropriate and erases these positive factors earlier than the fund manages to understand them. Nonetheless, the truth that this fund has a big allocation to company bonds does give it a bonus within the occasion of a correction. The most important driver of a market decline could be if america falls right into a recession that forces down company income. In such a situation, the Federal Reserve will virtually definitely cut back rates of interest in an try to restart financial development. That may improve the worth of the bonds within the fund’s portfolio. Thus, this fund has what quantities to a built-in hedge in opposition to a recession-driven market correction. As such, we most likely haven’t any actual purpose to fret a few distribution reduce proper now. This fund appears to be in good monetary form.

Valuation

Shares of the Tortoise Energy and Power Infrastructure Fund are at the moment buying and selling at a 5.21% low cost to internet asset worth. That is considerably pricier than the ten.55% low cost that the shares have averaged over the previous month. Thus, the present value seems to be a bit costly, and it may very well be attainable to acquire a greater value by ready for a short time for the low cost to enhance.

Nonetheless, this fund remains to be buying and selling discounted, so anybody shopping for immediately will mainly be getting the fund’s property for lower than they’re truly value.

Conclusion

In conclusion, the Tortoise Energy and Power Infrastructure Fund is a reasonably distinctive vitality infrastructure fund in that it maintains a steadiness between fixed-income and fairness securities. This could cut back the fund’s volatility considerably in comparison with an fairness fund, and it might even give it a bonus over its friends if america falls right into a recession within the close to future. The fund’s portfolio seems to be neglecting utilities, although, so that may cut back its attraction to some potential traders. Total, although, this does appear to be an honest approach to get a 7.33% yield immediately.