Up to date on June sixth, 2022 by Bob Ciura

Month-to-month dividend shares have instantaneous enchantment for a lot of earnings buyers. Shares that pay their dividends every month provide extra frequent payouts than conventional quarterly or semi-annual dividend payers.

Because of this, we created a full checklist of 49 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

As well as, shares which have excessive dividend yields are additionally enticing for earnings buyers.

With the common S&P 500 yield hovering round 1.5%, buyers can generate far more earnings with high-yield shares.

Screening for month-to-month dividend shares that even have excessive dividend yields makes for an interesting mixture.

This text will checklist the 20 highest-yielding month-to-month dividend shares.

Desk Of Contents

The next 20 month-to-month dividend shares have excessive dividend yields above 5%. Shares are listed by their dividend yields, from lowest to highest.

You’ll be able to immediately leap to a person part of the article by using the hyperlinks beneath:

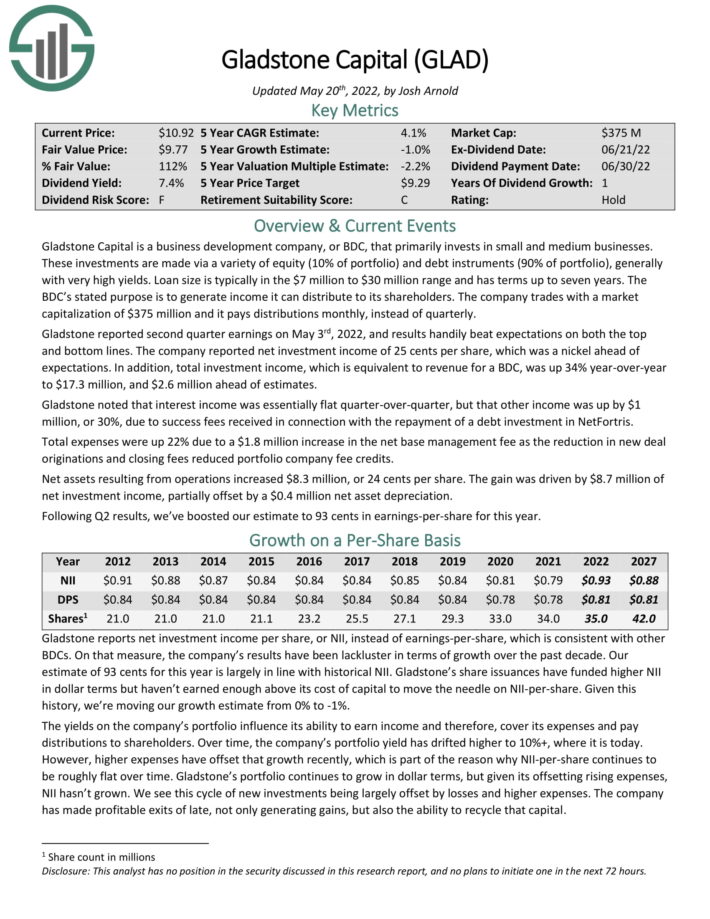

Excessive-Yield Month-to-month Dividend Inventory #20: Gladstone Capital Corp. (GLAD)

Gladstone Capital is a enterprise improvement firm, or BDC, that primarily invests in small and medium companies. These investments are made by way of quite a lot of fairness (10% of portfolio) and debt devices (90% of portfolio), usually with very excessive yields. Mortgage measurement is often within the $7 million to $30 million vary and has phrases as much as seven years.

Supply: Investor Presentation

Gladstone reported second quarter earnings on Could third, 2022, and outcomes handily beat expectations on each the highest and backside strains. The corporate reported web funding earnings of 25 cents per share, which was a nickel forward of expectations. As well as, complete funding earnings, which is equal to income for a BDC, was up 34% year-over-year to $17.3 million, and $2.6 million forward of estimates.

Gladstone famous that curiosity earnings was basically flat quarter-over-quarter, however that different earnings was up by $1 million, or 30%, attributable to success charges acquired in reference to the reimbursement of a debt funding in NetFortris. Whole bills have been up 22% attributable to a $1.8 million improve within the web base administration charge because the discount in new deal originations and shutting charges lowered portfolio firm charge credit.

Web belongings ensuing from operations elevated $8.3 million, or 24 cents per share. The achieve was pushed by $8.7 million of web funding earnings, partially offset by a $0.4 million web asset depreciation.

Click on right here to obtain our most up-to-date Positive Evaluation report on GLAD (preview of web page 1 of three proven beneath):

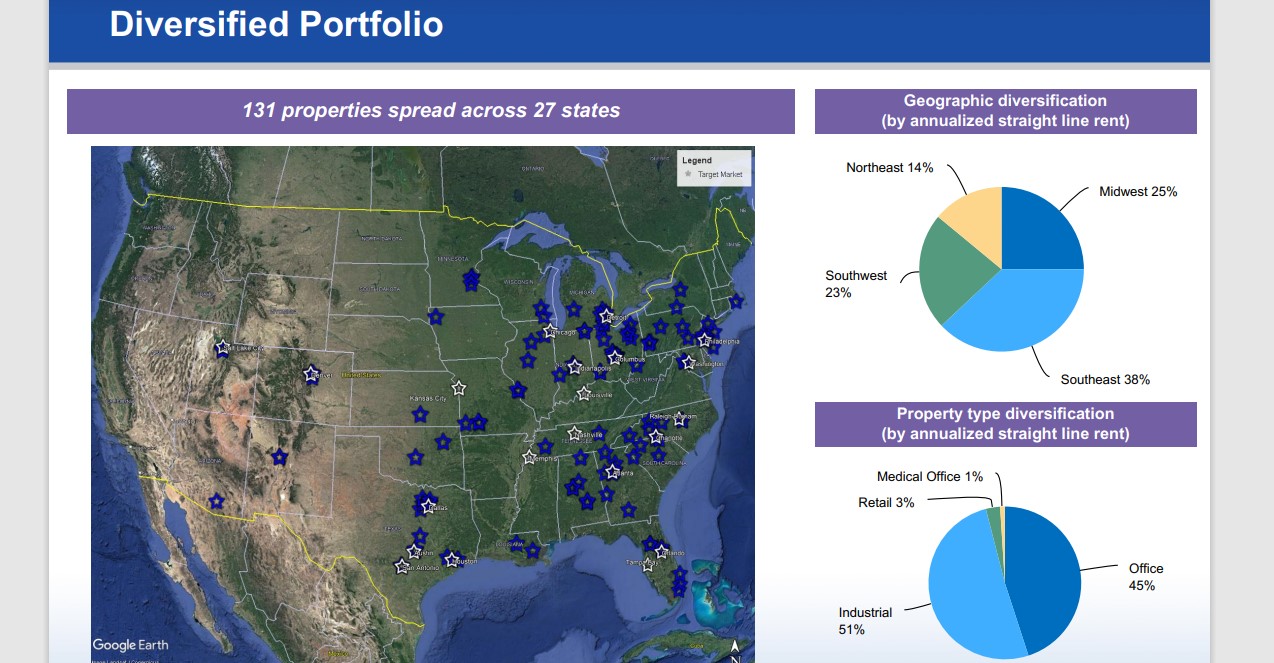

Excessive-Yield Month-to-month Dividend Inventory #19: Gladstone Industrial Corp. (GOOD)

Gladstone Industrial Company is an actual property funding belief, or REIT, that makes a speciality of single-tenant and anchored multi-tenant web leased industrial and workplace properties throughout the U.S. The belief targets major and secondary markets that possess favorable financial progress developments, rising populations, sturdy employment, and sturdy progress developments.

The belief’s acknowledged aim is to pay shareholders month-to-month distributions, which it has performed for greater than 17 consecutive years. Gladstone owns over 100 properties in 24 states which can be leased to about 100 distinctive tenants.

Supply: Investor Presentation

Gladstone reported first quarter earnings on Could 4th, 2022, and outcomes have been weaker than anticipated on each income and earnings. FFO-per-share got here to 40 cents, which was one cent decrease than estimates. Income was $35.53 million, which was up fractionally year-over-year, however missed estimates by $610k.

The corporate famous it collected 100% of money rents throughout all three months of the primary quarter. Core FFO was up 1.3% year-over-year, primarily because of the further lease income from acquisitions through the quarter. Gladstone acquired two fully-occupied industrial properties through the quarter, containing 136k sq. ft for $13.3 million. The weighted common cap price on the properties was 6.58%.

Click on right here to obtain our most up-to-date Positive Evaluation report on GOOD (preview of web page 1 of three proven beneath):

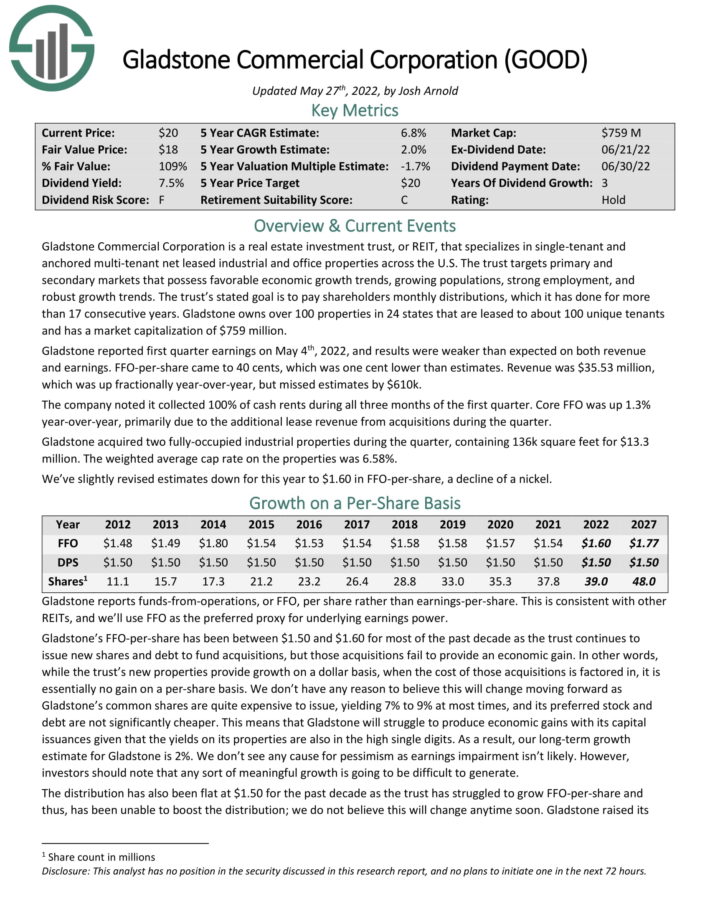

Excessive-Yield Month-to-month Dividend Inventory #18: Cross Timbers Royalty Belief (CRT)

Cross Timbers is an oil and fuel belief (about 50/50), arrange in 1991 by XTO Power. Unit holders have a 90% web revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% web revenue curiosity in working curiosity properties in Texas and Oklahoma.

The belief’s belongings are static in that no additional properties might be added. The belief has no operations however is merely a move–by car for the royalties. CRT had royalty earnings of $5.3 million in 2020 and $7.4 million in 2021.

In late March, CRT reported (3/29/22) monetary outcomes for the complete fiscal 2021. Manufacturing of oil and fuel plunged 54% and 24%, respectively, over the prior 12 months, primarily because of the pure decline of the fields. Nonetheless, the common realized costs of oil and fuel grew 57% and 132%, respectively, due to the sturdy restoration of the vitality market from the pandemic.

In consequence, distributable money circulation per unit grew 43%, from $0.77 to $1.10. The belief doesn’t present any steering for the operating 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRT (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #17: PermRock Royalty Belief (PRT)

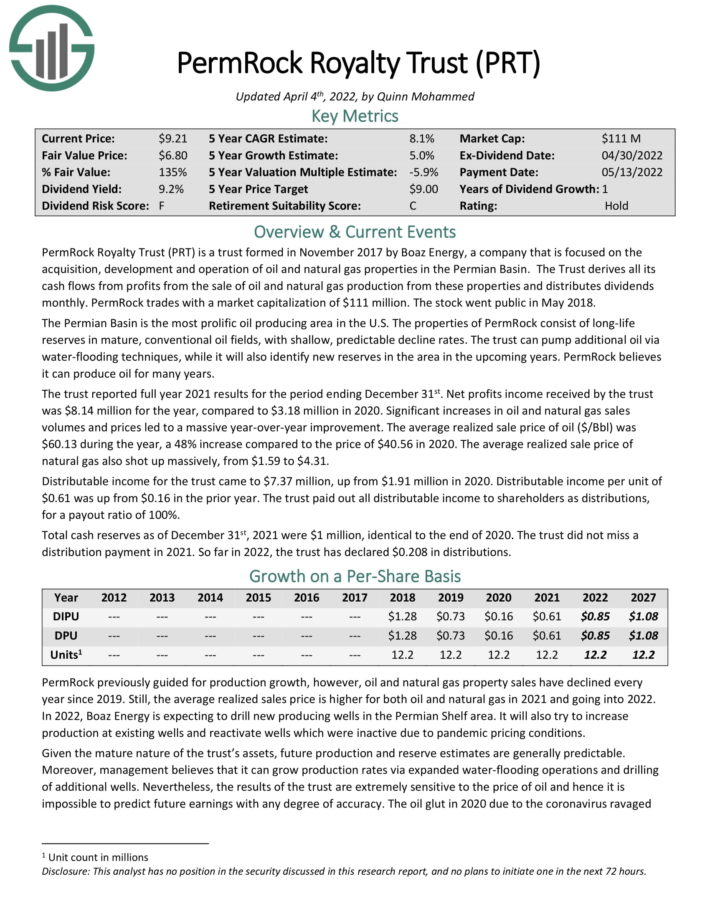

PermRock Royalty Belief is a belief shaped in November 2017 by Boaz Power, an organization that’s centered on the acquisition, improvement and operation of oil and pure fuel properties within the Permian Basin. The Belief derives all its money flows from income from the sale of oil and pure fuel manufacturing from these properties and distributes dividends month-to-month.

The belief reported full 12 months 2021 outcomes for the interval ending December thirty first. Web income earnings acquired by the belief was $8.14 million for the 12 months, in comparison with $3.18 million in 2020. Vital will increase in oil and pure fuel gross sales volumes and costs led to an enormous year-over-year enchancment. The common realized sale value of oil ($/Bbl) was $60.13 through the 12 months, a 48% improve in comparison with the worth of $40.56 in 2020. The common realized sale value of pure fuel additionally shot up massively, from $1.59 to $4.31.

Distributable earnings for the belief got here to $7.37 million, up from $1.91 million in 2020. Distributable earnings per unit of $0.61 was up from $0.16 within the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRT (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #16: San Juan Basin Royalty Belief (SJT)

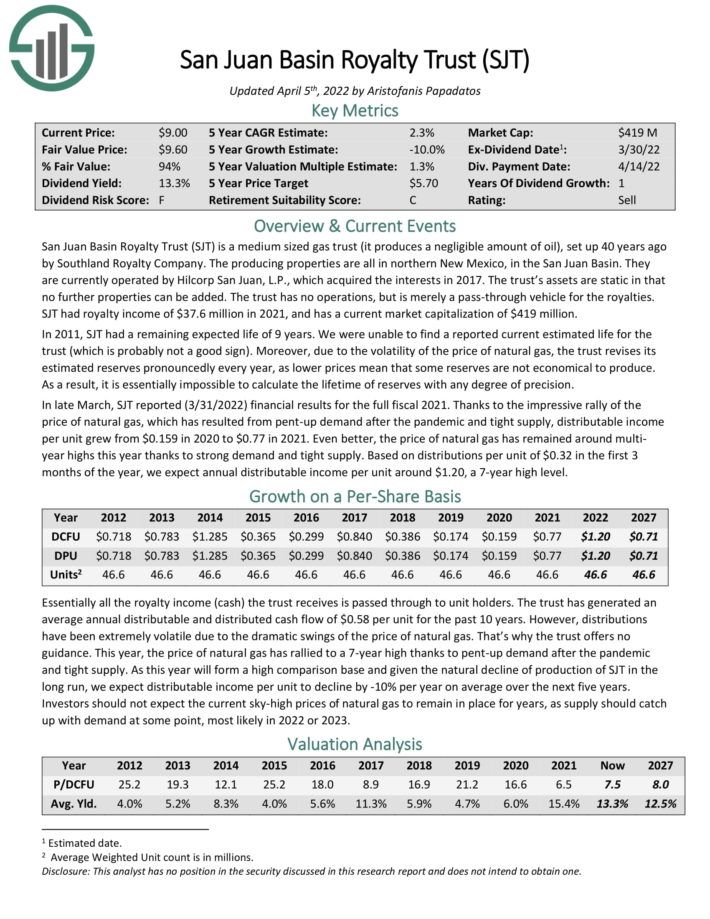

San Juan Basin Royalty Belief is a medium sized fuel belief (it produces a negligible quantity of oil), arrange by Southland Royalty Firm. The manufacturing properties are all in northern New Mexico, within the San Juan Basin. They are at present operated by Hilcorp San Juan, L.P., which acquired the curiositys in 2017.

The belief’s belongings are static in that no additional properties might be added. The belief has no operations, however is merely a move–by car for the royalties. SJT had royalty earnings of $37.6 million in 2020.

In late March, SJT reported (3/31/2022) monetary outcomes for the complete fiscal 2021. Because of the spectacular rally of the worth of pure fuel, which has resulted from pent-up demand after the pandemic and tight provide, distributable earnings per unit grew from $0.159 in 2020 to $0.77 in 2021. Even higher, the worth of pure fuel has remained round multiyear highs this 12 months due to sturdy demand and tight provide.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJT (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #15: Stellus Capital (SCM)

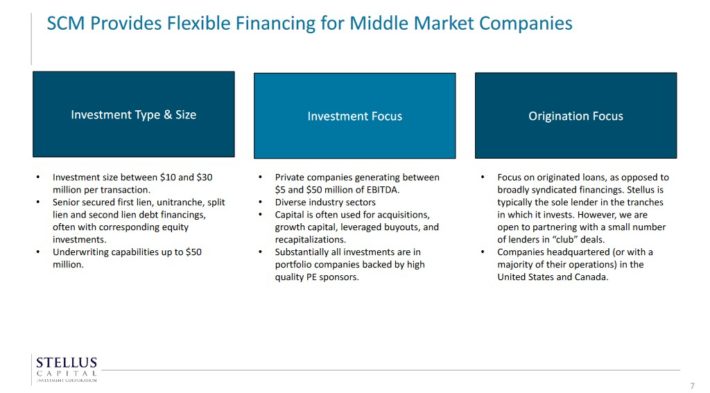

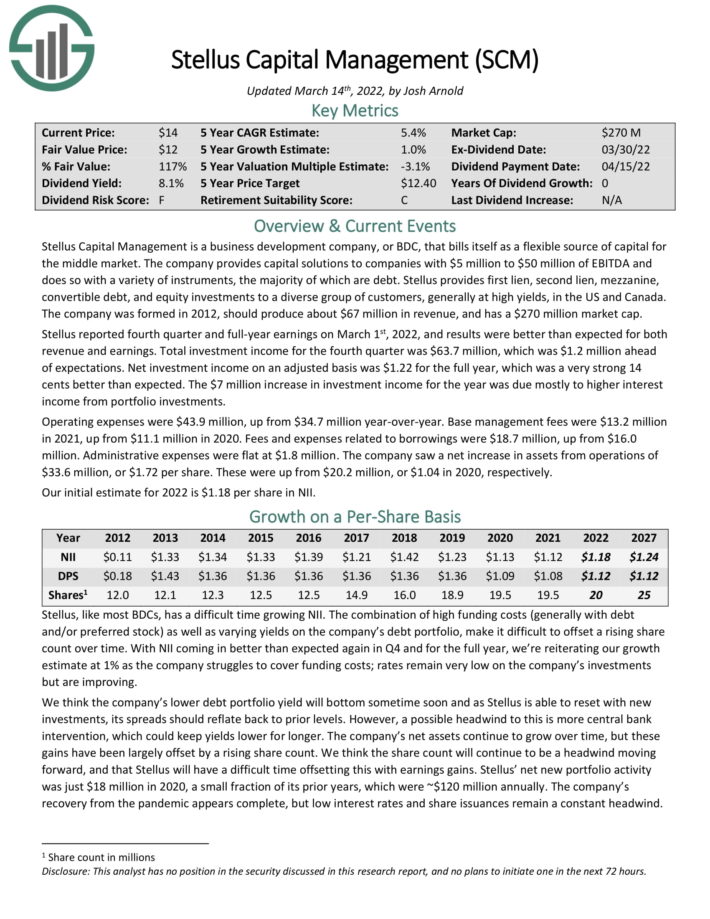

Stellus Capital Administration is BDC, that supplies capital options to firms with $5 million to $50 million of EBITDA and does so with quite a lot of devices, the vast majority of that are debt.

Stellus supplies first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of consumers, usually at excessive yields, within the US and Canada.

Supply: Investor Presentation

The corporate was shaped in 2012, and ought to produce about $67 million in annual income. Stellus reported fourth quarter and full-year earnings on March 1st, 2022, and outcomes have been higher than anticipated for each income and earnings.

Whole funding earnings for the fourth quarter was $63.7 million, which was $1.2 million forward of expectations. Web funding earnings on an adjusted foundation was $1.22 for the complete 12 months, which was a really sturdy 14 cents higher than anticipated. The $7 million improve in funding earnings for the 12 months was due principally to increased curiosity earnings from portfolio investments.

The corporate noticed a web improve in belongings from operations of $33.6 million, or $1.72 per share. These have been up from $20.2 million, or $1.04 in 2020, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCM (preview of web page 1 of three proven beneath):

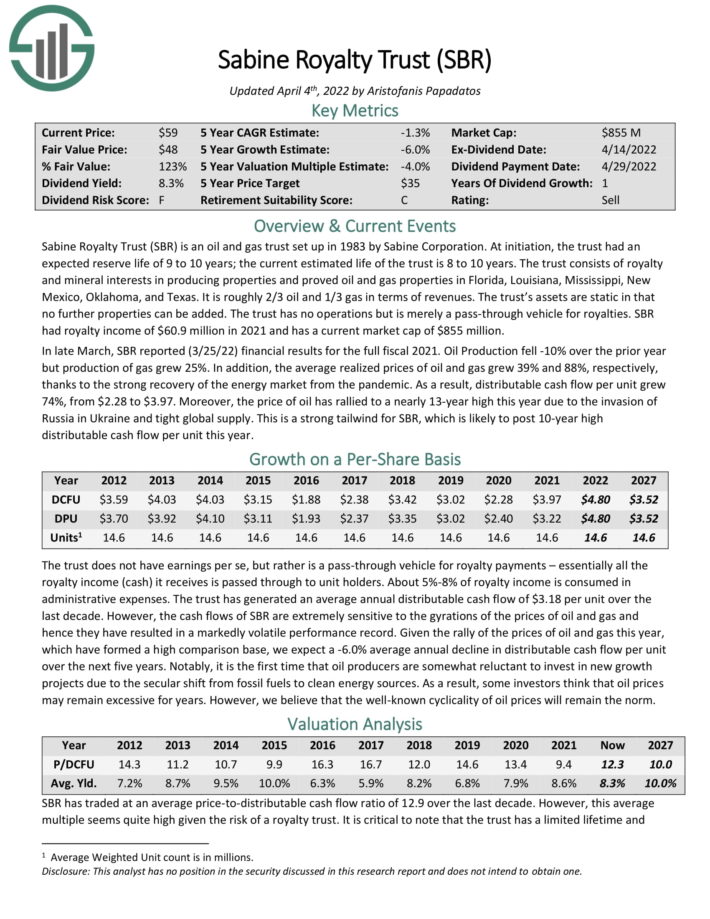

Excessive-Yield Month-to-month Dividend Inventory #14: Sabine Royalty Belief (SBR)

Sabine Royalty Belief is an oil and fuel belief arrange in 1983 by Sabine Company. At initiation, the belief had an anticipated reserve lifetime of 9 to 10 years; the present estimated lifetime of the belief is 8 to 10 years.

The belief consists of royalty and mineral pursuits in producing properties and proved oil and fuel properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It’s roughly 2/3 oil and 1/3 fuel by way of revenues.

The belief’s belongings are static in that no additional properties might be added. The belief has no operations however is merely a pass-through car for royalties. SBR had royalty earnings of $60.9 million in 2021.

In late March, SBR reported (3/25/22) monetary outcomes for the complete fiscal 2021. Oil Manufacturing fell -10% over the prior 12 months however manufacturing of fuel grew 25%. As well as, the common realized costs of oil and fuel grew 39% and 88%, respectively, due to the sturdy restoration of the vitality market from the pandemic. In consequence, distributable money circulation per unit grew 74%, from $2.28 to $3.97.

Furthermore, the worth of oil has rallied to a virtually 13-year excessive this 12 months because of the invasion of Russia in Ukraine and tight world provide. It is a sturdy tailwind for SBR, which is prone to put up 10-year excessive distributable money circulation per unit this 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBR (preview of web page 1 of three proven beneath):

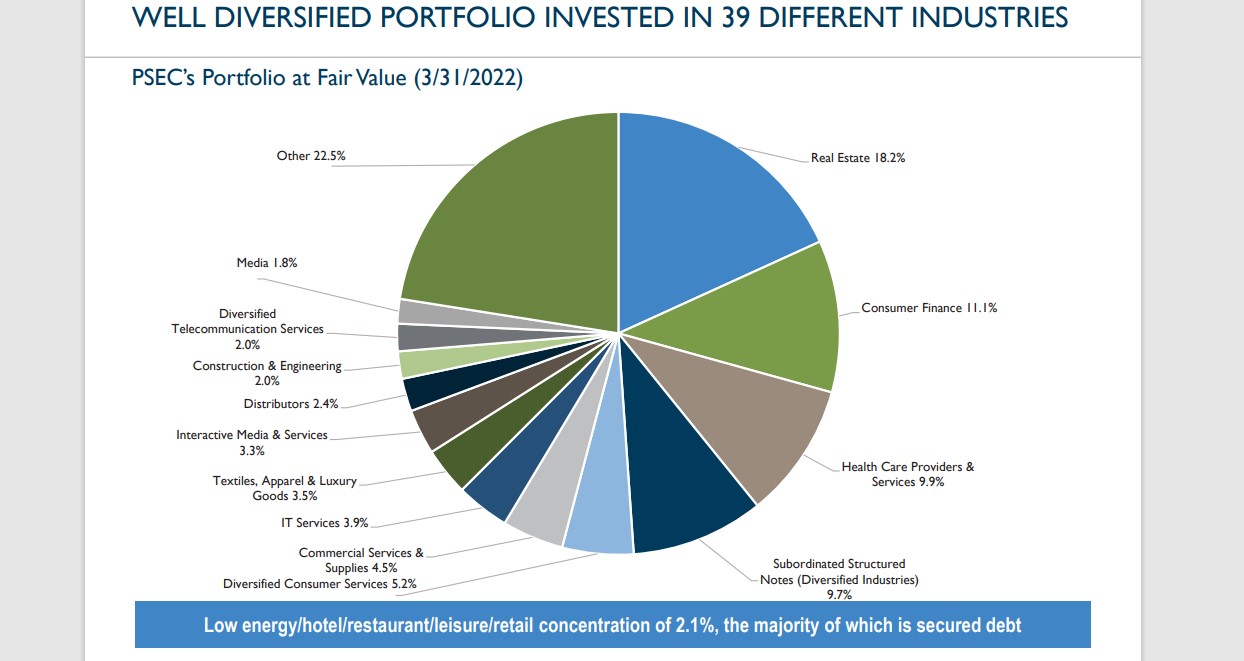

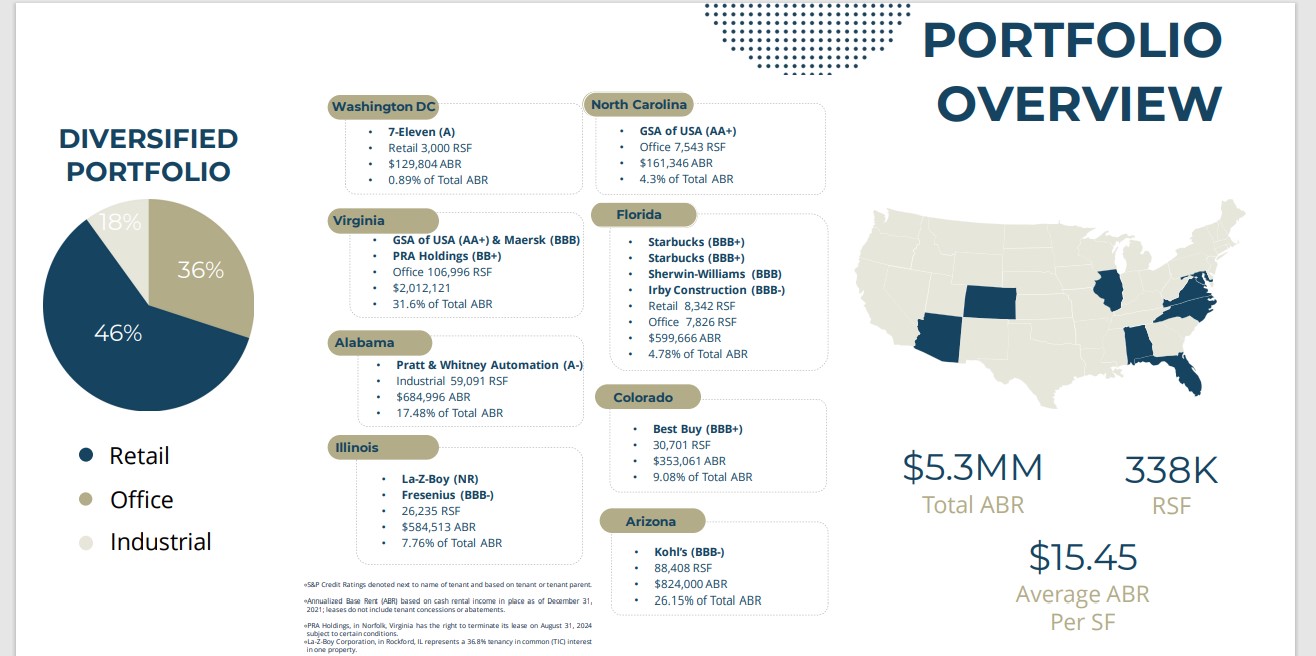

Excessive-Yield Month-to-month Dividend Inventory #13: Prospect Capital (PSEC)

Prospect Capital Company is BDC that gives personal debt and personal fairness to center–market firms within the U.S. The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments. The corporate produces about $680 million in annual income.

Supply: Investor Presentation

PProspect reported third quarter earnings on Could ninth, 2022 with outcomes coming in higher than anticipated on each income and income. Web funding earnings, or NII, got here to 22 cents per share, beating estimates by 4 cents. Whole funding earnings was $181 million, up 14% year-over-year and virtually $11 billion higher than anticipated.

NII per share was up from 19 cents within the year-ago interval, and web asset worth was as much as $10.81 per share from $9.38 a 12 months in the past. Working bills have been $94.4 million, up from $86.1 million in final 12 months’s Q1, serving to to drive the earnings beat.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven beneath):

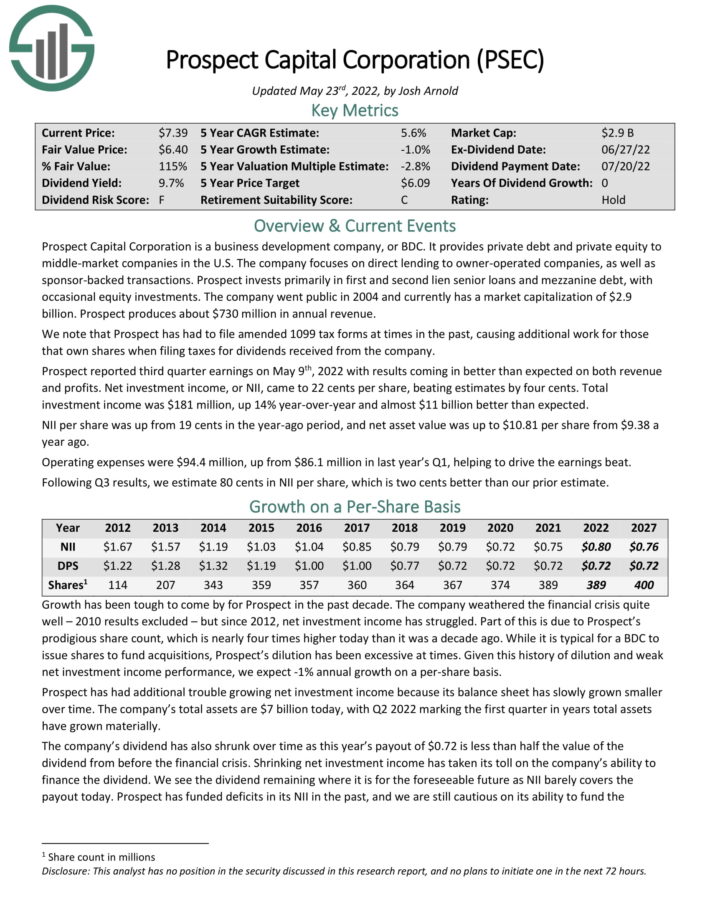

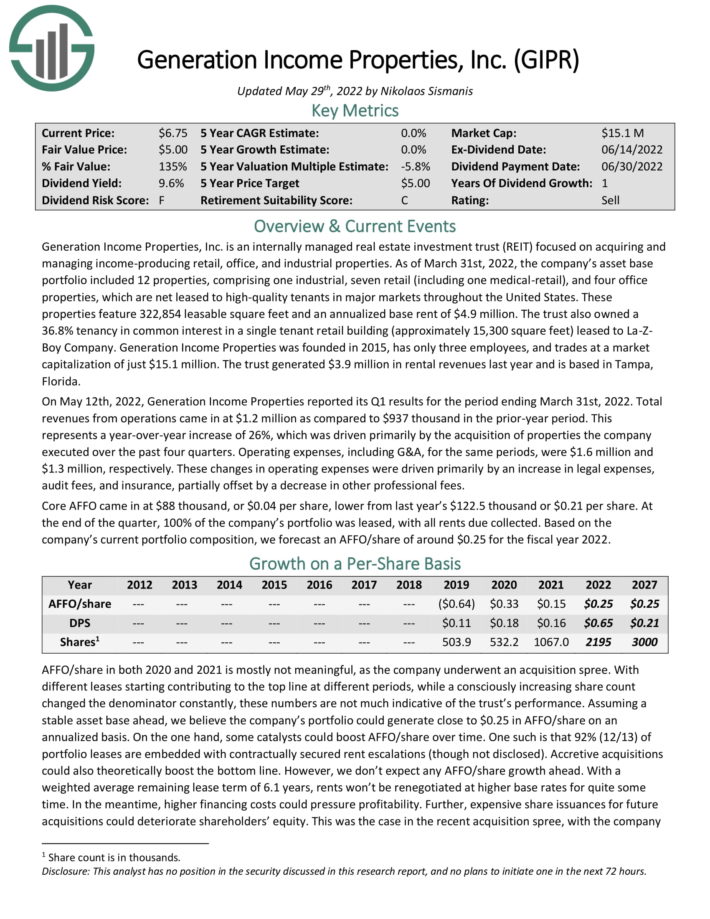

Excessive-Yield Month-to-month Dividend Inventory #12: Technology Revenue Properties (GIPR)

Technology Revenue Properties is an internally managed REIT centered on buying and managing income-producing retail, workplace, and industrial properties. As of March thirty first, 2022, the corporate’s asset base portfolio included 12 properties, comprising one industrial, seven retail (together with one medical-retail), and 4 workplace properties, that are web leased to high-quality tenants in main markets all through the US.

Supply: Investor Presentation

These properties function 322,854 leasable sq. ft and an annualized base lease of $4.9 million. The belief additionally owned a 36.8% tenancy in widespread curiosity in a single tenant retail constructing (roughly 15,300 sq. ft) leased to La-ZBoy Firm. The belief generated $3.9 million in rental revenues final 12 months and is predicated in Tampa, Florida.

On Could twelfth, 2022, Technology Revenue Properties reported its Q1 outcomes for the interval ending March thirty first, 2022. Whole revenues from operations got here in at $1.2 million as in comparison with $937 thousand within the prior-year interval. This represents a year-over-year improve of 26%, which was pushed primarily by the acquisition of properties the corporate executed over the previous 4 quarters.

Core AFFO got here in at $0.04 per share, decrease from final 12 months’s $0.21 per share. On the finish of the quarter, 100% of the corporate’s portfolio was leased, with all rents due collected.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIPR (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #11: PennantPark Floating Price (PFLT)

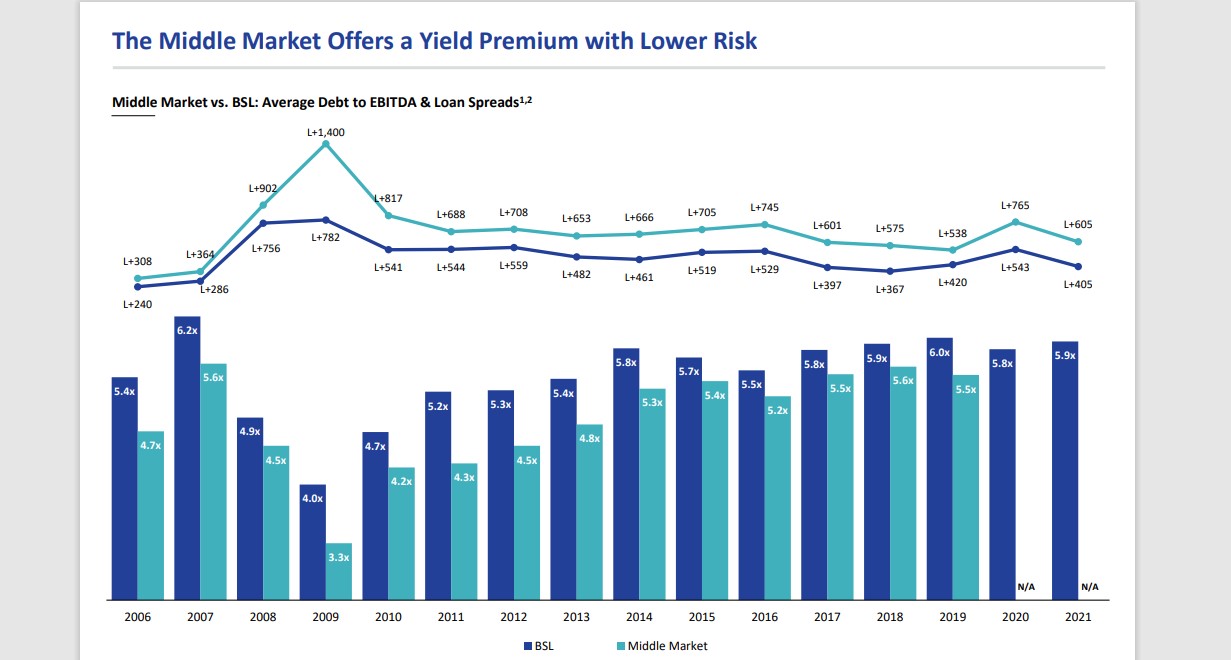

PennantPark Floating Price Capital Ltd. is a BDC that makes secondary direct, debt, fairness, and mortgage investments.

The fund also goals to take a position by floating price loans in personal or thinly traded or small–cap, public center market firms, fairness securities, most popular inventory, widespread inventory, warrants or choices acquired in reference to debt investments or by direct investments.

Supply: Investor Presentation

It usually invests in the US and to a restricted extent non–U.S. firms. It goals to put money into firms not rated by nationwide ranking companies.

PennantPark Floating Price reported second quarter earnings on Could 4th, 2022. Whole funding earnings for the quarter got here in at $24.6 million, up by 26.7% from $19.4 million within the year-ago quarter. Adjusted web asset worth per share stood at $12.41.

Furthermore, the corporate invested $113.2 million through the quarter in seven new and twenty-nine present portfolio firms with a weighted common yield on debt investments of seven.2%. That mentioned, the corporate’s gross sales and repayments of investments for a similar interval totaled $103.9 million. Money and money equivalents at quarter finish stood at $50.1 million. In the meantime, FQ2 web funding earnings elevated to $0.29 from $0.26 within the year-ago interval.

Lastly, PennantPark’s portfolio totaled $1,192.6 million, which incorporates $1,031.9 million of first lien secured debt, $1.0 million of second lien secured debt and $159.6 million of most popular and customary fairness.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven beneath):

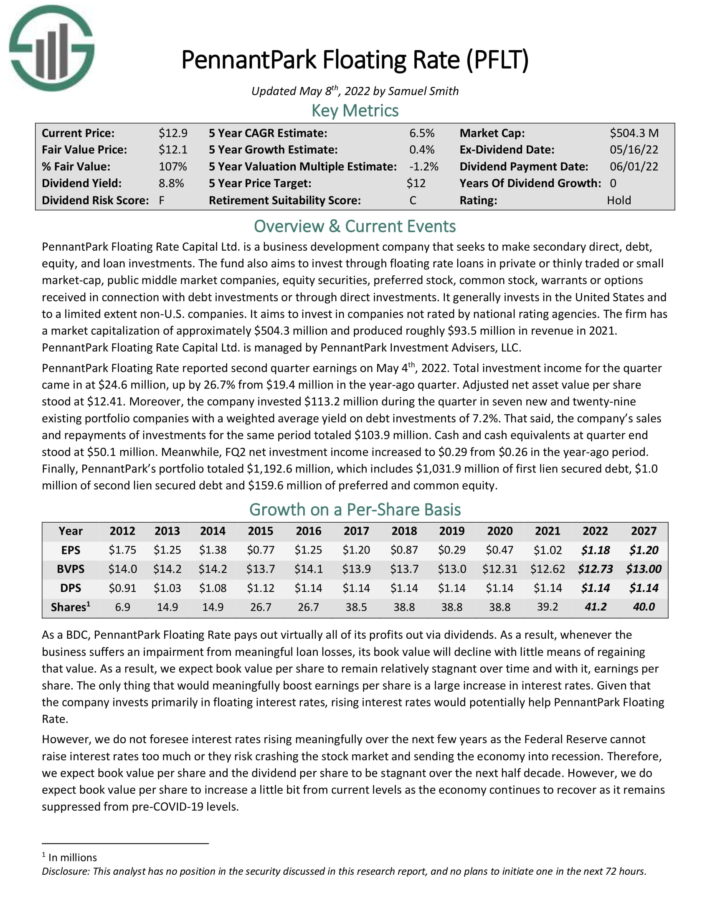

Excessive-Yield Month-to-month Dividend Inventory #10: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the US. It invests in company and non–company MBS consisting of residential MBS, business MBS (CMBS), and CMBS curiosity–solely securities.

Supply: Investor Presentation

Company MBS have a warranty of principal fee by an company of the U.S. authorities or a U.S. authorities–sponsored entity, similar to Fannie Mae and Freddie Mac. Non–Company MBS haven’t any such warranty of fee.

This fall earnings per share got here in at $0.45, down from $1.97 within the year-ago interval. Web curiosity earnings elevated 8.3% to $15.6 million year-over-year and adjusted web curiosity earnings decreased to $25.1 million from $97.9 million year-over-year.

The belief additionally reported 5.8x in leverage as of December 31, 2021, in comparison with 5.9x as of September 30, 2021. In the meantime, guide worth per widespread share stood at $17.99 at quarter finish, down from $18.42 sequentially.

Click on right here to obtain our most up-to-date Positive Evaluation report on DX (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #9: Horizon Expertise (HRZN)

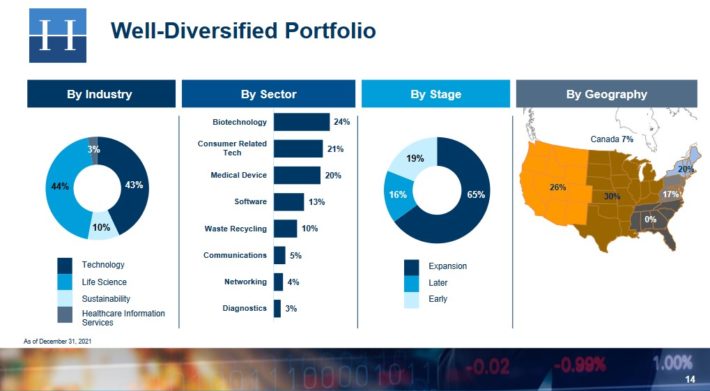

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the know-how, life sciences, and healthcare–IT sectors.

Supply: Investor Presentation

The corporate has generated enticing threat–adjusted returns by straight originated senior secured loans and extra capital appreciation by warrants, featuring a final–9–month annualized portfolio yield of 14.7%.

The corporate has exceeded the everyday trade common IRR of round 10% from its mortgage coupons by participating in dedication charges, steering charges, and potential fairness rights, maximizing its complete yield. Horizon Expertise has gross funding earnings of round $47 million yearly.

On Could third, 2022, Horizon launched its Q1 outcomes for the interval ending March thirty first, 2021. Whole funding earnings grew 7.5% year-over-year to $14.2 million primarily attributable to progress in curiosity earnings on investments ensuing from a rise within the common measurement of the debt funding portfolio.

Nonetheless, web funding earnings per share (ISS) declined to $0.26, 5 cents decrease in comparison with Q1-2021. This was attributable to a 16.6% improve in complete bills and the next share depend. Web asset worth (NAV) per share got here in at $11.68, in comparison with $11.56 within the earlier quarter, nonetheless.

After paying its month-to-month distributions, Horizon’s undistributed spillover earnings as of December thirty first was $0.47 per share, indicating a substantial money cushion. The portfolio remained comparatively secure, holding 86 companies on the finish of the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #8: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC specializing in financing early and center–stage companies by loans and CLOs.

The firm holds an equally break up portfolio of First–Lien, Second–Lien, and CLO fairness assets unfold throughout 8 industries, with the best publicity in enterprise companies and healthcare, at 36% and 25%, respectively.

On April twenty eighth, Oxford Sq. reported its Q1 outcomes for the interval ending March thirty first, 2022. The corporate generated roughly $9.9 million of complete funding earnings, a decline of two.9% in comparison with the earlier quarter. The decline on a sequential foundation was attributed to a smaller debt and CLO fairness portfolio, regardless of the next funding yield.

Particularly, the weighted common yield of its debt investments was 8.0% on the present value, in comparison with 7.7% throughout This fall-2021. The money distribution yield from OXSQ’s CLO fairness investments additionally elevated from 21.2% to 23.8% sequentially.

Whole bills, which primarily consists of curiosity paid by itself financing and managers’ charges, amounted to $5.5 million, have been $0.1 million decrease versus This fall-2021. Because of decrease complete funding earnings, nevertheless, NII (the web funding earnings) amounted to $4.3 million, or $0.09/share, implying a 4.4% decline sequentially. Web asset worth (NAV) per share was $4.65 in comparison with $4.92 final quarter, as DPS as soon as once more exceeded NII/share throughout that interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

Excessive-Yield Month-to-month Dividend Inventory #7: SLR Funding Corp. (SLRC)

SLRC is a Enterprise Growth Firm that primarily invests in U.S. center market firms. The corporate has 5 core enterprise models which embrace money circulation, asset-based, life science lending, tools finance, and company leasing.

The belief’s debt investments primarily consist of money circulation senior secured loans, together with first lien and second lien debt devices. It additionally affords asset-based loans together with senior secured loans collateralized on a primary lien foundation by present belongings.

The corporate trades on the NASDAQ beneath the ticker image SLRC. SLRC is externally managed by SLR Capital Companions, an unbiased funding advisor based in 2006. SLR has a crew of roughly 300 workers which incorporates over 130 origination and funding professionals in over twelve workplaces throughout the U.S.

The corporate’s complete funding portfolio was comprised 99% of senior secured loans, with just one% allotted to fairness and equity-like securities. The funding portfolio was valued at practically $2.1 billion as of December 31st, 2021. Floating price investments made up 54% of the portfolio. And to notice, the portfolio was diversified throughout roughly 600 distinctive issuers throughout 80 industries.

Excessive-Yield Month-to-month Dividend Inventory #6: Broadmark Realty Capital (BRMK)

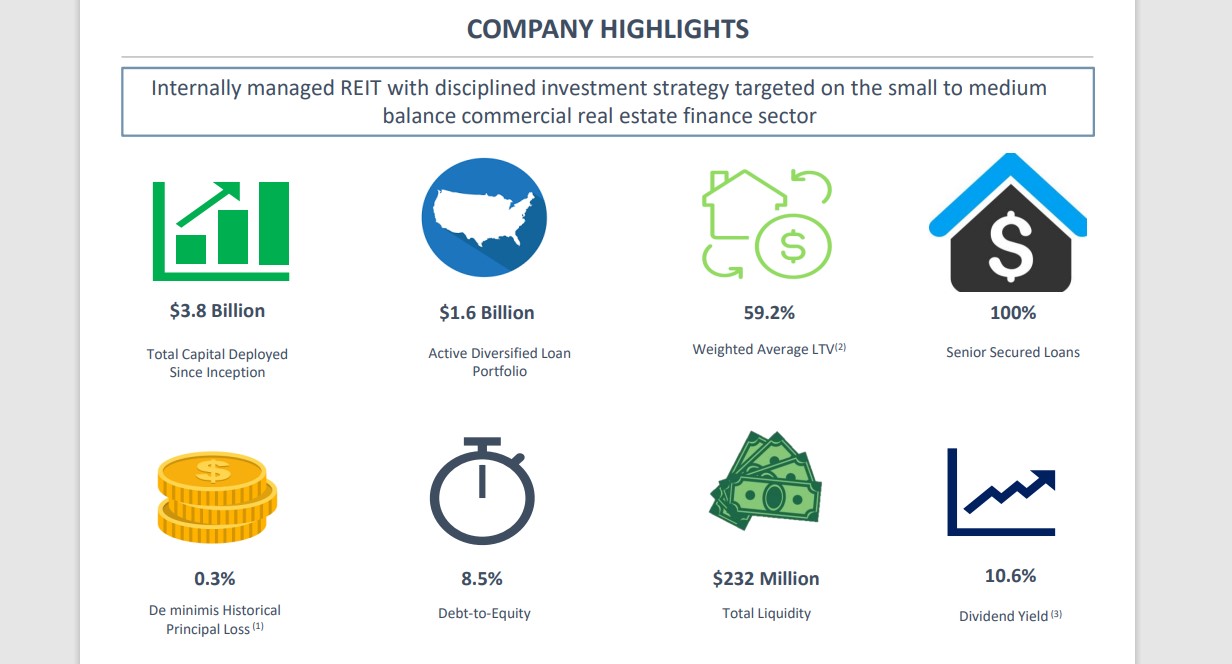

Broadmark Realty Capital Inc. is an actual property funding belief that gives short-term, first deed of belief loans which can be secured by actual property. Prospects use these loans to accumulate, renovate, rehab and develop properties for each residential and business makes use of within the U.S. Broadmark Realty shaped in 2010, however had its preliminary public providing in November 2019.

Supply: Investor Presentation

On Could ninth, 2022, Broadmark Realty reported first quarter outcomes for the interval ending March thirty first, 2022. For the quarter, income grew 1.4% to $29.87 million, which was $2.2 million decrease than anticipated. Adjusted earnings per share of $0.17 in contrast unfavorably to adjusted earnings per share of $0.18 within the prior interval and was $0.02 beneath estimates.

Broadmark Realty originated $189.6 million of latest loans and amendments for the quarter. First quarter origination was a 24% lower sequentially and at a weighted common mortgage to worth of 61.8%. Quarterly curiosity earnings totaled $24.1 million and charge earnings was $5.8 million. The overall portfolio consisted of $1.6 billion of loans throughout 20 states and the District of Columbia.

As of March thirty first, 2022, Broadmark Realty had a complete of $187.8 million of loans in contractual default. The belief resolved $36 million of loans in contractual default through the quarter. Provisions for credit score losses totaled $1.75 million in comparison with $2.71 million within the first quarter of 2021.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRMK (preview of web page 1 of three proven beneath):

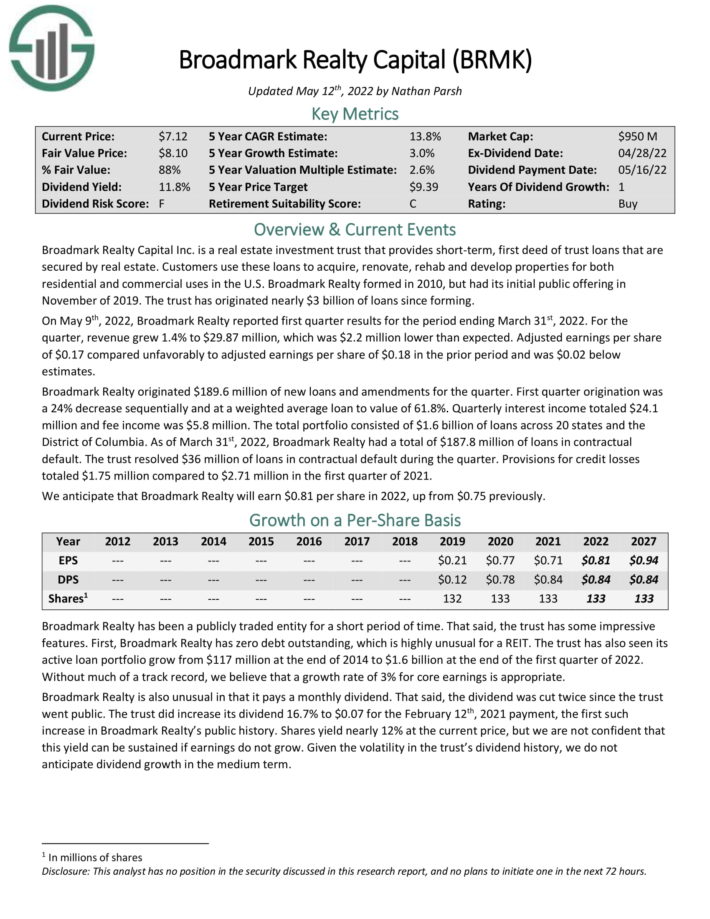

Excessive-Yield Month-to-month Dividend Inventory #5: Ellington Monetary (EFC)

Ellington Monetary Inc. acquires and manages mortgage, shopper, company, and different associated monetary belongings within the United States. The corporate purchases and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Moreover, it manages RMBS, for which the U.S. authorities ensures the principal and curiosity payments. It additionally supplies collateralized mortgage obligations, mortgage–associated and non–mortgage–associated derivatives, fairness investments in mortgage originators and different strategic investments.

On Could fifth, 2022, Ellington Monetary reported its Q1 outcomes for the interval ending March thirty first, 2022. Curiosity earnings got here in at $44.5 million, a 6.9% increased quarter-over-quarter. Nonetheless, core earnings per share got here in at $0.40, 4 cents decrease versus This fall-2021 attributable to elevated bills and the next share depend.

A lot of the progress this previous quarter is a direct results of increased mortgage origination exercise and sturdy efficiency from Ellington’s small steadiness business mortgage loans, residential transition loans, and shopper loans.

Particularly, Ellington’s complete lengthy credit score portfolio grew by 11% to $2.3 billion sequentially. Ellington’s guide worth per share declined from $18.39 to $17.74 over the last three months, with its dividend exceeding the underlying earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on EFC (preview of web page 1 of three proven beneath):

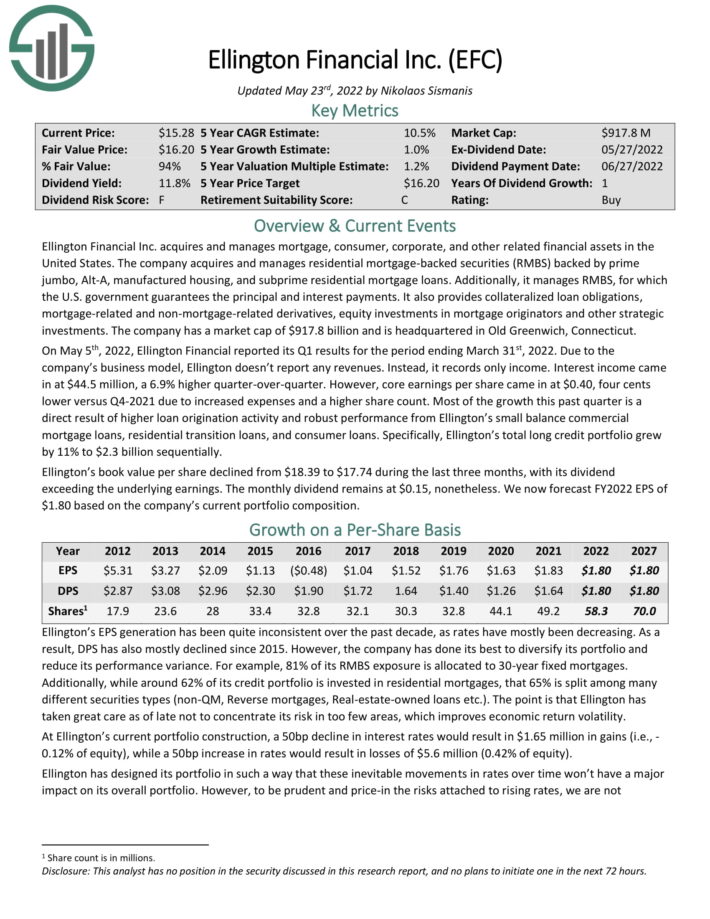

Excessive-Yield Month-to-month Dividend Inventory #4: Ellington Residential Mortgage REIT (EARN)

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Ellington Residential Mortgage REIT is externally managed by Ellington Residential Mortgage Administration LLC. The mortgage REIT has an company residential mortgage–backed securities (RMBS) portfolio of $1.2 billion and a non–company RMBS portfolio of $9.1 million. Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On Could 2nd, 2022, Ellington Residential reported its Q1 outcomes for the interval ending March thirty first, 2022. The corporate booked a $(1.33) web loss per share for Q1. Core earnings of $3.9 million this quarter led to core EPS of $0.30 per share, which covers the dividend paid within the interval.

EARN achieved a web curiosity margin of 1.76% in Q1. At quarter finish, Ellington had $29.9 of money, money equivalents, and different liquidity, and $11.3 million of different unencumbered belongings. The debt-to-equity ratio was 9.1x. E book worth per share declined from the prior quarter to $10.14, a 14% lower.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

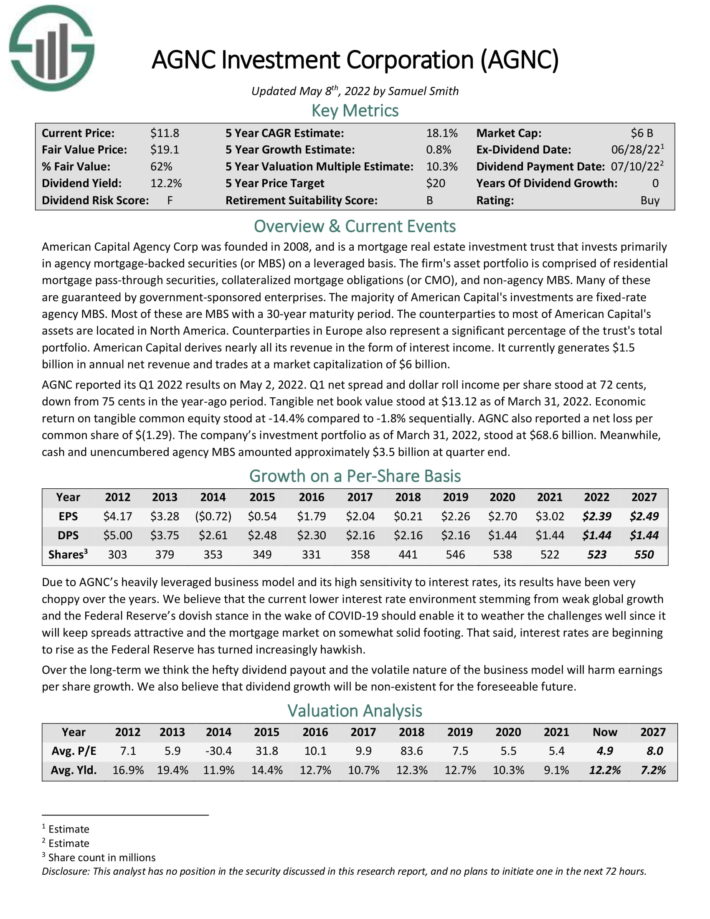

Excessive-Yield Month-to-month Dividend Inventory #3: AGNC Funding Company (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

The vast majority of American Capital’s investments are mounted–price company MBS. Most of those are MBS with a 30–12 months maturity interval. American Capital derives practically all its income within the type of curiosity earnings.

AGNC reported its Q1 2022 outcomes on Could 2, 2022. Q1 web unfold and greenback roll earnings per share stood at 72 cents, down from 75 cents within the year-ago interval. Tangible web guide worth stood at $13.12 as of March 31, 2022. Financial return on tangible widespread fairness stood at -14.4% in comparison with -1.8% sequentially.

AGNC additionally reported a web loss per widespread share of $(1.29). The corporate’s funding portfolio as of March 31, 2022, stood at $68.6 billion. In the meantime, money and unencumbered company MBS amounted roughly $3.5 billion at quarter finish.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC (preview of web page 1 of three proven beneath):

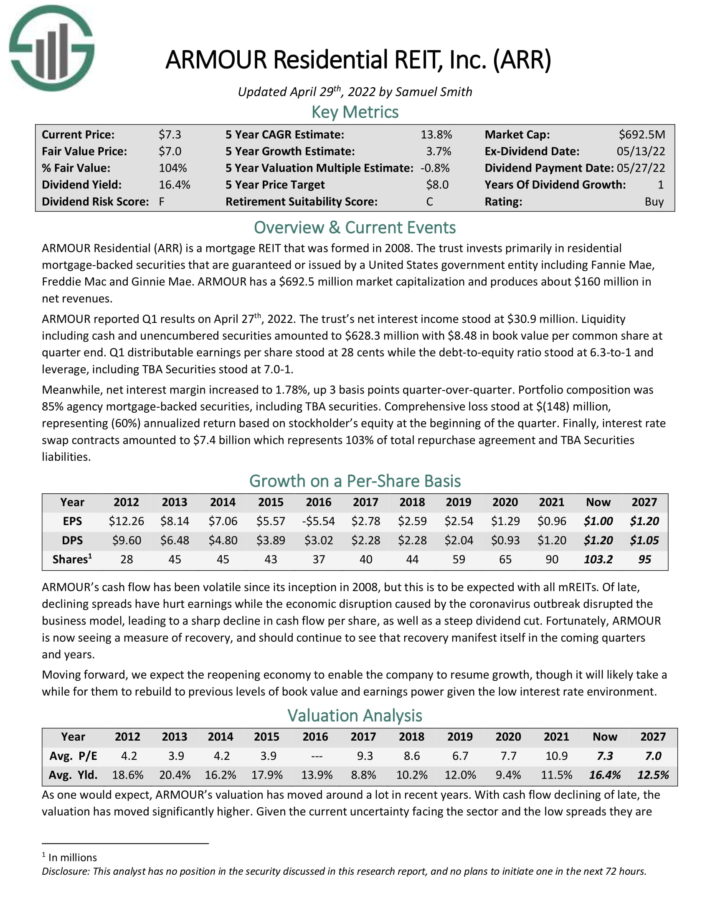

Excessive-Yield Month-to-month Dividend Inventory #2: ARMOUR Residential REIT (ARR)

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are assured or issued by a United States authorities entity together with Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR reported Q1 outcomes on April twenty seventh, 2022. The belief’s web curiosity earnings stood at $30.9 million. Liquidity together with money and unencumbered securities amounted to $628.3 million with $8.48 in guide worth per widespread share at quarter finish. Q1 distributable earnings per share stood at 28 cents whereas the debt-to-equity ratio stood at 6.3-to-1 and leverage, together with TBA Securities stood at 7.0-1.

Supply: Investor Presentation

In the meantime, web curiosity margin elevated to 1.78%, up 3 foundation factors quarter-over-quarter. Portfolio composition was 85% company mortgage-backed securities, together with TBA securities. Complete loss stood at $(148) million, representing (60%) annualized return based mostly on stockholder’s fairness at the start of the quarter.

Lastly, rate of interest swap contracts amounted to $7.4 billion which represents 103% of complete repurchase settlement and TBA Securities liabilities.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARR (preview of web page 1 of three proven beneath):

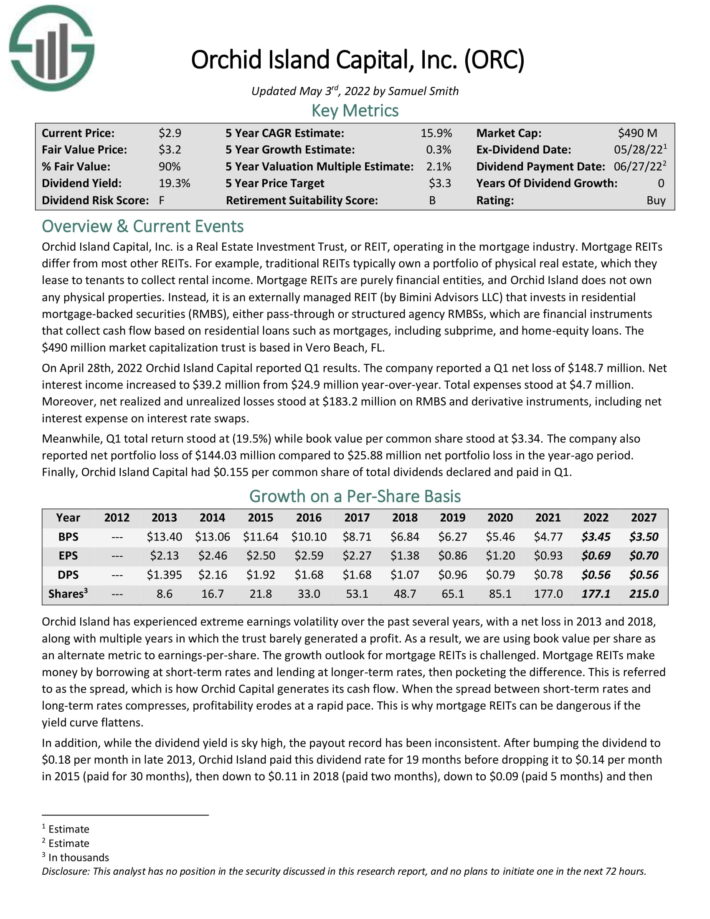

Excessive-Yield Month-to-month Dividend Inventory #1: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is a mortgage REIT. As such, Orchid Island does not personal any bodily properties.

As a substitute, it’s an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), both move–by or structured company RMBSs. These are monetary devices that gather cash circulation based mostly on residential loans similar to mortgages, together with subprime, and residential–fairness loans.

On April twenty eighth, 2022 Orchid Island Capital reported Q1 outcomes. The corporate reported a Q1 web lack of $148.7 million. Web curiosity earnings elevated to $39.2 million from $24.9 million year-over-year. Whole bills stood at $4.7 million. Furthermore, web realized and unrealized losses stood at $183.2 million on RMBS and by-product devices, together with web curiosity expense on rate of interest swaps.

In the meantime, Q1 complete return stood at (19.5%) whereas guide worth per widespread share stood at $3.34. The corporate additionally reported web portfolio lack of $144.03 million in comparison with $25.88 million web portfolio loss within the year-ago interval.

ORC not too long ago minimize its dividend by 18%, though the inventory nonetheless yields 17.8%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORC (preview of web page 1 of three proven beneath):

Last Ideas

Month-to-month dividend shares could possibly be extra interesting to earnings buyers than quarterly or semi-annual dividend shares. It’s because month-to-month dividend shares make 12 dividend funds per 12 months, as an alternative of the standard 4 or 2.

Moreover, month-to-month dividend shares with excessive yields above 5% are much more enticing for earnings buyers.

The 20 shares on this checklist haven’t been vetted for dividend security, that means every investor ought to perceive the distinctive threat elements of every firm.

That mentioned, these 20 dividend shares make month-to-month funds to shareholders, and all have excessive dividend yields.

Additional Studying

If you’re involved in discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will likely be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].