Some of the world’s biggest companies are facing multibillion-dollar writedowns on recent acquisitions as a wave of dealmaking gives way to a new era of economic uncertainty and higher interest rates.

With a third of the global economy forecast to be in recession this year, world leaders will this week gather in Davos, Switzerland, to discuss what the World Economic Forum has called a “polycrisis” as business leaders engage in a painful reckoning over their empire building.

US media and healthcare companies are among those to have slashed the value of business units in the past few months and accountants are warning that more cuts could be imminent as the annual reporting season gets under way.

Companies are required to assess the carrying value of intangible assets at least once a year, using assumptions about future cash flows and comparisons to stock market valuations, which fell sharply in 2022.

With higher costs owing to inflation and a weaker outlook for demand, many recently acquired businesses may struggle to justify their valuations, even before factoring in higher interest rates, which further reduce the present value of future cash flows.

“It’s a pretty deadly combination,” said Jasmeet Singh Marwah, managing director at Stout, a valuation services company. “For many businesses . . . they made the acquisition and the performance has not been at par with what they expected or budgeted for.”

Global dealmaking hit a record $5.7tn in 2021, but slowed sharply as 2022 progressed. According to Refinitiv, $1.4tn of transactions were agreed in the second half of last year compared with $2.2tn in the first, marking the biggest swing from one six-month period to the next since records began in 1980.

The premium paid for an acquisition over the value of its net assets is called goodwill and is recorded on the acquirer’s balance sheet. Goodwill writedowns grew in size in the US last year, to the point where they were occasionally big enough to wipe out a company’s profits in the quarter in which they were recorded.

The 10 largest goodwill writedowns at S&P 500 companies in 2022 totalled $35.4bn, according to data gathered by consultancy Kroll, compared with $6.1bn in 2021.

Launching a bid to join the Disney board this week, investor Nelson Peltz highlighted the around $50bn in goodwill on Disney’s balance sheet attributable to the acquisition of Fox, which he predicted would have to be largely written down.

Business and political leaders in Davos for the WEF’s first winter meeting since before the coronavirus pandemic confront a vastly different landscape to three years ago.

Ahead of the meeting, the WEF’s annual risk report warned of a “polycrisis” as the soaring cost of living and an economic downturn combine with continued failures to tackle inequality and climate change.

Kristalina Georgieva, the IMF’s managing director, who will be in Davos to present the fund’s latest economic outlook, predicted earlier this month that one-third of the world economy will be in recession this year, including half the EU.

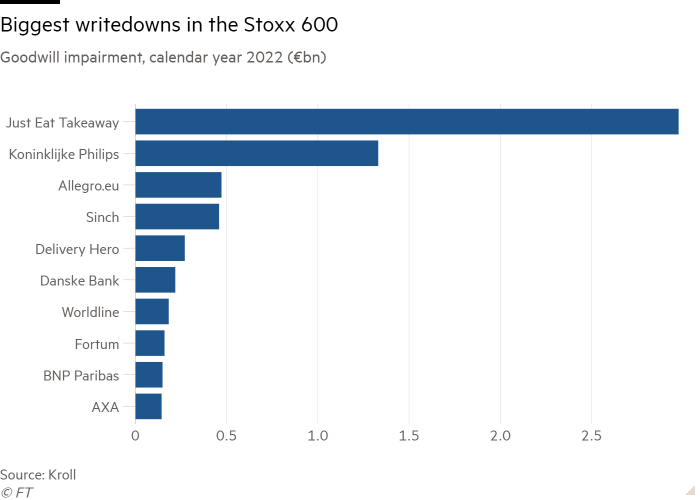

The size of goodwill writedowns in Europe has not so far risen. The 10 largest in the Stoxx 600 totalled €6.4bn last year, according to Kroll, down from €17bn in 2021.

European companies have later financial year-ends and less frequent reporting, said Carla Nunes, a Kroll managing director, suggesting that more goodwill impairments could come in the spring.

Dan Langlois, partner at KPMG, said recent acquisitions could be vulnerable to writedowns even if they are currently performing to plan.

“When you factor in cost inflation that maybe wasn’t anticipated, when you factor in higher interest rates, which drive up the rate you might use in a discounted cash flow analysis, and then factor in some of the uncertainties associated with a potential recession, those things in totality will influence fair value,” he said.

In October, Comcast reported a more-than-$8bn writedown of the broadcaster Sky, which it acquired in 2018, citing challenging economic conditions in the UK and other European markets and plunging the media group into a $4.6bn quarterly loss.

Earlier last year, Teladoc Health, which acquired virtual care provider Livongo for $13.9bn in 2020, recorded two consecutive quarters of writedowns totalling close to $10bn.

While companies are required to subtract goodwill writedowns from their profit, many exclude them from the “adjusted” numbers they highlight in earnings reports.

That does not mean investors should ignore them, said David Zion, founder of Zion Research.

When a company cuts the value of its assets, its debt to equity ratio goes up, which in turn increases the risk of breaching covenants on its debt, he said. It can also flatter future returns.

“Management will tell you it’s non-cash, it’s one-time, don’t worry about it. Don’t forget that, when return on assets is so good two years down the line, that is because they took a giant impairment.”

Kroll’s Nunes added that goodwill impairments provide a readout on the quality of a company’s dealmaking. “You can tell if you are getting a return on your investment,” she said, “or if the buyer may be overpaying for these businesses.”