Lari Bat

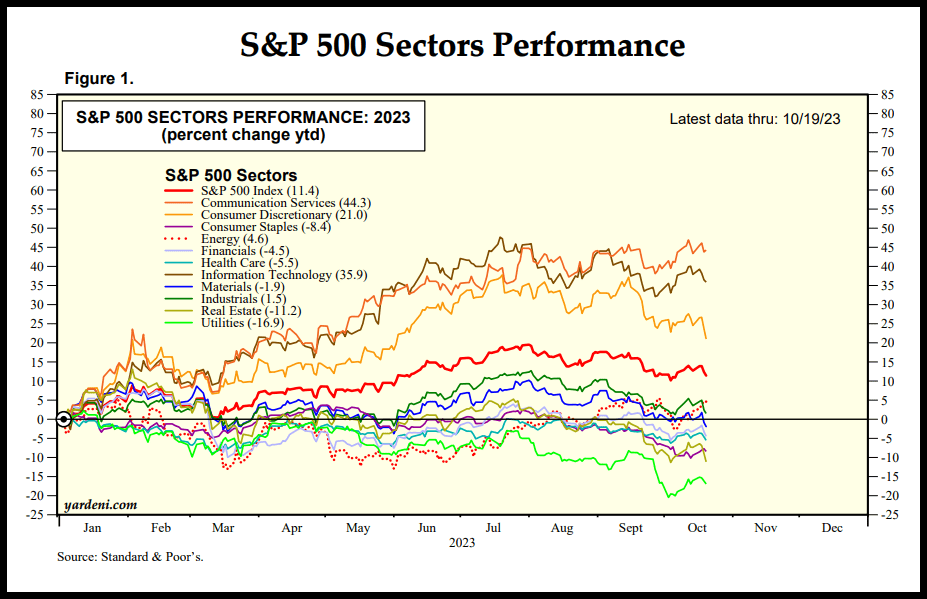

Real estate (XLRE) continues to be one of the worst-performing sectors, -10.86% YTD, amid historically high rates, tight supplies, and consumers’ reluctance to purchase after locking in historically low rates during the pandemic.

S&P 500 Sectors Performance (Yardeni Research, S&P)

Mortgage rates are well above 7%, dampening sales, which is why Firstam deputy chief economist Odeta Kushi stated, “Today’s housing market isn’t anything like the housing market of the mid-2000s – the housing market today is not overbuilt, nor is it driven by loose lending standards, sub-prime mortgages, or homeowners who are highly leveraged.” Despite tight supplies and the slowdown in the housing market, prices continue to climb, posing opportunities for investors interested in construction-related stocks.

Rather than engage in bidding wars, some homebuyers are looking to build from the ground up. The iShares U.S. Home Construction ETF (ITB) is +18% YTD and up nearly 44% over the last year. In addition to the uptick in U.S. home construction, the SPDR® S&P Homebuilders ETF (XHB) is +16.95% YTD. Although supply chain constraints and economic uncertainty are potential risks, especially given the current geopolitical and macroeconomic concerns for industrials, some of the fall in construction stocks may prove to be great buy-the-dip opportunities. Sterling Infrastructure (NASDAQ:STRL) fell as much as 15% intraday on October 13th amid selling pressures yet offers excellent fundamentals and a strong outlook. Tripling its share value over the last year amid a rise in infrastructure projects, consider this top stock for a portfolio.

Sterling Infrastructure, Inc. (STRL)

Market Capitalization: $2.21B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 10/20/23): 6 out of 654

Quant Industry Ranking (as of 10/20/23): 3 out of 34

Offering a buy-the-dip opportunity after its decline in recent weeks, Sterling Infrastructure is an industry leader in E-infrastructure, large-scale site development for data centers, transportation, and building solutions. Delivering tremendous top-line growth and expanding margins, Sterling’s track record of differentiated, higher-margin highway construction and engineering allows STRL to boast of building, creating, and facilitating change and that “Our people work smarter, not harder” to produce extreme results for the organization. After the Utah Department of Transportation awarded a large highway project and a $216M UDOT contract with its joint venture partner, W.W. Clyde & Co., Sterling is an undervalued company that offers strong growth and profitability through strategic execution.

STRL Stock Valuation and Momentum

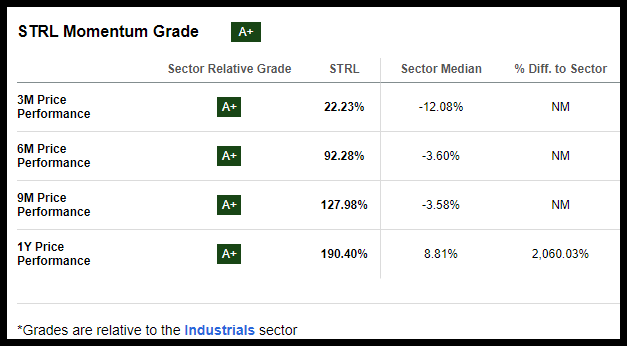

Despite Sterling Infrastructure’s bullish momentum, with a YTD price performance of +109% and +183% over the last year, STRL maintains a discounted valuation.

STRL Stock Momentum Grades (SA Premium)

Sterling’s quarterly price performance significantly outperforms the sector median and its B- Valuation Grade is supported by a forward PEG of 0.88x versus the sector median of 1.61x. Sterling’s forward Price/Sales is a 13% discount to the sector, and the company has a strong 6.17x Price/Cash Flow (TTM) compared to the sector’s 12.33x. Considering its gradually increasing quarterly price performance and A+ momentum, I believe this stock is primed for potential upside.

STRL Stock Growth and Profitability

As the trend for vehicle electrification grows, Sterling Infrastructure has looked to capitalize. Nabbing an EV battery facility project for Hyundai and a $45M site development contract for Rivian’s Georgia EV facility, it should be no surprise why STRL was selected as one of my Top 10 Stocks for the second half of 2023 and was selected by the best of the best quant stocks for Alpha Picks.

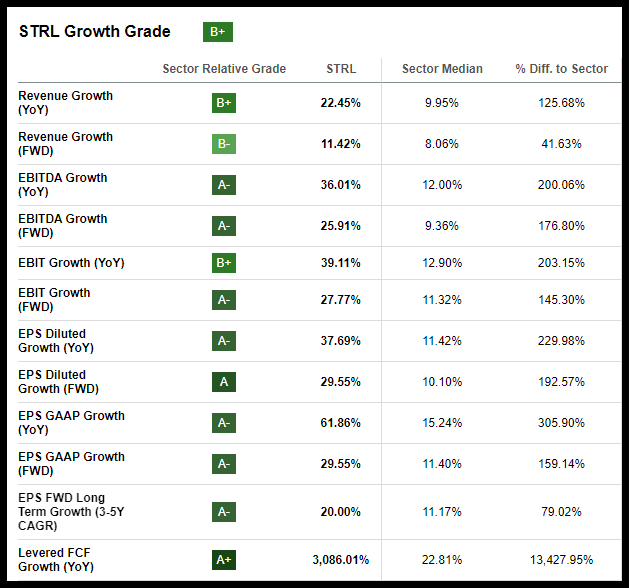

STRL Stock Growth Grades (SA Premium)

Sterling Infrastructure’s growth is strong on the heels of nine back-to-back earnings beats. Exceptionally strong cash flows for its latest earnings beats and 42% growth in its backlog from year-end 2022 have allowed its balance sheet to be in great shape. Sterling’s Q2 2023 EPS of $1.27 beat by $0.35, and revenue of $522.33M beat by and margin producing segments. STRL delivered 22% organic top-line growth. Highlighted by its President and CEO, Joseph Cutillo, during the Q2 earnings call,

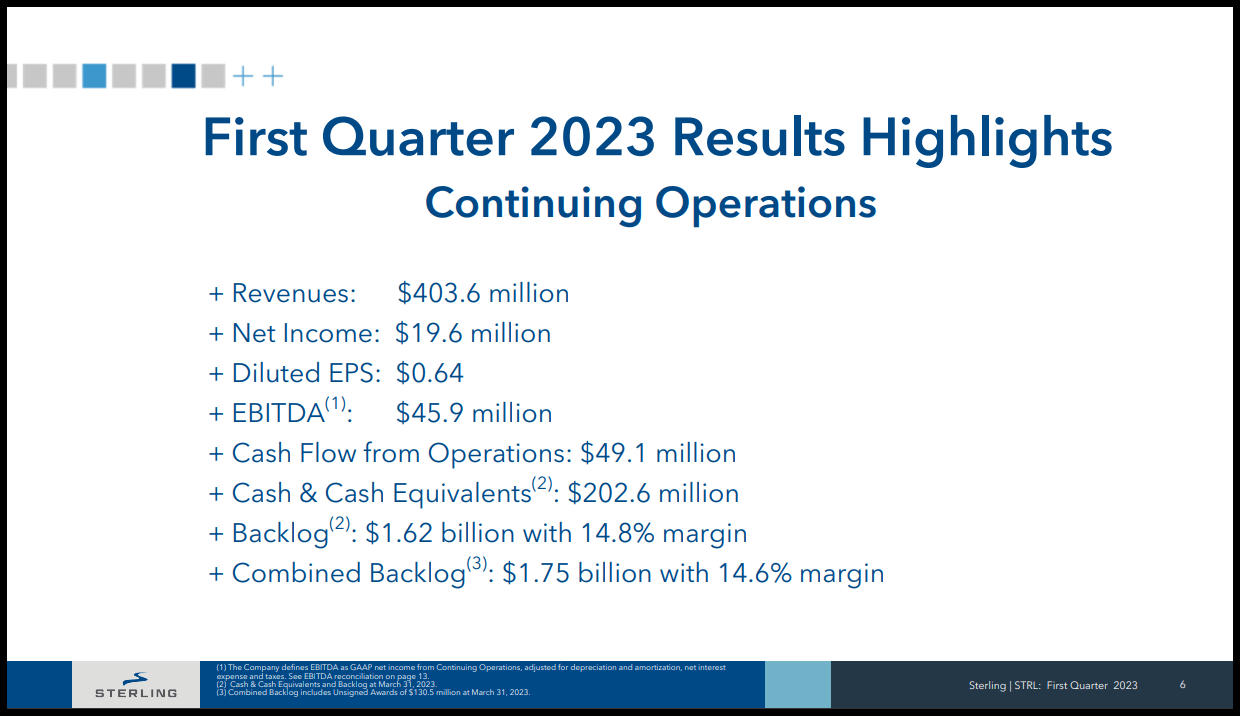

“Our people are out in the field every day, using their entrepreneurial spirit to win projects, execute flawlessly, and push Sterling to the next level…Our strong backlog position gives us confidence in our previously issued guidance ranges, which we are reiterating today. Based on our first quarter results, we believe we are tracking towards the high end of our 2023 guidance, which suggests a 13% increase in revenue and a 14% growth in net income.”

STRL Stock Q1 Results (STRL Stock Q1 2023 Investor Presentation)

Sterling’s backlog totals $1,624B, up $210M from the beginning of the year, and its, backlog gross margins were nearly 15%, its greatest backlog margin in history. Given the tremendous growth, two Wall Street analysts have revised their FY1 estimate up over the last 90 days with zero downward revisions. With plans to benefit from the 2021 Infrastructure Bill and a path toward sustainability, STRL hopes to expand its geographic footprint, revenue, and margins. With the easing of supply chains since COVID, Sterling has recaptured some of the losses from inefficiencies that impacted their margins during the pandemic and plans to ramp up its large projects.

Potential Risks

Supply chain constraints and macroeconomic challenges can pose risks to industrials, especially amid higher rates and consumers’ budgets. The surge in Interest rates and cost of raw materials has prompted many companies to feel the effects of increased expenses – an adverse effect on companies. Higher leverage tends to create higher amounts of interest to be paid, which can prove taxing for companies struggling to repay loans. The expensive cost of capital for companies unable to produce returns may find it challenging to stay afloat financially should a market slowdown occur.

Labor shortages and health and safety hazards also affect the construction and engineering industries. Although safety is a concern, STRL prides itself on achieving one of the industry’s best safety records – the cornerstone of its operations.

Concluding Summary

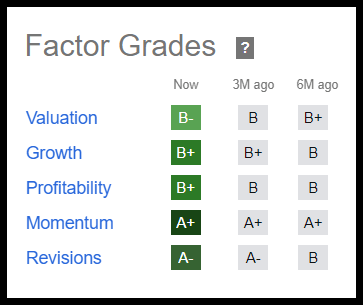

Industrials, namely construction, have experienced some volatility as economic slowdown, inflation, and geopolitical fears create headwinds. Where many companies lack growth or are trading at poor valuations, STRL is strong on each of the five core characteristics of valuation, growth, profitability, momentum, and EPS revisions.

STRL Stock Factor Grades

STRL Stock Factor Grades (SA Premium)

Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis, and STRL is one of the best-performing construction and engineering stocks over the last year. With a healthy backlog of business, high-margin projects in the pipeline, and its innovation and diversified segments, STRL is in a good position financially and has strong momentum. Consider buying STRL long-term in a sector known as one of the industries driving the U.S. economy.

We have many Top Industrial stocks to choose from, or if you’re seeking a limited number of monthly ideas from the hundreds of top quant stocks, consider exploring Alpha Picks.