Published on May 15th, 2023 by Felix Martinez

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs. These companies own real estate properties and lease them to tenants or invest in real estate-backed loans, which generate a steady income stream.

The bulk of their income is then passed on to shareholders through dividends. You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

Real Estate Investment Trusts (REITs) are a great choice for income investors as they must pay out 90% of their taxable income to shareholders in the form of dividends. This enables REITs to avoid paying corporate taxes. With over 200 REITs to choose from, many offer high dividend yields.

However, not all high-yielding stocks are worth investing in. It is important for investors to thoroughly assess the fundamentals to ensure that high yields are sustainable. Some high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

To help investors make informed decisions, a list of safe REITs and companies that own data centers with strong business models and property portfolios was created. These companies have more sustainable dividends than most REITs and should be considered as a safer option for income investors.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Data Center REIT No. 8: Keppel REIT (KREVF)

Keppel REIT is a real estate investment trust (REIT) listed on the Singapore Stock Exchange. The company was established in November 2005 and is managed by Keppel REIT Management Limited, a subsidiary of Keppel Capital Holdings.

Keppel REIT’s portfolio comprises a diversified mix of commercial properties, including office, retail spaces, and data centers, located primarily in Singapore’s central business district. As of December 2022, the company’s total assets under management were valued at approximately $9.2 billion.

The company’s investment strategy focuses on acquiring high-quality, income-generating properties with strong growth potential. Keppel REIT aims to provide stable and growing distributions to its unitholders by maximizing the value of its assets through active asset management and strategic divestments.

Source: Investor Presentation

Data Center REIT No. 7: DigitalBridge Group, Inc. (DBRG)

DigitalBridge Group, Inc. is a leading global digital infrastructure investment firm headquartered in Boca Raton, Florida. Formerly known as Colony Capital Inc., the company underwent a major rebranding in 2021 and changed its name to DigitalBridge to better reflect its focus on digital infrastructure investments.

DigitalBridge Group has a diverse portfolio of investments that includes digital towers, fiber networks, data centers, small cells, and edge data centers. These assets are critical components of modern communication networks, which are experiencing exponential growth due to the increasing demand for digital services and technologies. DigitalBridge Group is well-positioned to capitalize on this trend as a global leader in the digital infrastructure investment space.

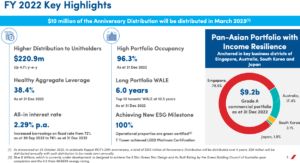

Source: Investor Presentation

On May 3rd, 2023, the company reported first-quarter results. Total revenue was up from $232 million in the first quarter of 2022 to $250 million last quarter. This is an increase of 7.4% year over year. However, expenses were up year-over-year by 12.3%. Overall, the company had a net income loss of $(1.34) per share compared to $(1.84).

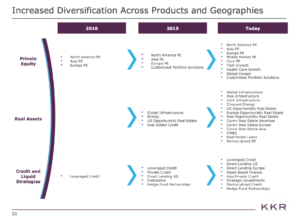

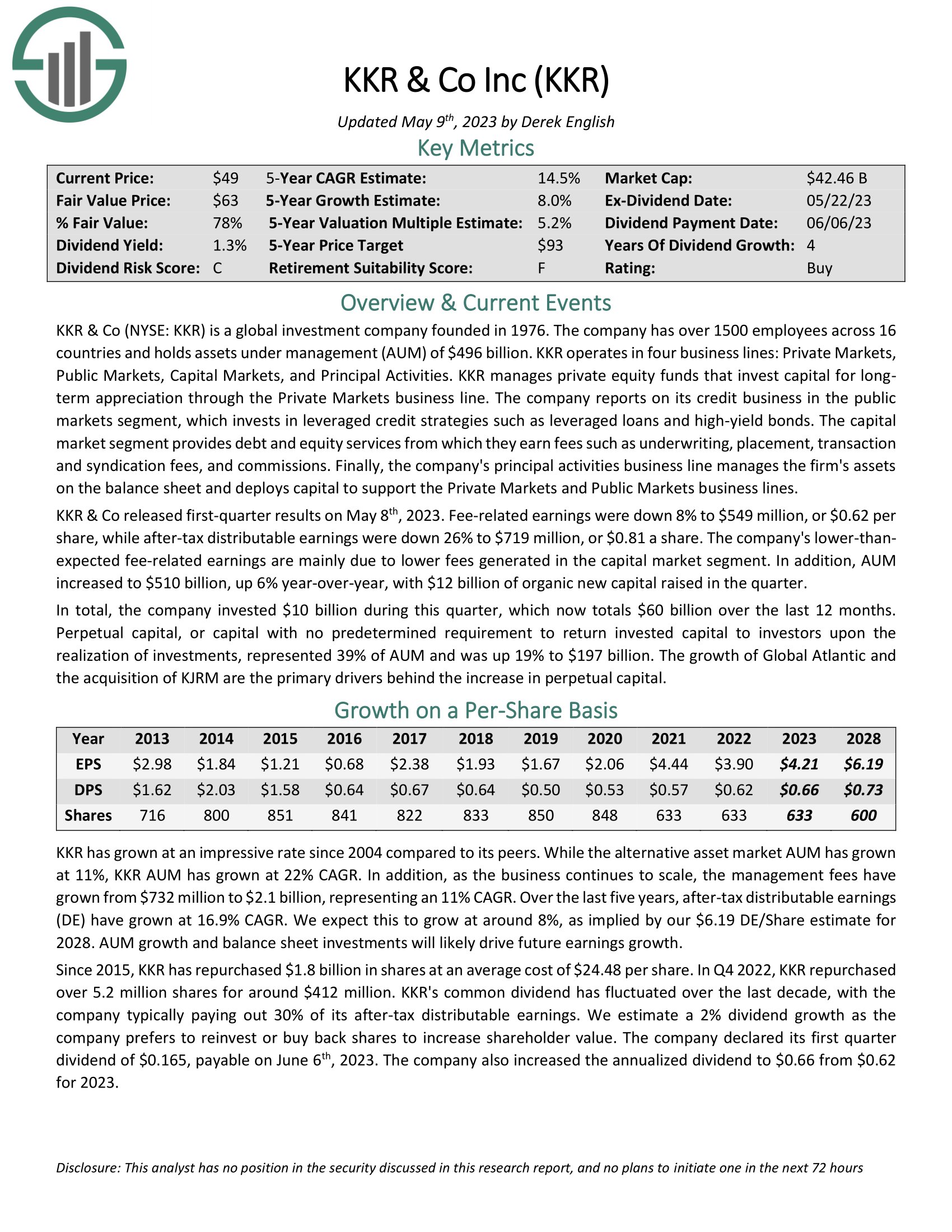

Data Center REIT No. 6: KKR & Co Inc (KKR)

KKR & Co (NYSE: KKR) is a prominent global investment firm established in 1976. The firm has a workforce of more than 1500 employees working across 16 countries, managing assets worth $496 billion. KKR operates in four business lines: Private Markets, Public Markets, Capital Markets, and Principal Activities.

Private Markets invest capital for long-term appreciation, whereas the Public Markets segment reports on KKR’s credit business, investing in leveraged credit strategies such as leveraged loans and high-yield bonds. The Capital Market segment offers debt and equity services, generating underwriting, placement, transaction, syndication fees, and commissions fees. Lastly, the Principal Activities business line manages the company’s assets on the balance sheet and allocates capital to support the Private Markets and Public Markets business lines.

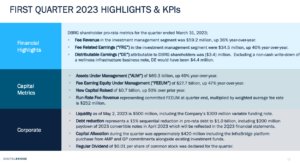

Source: Investor Presentation

On May 8th, 2023, KKR & Co released its first-quarter results, revealing that its fee-related earnings were down 8% to $549 million, or $0.62 per share, while after-tax distributable earnings were down 26% to $719 million, or $0.81 per share. The company’s lower-than-expected fee-related earnings were mainly due to lower fees generated in the Capital Market segment. Additionally, AUM increased to $510 billion, up 6% year-over-year, and the firm raised $12 billion of organic new capital in the quarter.

KKR invested $10 billion during the quarter, bringing its total investments to $60 billion over the past 12 months. Perpetual capital, which represents capital with no predetermined requirement to return invested capital to investors upon the realization of investments, made up 39% of AUM and increased by 19% to $197 billion. The growth of Global Atlantic and the acquisition of KJRM are the primary drivers behind the increase in perpetual capital.

Click here to download our most recent Sure Analysis report on KKR & Co Inc (KKR) (preview of page 1 of 3 shown below):

Data Center REIT No. 5: Blackstone Group Inc. (BX)

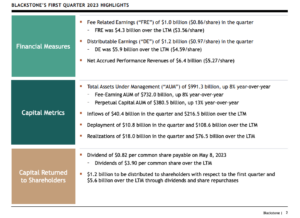

Blackstone is a major investment firm founded in 1985 by Peter Peterson and Stephen Schwarzman, who is still the CEO. As of the end of the first quarter of 2024, the company had a massive $991.3 billion in assets under management (AUM). Blackstone operates in four main areas, including Private Equity (29% of AUM), Real Estate (33%), Credit (29%), and Hedge Fund Solutions (9%). The company has a market cap of $108.4 billion and employs around 3,795 people.

Source: Investor Presentation

Blackstone was a publicly traded partnership, but the company became a corporation on July 1st, 2019. This change eliminated Schedule K-1 and replaced it with Form 1099-DIV. This move was intended to improve the market for the company’s shares. Blackstone has now been a corporation for ten quarters.

On April 20th, 2023, Blackstone reported its Q1-2023 results for March 31st, 2023. During the quarter, the company had total net realizations of $389.2 million, 59% lower year-over-year. Fee-related earnings also fell 9.6% to $1.04 billion, while total revenues plummeted 73% to $1.4 billion. Despite the ongoing turmoil in capital markets, the company raised a remarkable $40.4 billion in inflows.

During the quarter, distributable earnings equaled $1.2 billion or $0.97 per share, 36% and 37% lower year-over-year, respectively. However, total assets under management increased by 8% year-over-year to $991.3 billion, driven by $216.5 billion in inflows during the past 12 months. Blackstone also declared a quarterly dividend of $0.82. The company’s FY-2023 distributable EPS estimate was revised to $4.50, which will be adjusted over time based on inflows and market conditions.

Click here to download our most recent Sure Analysis report on Blackstone Group Inc. (BX) (preview of page 1 of 3 shown below):

Data Center REIT No. 4: Iron Mountain (IRM)

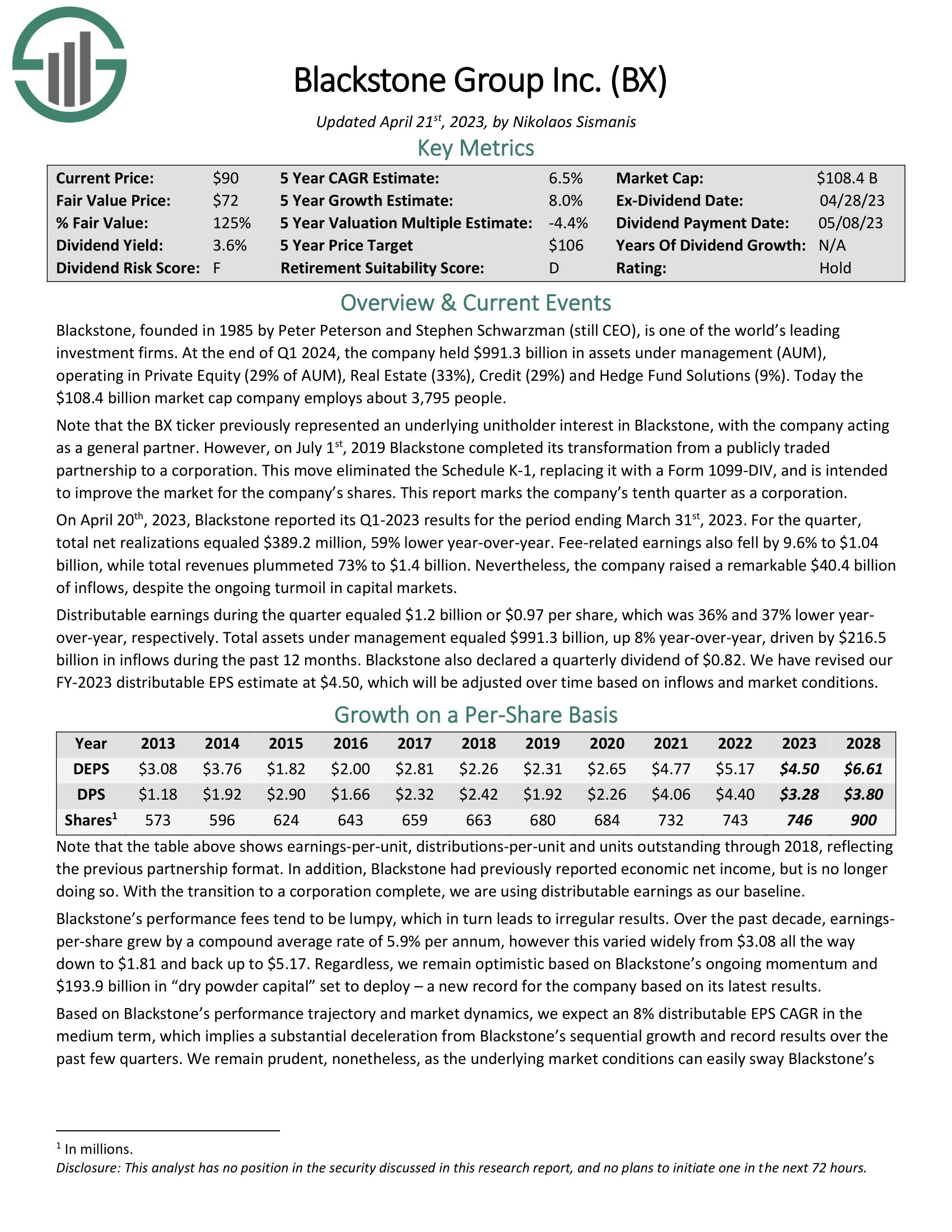

Iron Mountain is a Real Estate Investment Trust (REIT) that provides storage and information management services. Its services include record management, destruction, data protection and recovery, and computer backup services. The trust operates in North America, Latin America, Europe, and the Asia Pacific area. Iron Mountain was founded in 1951 and is based in Boston, MA.

Source: Investor Presentation

In its first-quarter earnings report released on May 4th, 2023, Iron Mountain announced that it generated revenues of $1.31 billion during the quarter, a 5% increase from the previous year. This was slightly below what analysts had expected but still improved over the not-very-strong first quarter of 2021.

During the first quarter, Iron Mountain’s normalized funds-from-operations increased to $0.97 per share compared to the previous year. Also, the company was able to increase its margins during the period.

Management provided guidance for adjusted FFO-per-share for the current year, with a range of $3.91 to $4.00, representing solid growth of around 4% at the midpoint of the guidance range, relative to 2022, which was a record year for the company.

Click here to download our most recent Sure Analysis report on Iron Mountain (IRM) (preview of page 1 of 3 shown below):

Data Center REIT No. 3: Equinix (EQIX)

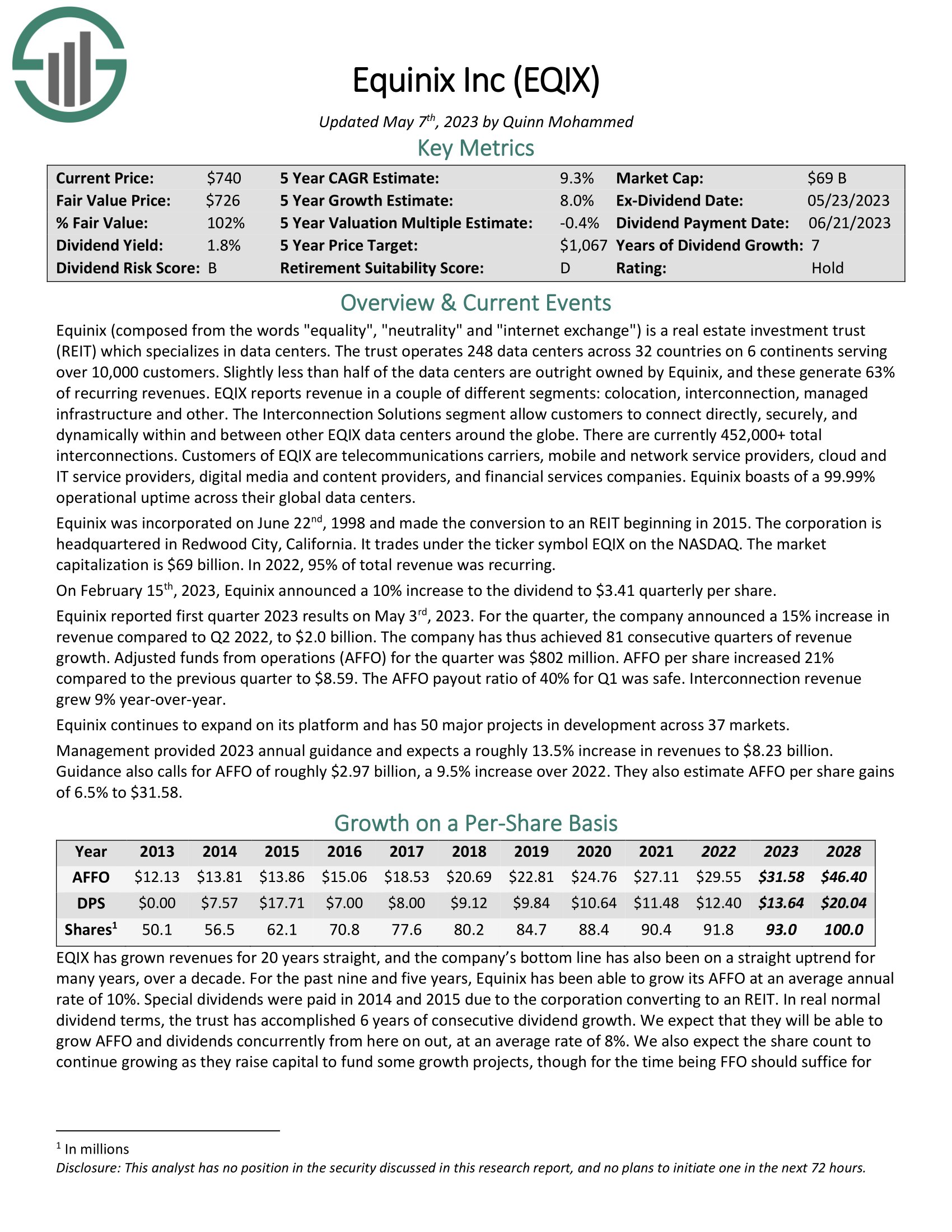

Equinix, a global leader in data centers and internet exchange services, made significant announcements regarding its financial performance in early 2023. On February 15th, 2023, the company declared an increase of 10% to its dividend, making it $3.41 per share every quarter. This increase indicates the company’s commitment to rewarding its investors.

Source: Investor Presentation

The first-quarter financial results were announced on May 3rd, 2023. The company achieved a 15% increase in revenue compared to the same quarter of the previous year, reaching $2.0 billion. This achievement marked Equinix’s 81st consecutive quarter of revenue growth, which is an impressive accomplishment. The adjusted funds from operations (AFFO) for the quarter was $802 million, and the AFFO per share increased by 21% compared to the previous quarter, reaching $8.59. Equinix maintained a safe payout ratio of 40% for Q1, indicating its ability to pay dividends. Additionally, the interconnection revenue grew by 9% year-over-year, indicating the company’s continued growth.

Equinix is a company that is actively expanding its platform and has 50 major projects in development across 37 different markets. Management provided the 2023 annual guidance and expects a roughly 13.5% increase in revenues, reaching $8.23 billion. The guidance also calls for an AFFO of roughly $2.97 billion, a 9.5% increase from 2022 and an estimated AFFO per share gain of 6.5% to $31.58. Equinix’s management continues to work towards expanding the company’s reach and diversifying its offerings.

Click here to download our most recent Sure Analysis report on Equinix (EQIX) (preview of page 1 of 3 shown below):

Data Center REIT No. 2: American Tower Corp (AMT)

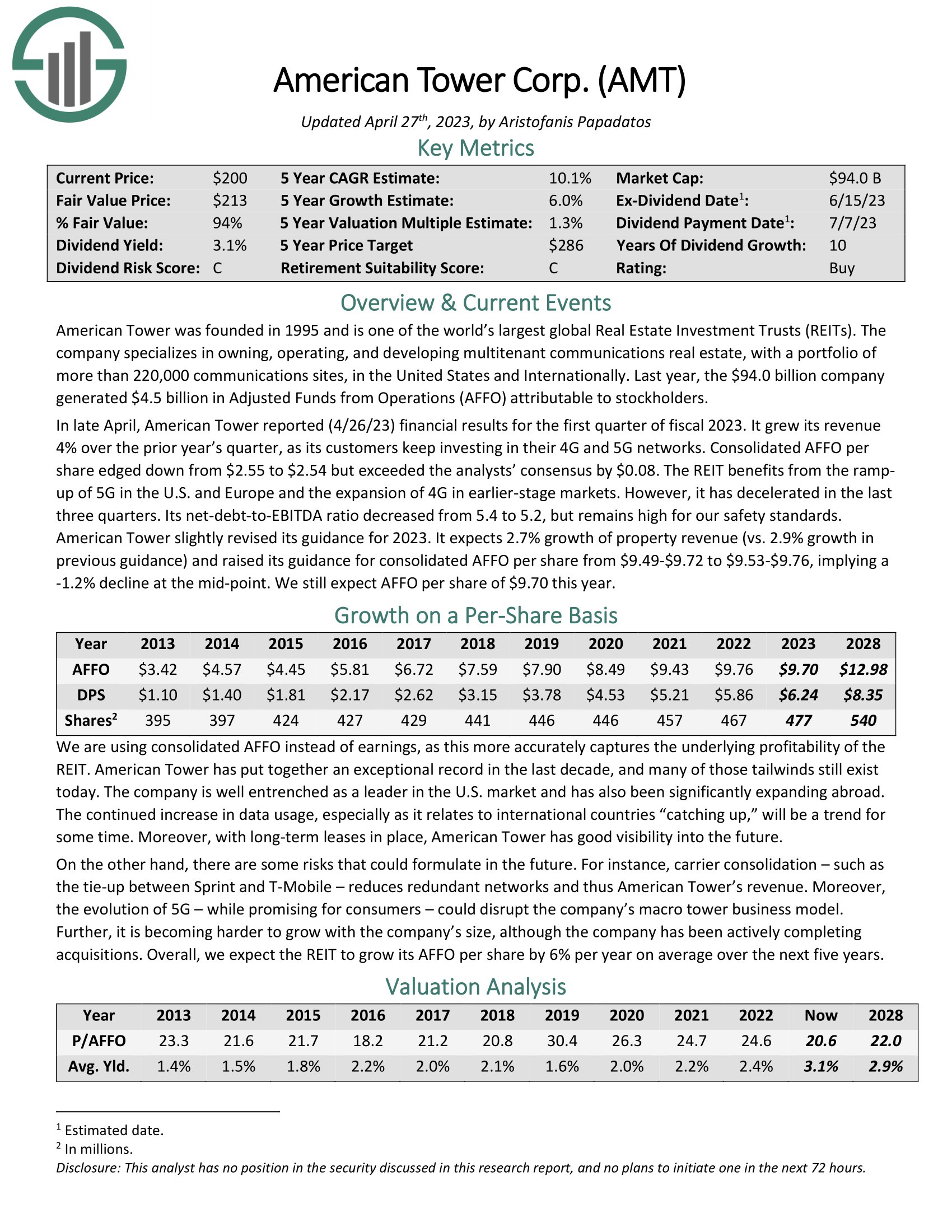

American Tower is a large Real Estate Investment Trust (REIT) focusing on the ownership, operation, and development of communication real estate. With over 220,000 communication sites worldwide, the company generated $4.5 billion in Adjusted Funds from Operations (AFFO) for stockholders in 2022.

Source: Investor Presentation

In April 2023, American Tower reported its financial results for Q1 of fiscal 2023, announcing a 4% increase in revenue compared to the previous year’s quarter. This growth was attributed to the company’s customers’ continued investments in 4G and 5G networks. Despite a slight decrease in Consolidated AFFO per share from $2.55 to $2.54, American Tower exceeded analysts’ consensus by $0.08.

However, American Tower’s net-debt-to-EBITDA ratio remains high by safety standards, and is down from 5.4 to 5.2. The company expects a 2.7% growth in property revenue in 2023, down from its previous estimate of 2.9%. It also revised its consolidated AFFO per share guidance to $9.53-$9.76, a mid-point decline of -1.2%. Nonetheless, this year’s $9.70 AFFO per share is still projected, indicating the company’s continued success in the communication real estate market.

Click here to download our most recent Sure Analysis report on American Tower Corp (AMT) (preview of page 1 of 3 shown below):

Data Center REIT No. 1: Digital Realty Trust (DLR)

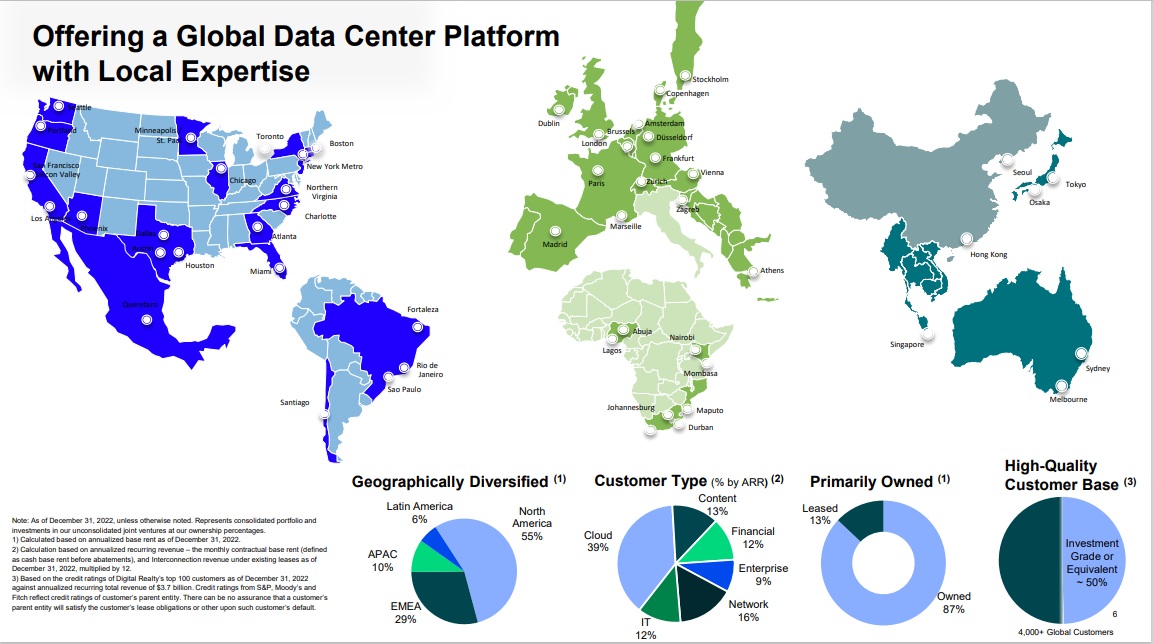

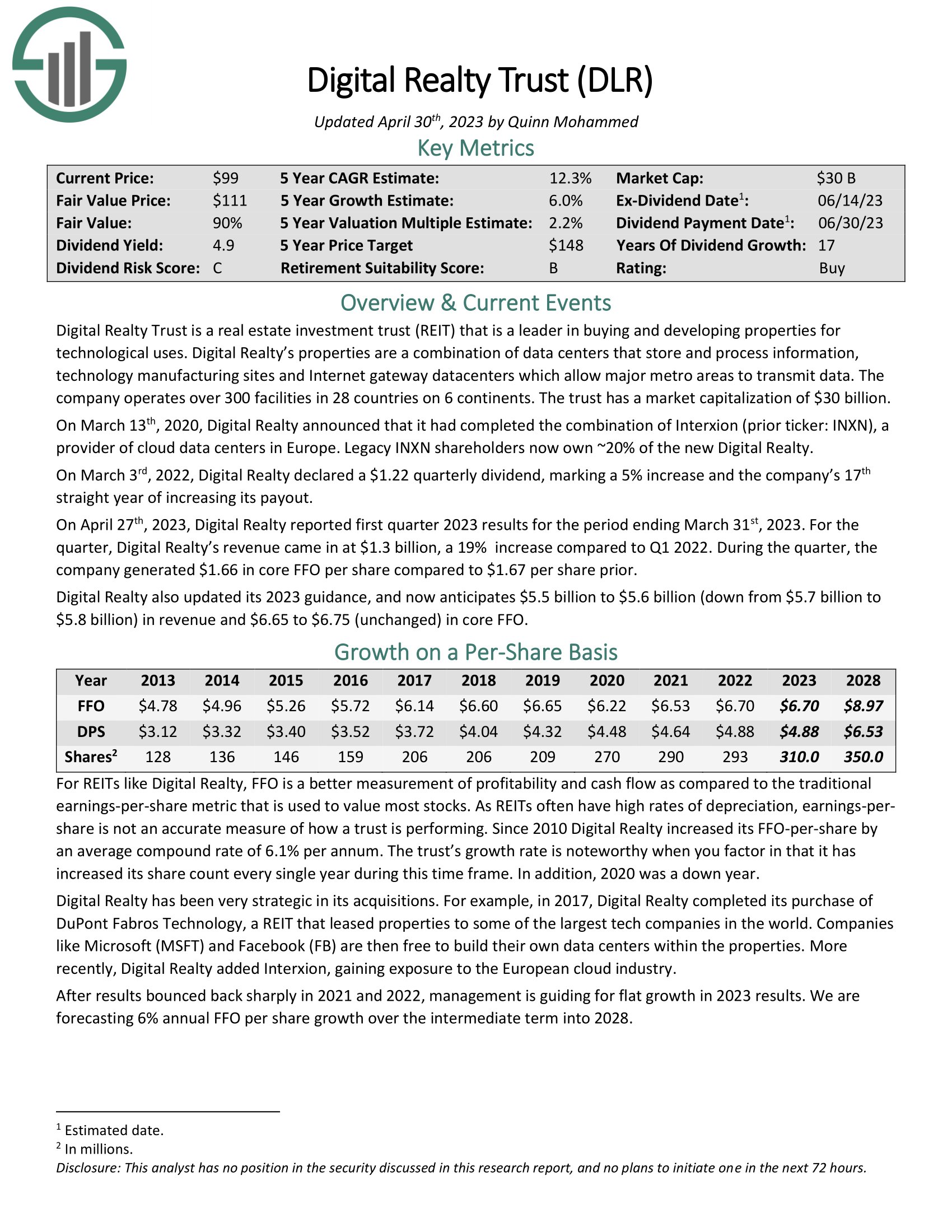

Digital Realty Trust is a REIT that is a leader in buying and developing properties for technological uses. Digital Realty’s properties are a combination of data centers that store and process information, technology manufacturing sites, and Internet gateway data centers that allow major metro areas to transmit data. The company operates over 300 facilities in 28 countries on six continents.

Source: Investor Presentation

On March 3rd, 2022, Digital Realty declared a $1.22 quarterly dividend, marking a 5% increase and the company’s 17th straight year of increasing its payout. On February 16th, 2023, Digital Realty reported Q4 2022 results for the period ending December 31st, 2022.

Digital Realty’s revenue came in at $1.2 billion for the quarter, a 3% increase compared to Q4 2021. During the quarter, the company generated $1.65 in core FFO per share compared to $1.67 per share prior. Digital Realty also initiated 2023 guidance, anticipating $5.7 billion to $5.8 billion in revenue and $6.65 to $6.75 in core FFO.

Digital Realty is unique among safe REITs in offering exposure to the technology sector.

Click here to download our most recent Sure Analysis report on Digital Realty (preview of page 1 of 3 shown below):

Final Thoughts

Investors seeking income may find REITs appealing due to their typically high dividend yields. Nonetheless, it is advisable to choose safe REITs that can continue paying dividends in the event of an economic downturn within the following year. To this end, the following eight REITs are considered safe options: they have reasonable debt levels, ample cash flow to sustain dividend payments, and offer high yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].